OGJ Newsletter

Market Movement

Oil demand slumps

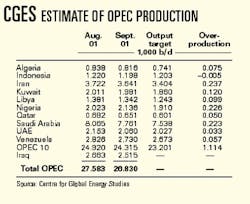

It is clear now that there remains little prospect of significant recovery in oil demand growth this year. After the Sept. 11 terrorist attacks on the US, prospects for global recession have deepened, taking oil demand with them.

After several weeks of seeing oil prices hover below the lower end of its targeted $22-28/bbl band for the OPEC basket of crudes, OPEC has sent clear signals to the market that it intends to cut production again in order to bolster sagging prices (OGJ, Nov. 5, 2001, Newsletter, p. 5). That accord is likely to be hammered out ahead of the Nov. 14 ministerial meeting in Vienna, so what emerges from OPEC then won't be a surprise. Neither is the size of the impending cut, likely to be 1 million b/d.

However, OPEC has sent a similarly clear signal to its counterpart oil exporters outside the organization: You are expected to do your part as well.

So far, there has been little indication of support among non-OPEC oil exporters for participating in OPEC's round of cuts. Only stalwart Oman has volunteered to join in the cuts. Even Mexico, co-architect of the seminal agreements with Saudi Arabia and Venezuela a few years ago that spawned OPEC's price-invigorating cohesion, has taken an initial pass.

These two countries and other oil exporters outside OPEC are likely to attend the upcoming Vienna meeting as well, and there will certainly be a lot of jawboning before then.

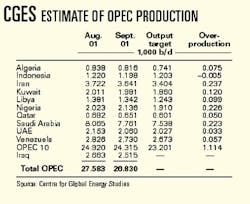

Even after the post-Sept. 11 collapse in demand, markets are bound to tighten somewhat, as the approach of winter weather inevitably boosts oil demand and as supply starts to diminish. OPEC managed to cut output closer to quota levels in September, and the cuts to follow will only shrink that pie further (see table).

Demand outlook

The prospect for oil prices being sustained now hinges on how demand in 2002 will be affected by the state of the world economy.

Embodied in this outlook is the critical risk that OPEC faces: Propping up oil prices also could delay the economic recovery that could sustain oil demand growth again, creating longer-term problems for OPEC.

According to London-based Centre for Global Energy Studies, the outlook for 2002 economic growth is either optimistic or pessimistic:

"The optimistic view sees a US-led recovery in the second half of the year, with global economic growth averaging 1.5-2.0%/year in 2002 and oil demand rising by some 750,000 b/d," CGES said. "Implicit in this view, however, is an economic stimulus in the form of lower oil prices-perhaps below $20/bbl."

A more pessimistic view, CGES maintains, sees no growth in the US economy next year and the global economy growing by only 1%.

"The global economy is clearly too big to be affected by just OPEC, but the organization's oil price policy over the coming 12 months could have some influence on the course the global economy takes," the think tank said.

CGES also noted that non-OPEC production is expected to increase by about 700,000 b/d in 2002, which will absorb all the demand growth-"even in the most optimistic of scenarios"-and thus squeeze OPEC's market share if demand growth fails to come about.

The worrisome aspect of this scenario is that the price point at which non-OPEC producers are forced to make noticeable cuts is well below OPEC's trigger point. So OPEC is likely to go it alone for now. The market is pretty well at that point now.

Again OPEC-mainly Saudi Arabia-finds itself acting as swing producer in a difficult market. The trick for the Saudis now is to navigate these treacherous market waters expertly enough to keep from losing too much market share, while keeping oil revenues up enough to satisfy local constituencies of concern yet keep oil prices from getting so high that the market is crippled for everyone.

Will there come a point when the Saudis decide that a low oil price is more in their interest than a high oil price?

null

null

null

Industry Trends

INVESTMENT prospectiveness in Latin America's oil and gas sector may advance rapidly with several un- folding developments.

While Pemex considers programs to entice foreign companies to develop Mexico's natural gas (see related story, p. 34), Brazil's National Organization of Petroleum Industry says that about $15 billion will be invested in Brazil's natural gas sector in the next 10 years. Gas represents only around 3% of Brazil's energy matrix, but the government plans to increase that to 12% this decade.

Heavy investments are already being made in construction of gas-fired thermoelectric plants throughout the country. NOPI also cited the construction of the gas-chemical complex being built in Duque de Caxias, Rio de Janeiro state.

State oil company Petrobras reports that around 6 million cu m/day of gas is flared in the Campos basin off Rio de Janeiro state. Petrobras is studying ways to install an infrastructure to utilize this gas.

In Venezuela, recent technological advances and improvements promise to greatly expand the commercial potential of massive extra-heavy oil resources in Venezuela, PDVSA-Intevep's Mariano E. Gurfinkel contends.

Gurfinkel outlined progress in commercializing Venezuela's vast Orinoco belt extra-heavy crude oil resources in a paper presented at the World Energy Congress in Buenos Aires last month (OGJ, Nov. 5, 2001, p. 20).

Heavy oil in the Faja region in northeastern Venezuela alone contains more than 1.2 trillion bbl of OOIP, Gurfinkel said.

Faja reservoirs are now being developed by integrating 2D and 3D seismic data, log data from existing vertical wells and new stratigraphic slim holes, and increasingly complex multilateral horizontal well completions. Horizontal sections have been extended to as much as 2,000 ft, boosting production to 1,200-1,600 b/d from 800-1,200 b/d. Design advances in electric submersible pumps and progressive cavity pumps for economically viable multilateral wells also have boosted individual well output to as much as 3,000 b/d on average.

In addition, new processes that focus on in-field upgrading are emerging.

Four integrated Orinoco heavy oil projects blend extra-heavy crude with diluent to transport production with a resulting average gravity of 16-17° to upgraders at Jose, Venezuela. Project economics are "very positive," Gurfinkel said, citing production costs of $1.75/bbl and upgrading costs of less than $2/bbl. This bodes well, he contends, for further capital investments as capital and operating costs continue to fall and the quality of the upgraded crude continues to rise.

Government Developments

OFFSHORE LEASING efforts are marking progress in the US and Canada.

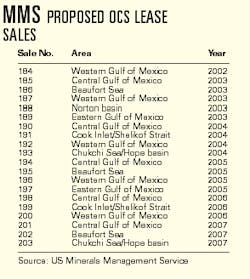

The US Minerals Management Service scheduled calls for 20 sales during 2002-07, with the usual central and western gulf sales to be held annually and eastern gulf sales in 2003 and 2005. The balance of sales would be off Alaska (see table).

MMS will accept comments on the proposed program until Jan. 24. It will hold public hearings Dec. 3-7 in Anchorage, Soldotna, Kotzebue, Homer, Nome, Kodiak, and Barrow, Alas. Hearings will be held Dec. 10 in Houston, Dec. 11 in New Orleans, and Dec. 12 in Mobile.

The agency plans to issue a final schedule in April, which, if un- changed by Congress, would take effect July 1.

MMS also released an assessment-as of Jan. 1, 1999-of conventionally recoverable hydrocarbon resources in the Gulf of Mexico and Atlantic Outer Continental Shelf.

The study said more than half of the oil and gas total in place in the northern GOM remains to be discovered, with mean undiscovered resources of 71 billion boe. That compares with the 65 billion boe of reserves (including cumulative production and reserves appreciation).

Meanwhile, MMS has issued the first programmatic, grid-based environmental assessment (Grid EA) for deepwater oil and gas projects.

MMS said that once a programmatic EA has been completed for a particular grid, another EA would not be necessary for most projects. The Grid EA was prepared for Kerr-McGee's Nansen project on East Breaks Blocks 602 and 646. Several more Grid EAs are in progress.

Off Nova Scotia, the Canada-Nova Scotia Offshore Petroleum Board has accepted bids totaling $527.2 million (Can.) for nine exploration licenses. The minimum bid was $1 million, and the highest accepted bid was almost $200 million.

Companies bid what they expect to spend on each lease for the first 5 years of the 9-year lease. If no federal or provincial ministerial veto occurs within 30 days, an exploration license will be issued.

The petroleum board said it accepted offers from Marathon Canada, Murphy Oil, Norsk Hydro Canada, PanCanadian Petroleum, Petro-Canada, Canadian Superior Energy, Shell Canada, Canadian Superior Energy, Bepco Canada, and Richland Minerals.

The petroleum board will not proceed with the call for bids previously expected in December. The next nomination closing date is Mar. 31, 2002. If held, the next call for bids is expected in June.

Quick Takes

OREGANO field in the deepwater Gulf of Mexico has started production.

Shell E&P brought the oil field on stream Oct. 17, a month ahead of schedule and $10 million under budget.

Oregano cost $120 million to develop, excluding lease costs, and holds 50 million boe of reserves, most of which is oil. The field, on Garden Banks Block 559 in 3,400 ft of water, is producing 11,000 b/d of oil from two wells through a subsea production system. Peak production of 20,000 b/d is expected by yearend.

The wells are tied back 8 miles to Shell's Auger tension leg platform in 2,860 ft of water on Garden Banks Block 426 (OGJ, Sept. 25, 2001, Newsletter, p. 9).

Shell said the project is another expansion of its hub strategy; Macaroni field, in 3,700 ft of water on Garden Banks Block 602, was tied into Auger in 1999.

In other production news, Petrobras has rebutted allegations that its administrative errors contributed to the loss of the P-36 platform in the Campos basin off Brazil in March. Eleven workers died during the explosions and fire on the $500 million semisubmersible platform (OGJ Online, Mar. 19, 2001). The Rio de Janeiro Chapter of the Regional Council of Engineering & Architecture (CREA-RJ) concluded that numerous decisions made by Petrobras contributed to the accident. These included transforming the drilling unit into a production platform and negotiations made with labor unions to speed revamping of the platform. Petrobras re- sponded, "Contrary to what the president of CREA-RJ affirmed, at no moment was Platform P-36 considered a unit solely meant for drilling. As from the project's very conception, it was designed as a drilling and production platform." The industry widely accepts the practice of revamping platforms, Petrobras added. Previously, Petrobras created a commission of inquiry, including members of its internal safety board, the oil workers' union, and the engineering department of the Federal University of Rio de Janeiro. The company retained Det Norske Veritas of Norway to support the investigation. "After 90 days of work, the commission...concluded that the accident with Platform P-36 resulted from a combination of several factors, and that it would be impossible to associate such factors to the findings alleged by the president of CREA-RJ," Petrobras said. Meanwhile, CREA-RJ is sending its report to the Brazilian Congress, requesting the creation of a special commission to investigate the accident. It also urged Rio de Janeiro's state assembly to expand its ongoing investigation.

Chevron- Texaco began oil production from the deepwater Kuito field Phase 1C development on Block 14 off Angola. The new phase added more than 30,000 b/d, bringing the field's output to 85,000 b/d. Production in 2002 is expected to average 66,000 b/d. Peter Robertson, president of ChevronTexaco Overseas Petrolem, said numerous deepwater projects are slated for Block 14. Engineering, procurement, construction, and installation bid packages are being finalized for Benguela and Belize fields. Reservoir and development studies are under way for the Lobito and Tombua oil fields. Kuito already has produced more than 39 million bbl. ChevronTexaco unit Cabinda Gulf operates Block 14 with a 31% interest. Partners are Sonangol, Agip, and TotalFinaElf 20% each, and Petrogal Exploracao 9%.

Statoil awarded ABB Group Zurich a $23 million contract to tie in Sigyn field oil and gas production to Sleipner A platform in the Norwegian North Sea. ABB has begun work on the engineering, construction, and installation of a deck structure. It will prepare and install the pipeline tie-in to Sleipner A and perform other work during a scheduled platform shutdown next year. The project is slated for completion in March 2003. ExxonMobil operates Sigyn field, a new development 12 km southeast of Sleipner A. The field is being developed subsea, and its production will be moved to Sleipner A for processing and transportation to shore. Sleipner is on Blocks 15/6 and 15/9.

BP signed a letter of intent for design, fabrication, and transport of what BP claims will be the world's largest semisubmersible drilling-production unit.

Daewoo Shipbuilding & Marine Engineering won the $380 million contract for a semi unit for the Crazy Horse project in the Gulf of Mexico. Terms call for delivery in first quarter 2004, with production startup expected in early 2005.

The contract involves the lower hull, deck box, some process and utilities equipment, 188-person quarters, and a complete dual-hoist, 2 million lb, fifth-generation drilling system.

Daewoo will build the unit at its yard in Okpo, South Korea. The lower hull will be 350 sq ft and the upper deck box 350 ft by 450 ft.

BP estimates reserves at the Crazy Horse complex (Crazy Horse on Mississippi Canyon Block 778 and 822 and Crazy Horse North on Mississippi Canyon Block 776) at 1.5 billion boe or more. At peak output, the semi could produce 250,000 b/d of oil and 200 MMcfd of gas.

The platform will also include water injection capability up to 300,000 b/d for pressure maintenance. Up to 20 wells will be drilled from the platform, and remote wells will be connected to the semisubmersible.

Elsewhere on the development front, BHP Billiton plans to invest $620 million in oil and gas development projects in Algeria, including $430 million for the Ohanet gas project. The company holds 45% interest in Ohanet. Woodside Petroleum has 15% of that project, with Algerian state oil firm Sonatrach and other partners owning the rest. Total investment in the Ohanet project will be $1 billion, with first production expected in 2004. Reserve estimates for the field exceed 3.2 tcf of pipeline-quality gas, 97 million bbl of condensate, and 115 million bbl of NGL. BHP Billiton also earmarked $190 million for development of Rhourde Oulad Djemma (ROD) oil field in the Berkine basin, 800 km south of Algiers. With estimated reserves of 300 million boe, ROD field extends to blocks operated by Agip and Sonatrach. First production is expected in first half 2003.

The DeepStar consortium let contract for a conceptual engineering study of a spar-deep draft caisson vessel that could work in 10,000 ft of water in the Gulf of Mexico. Halliburton KBR, formerly Kellogg Brown & Root, began work on the project in early October with completion slated for March 2002. The study involves engineering and cost analysis of a spar-DDCV with very large topsides and a large number of risers that will work in ultradeep water on a high-pressure, high-temperature reservoir. KBR will review three options for mooring system and riser design: steel mooring with steel risers, polyester mooring with steel risers, and polyester mooring with composite risers. The contract includes conceptual design and analyses; developing major operations sequences and identifying key equipment needed for fabrication and installation; developing cost and schedule estimates; and documenting analyses, design, drawings, schedules, costs, findings, and recommendations.

TRINIDAD AND TOBAGO has awarded a lease for offshore Block 3a to a group of companies led by BHP Petroleum (Americas).

Partner Talisman Energy says the award remains subject to final approvals and execution of a production-sharing agreement.

The block, 25 miles off northeastern Trinidad in 100-300 ft of water, covers 150,000 acres. It is adjacent to Block 2c, where the partners have drilled the Angostura-1, Aripo-1, and Kairi-1 wells.

The Block 3a consortium includes BHP 30%, Talisman 30%, BG 30%, and TotalFinaElf 10%.

Talisman said it believes Block 3a contains an extension of the play found with the Kairi-1 discovery. The Kairi-1 well penetrated a gross 933 ft hydrocarbon column containing 322 ft of net gas pay and 235 ft of net oil pay. The well tested 3,000 b/d of 29° gravity oil from one selected 14 ft interval of sand (OGJ Online, Aug. 23, 2001).

Elsewhere in exploration news, Apache said the JG-1X discovery in Egypt's Northeast Abu Gharadig Concession flowed on test at a rate of 4,190 b/d of oil and 5 MMcfd of gas. The Western Desert wildcat was tested through a 48/64-in. choke with 1,171 psi flowing wellhead pressure. It was perforated at 10,497-517 ft in the Jurassic Khatatba, making it the first Jurassic sand oil discovery in this part of the Abu Gharadig basin. Operator Shell Egypt has identified several potential offset locations. Apache said the JG-1X well will be put on production quickly because field facilities operated by a Shell joint venture are nearby. The discovery well is less than 2 miles from existing oil pipelines.

CHEVRON NIGERIA has awarded Foster Wheeler a $20 million front-end engineering and design (FEED) contract for a gas-to-liquids project.

Foster Wheeler will be responsible for the FEED and the preparation of the invitation to tender for the engineering, procurement, and construction contract.

The contract also includes the issue of inquiry for long-lead equipment items and preparation of project estimates.

Foster Wheeler said the GTL plant, to be built at Escravos, will provide significant environmental benefits by eliminating gas flaring. The plant will produce 34,000 b/d of synthetic fuel and naphtha products.

The plant is the first to use the Sasol slurry phase distillate process, which integrates three GTL technologies from Haldor Tops e, Sasol, and Chevron to produce GTL fuel and naphtha for export. It converts gas into liquid hydrocarbons in three steps.

In LNG shipping news, BG has agreed to a 20-year charter for a new LNG ship from Golar LNG. The 138,000 cu m capacity ship is under construction at South Korea's Daewoo yard and is scheduled for delivery in March 2003. The agreement secures capacity for BG to meet its projected LNG shipping requirements in 2003 and beyond, the company said. BG is considering several proposed LNG import-export projects worldwide. The new contract also simplifies earlier contractual arrangements between BG and Golar dating back to 1999. Golar said it is getting short-term improved cash flow in return for long-term reduced rates for BG.

THE FIRST BURIED SUBSEA ARCTIC PIPELINE has started transporting crude oil.

BP's Northstar project off Alaska produced first oil, MMS reported, noting that it is Alaska's first outer continental shelf development project (OGJ, Aug. 6, 2001, p. 74).

The project generated controversy as environmental groups argued that the pipeline to shore, and the project itself, endangered the delicate Beaufort Sea environment.

The 10 in. pipeline from Northstar field is the first buried subsea pipeline in the Arctic to be used for full-time production. It was laid 7-11 ft below the sea floor to avoid ice gouging. MMS said the specially designed flexible steel line is monitored by three leak detection systems. Capacity is 65,000 b/d.

From shore, Northstar crude is transported to the Trans-Alaskan Pipeline System terminus through an elevated overland pipeline section (OGJ, Apr. 30, 2001, p. 100).

The MMS said that over the life of the project, Northstar would produce 175 million bbl of oil. The project, about 12 miles northwest of Prudhoe Bay in the Beaufort Sea, includes three federal and five state leases. Interests are held by BP 98% and Murphy Oil 2%.

In other pipeline news, Enterprise Oil reports first oil flow through a pipeline linking the Val d'Agri oil center at Viggiano in Italy's Southern Apennines to Taranto. The 20 in., 136 km line has capacity of 150,000 b/d and moves crude from the Monte Alpi-Enoc fields in the Val d'Agri area of the Basilicata region to Taranto. The line will enable production to reach 45,000 b/d by yearend. AgipPetroli has a 84,000 b/d refinery at Taranto. The crude also can be exported to the Mediterranean market. Enterprise said that once development is completed at Cerro Falcone, about 104,000 b/d will flow through the oil center in 2003. Sam Laidlaw, Enterprise CEO said, "We will now focus on increasing output from Monte Alpi, the development of Cerro Falcone field, and moving Tempa Rossa toward sanction." Until August, production from the oil center was limited to 9,500 b/d because the oil had to be trucked to the refinery. Production was 37,000 b/d as of Nov. 1. Enterprise's share of output is 29%.