WCSB top Canadian supply source as frontiers face long lead times

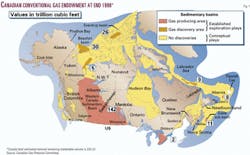

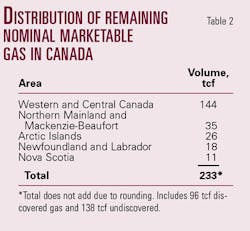

The Western Canada Sedimentary Basin (WCSB) is now and will continue to be the main area of conventional gas supply in Canada. Remaining nominal marketable gas is estimated to be 142 tcf (Fig. 1, Tables 1, 2).

Frontier basins will provide incremental supply as production and transportation infrastructure is installed. The Near Frontiers are expected to hold 46 tcf of nominal marketable gas, while the Remote Frontier Basins hold 44 tcf.

Nonconventional gas sources such as coalbed methane, gas hydrates, tight gas, and shale gas may be important if pilot production projects prove successful in demonstrating economically feasible production technologies. No marketable gas volumes are estimated pending the results of pilot projects.

These are the main conclusions in the latest and most comprehensive view of Canada's gas resources contained in the second report1 2 of the Canadian Gas Potential Committee, published in September 2001. The latest report is based on yearend 1998 data. It is a five year update from the first report, published in 1997.3 4

The new report presents a complete reassessment of the plays in western Canada plus an assessment of all frontier plays where gas discoveries have been made. The data presented in this article have been drawn from the CGPC report, but the interpretation is the responsibility of the author and may not totally reflect the views of the committee.

sssWestern Canada basin

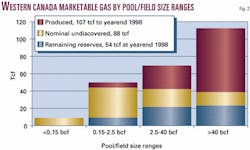

The distribution of gas resources in the WCSB by pool size and by exploration play provides an insight to understanding the volume and timing of gas that may be forthcoming from this key area.

Fig. 2 illustrates the distribution of resources by pool/field size in four size ranges. The legend shows the values for Remaining Gas Reserves (54 tcf), Undiscovered Nominal Marketable Gas (88 tcf), and Produced Gas (107 tcf).

Pools/fields larger than 40 bcf have provided 70% of the gas that has been produced from the WCSB. The 471 pools/fields in this size range comprise about 2% of the total number of discovered pools/fields.

Bars depicting produced gas volumes demonstrate clearly that the larger gas pools have been preferentially produced and are much more depleted than the pools in smaller classes. This is exactly what one would expect, as large, high productivity pools are the most attractive economic targets. In the future, more production must come from smaller, short-lived pools.

The envelope enclosing the Remaining Reserves and Nominal Undiscovered Gas contains the 142 tcf of Nominal Remaining Marketable Gas in the basin. Both the Remaining Reserves and Nominal Undiscovered Potential are concentrated in the smaller class sizes.

The following statistics describing the distribution of undiscovered potential are instructive (remember that in 2000 Canada produced about 16 bcfd, or 6 tcf/year5):

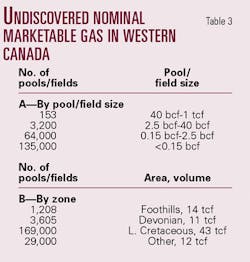

- Excellent, high impact targets are present in 153 undiscovered gas pools expected in the size range larger than 40 bcf (Table 3A). These pools are expected to range in size from about 40 bcf to 1 tcf Nominal Marketable Gas and to collectively hold about 16 tcf of the undiscovered potential.

- About 3,200 undiscovered pools are expected in the size range between 2.5 and 40 bcf Nominal Marketable Gas. These pools are expected to hold 21 tcf of the undiscovered potential.

- About 64,000 undiscovered pools are expected in the size range between 0.15 and 2.5 bcf Nominal Marketable Gas. These pools are expected to hold 35 tcf of the undiscovered potential.

- Some 9 tcf of the undiscovered potential is expected in over 135,000 micro-pools each smaller than 0.15 bcf Nominal Marketable Gas.

- At the average finding rate of three exploratory wells per discovery it would take about 200,000 exploratory wells, about twice as many as have been drilled to 1998, to find the 68,000 new pools larger than 0.15 bcf. This is an imprecise estimate, but it indicates the scale of drilling that may be required. An unknown number of small pools has already been discovered but not booked as discoveries. Many sit behind casing in existing producing wells.

In determining how much of the Nominal Marketable Gas may actually be marketable the following issues are important. The large, high impact targets face the greatest risk of falling into areas where exploration is not possible. Detailed analyses will be required to determine how many of the 153 expected undiscovered pools/fields may be accessible.

The expected 64,000 pools ranging from 0.15 to 2.5 bcf Undiscovered Nominal Marketable Gas (Table 3A) will be challenging exploration targets in an economic sense. Pools smaller than 0.15 bcf are unlikely to be intentional exploration targets and are unlikely to be economic to place on production. Discovered pools in this size range typically were thought to be larger, but when placed on production they depleted rapidly.

The stratigraphic distribution of undiscovered potential adds significant information that bears on the availability of natural gas. Table 3B shows the distribution of Undiscovered Nominal Marketable Gas for the three largest Play Groups and the five Other Play Groups analyzed in Western Canada. The Foothills Play Group includes traps involving all stratigraphic zones in the Foothills structural belt. For the remaining Play Groups, plays were organized on the basis of stratigraphic units ranging from Middle Devonian to Upper Cretaceous. The following statistics are relevant:

- In Western Canada, Lower Cretaceous reservoirs are expected to hold 43 tcf, over half of the Undiscovered Nominal Marketable Gas. But the largest undiscovered pools in any of the Lower Cretaceous plays are expected to hold only about 20 bcf Nominal Marketable Gas.

- The prime exploration targets lie in Foothills structures and Middle and Upper Devonian carbonate reservoirs in the plains. The Foothills plays hold 14 tcf of the remaining potential and have the largest undiscovered targets, just under 1 tcf Nominal Marketable Gas.

- Devonian plays in the plain hold 11 tcf of the remaining potential in targets approaching 500 bcf Nominal Marketable Gas.

- The remaining five play groups contain 12 tcf of the potential.

- The Play Group totals do not include the 7 tcf of reserves appreciation that was not assigned to specific plays. Reserves Appreciation is the increase in discovered reserves over time as additional information comes available.

Exploration targets in the Foothills and Devonian Play Groups face the greatest risk of falling into areas where exploration is precluded or restricted due to land use regulations. The propensity for gas in these Play Groups to contain significant quantities of hydrogen sulfide also complicates the process of obtaining drilling and development approvals. Smaller pools in all Play Groups, but particularly in the Lower Cretaceous, will face economic challenges.

An initial estimate suggests that at least 10% and possibly more than 20% of the Nominal Undiscovered Gas in the WCSB will not actually be available as marketable gas. This is due mainly to issues involving access to exploration and economics. The pace of exploratory drilling will dictate the rate at which gas can be supplied from new gas pools in Western Canada. If the rate of drilling and discoveries for 1988-97 were continued it would take 35 years to find the remaining resources in the basin.

Frontier basins

Frontier Basins include the sedimentary basins outside of the WCSB and Southern Ontario and Quebec.

The Near Frontier Basins are those more accessible for exploration and development. Remote Frontiers are those that are most isolated physically or by environmental moratoria. The distribution of discovered and undiscovered resources is listed in Table 1.

The Near Frontiers areas with Established Exploration Plays are the shelf off Nova Scotia, the Mackenzie Corridor and Eagle Plain, and the Mackenzie-Beaufort basin.

Together, they hold 46 tcf of Nominal Marketable Gas, 20% of the Canadian potential,. Remote Frontier Basins hold 44 tcf. While large, highly productive fields have been found and more are expected, the total resource in the Frontiers may not be as great as previous estimates6 have suggested.

The Deep Water Slope play off Nova Scotia is an exciting new play that may be analogous to the Gulf of Mexico, Brazil offshore, and West Africa offshore. The CGPC recognizes the potential of this area but could not make an assessment because the highly competitive activity in the play precluded access to new seismic data.

Industry has committed in the order of $1 billion (Canadian) in work bonus bids and has acquired thousands of kilometers of 2D and 3D seismic data covering the play. Drilling is expected to commence in 2001 and will accelerate in the following year. These will be the first exploratory tests guided by new seismic and geological understanding of deepwater sand deposition models. If the Deep Water Slope off Nova Scotia and Southwest Newfoundland is to become a major new hydrocarbon province we should expect discoveries in the early exploration wells.

More remote Frontier plays in the Arctic Islands, Newfoundland and Labrador, and Hudson Bay face severe technical and economic hurdles that will have to be crossed before any gas is forthcoming. Off Newfoundland, where oil and gas are being produced at Hibernia and Terra Nova, could become a gas producing area if sufficient nonassociated gas can be found to support pipeline or LNG production facilities. Most of the discovered gas resources in this area are associated with oil reservoirs.

The West Coast Offshore basins have been closed to exploration by environmental moratoria for many years. The British Columbia government is proceeding with a review process designed to open this area for exploration. The committee assessed the basins as subjective Conceptual Plays and assigned peer reviewed exploration risks to the plays. The resulting assessment of 14 tcf of gas in place (Table 1) is just over one third of the volume in recent estimates.7

Determination of the percentage of Nominal Marketable Gas that will actually become available from the Frontier Basins and the timing of availability will require extensive additional studies. Additional seismic and delineation drilling will be required before firm development plans can proceed with commitments for the required production and transportation infrastructure.

E&P events 1993-2001

In the five years 1994 through 1998, the time between the data cutoffs for the two CGPC reports, 5,983 new gas pools were discovered and booked. These contained 12 tcf of marketable gas, and by yearend 1998 about 25% of this gas had been produced.

The largest pool discovered contained 244 bcf in the Triassic at the Knopcik Montney A pool. In the Frontier Basins there was little exploration activity during this period, but the Hibernia field off Newfoundland came on production.

After 1998, successful delineation drilling in the Liard foldbelt resulted in the completion of high productivity gas wells that were placed on production in 2000.

The discovery in 2000 of one or more prolific gas pools at Ladyfern in British Columbia has been an exploration highlight. These discoveries in Slave Point metasomatic carbonate reservoirs8 have rejuvenated interest in an extensive Slave Point play area that extends from Alberta to the Foothills structural front in British Columbia. Ongoing exploration and production will determine the significance of this find that was estimated to hold 0.3 to 1 tcf of recoverable gas reserves.

Off Nova Scotia, the 'Deep Panuke' discovery in Jurassic Baccaro carbonate marked the discovery of a new exploration play. The Sable Offshore Energy Project came on stream in December 1999.

Nonconventional gas

In contrast to conventional gas, volumes of nonconventional gas in place are impressively large. The issue is how much of the gas in place can actually be produced at economically attractive rates.

The CGPC has not included any volumes of nonconventional gas as Nominal Marketable Gas pending establishment of commercial production. Nonconventional gas includes coalbed methane, gas hydrates, tight gas, and shale gas.

Widespread coal deposits in the WCSB, the Interior Basins in British Columbia, and in the Maritimes are being investigated in pilot projects directed toward determining if methane can be produced at commercially attractive rates. Studies to date suggest that the permeability of coals in Canada is low. Some challenges for new technology include:

- Locating areas with sufficient permeability to enable acceptable producing rates.

- Enhancing existing permeability to achieve a satisfactory producing rate per well.

- Mitigation of the overall environmental impacts of developing coalbed methane production, such as disposition of produced water and drilling many thousands of wells.

Natural gas hydrates are an ice-like solid formed by the inclusion of low molecular weight hydrocarbons in the crystal lattice of water under a specific temperature and pressure regime. Gas hydrates are widely distributed in Canada.9 The distribution is known from exploration wells and seismic in the Mackenzie Delta and Beaufort Sea, on and off the Arctic Islands, and off the East Coast. Hydrates are inferred to be present off the West Coast based only on seismic data.

Richards Island in the Mackenzie Delta is the site of a continuing research program where a test of the producibility of gas from a known hydrate zone in the Mallik area is planned in winter 2002. On Richards Island gas hydrates occur in highly porous Tertiary sands and gravels. Research into the technology required to produce natural gas from hydrates will be critical before commercial production can begin. As the hydrates on Richards Island occur in conjunction with deeper conventional gas pools, the opportunity may exist to increment production of gas from hydrates with the production from conventional reservoirs once a pipeline to the Mackenzie Delta has been built. A related project off Japan is under way to test subsea production from hydrates.

Production of gas from tight gas reservoirs and from shale is taking place now, but this is not distinguished from production from conventional reservoirs and it is difficult to measure the contribution from the nonconventional components. In some cases contributions of gas from coals may also be commingled with conventional production.

Assessments compared

The repetition of assessments on a 5-year cycle is an objective of the committee; this permits examination of what has transpired since the previous assessment as a check on the assessment process and logic.

The CGPC-2001 assessment for Conventional Gas is 31 tcf lower than the committee's 1997 assessment. New information, assessment of new plays, different treatment of appreciation, and the involvement of new volunteers with different experience produce the positive and negative changes that cause the difference. The net result is a decrease in Initial Nominal Marketable Gas Endowment of about 8%, which is well within the margin of error for assessment work.

The major change between the committee's first and second reports was the elimination of 273 tcf of marketable gas that had been attributed to Coalbed Methane. This change reflects a more realistic view of the potential of gas production from this resource pending the results of pilot projects.

Estimates in CGPC-2001 are 320 tcf lower than the most conservative case presented by the National Energy Board in its National Energy Supply Demand to 2025 Report.6

In its 1999 report, Table 5.1, Case 2, the NEB used the Conventional Gas assessment for the WCSB from CGPC-1997 and included Unconventional Gas and Geological Survey of Canada estimates for areas outside of the WCSB.

The GSC estimates include out of date reports in areas where subsequent exploration has had negative results, assessments of overlapping areas that have been added together, and assessments that do not recognize the high level of exploration risk in areas where no discoveries have been made. As a result the reported Ultimate Resource Potential for Canada6 is too high.

The outlook

Western Canada will continue to be the main gas supply area in Canada, but this area is mature and future supplies will increasingly be drawn from smaller, short-lived pools that will require intensive exploratory drilling.

The more accessible Frontier areas are already providing incremental gas supply on the East Coast and this will increase as additional projects proceed.

Frontier developments will require major investments in pipeline and production infrastructure.

Nonconventional gas sources may be important if pilot studies prove successful.

For nonconventional gas, technology to improve per well productivity and address related environmental issues would be required.

Remote Frontier areas face severe economic and technical hurdles; little exploration is in progress, and the lead-time to even conduct exploration is large to say nothing of commercial production.

Future gas supplies from all plays in Canada will require large capital expenditures and extensive drilling programs to access the predicted gas resources.

References

- "Natural gas potential in Canada-2001," Canadian Gas Potential Committee, Calgary, September 2001, 570 p.

- OGJ Online, Sept. 12, 2001.

- "Natural gas potential in Canada," Canadian Gas Potential Committee, University of Calgary, 1997, 113 p.

- Meneley, Robert A., "Where future Canadian gas supply will originate," OGJ, Dec. 15, 1997, p. 67.

- Natural Resources Canada, www.nrcan.gc.ca/es/erb/ngd/.

- "Canadian energy supply and demand to 2025," National Energy Board, 1999, 96 p.

- Hannigan, P. K., Dietrich, J.R., Lee, P.J., and Osadetz, K.G., "Petroleum resource potential of sedimentary basins on the Pacific Margin of Canada," Geological Survey of Canada Open File Report 3629, 1998, 85 p.

- Boreen, Thomas, and Colquhoun, Kelvin, "Ladyfern, North East British Columbia: Major gas discovery in the Devonian Slave Point Formation," abs., Canadian Society of Petroleum Geologists 2001 convention brochure, Calgary, 2001.

- Majorowicz, J.A., and Osadetz, K.G., "Gas hydrate distribution and volume in Canada," AAPG Bull., Vol. 85, 2001, pp. 1,211-30.

The author

Robert A. Meneley has been active in hydrocarbon exploration for 46 years. He was a volunteer on the Canadian Gas Potential Committee from 1993 to October 2001 and played a lead role in the generation and publication of the committee's first two reports. He has headed the Meneley Enterprises Ltd. consultancy since 1984. He is a graduate of the University of Saskatchewan and holds a BSc degree in geological engineering and an MSc degree in geology. [email protected]