OGJ Newsletter

Market Movement

Is an oil price war looming?

OPEC appears to have drawn a line in the sand with non-OPEC oil exporters, prompting the question of whether a market war is ahead.

Oil prices fell almost $4/bbl within a week of the Nov. 13 OPEC announcement that its members agreed to cut production by another 1.5 million b/d effective Jan. 1-but with a huge qualifier: only if non-OPEC oil exporters agree to cut their collective output by 500,000 b/d.

Never before has OPEC called for a specific cut by non-OPEC exporters in a quid pro quo bid to enforce a production cut to bolster prices. Such agreements in the past have allowed non-OPEC exporters to voluntarily trim output under a "gentlemen's agreement" that did not call for specific volume cuts. Consequently, some non-OPEC exporters have responded with only token cuts, even rolling them back unilaterally if it suited them; others ignored them altogether.

But tokenism won't be tolerated this time, OPEC warns. Saudi Arabia Oil Minister Ali al-Naimi said OPEC would "absolutely not" cut production unless Russia agrees to also cut its production.

Just as Venezuela was the overachiever in production growth that precipitated the last market share grab by Saudi Arabia, Russia now is the center of Saudi attention. Perhaps recalling that Russia was once the world's largest crude oil producer for a number of years (when still the Soviet Union), the country's emerging new giant oil companies have aggressively ramped up production of crude oil-almost 500,000 b/d/year in 2000-01.

Russia's response unclear

Russia's deputy premier last week indicated that his country and other non-OPEC oil producers will reach a production agreement with OPEC in the coming days. However, Mexican Energy Minister Ernesto Martens, who met with the Russian minister earlier this month, reported at presstime that no formal agreement on significant production cuts had been reached. Martens planned to have similar discussions with the Norwegian Oil Ministry, although the latter has indicated that it would not make output cuts.

Viktor Khristenko, the Russian deputy prime minister, said, "Supplementary measures will be decided following consultations between Moscow and members of OPEC as well as other non-OPEC producers. The situation on the oil market is a continuing worry for the Russian government."

He said the slump in world oil prices would present particular difficulties for Russia in the first half of next year.

Energy Minister Igor Yusufov, in his meeting with Martens, proposed creation of a parallel structure to OPEC with other non-OPEC oil producers to help stabilize prices. The proposed informal group would mostly serve as a means to exchange information among participants.

CERI doubtful over Russian cuts

Some speculate that the Russian stance on oil reflects a desire by Moscow to be fully embraced by the major developed economies as an equal. Why else would Russia be willing to risk the damage to its economy from an oil price collapse?

Moscow already is anxious about making massive debt repayments next year, and giving the struggling global economy a gift of low oil prices could buy a lot of forbearance, contends the Calgary-based Canadian Energy Re- search Institute.

CERI doubts Russia will cave in to OPEC's demand, setting the stage for the country to position itself as a secure long-term source of oil and gas demand supply to the West.

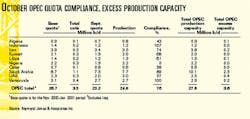

As a result, CERI believes WTI will average $20/bbl in the fourth quarter and will "fall off the cliff in 2002, averaging $14/bbl."

Yet other analysts warn that OPEC's resolve to move prices higher is being underestimated again, just as it used to be before OPEC displayed long-lived cohesion.

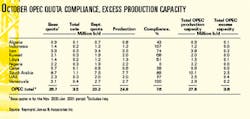

Raymond James & Associates noted that OPEC compliance with its pledged output cuts to date of 3.5 million b/d averaged 76% compliance as of October (see table, p. 5). RJA sees that cohesion holding up while the prospect of an oil supply disruption grows.

"Specifically, the oil futures strip is projecting a 2002 oil price of $22.29/ bblellipseWe, on the other hand, would be more inclined to take the over bet on our $26 oil forecast for 2002."

That outlook is based on three drivers: 1) OPEC will likely continue making production cuts until WTI oil prices return to the mid-$20/bbl, 2) even if OPEC doesn't make additional cuts, the RJA oil model suggests supply and demand in 2002 should be slightly underbalanced, and 3) the market is imputing no supply disruption risk into oil prices.

"OPEC has effectively taken 2.7 million b/d off of the market. More importantly, we think they could cut another 2 million b/d before excessive cheating impacts their cohesion," RJA said.

The price band is working, RJA said, adding that OPEC is letting the market determine supply and demand.

"Obviously, following the terrorist attacks on Sept. 11, OPEC has been reluctant to appear too price hawkish. We believe these concerns over being 'politically correct' are fading quickly as these stubbornly low prices are beginning to impact OPEC country economies," RJA said.

Even if OPEC held 2002 production flat with October 2001 production levels, OPEC production would be down 800,000 b/d in 2002.

"If we go even further and assume flat global oil demand and a non-OPEC production increase of 800,000 b/d, oil inventories in 2002 would be flat with current levels," RJA said. The historical relationship between inventories and pricing then would suggest oil prices in the mid-$20/bbl.

On the demand side, oil consumption has been flat to down in 5 of the past 50 years. More importantly, every year that oil demand was down coincided with a major price spike that changed consumption habits.

"That means that we believe an oil demand increase of 500,000 b/d in 2002 is much more likely than flat or down consumption," RJA said.

Industry Scoreboard

null

null

Industry Trends

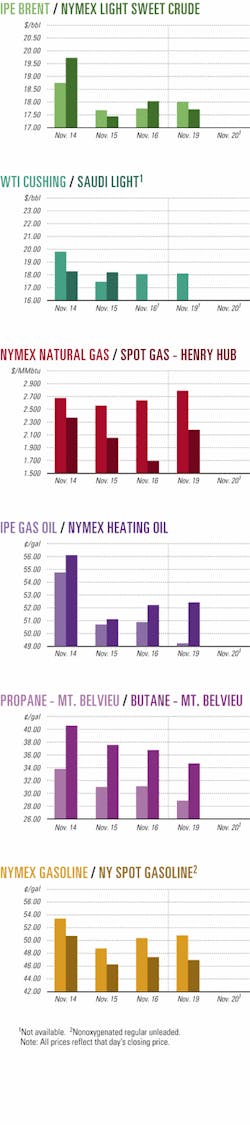

CANADA's natural gas prices at the wellhead are expected to decline in the near term because of growing surplus production combined with bottlenecks in the takeaway capacity of Canada's export pipelines.

But eventually rising demand for gas exports to the US could put upward pressure on gas prices, both in Canada and the US. That conclusion comes from Lehman Bros. analyst Thomas Driscoll after he assessed the oulook for Canadian gas production, inventories, and demand.

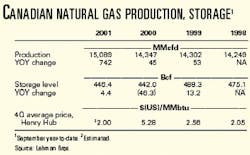

Canadian natural gas storage injections through Oct. 26 were 1.8 bcfd, or 0.4 bcfd stronger than last year and 0.3 bcfd stronger than the 4-year average. Meanwhile, Canadian inventories are at 462 bcf, 1 bcf below last year and 12 bcf lower than the 4-year average of 474 bcf.

"When looking at the September year-over-year changes in natural gas production for 1999-2001, 2001 exhibits the highest increase," Driscoll said.

However, lackluster demand is keeping gas stocks brimming, suggesting near-term downward pressure on gas prices.

The year-over-year inventory overhang of 4.4 bcf as of Sept. 30, 2001, was less than the year-over-year increase of 13.2 bcf in 1999 but compares with a 46.3 bcf decrease for the same period in 2000 (see table).

"It is important to note that Henry Hub natural gas prices during the fourth quarter averaged $2.56/MMbtu in 1999 and $5.28/MMbtu in 2000," Driscoll said.

PROPYLENE supplies worldwide are expected to start tightening in 2004, with a shortfall anticipated in 2005-15.

Chemical Market Associates Inc. said 50 million tonnes/year of polymer and chemical grade (PG-CG) propylene is produced worldwide. Steam crackers produce 70% of propylene supplies as a byproduct of ethylene, refinery FCC units generate 28%, and propane dehydrogenation and metathesis account for 2%. Over the next 15 years, growth in world PG-CG propylene supplies from steam crackers is expected to average 4.2%/year.

CMAI said world refineries generate 31 million tonnes/year of byproduct refinery grade (RG) propylene, mainly generated in FCC units as a by-product of gasoline and distillates production.

During the next 15 years, growth in world RG propylene supplies from FCC units is expected to average 5%/year, the CMAI study said.

Petrochemical demand for propylene is growing faster than ethylene demand, meaning that construction of steam crackers to meet ethylene demand will fall short of fulfilling propylene demand.

In the future, additional emphasis will be placed on recovering propylene from refinery FCC units, CMAI said. It forecast declining propylene prices through 2002 followed by escalating prices in 2004-06.

Government Developments

FERC PLANS to announce in December whether it will reconsider its decision to allow the Cove Point, Md., LNG terminal to reopen next year.

Williams Cos. received FERC approval a month ago to restart the terminal in May and expand storage capacity to 7.8 bcf from 5 bcf.

Since then, Sen. Barbara Mikulski (D-Md.) has led an effort to overturn FERC's decision (OGJ Online, Oct. 12, 2001). She argues that LNG ships could be hijacked and used to damage the Calvert Cliffs nuclear plant 4 miles from the LNG terminal.

In a closed meeting on Nov. 16, FERC met with Maryland state authorities, US lawmakers, and federal security officials (OGJ Online, Nov. 14, 2001).

Cove Point was built in 1974 and later closed due to poor economics. It was used as a gas storage site during the 1980s.

FIVE INDUSTRY trade associations last week called on the US Congress to pass "an effective and responsible" bill that would promote the safety of more than 2 million miles of oil and gas pipelines in the US.

In a letter to US Department of Transportation Sec. Norman Mineta, pipeline industry officials urged Congress and DOT to work together in a "unified fashion."

The Senate passed pipeline safety legislation earlier this year, but the House has yet to act (OGJ Online, Oct. 1, 2001). Congress took a 1-week break for the Thanksgiving holiday and is expected to adjourn Dec. 7.

Signing the letter were 14 oil and gas transmission and distribution pipeline companies and the leaders of the American Gas Association, American Petroleum Institute, Association of Oil Pipe Lines, American Public Gas Association, and Interstate Natural Gas Association of America.

THREE NATURAL gas associations have refuted claims that the US is becoming too dependent on natural gas to generate electricity.

The presidents of the Natural Gas Supply Association, INGAA, and AGA sent a letter to Sen. Jim Jeffords (I-Vt.), chairman of the Committee on Environment and Public Works.

The committee has been reviewing the environmental impacts of electricity generation.

In response to a letter that labor leaders previously sent to Jeffords, the gas associations said the US relies on coal to generate 51% of its electricity, while natural gas-fired electric power generation accounts for only 15% of the market nationwide.

The associations also challenged a claim that the US natural gas delivery system cannot meet anticipated demand increases. They said the nation would have enough gas to meet future demand, citing pipeline expansion plans averaging costs of $4.5 billion/year to 2015 and a National Petroleum Council Study that said the Lower 48 gas resource base is 1,466 tcf.

NGSA Pres. R. Skip Horvath, INGAA Pres. Jerald Halvorsen, and AGA Pres. Dave Parker sent the letter.

Quick Takes

Hopes that the Faroe Islands will emerge as a producing area received a boost following a discovery this month by Amerada Hess.

The company reported finding oil and gas with offshore wildcat 6004/16-1, which was drilled to 4,275 m TD in 950 m of water close to the boundary with the UK. The well was deepened after reaching the planned depth of 3,830 m.

Amerada Hess, as operator of License 001 off the Faroe Islands, confirmed that the discovery found light oil and gas in a gross interval of 170 m. A flow test was not performed on the well due to weather conditions. Following logging operations, the well will be abandoned.

Despite the local government's efforts to encourage exploration in the area over the past 20 years, only two wells have been drilled: a dry hole, drilled by Statoil in September, and this latest discovery.

BP's recent decision to develop its Clair discovery, which lies between the Faroes and the Shetland Islands, has led to rekindled interest in exploration in Faroese waters.

Faroes Petroleum Minister Eydun Elttoer said, "The success of this well is very important for the Faroe Islands as a future oil province, even if we do not at this moment of time know whether the find is commercial." Elttoer added that it is too early to speculate on the hydrocarbon quantities.

Amerada Hess is due to submit a report on the well, along with an appraisal program, within 8 months.

Elsewhere in exploration, Petro-Canada, operator of Terra Nova oil field off Newfoundland, said the first well on a separate fault block east of the field found 80 m of Jeanne d'Arc reservoir sands, confirming the presence of hydrocarbons. The well, Terra Nova C-69 1, was unable to gauge the extent of reserves in the Far East block, although prior to drilling it had been postulated at 100 million bbl. Petro-Canada said that, although the well was not tested, data from logs and sampling in the wellbore suggest that the sands were comparable to those of the reservoir sands in the delineated portions of the main field. Additional drilling will be required to establish the reserve potential of the Far East block and to provide the production wells needed when capacity becomes available on the Terra Nova floating production, storage, and offloading vessel. F Singapore's Sovereign Ventures said it is seeking experienced partners to explore and develop the first onshore oil and natural gas concession in North Korea granted to a foreign company. The concession, awarded by Korean Oil Exploration in September, covers 6,000 sq miles along the Chinese border across the Tumin River in the northeastern part of the Korean Peninsula. Sovereign Ventures postulates the concession's potential at 150 million boe. The concession provides an initial 3-year test period for seismic and geophysical exploration, a 2-year exploration drilling stage, and, if successful, a 20-year development and production stage. Sovereign Ventures will invest at least $10 million in the total project, including a minimum of $2 million in the seismic testing and exploratory drilling stages, officials said.

Gunnison field development plans are shaping up.

Kerr-McGee let contract to Technip-Coflexip unit CSO Aker Maritime for the construction of a truss spar to be used to develop the field in the Gulf of Mexico field.

Gunnison is on Garden Banks Blocks 667, 668, and 669 and 155 miles southeast of Galveston, Tex., in 3,122 ft of water (OGJ Online, Oct. 23, 2001).

CSO Aker Maritime will supervise the engineering, procurement, fabrication, and delivery of the complete hull, moorings, and riser system.

Finland's CSO Aker Rauma will engineer and procure the mooring system, while the riser system will be engineered and procured by CSO Aker Engineering in Houston. The hull, meanwhile, will be built at the CSO Mantyluoto yard in Finland. The hull will be 549 ft tall and 98 ft in diameter with a weight of 14,000 tonnes and displacement of 38,000 dwt.

Delivery of the spar hull is scheduled for third quarter 2003.

It will be Kerr-McGee's third truss spar, which incorporates a tubular truss system replacing the lower part of the cylindrical hull.

Kerr-McGee earlier this month let contract to Gulf Island to build the topsides for the Gunnison spar platform (OGJ, Nov. 5, 2001, Newsletter, p. 8).

Other development schemes continue apace. Canadian Imperial Venture received approval for its plan to develop Garden Hill oil field at Port au Port, Newf. The prospect is the province's first onshore field. Although production rates were not given, the discovery flowed 51° gravity oil from the Middle Ordovician in 1995. Canadian Imperial's partners in the venture are Hunt Oil Overseas Operating and PanCanadian Energy, which opened the field but did not develop it. Canadian Imperial said the 30,000 acre field is in a fault-bounded inversion fairway that parallels the western coast of Port au Port Peninsula. The development's first phase will include drilling and completing the Port au Port No. 1 sidetrack and transporting oil from it and the discovery well to North Atlantic Refining's 99,750 b/d Come-by-Chance, Newf., refinery. Associated gas will be used onsite.

Alaska's Department of Natural Resources (DNR) approved an expansion of the North Slope Point Thomson Unit (PTU), which lies east of Prudhoe Bay. Current PTU development plans should result in production by 2008. PTU operator ExxonMobil estimates the high-pressure reservoir has reserves of more than 8 tcf of gas and 200 million bbl of condensate. DNR said the proposed expansion leases were due to expire, and their inclusion in the unit extends the lease terms for as long as they are committed to the unit. DNR required firm commitments to explore the expansion area and develop oil and gas reservoirs as conditions for approval of the expansion application. The lessees agreed to drill an exploration well by 2004, begin drilling development wells by June 2006, and complete seven development wells by June 2008. ExxonMobil plans to ship the produced fluids west through the Badami sales pipeline and then into the Trans-Alaska Pipeline System. x Norsk Hydro said it expects to link three discoveries in a subsea development tied into the Oseberg field center. Hydro and its partners have made two oil and gas discoveries near Oseberg and have had one undevloped find. The Oseberg complex, including Oseberg West field, is on Blocks 30/6 and 30/9 in the Norwegian North Sea. Hydro estimates reserves at 120 million bbl of oil and 3.4 billion cu m (bcm) of gas, which brings total reserves for the area to 190 million bbl of oil and 6 bcm of gas. Norsk Hydro said it and other Oseberg area shareholders have drilled seven exploration wells in the infrastructure area during the past 5 years. Oseberg West-part of the Gamma Main geological structure proven in 1986-is being developed, and Tune field is scheduled to start producing next fall. Hydro said that, since starting operation in 1988, the Oseberg region has produced nearly 2 billion bbl of oil. The Oseberg area, about 130 km northwest of Bergen, comprises several oil and gas fields, including the Oseberg Unit, Oseberg Sør, Oseberg Øst, Brage, and Tune.

The UK government approved development of the second phase of the Juno network of gas fields in the southern North Sea. The partners in the project-operator BG, BP, and Amerada Hess-will now proceed with a $400 million investment to accelerate production from a group of small, dormant fields. The fields, which lie off Humberside in a region known as the Easington Catchment Area, were discovered in the mid-1970s and are estimated to contain more than 400 bcf of gas reserves. First gas from the fields-expected to flow in fourth quarter 2002-will be exported via BP's Cleeton-Dimlington infrastructure. During 2003, production from the fields is expected to peak at 300 MMcfd of gas. The fields to be developed are the BG-operated Apollo and Minerva and the BP-operated Whittle and Wollaston. BG operates a fifth development field, Artemis, which will be integrated into the Juno project pending successful appraisal in first quarter 2002. Drilling is expected to start on the Minerva and Whittle hubs before yearend. The platform and pipelines should be installed in summer 2002.

Topping petrochemical news, Fujian Petrochemical Co. Ltd. (FPCL), ExxonMobil China Petroleum & Petrochemical, and Aramco Overseas plan to submit a feasibility study for the Fujian petrochemical project to China's Development Planning Commission.

The integrated project would be built at FPCL's refinery at Quangang, Fujian Province. FPCL-a joint venture of Sinopec and Fujian province-will hold 50% of the Fujian venture, and ExxonMobil and Saudi Aramco will each hold 25%. The project will involve the construction of a world-scale ethylene steam cracker and polyethylene and polypropylene units, together with chemical derivatives manufacturing units and related distribution and marketing facilities.

The petrochemical complex will be integrated with the refinery, which will be expanded to a capacity of 240,000 b/d from 80,000 b/d. A petroleum products marketing JV that will supply wholesale and retail products throughout Fujian province will complement the expansion. The three companies also will be the owners of the marketing JV.

Production has begun from Hamaca field in Venezuela's Orinoco heavy oil belt, said ChevronTexaco.

The $1 billion development project includes a crude upgrader, now under construction.

Hamaca is producing 30,000 b/d of 8.5° gravity oil, which is blended with lighter crudes and sold internationally.

The 657 sq km Hamaca area contains more than 30 billion bbl of oil; over the project's 34-year life span, 2.1 billion bbl can be produced, the partners estimate.

The upgrader, at the Jose industrial complex on the northern coast of Venezuela, will be brought on stream in early 2004. That unit will upgrade the Hamaca project's production to a 26° gravity synthetic crude.

At peak field production of 190,000 b/d, the upgrader will yield 180,000 b/d of the syncrude.

Six US and three Canadian energy companies signed a memorandum of understanding regarding construction of an Alaska Highway natural gas pipeline.

The companies will develop a proposal for a pipeline from Prudhoe Bay field that parallels the Trans-Alaska Pipeline System to Fairbanks and then the Alaska Highway to northern Canada.

The nine firms expect to present a proposal to the major Alaskan North Slope producers-ExxonMobil, BP, and Phillips Petroleum-by yearend. If agreement is reached, they said the line could be in place by 2008.

The six US companies are a unit of Williams, Duke Energy, Sempra Energy International, Enron, PG&E Corp., and El Paso Natural Gas. The three Canadian companies, TransCanada PipeLines, Westcoast Energy, and Foothills Pipe Lines, have remained active partners in the Alaska Natural Gas Transportation System (ANGTS) project from its inception.

The parties said the MOU sets principles for reenlisting in the Alaskan partnership to construct the Alaskan portion of the pipeline. A key element of the MOU is that the current and reenlisting parties are committed to eliminating historic and other commercial barriers to the project. The Alaska Highway project would extend 1,700 miles from the North Slope of Alaska to northwestern Alberta. From there, existing lines would carry the gas to the US and elsewhere in Canada.

The companies signing the MOU are the original partners in the Alaskan Northwest Natural Gas Transportation Co. (ANNGTC) In 1977 the US government designated ANNGTC to construct and operate the Alaska segment of the line. ANNGTC holds a FERC certificate and other federal permits for the construction and operation of ANGTS.

Statoil has sold another shipment of LPG to China, which has purchased a total of 90,000 tonnes of LPG from the Norwegian firm.

This latest shipment was delivered from the state company's Mongstad refinery, near Bergen, and marks the first time Statoil has transported LPG from that plant.

Two rock caverns built at the Mongstad complex make it possible to build up and store LPG stocks over a 20-day period, Statoil explained.

Statoil also sells LPG from its Kårstø gas treatment facility north of Stavanger, from a plant at Teesside, UK, and from its Kalundborg refinery near Copenhagen.

Asia's current supply of butane and propane is insufficient to meet demand, said Statoil. "The price is highest in China, which is stockpiling for the winter," the company said.