MTBE demand to decline after peaking in 2001

Worldwide demand for methyl tertiary butyl ether (MTBE) will peak at 520,000 b/d in 2001, according to a paper presented at the 10th Annual DeWitt MTBE/Oxygenates & Methanol Conference.

Global MTBE capacity experienced extremely rapid growth in the past, and averaged over 10%/year since 1992.

Future prospects, however, have been lowered by continuing events in California, These factors are likely to result in less use, if not total elimination of MTBE, in the US, according to K. Dexter Miller, vice president, DeWitt & Co. Inc.

Miller prepared two different scenarios: a low-demand case and a medium-demand case. Both cases assume that MTBE will not be completely phased out, even in California, by the target date of January 2003.

Instead, it is more likely that it will take to year end 2005 to be completed. Miller noted, however, that MTBE use will continue to grow outside the US, at least until 2010.

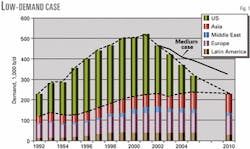

The low case assumes rapid elimination of MTBE in California and the total elimination in the US by 2010.

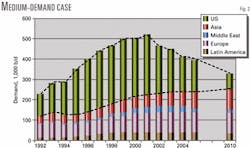

He believes the medium case is much more likely to occur. It assumes some MTBE use in California through 2005, and some continuing elsewhere in the US through 2010.

Present status

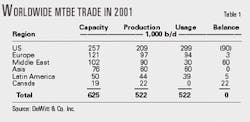

Currently, the worldwide MTBE industry operates at about 82% of capacity. About 41% of worldwide MTBE production resides in the US. The US consumes about 57% of worldwide production, however, the difference made up with imports, which total about 90,000 b/d. Two-thirds of this amount comes from the Middle East (Table 1).

California currently uses about 81,000 b/d of MTBE, primarily blended into reformulated gasoline (RFG).

Low-demand case

This case (Fig. 1) assumes that:

- California phases out MTBE by yearend 2003, a year later than planned.

- US East Coast reduces MTBE in RFG to about 47% in 2005 from 95% presently, and eliminates it by 2010.

- US Gulf Coast eliminates MTBE by 2010, albeit more slowly than the East Coast.

- The 2% oxygen limit will remain in place. Ethanol use will grow to 292,000 b/d by 2010 from 107,000 b/d in 2000. DeWitt feels this is an unlikely rate.

- Latin American MTBE use will remain steady, but with some reductions in capacity to rationalize world trade needs.

- Eastern and Central Europe will see continuing demand growth. Western Europe will see a slight reduction due to lower imports to the US, either as a bulk chemical or in RFG.

- Asia will continue its substantial growth, amounting to about a 50% increase by 2010, driven by air quality concerns.

- The Middle East will continue to serve as a swing producer. Capacity will be reduced, however, and the 2005-10 period will be critical, with low capacity utilization.

Medium-demand case

This case (Fig. 2), which DeWitt feels is much more likely, assumes that:

- California phases out MTBE 3 years later than planned, by yearend 2005.

- US East Coast reduces MTBE in RFG to about 71% by 2005, and 46% by 2010.

- Gulf Coast demand falls to about 58% of RFG penetration by 2010.

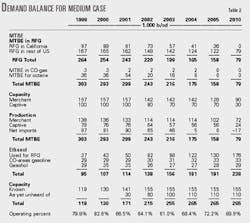

- The 2% oxygen limit will be retained, and ethanol demand will grow to 238,000 b/d (Table 2). This is still an unlikely rate.

- Latin America, as in the low case, will hold MTBE use at current levels.

- Western Europe production will hold steady while Eastern and Central Europe will continue to experience demand growth.

- Asia production will be the same as the low case.

- The Middle East will experience low utilization around 2005, but growth will resume thereafter.