OGJ Newsletter

Market Movement

Gas prices easing with warmer weather-but a bull market persists

Natural gas prices are finally beginning to moderate a bit with warmer weather, but not before price forecasts for the balance of 2001 were notched up again. So 2001 still looks like a bull market for natural gas, and 2002 looks pretty strong as well.

Temperatures continued to warm up last week across much of the US, following an upturn in temperatures the week before. The week of Jan. 15 saw heating degree days that were about 3% lower than the same week a year ago. And weather forecasters last week were projecting that temperatures across most of the contiguous US would remain at normal to above-normal levels through early February. Much of the winter to date has seen temperatures at normal to below-normal levels-notably picking up record lows in many places.The upshot is that spot and near-month futures prices for gas have dipped from near-$10/MMbtu levels to $6-7/MMbtu.

The warming respite pulled prices down to a more manageable-if still historically very high-level, as the frantic pace of withdrawal of gas from a rapidly depleting inventory was allowed to slow. Consequently, the year-to-year deficit in natural gas storage last week narrowed to 700 bcf, about 35% below the same level a year ago.

But it would not take much to leave US natural gas storage at a drastically low level at the end of the season, as temperatures would have to suddenly become unseasonably warm for the duration of the winter to do much to reverse the draw on natural gas stocks.

Gas price forecasts jumped

This kind of outlook has analysts scrambling to jump their forecasts for US natural gas prices for 2001 and 2002.

UBS Warburg once again has raised its projected composite spot natural gas price forecast for 2001 to $5.75/MMbtu from $3.80/MMbtu (see table). The analyst contends that its revised increase reflects the near-depletion of natural gas supplies, ongoing deliverability limitations, weak increases in Canadian imports, and a demand increase from baseload and peaking power generation.

For 2002, the analyst projects a composite spot price of $3.75/MMbtu. "Beyond residual pricing tightness carrying over from 2001, this forecast reflects an easing in demand destruction from unprecedented early 2001 [price] levels, further growth in power generation demand, as well as our continued conservative view toward overall deliverabilityellipse[in the form of] continued rapid wellhead decline rates and ongoing limitations in net Canadian imports," said UBS Warburg. An even more aggressive forecast comes from Lehman Bros., calling for a 2001 natural gas price forecast of $6.25/MMbtu, vs. its previous prediction of $5/MMbtu.

Lehman Bros. also projects a 2002 forecast of $4.50/MMbtu, up from its earlier prediction of $4.15/MMbtu. The reason? Lehman Bros. expects the US will exit winter with storage at about 200-400 bcf, making it unlikely that industry will be able to refill storage for next winter. That puts the storage shortfall at a level about equal with 6-7% of production over the 7-month refill season.

US supply-demand concerns

There doesn't seem to be any way around a tight gas market this year in the US, given expectations for even sizeable increases in production and decreases in demand.

Salomon Smith Barney thinks that natural gas prices "should remain on a relatively strong course," even if US gas production rises by more than 5% in 2001 and the US economy slows.

"If weighted temperatures for the remainder of this winter average 5% colder than normal [temperatures have averaged 15% colder than the 10-year average so far this season], our models indicate that, adjusting for incremental fuel-switching, less stripping of natural gas liquids, and reduced demand from the ammonia and methanol industries, storage levels exiting the winter would be around 500 bcf. This would certainly maintain upward pressure on natural gas prices and perhaps render our $5/MMbtu full-year 2001 composite natural gas price forecast conservative."

null

null

null

Industry Trends

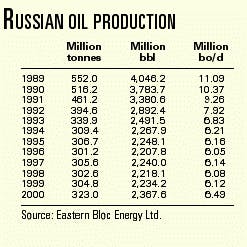

Internal restructuring is cited as one reason behind Russia's increased oil production.

Despite a lack of direct foreign investment in Russia since the August 1998 financial crisis, the Russian oil industry has reversed its declining oil production, which reached 6.49 million bo/d in 2000 from a low of 6.05 million bo/d in 1996 (see table).

Alexander Korsik, COO for OAO Sibneft, was quoted as saying that internal organizational restructuring was one reason for this reversal, reported Eastern Bloc Energy: "In 1999, when nobody was coming to Russia, we decided we should look for alternatives and came to the conclusion that we should speed up our restructuring in the way of creating a traditional western organization."

North American drilling activity continues to build.

There were 1,128 rotary rigs working in the US and 561 in Canada the week of Jan. 15, according to Baker Hughes.

A year ago, there were 781 US rigs active and 517 in Canada.

There were 887 rigs drilling for gas in the US the week of Jan. 15, vs. 637 a year ago. Drilling for oil in the US were 240 rigs vs. 100 the same week a year ago.

In European waters, the number of rigs under contract remained stable at 88, making for an 87.1% utilization rate. Worldwide, the number of offshore rigs under contract increased by 3 to 559, making for an 86.1% utilization rate.

US petroleum deliveries stalled last year at 1999 levels after 4 years of growth, according to API.

It said the stall occurred despite economic growth that, for the year as a whole, was likely the greatest in over 15 years.

API said US crude production was 5.838 million b/d in 2000, down 0.7%, which was a slower rate of decline than in 1999. Production in the Lower 48 of nearly 4.9 million b/d showed growth for the first time since 1997.

But Alaska production of 968,000 b/d was down 8% and the lowest annual mark since Alaskan North Slope production began in the 1970s.

"With no new federal lands or offshore sites available for expanded oil and natural gas production last year, US dependency on imported crude oil and refined products equaled an all-time high of 11.028 million b/d average for the year. That represented an annual increase of 1.7% over 1999, and it was a 13% jump last month compared with December 1999," API said.

Government Developments

WILL THE BUSH ADMINISTRATION'S FIRST ORDER OF BUSINESS BE A RESCUE OF CALIFORNIA'S POWER SECTOR BEFORE THAT CRISIS THREATENS THE WHOLE US ECONOMY?

Without a rapid and decisive response by the Bush administration, California's power problems threaten to plunge the state into an "economic depression, pulling the US down with it," says a prominent energy analyst.

The most important immediate need is to reestablish a viable market system, says Ed Krapels, director of gas and power practices for Energy Security Analysis Inc., Wakefield, Mass. The usual remedies of encouraging conservation, removing or easing restrictions on power generation, and negotiating with neighboring states will not work, he asserts.

To right the situation, the state must pay the market price for energy.

Helped by a faulty trading system that created a "classic trading trap" for the state's utilities, volatile gas and power spot prices were transformed from the nuisance they should have been "to an economic and financial calamity," Krapels said.

He says the gas and power spot price increases in 2000 would have had a minor effect on the state, if utilities had been allowed to engage in routine hedging-matching the maturity of their fixed price position with a portfolio of forward contracts.

Outgoing US Energy Sec. Bill Richardson this month issued an emergency order requiring 27 suppliers to provide Pacific Gas & Electric with natural gas, after the California utility complained that six of its suppliers had stopped or were threatening to halt deliveries. The order expired at 3 a.m. on Jan. 24.

On Jan. 19, outgoing Pres. Clinton signed a memorandum finding that a natural gas supply emergency exists in central and northern California. Issued under provisions of the 1978 Natural Gas Policy Act and the 1950 Defense Production Action, the order is designed to ensure gas is available for high-priority uses, such as home heating and electricity generation, and cannot be resold in the wholesale markets.

"I am issuing this temporary emergency order to keep the gas flowing while the state of California, utilities, and generators continue to work to find a solution to the current electricity and financial crisis," Richardson said.

MMS has issued revised guidelines to help operators submit oil and gas e&d plans for Gulf of Mexico leases.

Federal law requires a company to obtain MMS approval of either an exploration plan or a development plan before it can conduct drilling or production operations. MMS said that, previously, guidance regarding E&D regulations was contained in 12 different documents issued over the past several years. The new guidance, a Notice to Lessees and Operators, updates the older guidelines and consolidates them into one document.

One major change was that MMS clarified the nature of requirements for oil spill and chemical product information and limited the data requirements to only the plans that must undergo an environmental assessment under the 1970 National Environ- mental Policy Act. Gulf of Mexico Regional Director Chris Oynes said the revised guidelines will help operators file information needed for compliance with the 1990 Oil Pollution Act.

Quick Takes

Burlington Resources' Bighorn 6-27 well HAS set a drilling depth record for the Rocky Mountains area.

The well, located in 27-39n-90w, Fremont County, Wyo., was drilled to a TD of 25,855 ft, with a TVD of 25,821 ft, on Jan. 7. That surpasses the previous record set by Rainbow Resources' Federal 34 well, drilled to a TVD of 25,764 ft in Wyoming in 1979. Workers ran production casing about 2 weeks ago, but the well has not yet been completed or tested, company officials told OGJ.

Burlington Resources' Bighorn 5-6 well currently holds the producing depth record for Wyoming and the Rocky Mountains, with its deepest producing interval at 24,938 ft TVD. The Bighorn 6-27 is expected to break that record also, officials said.

Cairn Energy made a third gas find on Block CB-OS/2 off Gujarat, Western India.

Exploration well CB-B-1, about 6 km southeast of the UK independent's recent Lakshmi gas discovery, reached a TD of 1,286 m, encountering several hydrocarbon pay zones below 753 m.

Two zones in the Gauri discovery flowed gas on test at a combined rate of 39.2 MMcfd, while a third zone flowed oil at a stabilized rate of 1,039 b/d through a 32/64-in. choke. Cairn said initial estimates are that the discovery, which is on trend with and southwest of Hazira field, holds 100-300 bcf of gas. Cairn is considering development options for Gauri, which include tying it back to either Lakshmi or Hazira or developing it alone.

In other exploration action, Sonatrach has awarded Gaz de France and Petronas a 3-year exploration contract covering 17,000 sq km in the Ahnet basin south of In Salah in Algeria's Saharan desert. GdF anticipates the exploration phase will cost 25-41 million euros. If development is viable, production could begin in 2008.

Talisman Energy and National Fuel Gas unit Seneca Resources formed a JV to explore in the Appalachian basin. The 5-year agreement includes nearly 1 million acres in western New York and northwestern Pennsylvania. Talisman noted that there are 150,000 wells in the area, most of which are shallow and low-producing. Talisman and Seneca Resources will target Ordovician gas prospects at 6,500-11,000 ft. They are reviewing existing seismic and expect to drill the first well later this year.

Nexen, the former Canadian Occidental Petroleum, signed a memorandum of understanding for a production-sharing agreement for Yemen Block 59. This will be Nexen's seventh block in Yemen. Block 59 is near the Yemen-Saudi border, 250 km north of Nexen's Masila block, which is producing 230,000 b/d of oil. Executive Vice-Pres. and COO Charlie Fischer said the company plans to shoot 1,000 km of seismic and drill one well on Block 59.

Gaz Métropolitain and Enbridge have proposed a new gas pipeline in eastern Canada.

Gaz Métropolitain and Enbridge have proposed a $270 million (Can.) project to supply gas from fields off Nova Scotia to markets in New Brunswick, Quebec, and Ontario.

The 50-50 venture will tie into the existing Maritimes & Northeast Pipeline, which carries gas from Offshore Nova Scotia to the northeastern US. The Quebec utility and Enbridge will build a 262-km line, dubbed the Cartier pipeline, paralleling the St. Lawrence River from the New Brunswick-Quebec border to Quebec City, where it will interconnect with the existing Canadian gas transmission grid.

The proposed line would have initial capacity of 184 MMcfd of gas, of which 164 MMcfd will be earmarked for Gaz Mètropolitain and Enbridge. The Cartier line will be connected by a second line to the M&NE Pipeline north to the New Brunswick-Quebec border near Edmundston. M&NE Pipeline will construct and own this line.

Gaz Métropolitain, Enbridge, and M&NE Pipeline expect to file applications for both pipelines with Canada's National Energy Board (NEB) in spring 2002 and anticipate a late 2004 in-service date.

In other pipeline news, Gulfstream Natural Gas System awarded Stolt Offshore a contract to install the offshore portion of the Gulfstream natural gas transmission pipeline from Mobile Bay, Ala., to Tampa Bay, Fla. Stolt said this is the largest offshore pipelay project to date in the Gulf of Mexico. Stolt's LB 2001 semisubmersible pipelay barge will install the 437-mile, 36-in. concrete-coated pipe beginning in second half 2001. The 801 derrick lay barge will lay pipe in shallow water leading to shore approaches. The onshore portion of the line, 292 miles of 16-36 in. mainline and laterals, will transport gas across Florida to electricity-generation plants on the state's eastern coast.(OGJ, Oct. 25, 1999, p. 34).

Pertamina said the signing of a 20-year Indonesian gas sales agreement with Gas Supply Pte., a subsidiary of state utility Singapore Power, has been pushed back to Feb. 12 because of technical issues. The deal, which could be worth $14 billion, calls for the building of a 483-km pipeline from South Sumatra to Singapore. When the plan was announced last year, the agreement was expected to have been signed this month (OGJ Online, Dec. 4, 2000). The proposed agreement would call for Pertamina to provide 150 MMcfd of gas, starting in 2003, and ramp up volumes to 350 MMcfd by 2008. The gas will come from three production-sharing developments in Sumatra operated by Gulf Indonesia Resources and Santa Fe Energy Resources Jabung.

PetroChina is still seeking investment in its proposed 4,150-km gas pipeline from Xinjiang in western China to Shanghai in eastern China. PetroChina plans to delay the start-up of pipeline construction until June or July this year, from an earlier schedule of April, because cold weather in the west freezes the ground in April. The 49.1 billion yuan pipeline project will need 724.4 billion cu m of gas reserves to sustain an expected annual throughput of 12 billion cu m for 30 years. The company announced last October that it had discovered 494 billion cu m of gas reserves in Xinjian's Tarim basin, the major gas supply source for the pipeline.

Enbridge resumed throughput on its Line 4 heavy oil pipeline Jan. 20 after a bypass was completed around a rupture discovered Jan. 17. The company estimated 15,000 bbl of oil was spilled in a marshy slough near Hardisty, Alta. Line 4 carries crude from Edmonton, Alta., to Hardisty, then through Saskatchewan to Superior, Wis. Crews working to clean the spill were expected to recover more than 90% of the oil. The temporary pipeline is expected to transport 75-80% of the 600,000 b/d pipeline load. Once the repair is complete, Enbridge expects to operate at near the line's 640,000 b/d capacity for 3-4 weeks to make up throughput loss. Canada's NEB and National Transportation Safety Board are investigating the spill.

NEB plans a public hearing Jan. 31 in Calgary on Murphy Canada Exploration's application to build a $4.3 million, 10.3-mile pipeline loop. The 12-in. line would extend from the Pioneer Natural Resources Canada facilities in the Chinchaga area of northern British Columbia to Pioneer's compressor station 80 miles northwest of Manning, Alta. Completion would be Mar. 15.

Premcor said it would permanently close its 76,000 b/d refinery in Blue Island, Ill., at the end of the month.

Premcor said the refinery won't be cost-effective under EPA's new low-sulfur fuel regulations (OGJ, Jan. 1, 2001, p. 7).

The company said that, although it had spent $70 million on the refinery over the last 5 years, the plant does not generate a return sufficient to justify the additional investment needed to meet "the next wave of low-sulfur, cleaner-burning fuels."

Instead, Premcor will focus on higher-return projects at its other three refineries. It operates a 68,000 b/d refinery at Hartford, Ill., a 165,000 b/d plant at Lima, Ohio, and a 225,000 b/d refinery at Port Arthur, Tex. Premcor will continue to operate its petroleum products storage facility adjacent to the Blue Island refinery.

Rentech will conduct a study to determine the feasibility of using its GTL technolgy at a Wyoming methanol plant.

Wyoming Business Council, a state economic development agency, will give Rentech $800,000 to fund a feasibility study using Rentech's GTL technology.

There are two phases to the project. One involves the feasibility of retrofitting part of the existing methanol facility, which, Rentech said, could produce 2,500 b/d of GTL products. The second study involves the construction of a separate, 10,000 b/d greenfield plant at the same site. Rentech expects the study to take 6-9 months.

If either project proves feasible, the council will be able to recoup its investment from project financing and a production royalty for a limited term. The company also plans to create the first commercial GTL plant in the US by converting its Sand Creek methanol plant near Commerce City, Colo. That plant is expected on line in 2002.

Husky oil and petro-canada are making plans to develop White Rose field off Newfoundland.

Husky Oil Operations and partner Petro-Canada applied to the Canada-Newfoundland Offshore Petroleum Board to develop White Rose oil field, 350 km off Newfoundland in 115-130 m of water.

Husky said it is uncertain whether North White Rose gas field is commercially viable. Both are in the Jeanne d'Arc basin on the Grand Banks (see map). Production of the oil field could begin in 2003-04.

Husky plans to drill 10-14 production wells and 8-11 water and gas injection wells in the South White Rose reservoir to develop the field. The wells will be drilled in phases over 4-6 years. The company said 4-6 production wells, 1-3 water injection wells, and a gas injection well will be required for initial oil production. Produced gas will be reinjected.

Husky estimates White Rose reserves at 250 million bbl of 30° gravity crude. It expects a project life span of 12-14 years and peak production of 75,000-110,000 b/d.

Elsewhere on the development front, Norsk Hydro awarded development contracts worth 224 million kroner ($25.2 million) to Stolt Offshore and Fabricom Contracting for developing Vale field, a satellite of Heimdal field on Block 25/4 in the Norwegian North Sea. Under a 164 million kroner deal, Stolt will coat, lay, and trench a 16.5-km, 8-in. flowline between the Vale subsea production system and the Heimdal riser platform. The contract covers engineering, procurement, laying, and trenching of the umbilical, as well as tying in the lines at both ends. Fabricom will make topsides modifications on the Heimdal platform for the Vale and Vesterled field projects. That contract is for 60 million kroner. Hydro said the offshore work will take place during May-September, with first flow from Vale scheduled for December. Hydro plans to invest 800 million kroner in the Vale project, covering modifications and other work at Heimdal, including a new subsea template, pipelines, and drilling. The Vesterled project involves laying a 33-km gas pipeline that will connect the Heimdal platform to the existing Norwegian Frigg pipeline and extend from Frigg to St. Fergus, Scotland. The 600 million kroner pipeline will have a capacity of 11 billion cu m/year and is scheduled to come on stream Oct. 1 (OGJ Online, Oct. 18, 2000).

Unocal Global Trade has begun solution mining its Keystone gas storage facility near Kermit, Tex.

Located near the Waha Hub, the Keystone project will have 3 bcf of high deliverability salt cavern storage capacity, with sustainable 100 MMcfd injection and 200 MMcfd withdrawal capability.

The facility is to begin operation in first quarter 2002. Unocal owns 100% of the Keystone project.