US independents explore ways to finance drilling projects

US independents are finding it tough going seeking outside financing in the wake of lower oil and gas prices and slimmer cash flows.

That contrasts with the situation a year ago, when high oil and gas prices enabled exploration and production companies to fund their projects mainly from internal cash flow.

The basic forms of available capital have held steady over the years, but a producer's profile of capital providers can change with commodity cycle shifts. Financing options include bank debt, industry partnering, mezzanine and project finance, and private or public equity.

The cost of the financing varies with the amount of risk being taken by the capital provider. Generally, banks look for a rate of return ranging from 6% to 10%, mezzanine finance providers want about 20%, and private equity providers seek 30%.

Both the public and private equity markets for independents were healthier early this year when commodity prices were much stronger. But dropping oil and natural gas prices have also led to a tightening of equity markets for E&P firms in recent months.

"In terms of independents raising capital, the trend has been from equity to debt due to the impact that declining commodity prices and the slowing economy have had on the relative cost and availability of equity vs. debt," said Dean Swick, Arthur Andersen LLP partner in the global energy and utilities industry sector.

Noting an improvement in natural gas prices going into November, Swick said the equity markets might open again to independents in coming months "if there is a continued trend toward improvement in gas prices or a stabilization at a higher level."

Swick said independents have an easier time attracting capital at reasonable rates for development drilling and other low-risk projects. "Exploratory drilling is going to have to be funded by cash flow or very expensive equity," he said. "Some of the oil and gas companies have pulled back some growth plans," given a slowing economy and softening commodity prices, he said.

"Forward curves for gas and oil prices are not that strong right now, so I think it is a cautious wait-and-see approach for the next 6 months to see how gas prices react this winter and if oil prices improve," Swick said of the spending outlook for producers.

"Independents are looking very closely at their mix of assets and trying to determine which ones are going to give them the highest returns. The other ones they will defer making an investment in until a later time. Independents will be very judicious where they spend their money until both commodity prices and the economy get more robust," Swick said.

His advice to early-stage companies is to develop a well-defined strategy focused on stable, predictable results, adding that this is difficult in a volatile commodity price business.

"Producers need to have clear goals of increasing asset values and [improving] their cash flow each year. That, combined with good management, will make them very attractive to the capital markets. For the startup companies without a track record, the financing tends to have much more of an equity structure in pricing," he said, adding that financing for startup energy companies typically involves private capital funds and joint ventures with industry partners.

Development financing

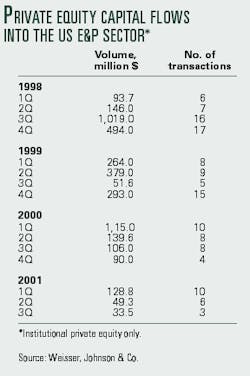

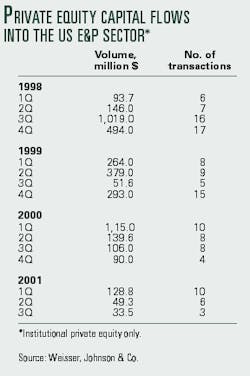

Weisser, Johnson & Co., Houston and New York, is a financial adviser working for oil and gas companies seeking private financing. The firm has arranged financing ranging from $5 million to $400 million, although most deals are $10-50 million.

"Many companies are out looking for capital right now. We see the greatest demand for mezzanine and project finance money, particularly for development drilling-oriented projects," said the firm's cofounder, Scott Johnson.

In late October, Johnson was working on closing two mezzanine deals. He has arranged mezzanine financing for early-stage private firms and for publicly traded companies.

Mezzanine deals can be structured in numerous ways, but each one basically involves interest on principal payments plus a royalty intended to give the capital provider an average rate of return of 20%, Johnson said.

The capital provider's rate of return hinges upon the success of the project. Johnson said the mezzanine finance provider generally will accept some exploration risk but wants to ensure recovery of its principal.

"All these mezzanine-financing deals are done on a project basis, which means they cover certain specific assets and not necessarily everything that a company owns," Johnson said.

Typically, the loan portion has an intended maturity of 3-5 years, with the royalty beginning only after the loan has been paid off.

For example, Weisser, Johnson helped Tipperary Corp., Denver, arrange $17 million in mezzanine financing for an Australian coalbed methane project. Tipperary received its funding from TCW Asset Management Co., Los Angeles.

David Bradshaw, Tipperary president and CEO, said the TCW financing enabled the start of a 20-well development-drilling program for the Comet Ridge coalbed methane project in Queensland.

Mezzanine financing is available from funds set up specifically to invest in oil and gas and from subsidiaries formed by some integrated gas and electric companies.

Exploration financing

Spinnaker Exploration Co., Houston, started 5 years ago as a grassroots exploration company that initially obtained $75 million in private equity, which helped finance discoveries in the Gulf of Mexico that led Spinnaker through an initial public offering.

"I think the best financing is designed in conjunction with a strategy. Our strategy is being a pure explorer. We've never bought a barrel or an Mcf," said Roger Jarvis, chairman, president, and CEO. "The concept behind Spinnaker was a technology and data-advantaged company that would be the new prototype for exploration in the Gulf of Mexico."

That advantage was achieved through a private equity agreement with Petroleum Geo-Services ASA (PGS) in which PGS put up $15 million of capital and granted Spinnaker a perpetual license to use PGS's existing nonpropriety 3D marine seismic data and any additional nonpropriety seismic data that PGS produces through Mar. 31, 2002.

"We went to the venture capital markets to balance out the commitment that PGS was making with their database," Jarvis said. In 1996, Spinnaker received $60 million in private equity from E.M. Warburg, Pincus & Co. LLC, New York.

"At the time we formed Spinnaker, it was the largest equity investment into any grassroots energy startup. We had no producing propertiesellipse.but Warburg saw a drillbit-focused strategy potentially big enough to access the public markets," Jarvis said.

He talked with seven venture capital firms, and Warburg financed the entire funding request. The next stage of financing was an $85 million conventional line of credit based upon the strong balance sheets of Spinnaker's partners, Warburg and PGS.

Spinnaker went public with an IPO in September 1999 and returned to the public equity markets in August 2000 to raise another $140 million in net proceeds through a secondary offering.

Jarvis attributed the company's success in the public equity markets to its early exploration successes and its subsequent "organic" growth in reserves and production.

As of Sept. 30, 2001, Spinnaker had no debt. Warburg owned 26% interest in Spinnaker, management owned 13%, and the public owned 61%. PGS sold all its holdings in Spinnaker via a registered offering in late 2000 for $150 million in net proceeds to PGS.

Jarvis foresees a transition coming for Spinnaker, which has announced plans to file a shelf registration with the Securities and Exchange Commission related to the potential public offering of up to $300 million.

The offering may involve any combination of debt securities, preferred stock, common stock, warrants, stock purchase contracts, and trust preferred securities from time to time, a news release said.

Meanwhile in October, Spinnaker was finalizing a $200 million conventional line of credit with a consortium of four or five banks.

"Chances are that if you look at us a year from now, we'll have a bit of debt. We're a different company than we were a few years ago. We've got production and cash flow. It's probably appropriate to take some debt," Jarvis said.

Spinnaker partners with other independents on its projects to help reduce costs, Jarvis said, adding Spinnaker generally owns 75-85% interest in its Outer Continental Shelf projects and about 25% interest in most of the deepwater projects in which it is involved.

Infrastructure financing

The deepwater Gulf of Mexico is a capital-intensive environment, and Jarvis said he is encouraged by the recent creation of hub production facilities that are financed by electric and gas parties and then leased by oil and gas producers.

"The big disadvantage an independent has in the deepwater is capital and infrastructure. To the extent that infrastructure is controlled by your competitor, it's hard to compete. These third-party merchant hubs are a very encouraging trend," Jarvis said.

Spinnaker is examining the possible use of a merchant production hub for at least one, possibly two deepwater projects, he added.

Meanwhile, the exploration unit of Dominion Resources Inc., Richmond, Va., and Pioneer Natural Resources Co, Irving, Tex., signed a deal with Williams Cos. Inc., Tulsa, which will invest $400 million for Devils Tower field infrastructure (OGJ Online, Sept. 5).

Williams will own a truss spar floating production facility along with gas and oil export pipelines. Dominion Exploration & Production Inc. and Pioneer will make fixed monthly payments. Dominion operates Devils Tower field, with 75% working interest, and Pioneer owns 25% interest.

In addition, Williams's energy marketing and trading group will purchase the associated gas production while Do- minion will market the oil production.

Dominion E&P Pres. and CEO Duane Radtke said, "Dominion is able to significantly enhance the field economics by monetizing the potential third-party use of the infrastructure. It will also allow Dominion to focus our efforts and our capital resources on our core business."

Guy Suffridge, commercial project developer for Williams' energy services business, said, "This is a business strategy we've been trying to sell to industry for about 3 years now. I see this as a key for independents."

Williams is expanding its infrastructure strategy to become an aggregator of production facilities, which account for about half the cost of developing a discovery, Suffridge said.

"If you spread that capital around several discoveries instead of just one, you make the threshold size of a discovery much smaller," he said. "Typically if you want to build a spar or a tension leg platform, you've got to have 100 million bbl or better. Of all the discoveries in the Gulf of Mexico, over half of them are less than 100 million bbl."

With a similar Gulf of Mexico hub facility, El Paso Energy Partners LP (EPEP), Houston, has installed the Prince tension leg platform in 1,450 ft of water on Ewing Bank Block 1003.

EPEP owns and managed the design and construction of the TLP and related oil and gas pipelines to gather and process oil and gas production from Prince field, a development project of El Paso Production Co., a business unit of El Paso Corp.

The platform will aggregate production from future oil and gas developments in the Ewing Bank and Green Canyon areas of the deepwater trend, EPEP said (OGJ Online, July 19, 2001).

Service company partners with producers

Another form of partnership within the industry involves direct investment by oil service company subsidiaries into oil and gas projects.

For example, Energy Resource Technology Inc., a unit of Cal Dive International Inc., Houston, has 20% interest in the Gulf of Mexico's Gunnison field (OGJ Online, April 30, 2000).

Kerr-McGee Oil & Gas Corp., Oklahoma City, has approved development of Gunnison in 3,100 ft of water using the Kerr-McGee Global Producer VII truss spar. Kerr-McGee operates the Gunnison area with 50% interest. Partners are Cal Dive and Nexen Inc., Calgary, with 30% interest.

Cal Dive created Energy Resource Technology Inc. as a production company that does not engage directly in exploration. ERTI is a wholly owned subsidiary that acquires and operates mature and noncore offshore oil and gas properties.

In the event that exploratory drilling is successful and a development decision is made, Cal Dive will actively participate in field development planning and will collaborate with the working interest owners in the execution of subsea construction work, the company said. Cal Dive in August 2000 received a letter of intent from Kerr-McGee for a contract to install infield flowlines in the Nansen and Boomvang fields in about 3,600 ft of water in the Gulf of Mexico. It has no equity interest in those projects.

Cal Dive implemented outside financial mechanisms to cover its proportionate drilling cost exposure in the Gunnison project so that shareholders are shielded from exploratory risk.

Owen Kratz, Cal Dive chairman and CEO, said, "We believe this is the first step towards a new industry model whereby both the oil company and service sectors can cooperate to achieve desired returns."

Acquisition financing

Timing is vital in financing arrangements, said Steve Antry, president and chairman of Beta Oil & Gas Inc., Tulsa, which completed its IPO in second quarter 1999. Beta has since acquired producing properties and undeveloped properties.

"Our timing has turned out to be very good," Antry said. "We completed a $5.6 million private placement offering this year. We pulled the trigger on it right before prices fell," he said, adding Beta has no debt.

Beta has bought its assets by using equity capital, he said. Last year, Beta acquired Red River Energy Inc., Tulsa, for $23.5 million. Beta issued 2.25 million shares of common stock to finance the deal.

The combined companies' assets are worth $50 million, representing a 112% increase in the value of Beta's assets. The combined companies' daily production is about 10 MMcfed, a 186% increase over Beta's previous production level.

"Private placements are our favorite way of raising capital. They are relatively easy to put together, and we can still provide registration rights for the underlying shares for investor liquidity," Antry said.

He is very familiar with the capital market side of the oil and gas industry, both from the perspective of working for oil companies and from previously founding an investment bank that specialized in energy financial and strategic restructurings.

"This is probably the most difficult environment right now that I've seen in 14 years to get capital as a small E&P company," Antry said. "It's a tough time to try and go get capital. If you can access the equity markets privately, it's probably about the only avenue that works right now for a small independent."

Dean Swick

Independents have an easier time attracting capital at reasonable rates for development drilling and other low-risk projects. Exploratory drilling is going to have to be funded by cash flow or very expensive equity.

Scott Johnson

"Many companies are out looking for capital right now. We see the greatest demand for mezzanine and project finance money, particularly for development drilling-oriented projects."

Chairman, CEO, and Pres.

Roger Jarvis

"I think the best financing is designed in conjunction with a strategy. Our strategy is being a pure explorer. We've never bought a barrel or an Mcf."

Chairman and Pres.

Steve Antry

"This is probably the most difficult environment right now that I've seen in 14 years to get capital as a small E&P company. It's a tough time to try and go get capital. If you can access the equity markets privately, it's probably about the only avenue that works right now for a small independent."