Petroleum shipping industry facing shortage, two studies say

Two analyses of petroleum-related shipping for the US and world, respectively, announced last month that that industry is headed for crisis.

The US may be facing a severe US-flagged tanker shortage, unless construction of double-hulled vessels picks up dramatically, according to the Shipbuilders Council of America, Arlington, Va. Root cause of the impending shortage is the US Oil Pollution Act of 1990.

In another study, shipping consultant Poten & Partners, New York, said that time-charter rates in force as late as last month for very large gas carriers (VLGC), carrying LPG, made it impossible for companies to justify new investments in new vessels.

Implications

According to the Shipbuilders Council, OPA 90 requires single-hulled tank vessels to be phased out of service or converted to double-hulled vessels to reduce the risk of oil spills. Under the legislation, the US will lose as much as 28% of its existing tank vessel capacity, including 45% of all large, ocean-going tank barges, by the end of 2004.

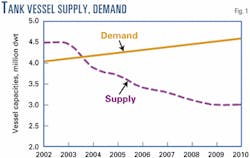

The association's analysis, which it said takes into account existing construction and orders, projects that at the present rate of double-hull construction, US tank vessel demand will exceed supply by 24% by yearend 2006 and by 34% by yearend 2009 (Fig. 1).

A shortage in tank vessels would have military and commercial implications, according to the analysis. Historically, almost all petroleum products have moved to a war zone in waterborne transportation with US vessels forming the backbone of this requirement.

US tank vessels are also crucial to meeting America's commercial transportation needs for petroleum products, said the analysis.

The SCA was not alone in raising these concerns; other maritime industry groups have also voiced concerns about US tanker capacity, it said. The association cited recent comments from the Maritime Cabotage Task Force and the Sealift Committee of the National Defense Transportation Association.

In addition to double-hull construction already underway, according to the analysis, more than 500,000 dwt will be needed by 2005 simply to meet growing demand for domestic waterborne transportation of petroleum products. That could equate to construction of about 25 tank barges of 20,000-dwt capacity over the next 3 years.

And the analysis said that, although there has been an increase in double-hull construction, construction falls far short of anticipated capacity demands in coming years.

"Operators waiting until the 11th hour to order ships could find insufficient shipyard capacity to meet new building demand-a problem that could be more acute as construction in the offshore and dry cargo segments develops," the analysis said.

And, it continued, the US Coast Guard, at the request of the US Congress, has undertaken a more comprehensive assessment of the progress to replace the single-hulled tank fleet with double-hulled tank vessels. Its report is anticipated presently.

Time-charter equivalent

VLGCs carry LPG, primarily propane and butane, in cargo lots of 75,000 cu m (40,000 metric tons) or more, said Poten & Partners. In 2000, the VLGC spot rate from the Middle East to Japan averaged $34/ton or a time-charter equivalent (TCE) of about $1.1 million/month for a newly built VLGC (daily TCE of $36,500/day).

With spot freight rates current as of October running less than $20/ton, the TCE had fallen to $450,000/month, or less than $15,000/day. With newbuilding prices at $65-67 million, said the consultant, rates are "not nearly enough to justify new investments."

Fig. 2, a TCE chart for VLGCs, shows the significant slump that has occurred this year.

Reasons for the malaise can be found in both supply and demand factors at play.

On the supply side, the VLGC trading fleet will increase by a total of eight newbuildings this year (six had been delivered by Oct. 1) with no retirements in the form of scrapping.

On the demand side, Middle East LPG exports, the primary business for VLGCs, declined in 2001. The key supplier, Saudi Arabia, in order to keep their domestic petrochemical market supplied, is expected to export around 2 million fewer tons in 2001 than in 2000. This has resulted in a loss of employment for about five VLGCs.

Eight newbuildings being added to supply with a loss of demand for five existing vessels, said Poten & Partners, is a swing of 13 vessels to the surplus side of the supply-demand balance.

"Thirteen vessels may not sound significant to tanker owners who operate in fleet segments of hundreds of vessels, but the VLGC fleet only numbers 100 vessels. Thus this addition of 13 vessels to fleet surplus, representing 13% of the fleet, has had a profound impact on VLGC rates," said the company.

For comparison, this would be equivalent of "adding 77 Aframax tankers to the current fleet of about 600 vessels."

Consequently, VLGC time charters have virtually disappeared as expectations of low spot rates increase. Only one new 1-year time-charter had been recorded for the year through Oct. 1, 2001.

Clean products trade; pooling

Although VLGCs are built to carry LPG, some can also carry clean-product cargoes. Last winter, this trade saved many VLGC owners, said Poten & Partners. Worldscale rates approaching W400 were equivalent to an LPG Persian Gulf-to-Japan spot rate of $50/ton. Several VLGCs went into clean products trade at that time.

Unfortunately, clean products rates of WS160 to WS180 were no longer as attractive in October. But VLGC owners have no other alternative if LPG cargoes are unavailable.

In September, said the consultant, 10 VLGCs were fixed in the clean products trade. VLGC owners, having despaired of the near-term prospects in the LPG market, were hoping for another upturn in clean product rates this winter.

Unlike tankers in which pools and individual owners compete for business, two groups-the Japanese-chartered fleet committed to Japanese LPG imports and the Bergesen controlled fleet-dominate the LPG fleet.

The Bergesen pool controls some 20 VLGCs of a 100-vessel fleet. This pool, formed last year and complemented by vessels from Dynegy and Mitsubishi, was initially successful in setting market rates by controlling the number of vessels responding to demand, said Poten & Partners.

The average timecharter rate of pool vessels rose to $800,000/month in first quarter 2001, helped by the high rates for clean products carriers. But "rates have fallen sharply since then and idle time has grown." One pool vessel was idle from the beginning of May throughout the period of study.

The consultant said the question before the pool was whether it made sense to set a high fixing rate for LPG cargoes when there were no takers.

Would there be more business if the asking rate for Persian Gulf-to-Japan were reduced to $20/ton from $35/ton or so? One reason so few fixtures had concluded at $35/ton was that the rate encouraged companies to enter into FOB-cost and freight exchanges that reduce their need to enter the VLGC spot market.

On the other hand, said Poten & Partners, the reduction in Middle East LPG exports suggests that there may not have been much spot shipping demand had Bergesen lowered its rate ideas.

The Bergesen pool capacity to set a fixed rate initially proved successful in 2000, but through September 2001 was no longer so. Following a meeting of the Bergesen pool members, there were indications that the fixed-rate policy would be dropped and the pool would become more flexible in its rate policies in order to be more responsive to market conditions.

At the beginning of fourth quarter 2001, the Bergesen pool appeared likely to pursue more varied chartering arrangements, including entering into contracts of affreightments rather than simply offering their VLGCs on a timecharter basis.

No easy resolution

Poten & Partners concluded the VLGC surplus would continue with the continued delivery of newbuildings: only one in 2002 but seven in 2003 and 2004. The orders are primarily for Japanese charterers, which do not expect any increase in Japanese LPG import trades.

Some of these orders are replacement orders for older vessels that will be either retired or sold at the end of their charters. But others appeared to be new orders that the Japanese charterers may use to compete aggressively for all LPG transportation business, whether into Japan or not.

At the end of third quarter 2001, Japanese VLGCs were already being offered for any non-Japanese time-charter business that might be available. Thus, said the consultant, surplus ships and competition from Japanese charterers are likely to remain problems for the VLGC fleet.

Correction

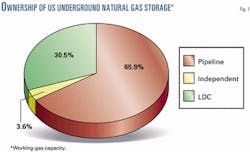

The legend in "UNDERGROUND GAS STORAGE-Conclusion: Industry-segment uses reflect evolution of storage" by H.C. Cates (Oct. 15, 2001, p. 58) inadvertently reversed the chart segments for LDC and Independent ownership. The corrected figure is shown above.