CERI: Canadian gas producers' plans hinge on supply

The continuously shifting dynamics between supply of and demand for natural gas in North America have a number of Canadian producers rethinking their exploration and development plans.

This was one of the major findings in a survey of Canadian producers conducted in the third quarter by Canadian Energy Research Institute. For the 10th straight year, CERI polled producers on their expectations for gas prices, capital spending, drilling, deliverability, and production. CERI researchers then reported their findings in the publication "2001 Canadian Natural Gas Producer Survey and Deliverability Outlook."

In its analysis, CERI also noted interesting trends in merger and acquisition activities within the Canadian oil and gas industry.

"The pressures of strong demand growth and lagging supply in North American natural gas markets through 1999 and 2000 eventually boiled over by the end of 2000," observed Paul Mortensen, research director, and Matthew Foss, economist, in their analysis of this year's survey.

"As 2001 began, a unique combination of factors suddenly came into alignment to relieve the pressure," they said. "Supply and demand responded more significantly than many expected, as industrial gas demand fell and additional gas supplies were obtained by reducing the extraction of natural gas liquids.

"The arrival of mild temperatures and a continued slowing in the economy magnified the weakening demand response. The reaction was so strong that perceptions of a supply-constrained market now have been replaced by impressions of excess supply," the analysts said.

Natural gas prices

CERI's survey found that the downward trend of natural gas prices over the past year has worn away at Canadian producers' typical pattern of basing exploration and development plans on conservative price expectations. This change, the CERI analysts said, "may result in producers soon revising their price expectations downward for planning purposes."

Collectively, the producers polled this year expected gas prices to average $5.72 (Can.)/Mcf in 2001, $4.42/Mcf in 2002, and $4.05/Mcf in 2003. (These aggregate averages were calculated using a weighting for each producer proportional to its expected production volume during each year in question.)

By comparison, CERI's current average gas price forecast for 2001 is $6.05/Mcf, it said. Going into 2002, this average drops to $2.95/Mcf. "A recovery in demand growth and continued strains on the industry to increase supplies will eventually tighten supply-demand margins again and make prices in the $4 range achievable over the longer term," CERI said.

Capital spending

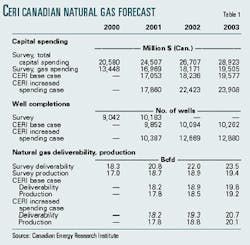

The "huge" jump in 2001-02 capital spending plans was "the most noticeable change" in this year's survey, the analysts said.

"Gas spending was almost 40% higher in 2000 than the levels producers indicated in last year's survey," CERI said. The analysts attributed the increase to the rise in natural gas prices.

The analysts noted, "Despite these ambitious plans, the size of the drilling fleet and a lack of personnel continue to constrain producers from reinvesting revenue at rates achieved in 1998."

After examining a higher spending scenario-given the absence of any personnel or equipment constraints-CERI surmised that price expectations would have to remain below $3.50/Mcf during 2002-03 before producers would begin to reassess their spending plans (see table).

Well completions

Natural gas well completions should continue their strong pace, the analysts observed.

"Since 1998, the number of gas well completions has grown by over 2,000/ year, with the largest increases in the shallow gas areas of southeast Alberta and Saskatchewan," CERI noted. In 2001, CERI added, those producers surveyed expected to complete more than 10,000 gas wells, which included "substantial increases" in Alberta and British Columbia.

CERI said that while shallow gas drilling continues to be a large part of producers' drilling plans, there is a sense that the industry is beginning to move to deeper targets to the north and west of the Western Canada Sedimentary Basin.

CERI's base case estimates that the number of gas well completions will increase-albeit marginally-in 2002-03. In the "increased spending" scenario, a decline in equipment and personnel constraints should allow gas well completions to approach 13,000/ year.

Deliverability, production

CERI's base case scenario sees deliverability rising by an average 800 MMcfd/year during 2000-03. CERI reached this estimate using regional historic references for well completions, production per completion, and connection rates.

Regarding producers' reporting their deliverability capabilities, however, the analysts noted: "There is a strong temptation for producers to estimate their efficiency and performance as among the top performers in the industry. Because companies must compete with their peers for access to capital investment, estimates of future performance attempt to put companies in the best light possible.

"This sentiment tends to inflate the survey-based projection of deliverability and production growth relative to capital expenditures." And therefore, "The survey results for expected deliverability appear overly optimistic and are not likely achievable. The producer outlook may incorporate some double counting associated with the high level of merger and acquisition activity in 2000-01," the analysts said.

CERI added that if a relatively tight margin between deliverability and production were maintained, Canadian gas production in the base case would nearly reach the level indicated by the survey for 2003. Under the base case, production grows by an average 730 MMcfd during 2000-03. (The deliverability and production projections in the base case reflect the capital spending plans of producers collected in the survey.)

M&A trends

The CERI analysts noted that, despite the potential for the dollar value of any future merger and acquisition deals in the Canadian oil and gas industry to be maintained (or even increased), the number of possible deals would most likely decline, given that a majority of Canada's medium-sized firms have been recently acquired.

"The prospects for some of Canada's senior producers to come into play appear as strong as ever," the analysts noted. "Corporate share prices have retreated from previous highs, and Canadian companies remain undervalued relative to their US counterparts.

"The diversion of capital and personnel to frontiers in the North and the East Coast may become an issue for future development in western Canada. While the next major developments on the frontiers are beyond the time horizon of the survey, their influence may be felt in a declining share of capital for western Canada, beginning in 2003," the analysts said.

"With additional deliverability from the frontiers not likely to show up until the 2005-07 time frame, adequate production growth must be maintained in western Canada in 2004 and beyond," they said.