Managing Oil and Gas Companies - Capital budgeting methods in the upstream petroleum industry: simple adjustments for complex problems

When an oil company analyzes an upstream investment project in a country with high taxation levels and where debt service charges are deductible, complex problems can arise with regard to a company-wide standard for assessing such investment decisions.

In the case presented in this article-based on a study conducted for TotalFinaElf SA-the loan amount contracted to finance the investment can be substantially higher than the figure corresponding to the target debt ratio that the company sets for similar projects (theoretically in the same risk class) and has to respect on a company-wide basis.

In this case, the loan amount contracted to finance this type of project cannot be evaluated by conventional methods. We hav, accordingly, proposed the necessary adjustments to adapt the conventional methods, BTWACC (before-tax-weighted average cost of capital) and standard after-tax weighted average cost (WACC) of capital. It so happens that the adaptation of the standard after-tax WACC method (also called the ATWACC method) leads to an extremely simple generalization of the method, so that its use can be proposed in general for all types of project. This article describes the method.

Overview

More precisely, in the upstream petroleum industry, the international companies normally use the BTWACC method to evaluate their investment projects. The discount rate is calculated before taxes and hence does not depend on the tax specificities associated with the project examined. This makes it necessary to define only a small number of discount rates at the scale of the company.

Yet the method does not allow the analysis of projects displaying a different debt ratio from the one employed by the company to determine the discount rate. In practice, in fact, the debt ratios observed often vary widely from one project to another-or from 1 year to another for a given project-even though the company has decided to comply, on a company-wide basis, with a target debt ratio defined for all the projects of the same risk class (for example, for all reserves development projects). The discount rate is calculated from this target debt ratio.

The reasons for this situation are mostly tax-related: better to borrow more for a project subject to a high tax rate in order to maximize the amount of the interest tax shields (and, at the same time, borrow less, or not at all, for a project for which interest charges are nondeductible). Differences in interest rates can also exist between projects-for instance, if the loans are guaranteed by the subsidiaries.

As far as we know, it is not possible to account in a simple way of all these factors with the BTWACC method. Conversely, as stated above, the standard WACC method can easily be adjusted to incorporate all the factors mentioned in the economic evaluation. Following a brief review of the two methods is a proposal for such an adjustment. We then define the company discount rate in connection with the generalized ATWACC method. That is followed by an examination of the use of the method proposed for production sharing contracts and concessions. We then propose a numerical example of the application of this method, followed by our conclusions. Note also that the methodological proposals presented in this article are the subject of theoretical developments in other publications (see references).

Methods reviewed

The standard WACC method is based on the principle of separation between the company's financing decisions, handled by the financial division, and the investment decisions analyzed by the "projects" department. The discount rate i is defined as an after-tax weighted average cost of capital.

If w is the target debt ratio defined by the company for projects in the same risk class, r the debt interest rate, c the cost of equity, and t the tax rate to which the company income is subject, we have:

i = wr (1 - t) + (1 - w) c

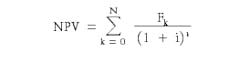

As a rule, the cash flows considered do not incorporate any flow connected with outside financing of the project. Only the investment expenditures and after-tax operating cash flows, denoted Fk in year k, are taken into account. For a project of N years, the net present value:

null

In the upstream petroleum industry, the BTWACC method (also called the Arditti-Levy method or the shadow interest method) is often preferred to the ATWACC method. The corresponding discount rate is in fact defined as a before-tax weighted average cost of capital and is hence independent of the tax rate. The interest tax shields due to the financing costs are added to the operating cash flow. This approach thus appears to be more appropriate for upstream petroleum industries subject to a variety of specific tax rates. These tax rates in fact make it difficult to determine an after-tax cost of borrowing (and hence an after-tax discount rate). Conversely, they are easily taken into account through a cash flow calculation.

Unfortunately, the field of application of this method is restricted to projects presenting the same debt ratio as the one used to compute the discount rate (which is seldom the case in practice).

Generalized ATWACC method

The method proposed can be considered as a generalized ATWACC method because it enables the company using a discount rate defined as an after-tax weighted average cost of capital to analyze a project for which the after-tax cost of the loan is different from the one considered to determine the discount rate. Moreover, it implicitly helps to evaluate a project whose debt ratio is of any value (this point will be discussed further in the next section).

Let us assume that the company is studying the profitability of a project to be carried out in a foreign country with a different tax rate, or, in general, whose revenues are taxed in year k at an effective rate qk different from the rate t used to calculate the discount rate. This effective tax rate qk may possibly result from the cumulative effect of project's specificities, subsidiary, and-in the presence of worldwide taxation-parent tax rates with suitable adjustments for foreign tax credits, dividend withholding taxes, etc. This project is partially financed by a loan contracted at a rate r' (possibly different from the rate r used to calculate the discount rate).Let us denote (all data are considered in current money):

r = (1 - t) (r: after-tax cost of the loan used to calculate the discount rate)

r'k = (1 - qk) r' (r'k: after-tax cost of the loan actually borne by the project at year k)Bk - 1 is the loan amount assigned to the project, remaining due at the end of the year k - 1

Let us consider that any dollar borrowed in the country at cost r'k substitutes for a loan dollar that would otherwise be contracted at cost r. This reasoning is consistent with the satisfaction of a target debt ratio.

As a rule, the cash flow to be considered for year k to examine the profitability of the project is Gk defined as follows:

Gk = Fk + (r' - (r'k) Bk - 1

The differential between the after-tax interest charges considered to calculate the discount rate and those actually borne by the project is added to the operating cash flow.

If the loan associated with the project is contracted at the same rate as the interest rate used to calculate the discount rate (r' = r) then: Gk = Fk + (q - t) r Bkk - 1Note that if the project debt ratio, defined with respect to its economic value, is the same as the target debt ratio used to calculate the discount rate, it can be proved that1:

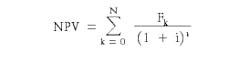

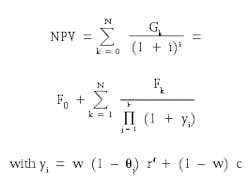

null

This equation (Pierru, Babusiaux, 2000a and 2000b) can be interpreted very easily. The proposed method yields a project value that is the one obtained by discounting the operating cash flows at the real costs (yk) of the capital employed by the project.

Defining after-tax cost of debt

How does one define the after-tax cost of the debt used to calculate the discount rate-in other words, how to pick the value (1 - t) r?

From a theoretical standpoint, it is interesting to select (1 - t) r by a marginal reasoning leading to an optimal allocation of the debt. In fact, two types of consideration can influence the assignment of the debt:

- Differences in interest rates may exist between countries, and the before-tax cost of the loan may thus not be the same for all the projects.

- Allocating the debt to projects subject to high tax rates helps generate significant tax savings.

The company will prefer to allocate the available debt to projects displaying the lowest after-tax loan costs (for example, by enabling some subsidiaries to be more indebted than others). This makes it possible to define an "after-tax marginal cost of the debt" (denoted r'); this is the after-tax cost borne by the last dollar of loan allocated.

To evaluate the different projects correctly demands taking wr' + (1 - w) c for the company discount rate.

We saw that:

Gk = Fk + [r - (1 - qk) r'] Bk - 1To maximize the value of the project or that of the company clearly leads to the same decision: A loan can only be allocated to the project if r- (1 - qk) r' greater than or equal to 0, in other words, if the after-tax cost of the loan is advantageous (which is reflected by a positive cash flow). If not, to assign a loan to the project decreases the net present value of the project. Because the point of view of the project and of the company are consistent, the financing decision can be decentralized.Consideration of contractual terms

The adaptation of the proposed method to the consideration of contractual terms specific to the upstream petroleum industry basically does not raise any particular problem.

Let us take r' = r to better emphasize the impact of the tax terms on the calculation of the cash flow Gn. In connection with a concession in which the financial charges are deductible from the taxable income, the formula is written: Gn = Fn + (qn - t) r Bn - 1. This definition of Gn remains valid by allocating a zero value to qn, if one considers a concession for which the financial charges are not deductible from the taxable income or a production sharing contract for which the financial charges are not recoverable and thus not included in the definition of "cost oil."For a production sharing contract in which financial charges are recovered in the form of cost oil, it suffices to consider that these financial charges substitute for an equivalent amount of "profit oil" that otherwise would have been shared between the company and the fiscal authorities of the state. From the company's viewpoint, the gain generated by the consideration of these financial charges is then Tn r Bn - 1 (Tn: percentage of "profit oil"- or, if applicable, of "excess oil"-accruing to the state in year n). The cash flow to be considered is then:

Gn = Fn + (Tn - t) r Bn - 1.

Numerical example

Consider a company using the following data (in nominal money) to compute its discount rate:

c = 15%, r = 8%, t = 35%, w = 40%. Here, w represents the target debt ratio to be satisfied on a company-wide basis, r and t having been determined by the central services of the company according to considerations such as those outlined prevously. The ATWACC (i) employed is thus roughly equal to 11%.

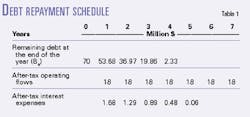

The company is studying an investment project which consists of bringing an oil field into production. The earnings produced by this project are subject to a tax rate q of 70%. We assume that the fiscal system is a concession that allows deductibility of the interest expenses from the taxable income. The actual interest tax shields generated by the project are different from those implicitly assumed in the discount rate, which must be taken into account in the economic valuation. The generalized ATWACC method will be used.The project under study has a lifetime of 7 years, the investment outlay ($82 million) being spent in year 0. The after-tax operating cash flow is assumed to remain constant and equal to $18 million each year (from year 1 to year 7). The project is partly financed by a loan B0 of $70 million made in year 0 at an interest rate equal to the one used to determine the discount rate (to simplify the calculations). The loan reimbursement is assumed to be "as fast as possible," as is often the case in practice.

The first step is to compute the schedule of debt reimbursement. For this, it suffices to say that each year the remaining debt will decrease by an amount equal to the difference between the after-tax operating flow and the after-tax interest expenses (the tax rate considered being 70%, the effective project rate). The results are given in Table 1.

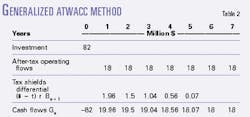

The computation of the stream of cash flows Gn is done here by adding the differential of interest tax shields to the after-tax operating cash flow. The results are given in Table 2.

The method yields a net present value of $6.7 million.

Conclusions

In the example presented, the difference in results with the BTWACC method would not be very significant and should not change the proposal of decision that the project analysts will submit to the company management.

A significant difference could nonetheless appear in some cases. It would then be misleading to give priority to a nonrigorous approach such the BTWACC method, especially as the proposed method offers many advantages from the practical standpoint:

Apart from these different points, note that, in practice, this method raises fewer theoretical problems, particularly in terms of consistency between the project and company debt ratios, than does the BTWACC method.

Bibliography

Babusiaux, D., Pierru, A. (2001). "Capital budgeting, investment project valuation, and financing mix: methodological proposals," European Journal of Operational Research, Vol. 135(2), pp. 326-337.

Pierru, A., Babusiaux, D. (2000a). "A general approach to different concepts of cost of capital." In: Bonilla, M., Casasus, T., Sala, R., (Eds.), Financial Modelling, Physica-Verlag (contributions to Management Science), Heidelberg, New York, pp. 339-351.

Pierru, A., Babusiaux, D. (2000b). "Capital budgeting and cost of capital: a unique formulation of the main investment decision methods," abstracting journals: Valuation, capital budgeting and investment policy 3(15), European Financial Management Association, 2000 Athens Meeting 1(2),

Social Science Electronic Publishing (Downloadable from website http://www.ssrn.com).

The authors

Denis Babusiaux is a director at the Institut Français du Pétrole and professor of capital budgeting and energy modeling. He is a past president of the French affiliate of the International Association for Energy Economics. He graduated from Ecole des Mines de Paris and from the IFP School and holds a PhD in management science. He can be reached via e-mail at [email protected].

Axel Pierru, currently an assistant professor at the IFP School, is coauthor with Denis Babusiaux of several research articles on capital budgeting. He is a member of the European Financial Management Association and of the EURO Working Group on Financial Modeling. He holds an MS in petroleum economics and Management from the IFP School. He received his PhD in Economics from the Université Paris I Panthéon-Sorbonne. He can be reached via e-mail at [email protected].