OGJ Newsletter

Market Movement

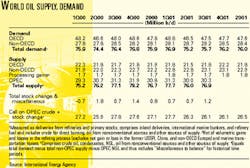

Sluggish third quarter demand

Global oil demand in the third quarter contracted by an estimated 750,000 b/d from the third quarter of last year, but IEA has not lowered its demand growth estimates for 2001 and 2002 at all since its October report.

OECD demand fell by 2.5% in September, the biggest monthly drop this year. Preliminary reports show that oil deliveries during the month contracted in eight of the largest OECD economies at an aggregate rate of 3%, led by a 4.9% decline in North America.

Jet fuel deliveries held up better than had been expected. Early estimates indicate that jet fuel deliveries during September fell as much as 15.6% in the US, but DOE reports suggest that they have since recovered to less than 10% below last year's levels.

"Tepid growth in OECD oil deliveries expected next year, following an overall contraction this year, places the spotlight on non-OECD economies as the main source of demand gains," IEA said. The agency expects oil demand to continue to expand among the fast-growing populations of the Middle East, where economic growth this year has benefited from the influx of revenue from high international oil prices and domestic consumers have enjoyed prices well below those of the international markets.

Russia has remained mostly unaffected by the global economic slowdown, and its economic growth is expected to remain on course for a 5-6% expansion rate this year. IEA noted that neither Russian business nor consumer activity has been affected by the events of Sept. 11, as retail sales jumped 11.3% in September compared with a year earlier.

The current phase of the UN-sponsored Iraqi oil-for-aid program will end Nov. 30. Although there is some concern that Iraqi exports might be disrupted, as they have during past rollovers in the program, IEA reckoned that the markets already have factored this possibility into pricing, as other OPEC countries could easily compensate for the loss with their spare capacity. OPEC's new 1.5 million b/d quota reduction is not scheduled to go into effect until Jan. 1, 2002 (see related story, p. 41).

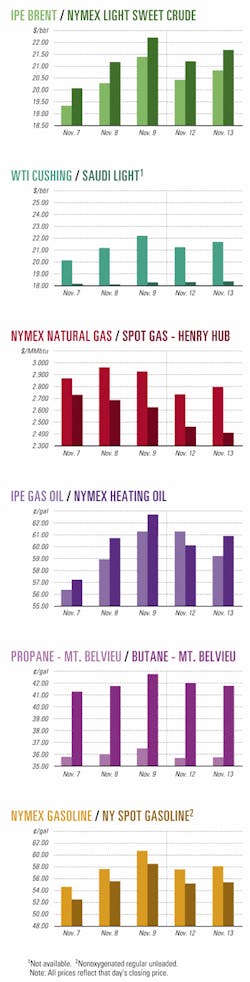

Prices, margins mostly lower

Steady, large builds in US inventories led gasoline prices around the world lower last month. Other product prices declined as well, for which the smallest decline was gas oil. Demand for gas oil held up, especially in Europe, where demand was strong ahead of the winter heating season.

Although refining margins improved in Europe during October, they were generally mediocre worldwide and declined as the month progressed. In Europe, average Brent cracking margins during October inched up $0.01/bbl from September to $0.78/bbl, while hydroskimming margins improved by $0.53/bbl to -$0.26/bbl. Singapore refining margins were mixed, with averages for hydroskimming up and those for cracking down from a month earlier.

US Gulf Coast cracking margins were altogether lower in October. Brent cracking margins averaged $0.35/bbl-$1.56/bbl lower than during the previous month-while US Gulf Coast WTI cracking margins were off $0.57/bbl to $0.16/bbl.

Preliminary numbers show that total OECD refinery throughput for September was nearly unchanged from the previous month but 315,000 b/d below the year-earlier figure. "With weak product demand and product prices expected," IEA said, "the near-term outlook for margins ranges from neutral to negative, depending on whether any further supply reductions support crude prices."

null

null

null

Industry Trends

NON-OPEC oil production levels are expected to rise by an average of 700,000 b/d/year over the next 2 years, forecasts Energy Security Analysis Inc.

ESAI's Sarah Emerson contends that OPEC will continue to take an active role in oil markets for the next 2 years as its struggles to keep oil prices within its targeted band.

"The lower end of the $22-28/bbl band for the OPEC basket may end up a price floor that OPEC will have to work hard to defend," she said. The difficulty OPEC faces is mainly in the growth of supply from non-OPEC countries.

Emerson notes that crude oil production in the former Soviet Union over the next 5 years-and especially within the next 2 years-will grow by 200,000 b/d/year, or about half of all non-OPEC growth forecast for the period.

At the same time, oil prices will continue to be extremely volatile, given OPEC activism, uncertainty over Iraqi supplies, continuing segmentation of downstream markets, and the strengthening ties between physical and financial markets."So, from time to time, crude oil prices will be very strong," Emerson said. "Even so, gains in OPEC's productive capacity and continued growth in non-OPEC production will mean that there's plenty of oil."

Accordingly, she sees global supply and demand balancing at a price closer to $20/bbl (WTI) than to $30/bbl.

US E&P stock prices have risen sharply, but those values could drop in coming months.

That word of caution comes from Lehman Bros. analyst Thomas Driscoll. The average large market-capitalization E&P firm has seen a 28% hike in its stock price since Sept. 26, he said.

"The rally in the shares has reflected several positive developments, including a slowing in storage injection levels, falling US natural gas production, and sharply higher spot natural gas prices," Driscoll said. But he cautioned that "the excitement may be overdone and that the shares could suffer over the next several months." E&P shares often peak in anticipation of winter, he said.

Meanwhile, despite US companies' recent appetite to acquire Canadian oil and gas companies, Driscoll doubts the Canadian government will move to curb non-Canadian investment into its energy sector. High-profile deals this year have included Conoco-Gulf Canada, Devon-Anderson Exploration, and Burlington Resources-Canadian Hunter.

"The question about whether the Canadian government will step in and block foreign companies from making future acquisitions in Canada is an interesting oneellipseWhile there is a slight chance, the risk is not that high," Driscoll said.

The Canadian Association of Petroleum Producers reports that 48% of the Canadian E&P sector is controlled by non-Canadian companies compared with 74% in 1977, which marked a 25-year peak. "The [Canadian] government still receives taxes and royalties no matter who the producer is," Driscoll said.

Government Developments

AS ANTICIPATED, President George W. Bush last week said the US will fill the Strategic Petroleum Reserve to its capacity of 700 million bbl.

The US will fill the reserve with about 108 million bbl of federal royalty oil from Gulf of Mexico fields. The process will take more than 2 years. Bush said, "The SPR will be filled in a deliberate and cost-effective manner. This will be done principally through royalty in-kind transfers to be implemented by the Department of Energy and the Department of the Interior.

"Our current oil inventories, and those of our allies who hold strategic stocks, are sufficient to meet any potential near-term disruption in supplies. Filling the SPR up to capacity will strengthen the long-term energy security of the US," he said.

The SPR has a capacity of 700 million bbl at four salt dome storage sites on the Gulf Coast. It holds about 545 million bbl, equivalent to just over 50 days of US imports (OGJ Online, Oct. 30, 2001). Under a Clinton administration program, several oil companies "borrowed" crude from the SPR and are obliged to replace it with more crude than they took, a transaction that will bring the SPR to about 590 million bbl.

Interior Deputy Sec. Steve Griles was authorized to work with the Minerals Management Service to implement the transfer. MMS will begin taking about 60,000 b/d in April for the SPR and expects the volume to grow to 130,000 b/d by October 2002.

UK ENERGY Minister Brian Wilson has established a China-Britain Natural Gas Working Group to strengthen links and identify business opportunities.

During a recent trade mission in China, Wilson said, "The UK has 25 years of experience in legislation, regulation, and use. We have committed ourselves to assist and collaborate with China in many aspects of developing a natural gas market. The working group will share this experience and help ensure that the development is both safe and environmentally acceptable."

He sees four key areas of collaboration: policy creation, gas supply, infrastructure, and the utilization of natural gas in China. Wilson encouraged more joint ventures between Chinese and UK companies.

Next year, UK companies plan a record 18 trade missions to China, he said, adding that these are small and medium-sized companies.

INDONESIA has passed legislation to end Pertamina's monopoly.

The Indonesian House of Representatives late last month passed an oil and natural gas law that prepares the way for full liberalization of the country's energy sector and effectively ends the monopoly of Pertamina, the state oil corporation. The government plans within a year to set up a new executive body to handle regulatory responsibilities and manage contract approvals and foreign oil and gas contracts. It also will create a separate entity to oversee domestic fuel supplies and distribution, officials said.

Pertamina will be turned into a limited liability company within 2 years. Meanwhile, however, the company will continue to supply fuel in the domestic market for 4 years as part of the transition period to deregulate downstream operations, officials said.

Quick Takes

KERR-MCGEE has brought its $650 million Leadon field development project in the North Sea on stream, less than 2 years after discovery and less than 1 year after the government granted development approval.

Leadon is on Blocks 9/14a and 9/14b in the UK North Sea about 220 miles northeast of Aberdeen (OGJ Online, Jan. 10, 2001).

It currently produces 10,000 b/d from subsea horizontal wells tied back to the Global Producer III floating production, storage, and offloading vessel. Production is expected to peak at 45,000 b/d during second quarter 2002.

Kerr-McGee estimates reserves in the Greater Leadon area-which includes satellites Birse and Glassel-at 120-170 million boe.

The UK Department of Energy has given approval for BG Group to start a second drilling program on its Armada gas complex in the North Sea. The $100 million program is designed to maximize production during 2002-10. The Galaxy III heavy duty jack up was expected to begin drilling the first of two wells this month. A third may be drilled, depending on the results of the first two. The program follows successful reservoir and well performance in Phase 1. Operator BG holds a 45.27% interest in Armada. Its partners are BP 18.20%, TotalFinaElf 12.53%, Phillips Petroleum 11.45%, Yorkshire Energy 6.97%, and Agip 5.58%. The program is designed to extend the field's current production plateau of 450 MMcfd and extend the life of the field to 2010. The three Armada fields-Fleming, Drake, and Hawkins-extend over 31 sq km on exploration Block 22/5b. First gas was produced in October 1997, after completion on schedule at a cost of £437 million, £100 million below budget. Gas is exported via the CATS pipeline to Teesside, with liquids transported through the Forties pipeline system to Cruden Bay.

TWO INDEPENDENTS have announced plans to expand their coalbed methane joint venture beyond the Palliser Block in southern Alberta.

PanCanadian Energy and MGV Energy have increased their capital program for the project to $30 million (Can.) from $15 million.

PanCanadian declined to state what other blocks are involved in the expansion but said they are PanCanadian-owned blocks "mostly in southern Alberta."

PanCanadian and MGV Energy, the Canadian subsidiary of Quicksilver Resources, formed the JV in late 2000 to explore the 1 million acre Palliser Block.

Mike Gatens, chairman and CEO of MGV Energy, said, "Our drilling in the Palliser block is the largest CBM exploration and pilot in Canadian history. The encouraging exploration results there have prompted us to accelerate our schedule and expand our exploration activity to other areas of Alberta."

BG has drilled two successful appraisal wells on the Blake Flank structure in the outer Moray Firth area of the North Sea, 64 miles off Aberdeen. Tests of the first zone, over the Coracle formation, yielded a flow rate of 2,450 b/d through a 56/64-in. choke. The second test was designed to determine the productivity of the overlying Captain sands. It yielded a flow rate of 3,000 b/d through a 1-in. choke. BG is drilling a sidetrack, 13/24a-8, to confirm volumes within the structure. If it proves successful, BG and partners intend to accelerate the Blake Flank development. The Blake Flank structure lies northeast of the Blake Channel structure. BG is the field operator and holds 44%. Blake field started production in June, 18 months after project sanction. It has estimated gross field reserves of 70 MMboe and has reached a peak flow of 60,000 b/d.

Peru's state oil firm Perupetro said four oil companies are considering leases of Blocks 56, 57, and 58 near the Camisea gas fields. Perupetro has opened a data room and expects to receive contract proposals by yearend. No decision has been reached on whether to offer the blocks together or individually. The four firms are TotalFinaElf, Repsol-YPF, Occidental Petroleum, and Hunt Oil. They represent the Camisea consortium, which the Argentine firm Pluspetrol operates. Block 56 holds the Pagoreni gas structure that a Royal Dutch/Shell subsidiary discovered 3 years ago. It and the small Mipaya structure Shell found earlier have estimated resources of 4 tcf of gas. The other two blocks have no discoveries but are considered promising. Meanwhile, Hunt is developing a feasibility study for the Camisea partners on methods to export LNG or gas-derived liquids. Camisea is expected to go on stream in first quarter 2004, although the project deadline is August 2004.

HYUNDAI HEAVY INDUSTRIES has named an alliance of Fluor and AMEC as its subcontractor for what a Fluor spokesman said will be the world's largest deepwater floating production, storage, and offloading facility.

Esso Exploration Angola operates the Kizomba development on Block 15 off Angola. The Fluor Daniel-AMEC alliance AFD will provide engineering and procurement assistance for topsides and project management services for the FPSO, which will be able to process 250,000 b/d and store more than 2.2 million bbl of oil.

With production expected in 2004, the $3 billion Kizomba A development will tap reserves pegged at 1 billion bbl of oil in 3,300-4,200 ft of water.

TYUMEN OIL (TNK) hosted a grand opening earlier this month for a $100 million catalytic cracking unit at its Ryazan refinery 120 miles southeast of Moscow.

Installation of the new unit was completed by a contractor group led by ABB Group unit ABB Lummus Global.

TNK increased the refinery's throughput and efficiency, with a crude conversion rate increase to 68% from 59%. Officials said additional units will be built to increase conversion of crude to light petroleum products to 75% by the end of 2002 and to 82% by the end of 2003.

The refinery's current capacity is 230,000 b/d but is expected to increase to almost 300,000 b/d by 2003.

In other refining news, Ultramar Diamond Shamrock said its St. Romuald, Que., refinery has met tighter low-sulfur fuel requirements 9 months ahead of the Canadian government's deadline. It attributed this achievement to the company's "Sahara project," a 7-year agreement with Algeria's Sonatrach to supply 35,000 b/d of light, low-sulfur crude. UDS said the Sahara project enabled the construction of a 30,000-35,000 b/d "minirefinery" at the plant (OGJ Online, May 1, 2001). Canada's limit on the sulfur content in gasoline is 1,000 ppm but will drop to 150 ppm between July 1, 2002, and Dec. 31, 2004.

Frontier Oil plans expansions at its Wyoming and Kansas refineries. The Cheyenne Department of Environmental Quality granted a permit allowing Frontier's Cheyenne, Wyo., refinery capacity to be increased to 46,000 b/d from 41,000 b/d. Frontier said minor equipment upgrades will allow it to operate at the higher capacity within a few months. Also, Frontier is applying to increase the permitted capacity of its El Dorado, Kan., refinery to 121,000 b/d from 110,000 b/d.

BP said it will shut down an older crude processing unit and a polyethylene production unit as part of a restructuring effort at its Grangemouth refining and petrochemical complex in Scotland. The restructuring also will lead to the loss of up to 1,000 jobs over 2 years. The company said the complex was severely affected by the economic downturn, unprecedented depressed chemicals markets, and a series of operational problems. BP will streamline Grangemouth's three main businesses-a 10 million tonne/year refinery, a petrochemical complex that produces more than 1.5 million tonne/year of chemicals, and the 1 million b/d Forties pipeline system and terminal-into a single organization, designed to simplify site operations while increasing reliability and efficiency. The restructuring follows a major safety review after a "series of incidents" last year, BP said.

THE CASPIAN PIPELINE CONSORTIUM has awarded Bouygues Offshore subsidiaries contracts worth $40 million for CPC project maintenance in Russia and Kazakhstan.

The 5-year contracts involve the CPC terminal on the Black Sea near Novorossiysk, Russia.

The maintenance contract also involves 1,500 km of pipeline connecting Tengiz field in Kazakhstan to the CPC terminal.

CPC consists of 11 participants led by ChevronTexaco and includes the governments of Russia, Kazakhstan, and Oman.

In other pipeline news, Horizon Pipeline has begun construction of a $79 million natural gas pipeline in northern Illinois. Completion is expected in April 2002. Horizon Pipeline is a joint venture of Nicor unit Nicor-Horizon and Kinder Morgan subsidiary Natural Gas Pipeline Co. of America (NGPL). The project includes the construction of 27 miles of 36-in. line, the lease of capacity in 46 miles of existing NGPL pipeline, and the installation of gas compression facilities. Horizon Pipeline will be able to transport 380 MMcfd from near Joliet, Ill., into McHenry County, connecting the emerging supply hub at Joliet with the northern part of the Nicor Gas distribution system and the existing NGPL pipeline system. Nicor has committed to transport 300 MMcfd on the line (OGJ Online, July 18, 2001).

BP has outlined plans to construct the Cleopatra gas gathering system, the second major component of its Mardi Gras transportation system in the Gulf of Mexico. Cleopatra will gather BP's gas from the company's Mad Dog, Atlantis, and Holstein developments in the southern Green Canyon area and deliver that gas to Ship Shoal Block 332 in shallow water. Previously, BP announced plans for its Okeanos gas gathering system, which will handle gas from the Crazy Horse and Nakika developments in the gulf. Cleopatra will begin service in 2004, in time for startup of the Holstein field.

TOPPING TANKER news, the Ninth Circuit Federal Court of Appeals in San Francisco has voided a $5 billion punitive damage award against ExxonMobil for the 1989 Exxon Valdez oil spill in Prince William Sound off Alaska.

The court said the amount was too high in light of recent US Supreme Court decisions governing such awards.

The three-judge panel remanded the case to the Anchorage federal district court with orders to reduce the award to an amount consistent with constitutional limits.

In a 1994 jury trial, Exxon was required to pay $287 million in compensatory damages to Alaska fishermen, commercial interests, and property owners plus $5 billion in punitive damages for allowing the accident to occur.

ExxonMobil spent $2.2 billion on the spill cleanup, continuing the effort from 1989 until 1992. It said that over 11,000 persons and businesses received more than $300 million in compensation.

In other tanker news, Paris Judge Dominique de Talancé has indicted TotalFinaElf over the Erika heavy fuel oil spill in December 1999. Talancé charged the Franco-Belgian oil company with "complicity in endangering the life of other people and for maritime pollution." TotalFinaElf must pay 50 million francs as surety and must not charter tankers more than 15 years old to transport heavy fuel oil. All the parties involved in the wreck have been indicted, including Erika's captain, a certification company, the shipowners, and members of France's maritime administration. The indictment followed an official report that blamed the group for poor vetting of the tanker and for its management of the crisis between the time of the distress signal and the moment when the ship broke in two and sank (OGJ Online, Oct. 5, 2001). TotalFinaElf has denied all charges. The company said, "The group will continue to cooperate without reserve with [the Ministry of] Justice, as it has never ceased to do, and intends to demonstrate that neither the company nor its collaborators have contributed to the facts for which they are being blamed." The company said it has paid 1.2 billion francs for cleaning the coastline, removing oil from the tanker, and treating the recovered waste.

This special analysis of the IEA's Oil Market Report and its effects on the international oil market was provided by Marilyn Radler, Economics Editor.

Correction: Iraqi production for August was incorrectly reported (OGJ, Nov. 12, 2001, p. 94). Iraq's correct crude oil production for August was 2.79 million b/d.