Increased US workover-rig activity forecast

Strong oil prices and a backlog of well-maintenance jobs deferred by recent mergers and property exchanges among operators will trigger major increases in the US land workover market in 2001-02.

Simmons & Co., a Houston investment banking firm, tracks the oil field service industry.

"Workover activity should increase 31% next year to 1,350 rigs-slightly below the 1997 average of 1,422-and 10% more in 2002 to 1,491 rigs," said a report compiled by Scott B. Gill, director and co-head of research for Simmons & Co. International.

That prediction, issued in late October, was based on the firm's outlook of average prices of $26/bbl for oil and $3.75/Mcf for natural gas through 2001.

By late December, however, company officials had upgraded their price predictions to $27/bbl and $4.30/Mcf.

One reason for the expected rebound, Gill said, is that continued strong wellhead prices for oil give exploration and production companies a cash incentive to do more oil-related work next year.

High commodity prices generally stimulate workover activity as a relatively inexpensive way to bring more production quickly on line.

Simmons officials believe the incremental production from both minor and major well-servicing jobs or even an extensive workover would provide a 90-day cash payback at current price levels.

And oil wells need more remedial maintenance and repair than gas wells.

Trends

Most US drilling has been directed to gas in recent years, with a definite trend toward deeper gas plays.

"Workover rigs have a role in the completion and stimulation of these deeper wells and in deepening existing wells," Gill reported.

"We believe that workover demand for gas-directed wells will not slacken and demand for oil-related workovers should provide a substantial bounce in activity."

Well-servicing operations generally lag changes in commodity prices by about 3 months. But there has yet to be the resurgence in well servicing to the same degree as oil prices have improved this year.

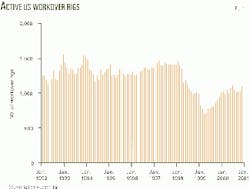

"US workover activity has been stagnant since February at just over 1,000 active rigs [Fig. 1]. Similarly, US oil-directed drilling on land hit a wall in April with slightly less than 200 active rigs (as measured by Baker Hughes Inc.'s weekly rig count).

"While both indicators are up sharply from their trough levels in 1999, current activity is dramatically below levels experienced in 1997, a period when oil prices were 45% less than the current price," Gill reported.

Contributing to the suppressed level of workover activity were the number and size of property transactions in oil-dominated US producing basins, he said.

Of the 14 major merger and acquisition transactions during the first 6 months of 2000, 6 involved properties in the Permian basin, including the Occidental Permian Ltd. acquisition of Altura Energy Ltd. and the Unocal Corp. and Titan Exploration combination that formed Pure Resources Inc.

Although the Permian basin is mature, it's still one of the largest oil-producing areas in the US.

More important, Gill said, a third of the total US workover rig fleet is located in West Texas, including the largest capacity of stacked workover rigs at 43%.

Property transactions typically delay new upstream projects for a time.

As a result, Gill said, "A large backlog of drilling and workover activity has likely built [in the Permian basin], while these organizations have adjusted and retooled their operations post-merger."

Shortages

Gill said market drivers support activity levels in excess of 1,800 rigs.

The well-servicing industry, however, does not have the resources-crews, rigs, and equipment-readily available to meet that demand level in 2001.

The US land well-servicing industry is currently working at about 55% capacity of its official total of 1,872 rigs.

But the Simmons report said actual utilization is closer to 64%, since 250 rigs are "in such poor condition that they will likely never work again."

Moreover, consolidation of the industry has left substantially all of the stacked-rig capacity with the two largest contractors: Key Energy Services Inc., East Brunswick, NJ, and the Pool Well Services division of Houston-based Nabors Industries Inc.

"This point is important to remember when assessing the pricing outlook for the workover rig market," Gill said.

Key Energy and Pool also have been the primary consolidators through multiple acquisitions in recent years.

The two, along with privately held Basic Energy Services Inc., Midland, Tex., control 61% of the total US workover rig fleet, Gill reported.

Key Energy is the biggest well-servicing company with 38% of the fleet compared to 20% for Pool and 3% for Basic Energy Services.

The rest of the fleet is divided among 122 contractors who operate an average 12 rigs each, with none owning more than 50.

That's a far cry from 1990 when the "Big Three" of that period controlled only 32% of the 3,846-rig fleet.

The rest of the 300 well-servicing contractors then in business were divided into two other groups, with those owning 21-100 rigs controlling 25% of the fleet, and the largest single portion, 43%, going to those contractors with 20 or fewer rigs.

The smaller workover contractors remain localized, operating within a small 75-mile radius.

Meanwhile, lack of qualified workers has already tightened the workover rig market even before the impending ramp-up of activity.

"We believe supply and demand balance for rigs is very tight," Gill reported.

"We think it is conservative to expect that rates for workover rig contractors could reach 74% of our estimated replacement cost levels during 2002. This equates to 17% greater pricing than current levels, which are near 1997 levels and about 64% of replacement cost rates."