Gas-power firms dominate Energy 50 ranking in 2000

The yearend 2000 ranking of the world's 50 largest energy firms is dominated by companies with new business models-the main focus of these firms is on business development rather than their capital assets. Also, the ranking is dominated largely by gas and power companies that performed as well-if not better-than traditional oil and gas firms.

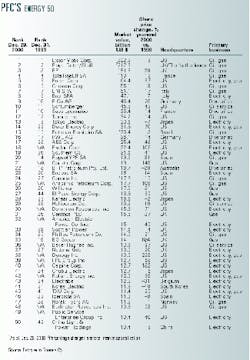

The most recent Energy 50 ranking, which is a quarterly assessment based on the companies' market capitalization, was released earlier this month by Petroleum Finance Co. (PFC), Washington, DC (see table, p. 28). Total market capitalization of the 50 companies at yearend 2000 tallied $1.82 trillion, vs. $1.66 trillion at the end of 1999, the analyst said (OGJ, May 29, 2000, p. 27).

"The Energy 50 demonstrates that the energy industry continues to be extremely dynamic," said J. Robert West, chairman of PFC. "It is a key link between the new economy and the old economy." West also noted that the 22% gain made by the Energy 50 in 2000 outperformed the Standard & Poor's 500 Index's 10% loss during the same period.

Other trends noted were:

- Gas and power companies, which continue to converge apace, are driving much of the convergence momentum among other types of firms.

- Pipeline companies continue to invest in telecommunications assets.

- Convergence between oil and gas companies and utilities has not yet taken shape.

Top performers, newcomers

Gas and power companies could continue to outperform oil and gas companies in the coming years, PFC reckons, basing its analysis on consensus earnings growth estimates. "To improve returns, oil and gas companies have frequently turned to mergers and acquisitions as a means of expanding unit efficiencies for earnings growth," PFC explained. "[We believe] that acquisitions will now need to focus on capturing earnings growth beyond what can be obtained through increased unit efficiencies, i.e., targeted profitable volumetric growth.

"In that sense," the analyst continued, "ChevronTexaco [Corp.] and TotalFinaElf [SA] may be a more optimal size for this type of growth among integrated oil and gas companies."

Of the gas and power companies, the topmost performer was Houston-based Dynegy Inc., PFC said. Calpine Corp., San Jose, Calif., was another high performer. Calpine experienced a boost in its stock price just as California's power supplies began to tighten during the start of the second quarter last year. PFC noted, however, that both of these wholesale power suppliers, and others like them, could face difficulties in the near future due to their considerable exposure to large California utilities such as PG&E Corp. and Southern California Edison, which are currently experiencing credit problems due to the tight California power market.

Other strong performers in 2000 included El Paso Energy Corp., Houston; Exelon Corp., Chicago; Anadarko Petroleum Corp., Houston; and Enron Corp., Houston.

Entrants that have made the Energy 50 in the last year include: Dominion Resources Inc., Richmond, Va.; American Electric Power Co. Inc., Columbus, Ohio; Baker Hughes Inc., Houston; Reliant Energy Inc., Houston; FPL Group Inc., Juno Beach, Fla.; Burlington Resources Inc., Houston; and Public Service Enterprise Group Inc., Newark, NJ.

Mergers, demergers

Although merger discussions took place last year between oil and gas companies and utilities, PFC pointed out that no "groundbreaking" deals transpired. The analyst observed: "Convergence for its own sake adds little value unless a portfolio emerges that holds greater prospects for growth. However, convergence can clearly make a difference if an acquisition extends a market or holds the potential to create new onesellipse"

Concerning mergers, PFC said that larger companies clearly do have certain advantages over smaller ones. These advantages include lower costs of capital, higher returns on capital employed, portfolio liquidity, and the ability to compete for the larger projects.

PFC highlighted five big mergers in the oil and gas sector either completed or announced in 2000: BP and ARCO, TotalFina SA and Elf Aquitaine, Anadarko and Union Pacific Resources, Chevron Corp. and Texaco Inc., and ENI SPA and Lasmo PLC.

In the gas and power sectors, prominent mergers included the formation by German firms Veba AG and Viag AG of E.On AG, PECO Energy Co. and Unicom Corp. joining to form Exelon, El Paso Energy and Coastal Corp., FPL and Entergy Corp., National Grid Group PLC and Niagara Mohawk Holdings Inc., and Endesa SA and Iberdrola SA.

Other large companies, such as BG, for example, underwent demergers. BG last year separated from its UK transmission entity, Transco (OGJ, Sept. 25, 2000, p. 39). The move, said PFC, positioned BG as an international integrated gas company.

"BG has a unique business model focused on integrating E&P with mid- and downstream gas operations, notably in the Southern Cone [of South America], North Africa, and India," the analyst said. The separation from Transco also liberated BG from certain regulatory constraints.

In addition to mergers and demergers, many parent companies spun off their unregulated units, creating some of the "highest growth prospects in the gas and power sector," PFC said.

Completed or anticipated spin-offs include: Southern Energy Inc. from Southern Co., NRG Energy Inc. from Xcel Energy Inc., Orion Power Holdings Inc. from Constellation Energy Group Inc., Reliant Resources from Reliant Energy, and Aquila Energy from Utilicorp United Inc.

Fast risers

There are several oil, gas, and power companies labeled by PFC as "fast-moving" and "dynamic" that have yet to make its Energy 50.

Apache Corp., Houston, tops this list. "In addition to high oil and gas prices," PFC noted, "Apache's recent success is attributable to its asset acquisition strategy focused on the successful and profitable execution of acquiring nonstrategic assets of larger companies or acquiring smaller producers (see Company News, p. 32)."

Another up-and-comer is Kinder Morgan Inc., Houston, said PFC, due to its diverse asset base of 30,000 miles of US pipelines, retail gas distribution operations, storage capacity, and power generation.

Xcel Energy, formed by the merger of New Century Energies, Denver, and Northern States Power Co., Minneapolis, is another company on PFC's watch (OGJ, Apr. 5, 1999, p. 41). Holding company Progress Energy Inc.-formed through the combination of Carolina Power & Light, Florida Power & Light Co., North Carolina Natural Gas Corp., Strategic Resource Solutions, and Progress Telecom-is another.

NiSource Inc. of Merrillville, Ind., makes PFC's fast-riser list because NiSource's subsidiaries are involved in a wide range of gas and electricity activities. The diversification of both Allegheny Energy Inc. and KeySpan Corp. have also registered on PFC's fast-riser radar screen.

Southern Energy and NRG Energy round out PFC's list.