OPEC-consumer cooperation needed to ensure adequate future oil supply

In assessing the prospects for the continued ability of the Organization of Petroleum Exporting Countries to meet future oil demand, it is necessary to present the concept of oil production capacity as a multidisciplinary subject.

Thus it is critical to focus on the subject's three most important aspects:

The technical aspects include (a) the discovery of oil, (b) the development of undeveloped reserves into production capacity, and (c) the maintenance of those capacities. It is important to remember that those technical operations require an evaluation of costs and profitability and the provision of capital.

On the subject of policy analysis, we will examine the decision-making pro- cess, emphasizing the larger reserves and production capacity of OPEC, as well as OPEC's heavy capital requirements.

It then follows that we ask (1) if OPEC's reserves will automatically be developed into higher production for meeting the future oil requirements of the world and (2) if OPEC spare production capacity will continue to be available as a cushion for world oil supply security.

In the course of analyzing those two prospects, we must also focus on both laissez-faire and market-regulation strategies, noting the oil market's short-term memory and its general expectations from OPEC.

This brings us to a recognition of the need for a global compromise in a "new world energy order," which can happen only with greater transparency by OPEC, positive engagement of all producers and consumers, and a greater role for economics than politics.

Exploration and development

Conducting an exploration program is the first technical step, and its success is an obvious prerequisite for establishing production capacity.

It is, however, worth remembering that large quantities of undeveloped oil reserves from previous exploration work already exist in many parts of the world (especially in OPEC countries).

The second technical step after exploration is the development of reserves into smoothly functioning production capacity. However, that is not the end of the story. There is a third technical step, i.e., the maintenance of production capacity. This is critical but all too often forgotten.

In particular, one should note that large quantities of remaining oil reserves in many parts of the world are located in producing fields, and many of those fields have been in production for a few decades. They constitute a major part of global production capacity and they are declining.

Maintaining the production capacity in these fields is therefore critical, but it is a technically challenging task and requires heavy investments. Increasing those capacities above their current levels is an even more complicated and costly process.

Mostly this situation is observed in OPEC areas, particularly in the Middle East, but it is also a feature in many other parts of the world.

Role of technology

Advances in technology have increased the efficiency of upstream operations, and costs have come down.

Compared with a few years ago, oil is discovered more cheaply today and is brought on stream more quickly and at lower cost. For example, a Centre for Global Energy Studies analysis of the North Sea shows that, in the 1990s, development and production costs fell by 31% off Norway and by 17% off the UK.

However, questions still remain concerning the size of the world's resource base, including the quantity of oil to be discovered in the future. Will the resource base impose a constraint on the level of oil production? In other words, will the world run out of oil, or will market forces stimulate more oil discovery?

Two schools of thought exist on this issue, and it remains a controversial subject. The key question in this debate is the order of magnitude of the resource and the time horizon for its exploitation. However, whatever the correct picture might be, there is a general consensus that OPEC areas hold much larger reserves at present and that the size of their ultimate future discoveries will be larger than those in the rest of the world.

Costs, profitability

An important economic parameter in an analysis of future production capacity is the cost of exploration, development, and maintenance operations.

Costs vary in the various oil pro- vinces of the world and among the various fields in each province. The costs reflect their geological, reservoir, and geographical characteristics. Some fields and provinces are "high cost," while others are "low cost."

Under a high oil price regime, investments in upstream operations will be profitable in almost all areas of the world, but there still remains an element of risk. There is a lead time between expenditure and the resulting revenue. It takes a few years before exploration work results in discovery and before field development activity leads to oil production. By that time, oil market conditions could weaken and the price of oil might drop.

There might not be sufficient demand for that particular quality of oil or in that geographic location, unless offered at a price discount. The effect might be that revenue from the sale of the produced oil might not be sufficient to recover the initial investment and its accumulated interest over the long exploration-development period.

Capital requirements

Whatever the costs, the more important point about oil production capacity is the provision of funds for carrying out the exploration and production operations.

This is a key factor, and the availability of funds cannot be taken for granted. The sums required for supplying world oil needs constitute significant volumes on the global scale. The commitment of such funds to the oil sector is not automatic.

Although capital provision is, strictly speaking, an economic issue, it is to a great extent influenced by policy and politics.

Decision-making process

The overriding issue in all the preceding parameters is the process of deciding whether to invest and to carry out exploration, development, and capacity maintenance operations. Such decisions are usually based on technical and economic considerations, but perceptions often play a greater role. Talking about production capacity, we are discussing the supply side of the international oil market. However, this cannot be separated from demand.

The decision-making process and the commitment of funds depend on the expectations for the future trends in the oil market, the global economy, policy developments, and political events.

We have to acknowledge that, in spite of the many sophisticated forecasting techniques and models of the global economy, energy, and oil, the final parameter is the perception of the decisionmaker or his or her advisers.

We also have to face the fact that the private-sector investor expects that, following any decision, exploration and development operations will follow immediately and in the shortest time, resulting in the maximum allowable production from a field and the earliest recovery of the investments.

On the other hand, past experience shows that an OPEC investor also has to consider the possibility that the costly production capacity might not be utilized. This is an extra element of risk for the OPEC investor.

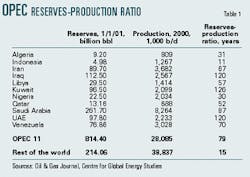

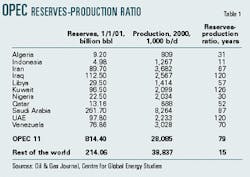

OPEC has, at many intervals in the past, held spare production capacity. At present, the size of this unused capacity is about 5 million b/d (Table 1).

Should the organization bear this extra, expensive burden?

OPEC reserves development

Whatever school of thought one might follow on the size of world oil resources, the smaller resource base in non-OPEC areas implies that the future decline in production capacity of these areas would occur earlier than OPEC regions.

At present, three-fourths of the remaining world oil reserves are held in OPEC areas, and the estimated future OPEC oil discoveries are also expected to be larger than those in the rest of the world (Table 2).

On the other hand, there is an implicit universal assumption that these reserves provide a guarantee for supplying the future growing oil needs of the rest of the world.

However, such an assumption requires the development of OPEC reserves into increased oil production capacity. It also requires that continued exploration work will be carried out in order to sustain OPEC's resource base by finding its undiscovered reserves.

It is generally taken for granted that OPEC will maintain that capacity and will expand it in line with growing world oil demand in the coming years. Moreover, the world assumes that the organization will always continue to maintain a certain percentage of its capacity as a comfortable cushion of spare production capacity. The cushion is also expected to grow in size in line with the growing world oil demand.

In other words, as the volume of world oil consumption increases in the future, the production capacity of OPEC and the size of its spare capacity must also continue to expand. The world depends on this extra capacity to provide security of supply for the consumers. It will be utilized during unforeseen events, and oil flow will be maintained under all circumstances.

OPEC's capital requirements

Should OPEC countries commit their national resources to the major undertaking discussed previously in order to provide global security of oil supply?

As noted earlier, these undertakings require very significant investments and a long lead-time. Investment requirements vary among OPEC member countries but range from about $4,000 to $15,000 in order to add 1 b/d of new production capacity and as much as several hundred dollars each year to maintain 1 b/d of production capacity.

These figures imply $4-15 billion for adding 1 million b/d of oil production capacity and $200-700 million/ year for maintaining 1 million b/d of capacity. Even taking the lower end of the range in these estimates for the low-cost members of OPEC implies huge investments.

If that production capacity were utilized, one could expect the swift recovery of the investment under good market conditions or a longer payback period under weak market conditions.

However, keeping spare capacity with no revenues implies huge expenditures that may never be recovered. The main aim of these expenditures is to guarantee world oil supply security. OPEC has been bearing such costs in the past, but should it continue to do so in the future? The answer to this question is really a major item of OPEC policy, but it also involves non-OPEC producers, the international oil industry, and oil consumers. The following discussions seek to elucidate some of the more relevant issues.

Regulating the market?

On a global scale, it is often implicitly assumed that investments will be on hand, exploration and development operations will continue, sufficient oil supplies will be available for the world's oil consumers, and supply-demand will always be balanced in the global oil market.

However, this assumption might not be valid, or one might say that it is not accepted universally.

One school of thought would argue that, left to the free market, its mechanisms will lead to the use of the most efficient sources of supply and to the most effective response being made to meet future demand.

Another school would argue that such free market mechanisms lead to cycles of excess and shortage, i.e., global oil market instability. Thus, some degree of control and regulation will be required.

As we know, the history of the world oil market has witnessed regimes from both schools as well as a combination of the two. Some degree of market regulation has usually been practiced either by the major private companies or by state organizations.

In the last 30 years, OPEC has been a major player in the international oil market, and the organization believes that it has played a stabilizing role.

Oil market memory

It is fair to say that the oil market has a short-term memory, and it is more influenced by current and recent events.

It was early last decade in the aftermath of the second Persian Gulf war that we were concerned about the slow pace of field development and production capacity expansion in OPEC countries. The activities conducted by the national oil companies were thought to be on too small a scale and progressing too slowly. Concerns were raised that, in spite of the large volume of proved reserves, OPEC might not be able to meet the global demand for its oil in that decade.

However, when the price of oil had fallen to less than $10/bbl in 1998-99, some saw a global surplus of oil supplies and production capacity, especially in OPEC areas. OPEC production capacities were said to be growing at rates greater than the growth in demand, and the organization's production discipline was under pressure. A free-for-all production scenario and further collapse of oil prices were seen as likely possibilities.

Yet with high oil prices in summer 2000, some were concerned about a short-term shortage of oil. It was feared that even OPEC spare capacity could not be brought on stream in time to meet increasing world demand in the following winter months.

Finally, this summer brought fears over the possibility that OPEC discipline could break down in the face of the organization's large unused capacity. However, there is now concern about capacity shortage in case of possible military action following the tragic events in the US.

Expectations from OPEC

It is not intended here to discuss the role of OPEC in the oil market.

However, it is worth remembering that, according to OPEC statutes, the goals of the organization include "coordinating and unifying member countries' petroleum policies and determining the best means for safeguarding their interests, individually and collectively." The goals also include "the stabilization of prices in the international oil market with a view to eliminate harmful and unnecessary fluctuations" and securing "an efficient, economic, and regular supply of petroleum to consuming nations and a fair return on their capital to those investing in the petroleum industry."

Despite this, OPEC's efforts at stabilizing the oil market and securing revenues have sometimes been misinterpreted. In a low oil-price environment, OPEC is called upon to undertake measures to raise the price of oil. Similarly, in a high oil-price environment, OPEC is asked to increase production and lower the price of oil.

Yet when the organization takes action, it is criticized for interfering in the free market. At the same time, the common agricultural policy in Europe and measures for tackling overcapacity in the international steel market are portrayed as accepted policy actions.

In spite of these criticisms, the world expects OPEC to act and undertake both short-term and long-term policies for world oil market stability. It is expected that the organization should almost micromanage the market and respond to events even on a weekly or daily basis. At the same time, OPEC is expected to evaluate the long-term outlook and undertake policies for the coming decades.

Global responsibility, cooperation

Maintenance of a growing spare oil production capacity by OPEC provides security of supply.

But could a "new world energy order" also provide security of demand for OPEC and other producers? Oil demand will be driven down by high taxation on petroleum products, the Kyoto Protocol, alternative liquid fuels, and by numerous other developments. In the meantime, there could be increased market instability.

The resulting oil price fluctuations will be harmful to producers and consumers alike and should be avoided. However, this requires both short-term and long-term considerations. Such goals require international cooperation.

In this respect, reducing uncertainty in data and information is an obvious first step, and OPEC can initiate this effort. Naturally, some degree of confidentiality is necessary in all business transactions, and 100% transparency is not a realistic expectation.

Nevertheless, there are steps that OPEC could take in this direction. As examples, there are the size of OPEC's oil reserves and the group's level of production. It is unfortunate that some analysts refer to the mid-1980s upward revision of oil reserves in OPEC countries as "political reserves" and that "secondary sources" are used for OPEC's monthly oil production figures.

CGES did carry out some research on the upward revision of OPEC reserves. We believe that an upward adjustment was justified, especially following decades in which the results of exploration and development operations had unnecessarily been treated as confidential. Adding those discoveries did mean higher reserves than had been routinely reported by various publications all those years. However, a proper estimation of reserves requires detailed and comprehensive data and multidisciplinary teams of experts. These were beyond CGES objectives.

Finally, it is necessary to stress that OPEC has strived for oil market stability and will continue to do so in the future. However, we have to acknowledge that this goal would be better achieved in a more cooperative rather than confrontational world, with the positive engagement of other oil producing nations and indeed also the oil consuming countries.

This requires international compromise, but let us hope it will be based more on business principles than on political rhetoric. Unfortunately in today's world, political considerations all too often drive economic decision-making and hamper the formation of sound economic policies.

But perhaps it is not too idealistic to strive for a world oil market driven by economic principles, though understandably, within the constraints of the world's political environment.

Acknowledgment

This article was adapted from a presentation given to the OPEC seminar, OPEC and the Global Energy Balance: Towards a Sustainable Energy Future, held in Vienna Sept. 28-29. The views expressed are the author's and do not reflect the official position of CGES.

The author

Manouchehr Takin is senior petroleum upstream analyst with the Centre for Global Energy Studies. He worked for 9 years as senior officer in the Organization of Petroleum Exporting Countries Secretariat analyzing global energy and oil markets. Before that, he worked with National Iranian Oil Co., Ultramar, Amoco International, the Iranian Oil Consortium, and other oil companies. Takin holds a BS in geology from Manchester University, UK, an MBA from the Industrial Management Institute, Iran, and a PhD in geophysics from Cambridge University, UK.