EU study of Caspian area oil, gas pipelines compares routes, costs

Under auspices of the European Union, two studies of pipeline transportation out of Caspian Sea producing areas have concluded that such systems are technically, economically, and environmentally feasible but depend critically on route selection.

The studies were conducted by ILF Consulting Engineers, Munich; Kvaerner Process Systems AS, Lysaker, Norway; Snamprogetti, Milan; and Partex-IGE SA, Lisbon, within the frame of the European Union's Tacis INOGATE program. (Tacis = Technical Assistance to the Commonwealth of Independent States; INOGATE = Interstate Oil and Gas Transports to Europe)

Both studies were concerned with the technical, economic, and environmental feasibility of new complementary export routes up to the existing or planned international oil and gas pipeline connections that are suitable for access to the markets of Europe under an expanded EU.

This article highlights the main results of these feasibility studies. Table 1 identifies transport options and presents transport costs for export systems from the Caspian Sea producing areas to European markets.

Click here to view Caspian Sea production transport options, costs (table 1)

This table is in PDF format and will open in a new window

Caspian area potential

The Caspian Sea region contains considerable hydrocarbon resources, and a growing number of international companies are developing known Caspian oil and gas reserves or are exploring for additional resources.

One of the main issues facing Caspian-area oil and gas development, however, is the great distances from the producing areas to European markets. This distance implies the construction of long pipelines that must cross several countries before reaching marine terminals or pipeline connections serving prospective European importing countries.

The existing pipeline infrastructure in the region around the Caspian Sea consists largely of pipelines originally designed mainly to supply the internal market of the former Soviet Union (FSU).

Therefore, export of Caspian oil and gas to Europe requires creation of new complementary transport-transit export systems that could combine onshore and offshore oil and gas pipelines, marine loading and unloading terminals, and associated sea transport by tanker as the primary goal together with the rehabilitation and expansion of the existing transport systems.

The first Tacis project focused on the technical, economic, and environmental feasibility of transporting significant oil and gas volumes from Caspian producing countries of Azerbaijan, Kazakhstan, Turkmenistan, and Uzbekistan to European markets through new pipelines crossing the Caspian Sea.

In this context, the potential on and offshore oil and gas production from these countries had to be assessed, the need of new transport facilities analyzed, and on and offshore corridors for the Caspian Sea crossing pipelines identified.

Furthermore, the technical, economic, and environmental feasibility of these new pipelines including their related necessary upstream and downstream facilities had to be studied.

The second Tacis project dealt with the technical, economic, and environmental feasibility of creating new complementary interconnecting export systems or routes (pipelines) from the Caspian oil and gas producing areas to European markets. These systems include a combination of on and offshore pipelines, marine loading terminals, and associated transports by tanker.

In this context, the oil and gas transport and transit capacity of Caspian countries had to be assessed and the need and timing for additional oil and gas pipeline systems defined. These systems include treatment, storage, and other transport facilities required to establish continuous and reliable links between the producing areas and the market.

It was also necessary to evaluate the technical, economic, and environmental feasibility of new pipelines including their necessary upstream and downstream facilities.

The following subsections summarize the main results of both Tacis feasibility studies.

Supply, demand analyses; transport scenarios

Analysis determined the current crude oil and natural gas supply and demand situations within, on the one hand, producing Caspian region countries and, on the other, consuming European countries, as well as projections for 20 years.

In addition, the studies defined three different scenarios (high, medium, and low) of hydrocarbon developments in the Caspian region along with transport quantities available for exports to European markets.

This process took into account transport capacities of existing and planned oil pipelines of the Caspian Sea region as well as previously mentioned different scenarios.

It found only 22 million tonnes/year (tpy) of crude would be available for the trans-Caspian oil pipeline originating from Kazakhstan, Uzbekistan, and Turkmenistan by 2010.

Addition of Azerbaijan's projected or potential crude oil exports to the European market yields an oil transport quantity of 50 million tpy available by 2010 for the pipeline section westward as a continuation of the oil pipeline system crossing the Caspian Sea. The complete possible oil export quantity of Caspian region dedicated for Europe will increase to 100 million tpy by 2020.

Considering the planned Turkmenistan-Iran-Turkey natural gas pipeline as well as the different gas development and production scenarios of the Caspian region, there is enough gas available to launch the trans-Caspian natural gas pipeline to export 14 billion cu m/year now and 47 billion cu m/year by 2010.

Addition of Azerbaijan's projected or potential natural gas exports to European markets indicates the availability of a natural gas transport quantity of 50 billion cu m/year by 2010 for the pipeline section westward as a continuation link of the gas pipeline crossing the Caspian Sea. The total possible gas export quantity of the Caspian region allocated for Europe will increase to 100 billion cu m/year by 2020.

Potential pipelines

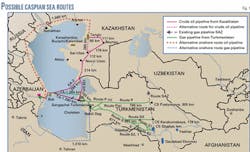

Fig. 1 provides an overview of possible routes of the trans-Caspian crude oil and natural gas pipelines: The pipeline route for Caspian Sea crude oil mainly from Kazakhstan starts at the Tengiz oil field and runs south to the possible landfall points on the eastern coast of the Caspian Sea.

After crossing the sea, the oil pipeline arrives near Baku at the Azerbaijan's peninsula of Absheron in order to absorb the Azeri crude and to continue further westward as a land pipeline.

From this landing point on the northern coast of Absheron, the pipeline reaches the southern coast of the same peninsula at the oil terminal of Sangachal. This location is an intermediate oil-receiving terminal for Caspian crude flowing along the east-west corridor via the trans-Caspian oil pipeline.

From here, the oil pipeline route runs westward within the same corridor of the existing Baku-Supsa early-oil pipeline.

The pipeline route for Caspian natural gas mainly from Turkmenistan starts at the Shatlyk gas field in southeastern Turkmenistan and runs north then turns west as a new gas pipeline up to the previously named two possible landfall points.

After crossing the sea, the gas pipeline arrives near Baku in order to absorb Azeri gas and to continue further westward.

Table 2 summarizes the main design parameters and hydraulic calculations for the trans-Caspian crude oil and natural gas pipelines, including their onshore sections and landfalls. These parameters and calculations assume a new gas export system that doesn't use existing gas facilities.

Click here to view Design parameters, hydraulic calculation results: trans-Caspian (table 2)

This table is in PDF format and will open in a new window

Alternative continuation routes

The second Tacis project identified possible alternative pipeline routes for export of Caspian crude oil and natural gas to the European markets; these appear presently.

A new export terminal at Sangachal near Baku is assumed to be the starting point downstream of trans-Caspian pipelines.

Among the crude oil pipelines described below, Pipeline No. O1 belongs to the type of pipeline routes that do not bypass both Turkish straits (Bosporus and Dardenelles), whereas the remaining pipelines represent the second group of pipeline routes which bypass those straits.

Although three lines (Nos. O1, O7, and O8) were studied by the Tacis contracting companies only, the remaining pipelines have been studied or planned by third-party companies or institutions.

During their study, the contractors collated, analyzed, and accounted for data, information, results provided by these third parties.

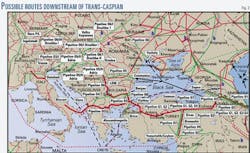

Fig. 2 gives an overview of routes of the crude oil and natural gas pipelines continuing downstream of the trans-Caspian pipelines towards European markets.

- No. O1: Baku-Supsa crude oil main export pipeline runs over the complete length from the originating point at Sangachal terminal on the Caspian Sea coast near Baku to the terminal of Supsa on the Georgian Black Sea coast, parallel to the existing early-oil pipeline.

- No. O2: Baku-Ceyhan crude oil main export pipeline stretches from the Sangachal terminal to the marine terminal of Ceyhan on the coast of the Mediterranean Sea in Turkey. The route leaving the terminal of Sangachal parallels the existing early-oil pipeline west-northwest. South of Tbilisi, it traverses westward over the mountainous area of Georgia and parallels an existing railway leading directly to the Georgia-Turkey border.

Leaving the border, it proceeds south and southwestly towards the mountainous area north of Turkey. Thereafter, it continues westwards, turning southwestly where it passes several districts and reaches the Ceyhan marine terminal.

- No. O3: Burgas-Alexandroupolis crude oil pipeline generally runs southwestly from the terminal of Burgas on the Bulgarian coast of the Black Sea to the marine terminal of Alexandroupolis on the Greek coast of the Aegean Sea. Thereby, it crosses Bulgaria and Greece.

- No. O4: Burgas-Vlore crude oil pipeline generally traverses westward from the terminal at Burgas to the marine terminal of Vlore on the Albanian coast of the Adriatic Sea. Along this route, it crosses land territories of Bulgaria, Macedonia, and Albania.

- No. O5: Constantza-Omishali crude oil pipeline generally passes westward from the terminal of Constantza on the Romanian coast of the Black Sea and runs further up to the tie-in (off-take or crossing) point in Hungary for connection to the existing Adriatic pipeline. From here it turns southwesterly in order to reach the marine terminal of Omishali on the Croatian coast of the Adriatic Sea.

- No. O5/I: Constantza-Trieste crude oil pipeline generally passes westward from the terminal at Constantza and runs farther through Hungary and Slovenia to reach the marine terminal of Trieste on the Italian coast of the Adriatic Sea. Along its entire way, it crosses Romania, Hungary, Slovenia, and Italy.

- No. O6: Odessa-Brody crude oil pipeline passes generally northwestward from the marine terminal of Odessa-Yuzhniy on the Ukrainian coast of the Black Sea and runs through Ukraine to reach the land terminal of Brody on the existing Ukrainian crude oil pipeline system of Druzhba.

- No. O7: Samsun-Ceyhan crude oil pipeline originates near the Turkish town of Samsun on the Black Sea coast and runs north-south across the territory of Turkey reaching the terminal of Ceyhan.

- No. O8: Kiyiköy-Ibrice crude oil pipeline starts near the Turkish village of Kiyiköy on the Black Sea coast and passes from there southwesterly through Turkish territory to reach the Turkish village of Ibrice on the coast of the Aegean Sea.

- No. G1: Baku-Ankara-Velke Kapusany natural gas pipeline runs along a corridor of main locations such as Baku, Ankara, and Velke Kapusany, traversing more or less in parallel to either existing or planned pipelines.

From the Turkish town of Sivas eastward towards the Turkey-Georgia border, it follows partly the existing route of Iran-Turkey natural gas pipeline running along the main road. Along this road easterly towards the Caucasus, it matches with the corridor of the Baku-Tbilisi-Ceyhan crude oil pipeline. From Sivas westward, it follows the other studied route of Samsun-Ceyhan crude oil pipline running alongside with another main road.

Arriving at an existing Bulgarian compressor station, it partly follows the existing Bulgarian gas pipeline corridor towards Sofia and then strikes up to the north bypassing Sofia on the eastern side. Inside Romania, it continues northward across the South Carpathian mountains.

It runs further northward along the Romania-Hungary border, passing westerly in order to cross the Hungarian border and reach more northerly the existing gas station of Velke Kapusany in Slovakia.

- No. G2: Baku-Ankara-Biccari natural gas pipeline runs from the starting point near Baku up to the off-take point west of Istanbul and is identical to the route section as described for No. G1. From this off-take point, it runs westward across Greece, Macedonia, and Albania. Then, it crosses the Adriatic Sea to reach a compressor station at Biccari in southern Italy.

- No. G3: Baku-Supsa natural gas pipeline runs over the complete length from its originating point up to the LNG terminal of Supsa in parallel to crude oil pipeline No. O1.

- No. G4: Baku-Ceyhan natural gas pipeline runs within the same corridor and in parallel to the crude oil pipeline of No. O2.

Table 3 summarizes the main design parameters and hydraulic calculation results achieved so far on a conceptual basis for only the crude oil and natural gas pipelines studied by ILF as continuing link of the trans-Caspian oil and gas pipelines towards European market.

Click here to view Design parameters, hydraulic calculation results: continuing links (table 3)

This table is in PDF format and will open in a new window

Cost estimates

The cost figures (capital expenses, or CAPEX) in 1999 $US were estimated and cover complete project stages from project management, design and engineering, survey, and soil investigations up to field construction and installation, supervision, commissioning, insurance, and certification.

Furthermore, contingency of 10-15%, accurate on the order of ±25-30%, is applied, and Western European market prices (derived from in-house data and experience of previous similar projects) are used for labor, machinery, material, and transport, etc.

The operating costs (OPEX) cover power and consumables, labor and vehicle lease, spares and maintenance, as well as inspections. The calculations cover a project life cycle of 20-30 years, without inflation.

In contrast to cost calculations for the trans-Caspian pipelines, the projected operating costs in case of continuing land pipelines include depreciation of the investment on a linear basis over 15 years, enabling potential re-investment at 50% of the analyzed project life period.

Furthermore, cost figures are related to a 100% value of capacity utiliza tion.

Table 4 summarizes both CAPEX and OPEX of the trans-Caspian crude oil and natural gas pipelines including their land links and downstream continuation to European markets.

Click here to view Estimated costs: trans-Caspian pipelines (table 4)

This table is in PDF format and will open in a new window

The integrated export system consists of the entire transportation route from the originating point of crude oil (Tengiz field in Kazakhstan) and natural gas (Shatlyk field in Turkmenistan) within the Caspian region up to the European market (selected here, for instance, the terminal of Trieste in Italy for crude oil and the terminal of Marseille in France for LNG as ref er ence points for terminals of final destination), and encompasses the Trans-Caspian crude oil and natural gas pipelines including land sections and their downstream pipeline continuations and marine transportation by tankers (in case of crude oil and LNG).

Conclusions

Table 1 shows the transport options considered in association with both Tacis INOGATE feasibility studies for export of Caspian crude oil and natural gas to European markets as well as the total comparable transport costs of various transport options studied.

The trans-Caspian oil and gas pipelines are feasible from technical, economic, and environmental points of view.

Final selection of the Caspian crossing pipeline routes covering both offshore and onshore sections depends not only on technical parameters but also on political decisions. This aspect influences the choice of either a single route or two different routes (one for oil and one for gas) crossing the Caspian Sea.

By far the least expensive alternative for transportation of Caspian crude oil to European market is Option AO (with a minimum transport cost of 20.2 Euro/tonne) along the route across the Black Sea and both Turkish straits (Bosporus and Dardenelles).

The obvious cost advantage, however, compared with the other transport options must not be seen in isolation.

Attached to Bosporus passage are certain safety and ecological aspects whose attendant political sanctions may make this option practically useless. It can be assumed that the oil transport capacity of the straits is somewhere between 50 and 80 million tpy, whereas the present tanker traffic has already reached this range.

Today's existing bottleneck will be substantially aggravated, if additional oil will have to be shipped from the Black Sea ports.

Therefore, the subsequent bunching of tankers beyond the present pattern will increase the risk of tanker acci dents or environmental pollution. Who will bear the related costs? Insurance companies as well as shippers must be involved.

The focus must therefore be on transport options avoiding as much as possible the Turkish straits. Such alternatives will, however, be more costly due to the "broken transport traffic," that is, by the change of pipeline-tanker-pipeline including multiple loading and discharge at sea and pipeline terminals.

In this case, the second and third best, Option BO (23.6 Euro/tonne) and GO (24.1 Euro/tonne), will qualify.

Option GO, using the route via Tengiz-KA2-Baku-Supsa-Burgas-Alex-androupolis-Trieste, is preferred, however: Although slightly more expensive than Option BO, the Burgas- Alexan droupolis secondary pipeline project is clearly more developed and has the backing of all governments involved. In contrast to this, it is currently not the case for the Option BO covering the route via Tengiz-KA2-Baku-Supsa- Kiyiköy-Ibrice, for which the attitude of Turkish government is not favorable.

The Turkish preference is clearly the Baku-Ceyhan pipeline for environmental reasons because all transport options (except the Option IO) involve the Black Sea.

It is no secret that its present pollution is already rather high.

The situation is not as threatening as the bottleneck problem of the Turkish straits. Additional tanker traffic will, however, certainly increase the environmental pollution risk. Therefore, it cannot be concluded that sooner or later regulations will be issued to protect the Black Sea.

In this respect, Option IO (24.8 Euro/tonne), using the Tengiz-KA2- Baku-Ceyhan crude oil pipeline route, offers a sound and optimum transport solution for exports of the Caspian crude to Europe.

For geographical reasons, Turkey appears to be the logical market for Caspian gas. Demand is already high today and will grow further.

New gas lines to Europe will be necessary be cause existing old FSU systems are tech nically limited and unsuitable for accommodating additional export volumes.

Furthermore, access to these systems is at present politically restricted. Taking this into account, the Option AG using the envisioned gas pipeline to Velke Kapusany will have the advantage of enabling East-European countries to receive also Caspian gas because they exclusively depend on Russia.

Looking at transport costs of the various transport options, reveals that LNG alternatives (263.3-296.3 Euro/M cu m) are more expensive than long distance gas pipelines (185.3-187.3 Euro/M cu m).

The author

Orhan Degermenci is a project engineer and manager with ILF Consulting Engineers, Munich, which he joined in 1992. He holds a doctor of engineering (1992) in petroleum engineering of the Technical University of Clausthal-Zellerfeld, Germany.