Ultradeepwater play paces gulf, North America

With the discovery of giant Crazy Horse and Atlantis fields, as well as Mad Dog, Holstein, and Trident, the ultra deepwater Gulf of Mexico play has become front-page news. In our view, this is the most important exploration play in North America today.

Through mid-2001, industry appears to have found 3-4+ billion boe in nine discoveries (Table 1). Only nine fields in the entire Gulf of Mexico discovered before 1996 have estimated ultimate recovery of more than 500 MMboe, but discoveries announced in the last 2 years in the ultradeepwater, frequently Miocene play may have added three or more to the giant field list.

A number of large discoveries have been made in the primary salt-withdrawal minibasins, or primary basins, of the deepwater gulf. These include Auger, Mars, Mensa, and Ursa. The ultradeepwater play has shown that it holds the promise of even larger discoveries, such as Crazy Horse and Atlantis, and reservoir productivity that meets or exceeds anything seen previously in the gulf.

BP PLC and Chevron Corp. have estimated that as much as 40 billion boe may ultimately be found in the deepwater gulf, equivalent to cumulative discovered reserves on the Gulf of Mexico shelf. Of that 40 billion boe, about 10 billion boe have been found to date.

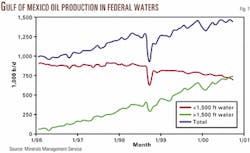

Production has grown quickly from the deepwater gulf, and oil output from fields in more than 1,500 ft of water has recently exceeded that from shallower water (Fig. 1).

The discoveries have generally been oil prone, but gas production from fields in more than 1,500 ft of water had reached 2.3 bcfd by summer 2000. We used 1,500 ft of water as a cutoff to show broader deepwater production trends because only one field is producing in more than 5,000 ft of water. Oil and gas output from deepwater fields is set to grow at an increasing rate as several recent discoveries come on line in the next few years.

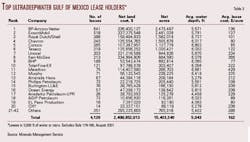

Before summer 2001 leasing, 42 companies held more than 15 million acres in the ultradeepwater gulf (Table 2). In this article, ultradeepwater is generally 5,000 ft of water or more.

Exploration history

It is helpful to step back in time to the early 1990s to appreciate the evolution of the ultradeepwater play.

Major oil companies, including Shell Oil Co., ExxonMobil Corp., and BP, were using their highly evolved seismic bright-spot identification tools to develop the shelf and primary deepwater basins out to 5,000 ft of water.

Discoveries were still being made, but they were shrinking in average size. As a result, some of the major integrated oil companies began efforts to determine whether other play types existed in the gulf that might yield larger discoveries.

BP and others took a fundamental approach, using basin-scale sequence stratigraphy and geochemical models to study reservoir development as well as potential sources and pathways of oil migration. At the same time, the industry was making progress on imaging structures below the massive salt sheets that cover much of the ultradeepwater province.

Deepwater drilling and production technologies, in the US and Brazil in particular, were advancing as industry set its sights on deepwater targets around the world. These technological advances, in combination with spectacular gains in computing power during the past decade, have driven both the cost and cycle time from the acquisition of seismic to first production steadily lower.

Processing time for advanced prestack depth migration that used to take weeks now takes days, and much interpretation occurs at workstations by the geophysicist rather than offsite by third parties.

Better knowledge of velocity profiles of sediment and salt bodies has improved industry's ability to resolve salt features, particularly the base of salt, and the large structures beneath them. Most active players have acquired spec 3D seismic data that cover most of the ultradeepwater gulf, improving their regional understanding of the play potential.

Geophysical, drilling gains

Advanced prestack time and depth migration permits enhanced imaging of the large structures beneath and seaward of the Sigsbee salt escarpment.

Sequence stratigraphy, palinspastic restoration, and geochemistry are the primary tools being used to predict reservoir and hydrocarbon charge. Oil companies will likely continue to test evolving processing techniques as more well control and better understanding of the play allows.

As water depth increases, drilling becomes more problematic in that the weight of the hydrostatic column of water on sediments that are just below the sea floor can result in fracturing of those shallow zones and lost circulation. A conventional drilling plan would typically require numerous casing strings, and even then the risk of lost circulation could be high.

As a potential solution, industry is working to develop dual-gradient drilling technology to relieve the hydrostatic column of seawater from the drill bit via a subsea pumping system installed at the sea floor that lifts the mud back to the surface, effectively maintaining the pressure in the annulus at the mudline only slightly above the pressure in the surrounding seawater.

This technology recently tested by Texaco at Shasta field, has the potential to reduce the number of casing strings, resulting in larger casing across the productive intervals and increased well deliverability.

Geologic distinctions

Geologically there is a fundamental difference between the huge structures being imaged in the ultradeepwater and the more conventional primary basins that have been pursued in shallower water.

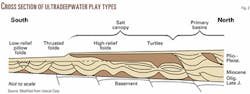

The shallow water shelf is dominated by extensional features related to sediments slumping down the shelf toward the abyssal plain. At the same time, the thick accumulations of sediment deposited on the Jurassic Louann salt have caused it to become plastic and mobile, resulting in the formation of a series of shallow allochthonous salt escarpments covering much of the deepwater gulf.

The lateral movement of salt and sediment from a proximal to more distal setting has led to the formation of a compressional fold belt in the deepwater. The dynamic interaction of mobile salts and deepwater turbidite deposits has led to extremely large structures accompanied by the localized accumulation of thick, high-quality reservoir sands.

A combination of pelagic muds and forcefully emplaced salt diapirs and canopies gives these large reservoirs their top seal. Several major subsalt compressional fold types are being pursued in the ultradeepwater gulf (Fig. 2).

Recognizing that common terminology within the industry has yet to emerge, we discuss in this article four major play types that have so far been identified in the ultradeepwater gulf. Moving from east to west, three are the Eastern Gulf thrust belt, Atwater fold belt, and the Perdido fold belt (Fig. 3).

In addition, turtle structures have been identified as a separate play type that stretches from Mississippi Canyon on the east to Walker Ridge on the west. Within these broad trends, a common characteristic is the very large size of the structures. Key differences involve the thermal maturity of source beds and the age of structures.

Turtle structures

Based on the success at Crazy Horse, turtle structures are receiving great attention.

Turtles form when turbidity flows accumulate in salt-related structural lows. As sand accumulates, pressure on underlying salt increases, causing it to shift laterally. The resulting turtle-shaped feature is thickest and structurally highest in the center.

Pay sands in these prospects are Upper-Middle Miocene in age and are present at depths as great as 30,000 ft below sea level in very deep water. The key uncertainty with turtle structures is whether a trap was in place during the hydrocarbon migration phase.

BP has said reservoir characteristics at Crazy Horse on Mississippi Canyon Block 778 are excellent, implying outstanding well productivity. It compared Crazy Horse favorably to Magnus field in the UK North Sea, where wells flowed at rates exceeding 20,000 b/d at peak. This should help allay concerns about productivity from reservoirs below 25,000 ft.

Chevron completed operations on a reported turtle structure at the Poseidon prospect on Mississippi Canyon 727, six blocks west of Crazy Horse.

Shell is drilling a deep test on Missi ssippi Canyon 687, 21/2 blocks northwest of Crazy Horse North, targeting what is believed to be a Miocene-age turtle structure below its large Mensa gas field, which produces from shallower sands. Other postulated turtle structures include those imaged beneath Shell's Crosby (formerly Flathead) discovery on Mississippi Canyon 899 and below Ursa at Mississippi Canyon 809 and BP's Blind Faith discovery 20 miles northeast of Crazy Horse in 6,937 ft of water on Mississippi Canyon 696, and Dominion Exploration & Production Inc.'s Devil's Tower appraisal on Mississippi Canyon 773.

Anadarko Petroleum Corp. said it has mapped 7,000 acres under closure with pay intervals anticipated below 21,000 ft at its Eiger Sanction prospect on Mississippi Canyon 667 and three adjacent 100%-held blocks. An exploratory well is drilling on this prospect.

ExxonMobil Corp. is active at the Hawkes prospect on Mississippi Canyon 465, 508, and 509 and at Timber Wolf on Mississippi Canyon 555. Murphy Oil Corp.'s Sport of Kings prospect, to be drilled next year, is on the block north of Crazy Horse.

Eastern gulf

The Eastern Gulf thrust belt play in eastern Mississippi Canyon and eastern Atwater Valley has produced spotty results.

Geochemical analysis shows that in some areas the source rocks have not been buried deeply enough to generate hydrocarbons, creating a "patchwork quilt" of thermally mature opportunities. Shell's West Blackjack prospect on Atwater Valley 471, first to test the region in the late 1980s, was deemed noncommercial. Well results indicated the oil source might be immature, which cast some broad doubt on the play's potential.

Of the more recent Gamera (Atwater Valley 118), Wind River (Atwater Valley 378), Phoenix (Mississippi Canyon 1002), and Showboat (Atwater Valley 336) prospects, none has discovered commercial hydrocarbons, although some may not have gone deep enough to test the most prospective sections.

BHP Petroleum drilled and abandoned Bass Lite on Atwater Valley 426, and Chevron was reportedly unsuccessful on its Ken prospect on Mississippi Canyon 864. Chevron drilled and temporarily abandoned the Ray prospect on Atwater Valley 386-430.

Atwater fold belt

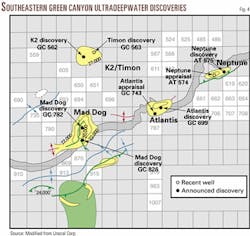

The Atwater (Eastern) fold belt received much attention following a string of large discoveries, particularly Mad Dog and Atlantis (Fig. 4). The discovered resources, 0.9-1.7 billion boe or more in the southeastern corner of Green Canyon, rival the Crazy Horse area.

Based on the considerable success, we would expect industry to continue to focus its efforts on this play, with increasing activity to the southwest in deeper water likely over time.

Prospects being drilled generally target Miocene turbidites deposited at the distal edge of the continental slope. These rocks are fine to medium grained, very well sorted sandstones with generally excellent reservoir qualities. Trapping configurations were created as these thick sands were deposited and interacted with underlying salt bodies, forming very large folds and turtle structures.

BP's 1995 Neptune discovery opened this trend, and other successes followed in quick succession at Atlantis, Mad Dog, K2/Timon, and Champlain. Definitive results are not yet available on the Texaco-operated Catahoula prospect on Walker Ridge 70, which was temporarily abandoned, or Anadarko's Atlantis East prospect in 3,800 ft of water on Atwater Valley 353.

The Mad Dog field area covers eight blocks: Green Canyon 738, 739, 781, 782, 783, 825, 826, and 827. Three appraisal wells were successful, and BP plans to start production in 2004. Co-owner BHP announced a revised reserve estimate of 200-450 MMboe.

BP targets production from Atlantis on Green Canyon 699 in 2005. A second well on Green Canyon 743 three miles southwest of the discovery cut more than 500 ft of net Miocene pay, including pay zones not present in the discovery well. The 3 Atlantis well confirms previous reserve estimates of 400-800 MMboe.

BP is to start production in 2004 from the Holstein discovery on Green Canyon 644-645.

BP/BHP discovered Neptune in 1995 some 32 miles northeast of Mad Dog in 6,200 ft of water on Atwater Valley 574-575. With recent successes at other locations presumably more significant, Neptune development appears to have been relegated to the back burner.

K2/Timon and Champlain lie beneath the Sigsbee salt canopy, indicating the potential that has been opened by ad vances in seismic imaging technology. Conoco discovered K2 in 1999 on Green Canyon 562. BP later drilled on adjacent Block 563. Conoco assessed K2/Timon as smaller than 100 MMboe, and the development outlook is unclear.

Champlain, in 4,385 ft of water on Atwater Valley 63-64, cut 140 ft of net oil and gas pay. It went to 18,898 ft, and sidetracks were drilled to 23,540 ft MD and 24,989 ft MD. Additional appraisal wells have been drilled this year.

Whereas the high relief folds and pillow folds deposited basinward of the turtle regions have proven highly prospective, the huge thrusted folds found even farther offshore have not been successfully tested to date. Casualties included BHP's Chinook well on Walker Ridge 425-469, Chevron-Texaco's Loyal prospect on Walker Ridge 465, and Unocal's Dana Point wildcat on Walker Ridge 678.

Marathon Oil Co. plans to drill Redwood on Green Canyon 1001 and the Flathead prospect west of Redwood in extreme southern Green Canyon, both on trend with Atlantis and Mad Dog.

Perdido fold belt

West of the Atwater fold belt in the East Breaks and Alaminos Canyon areas is a series of huge structural box folds. These structures differ in age from those to the east with the target formations dating to the Cretaceous and older.

Because these older rocks have had much longer to mature, issues related to salt tectonics and thermal maturation are less important than reservoir quality and trapping mechanics.

Positives for exploration in the play are that structures are very large and some of them are not covered by thick salt sheets, making seismic interpretation less difficult.

Complicating the structural interpretation is a longer history of sediment load ing in this area than to the east, which has resulted in more folding and faulting. In addition, the nature of the older, more brittle rocks appears to be making this region much more difficult to drill.

The Shell operated BAHA wells were the only attempts to test these features until Unocal drilled the Trident discovery 30 miles southwest of BAHA in Alaminos Canyon.

BAHA, on Alaminos Canyon 600, was the first test drilled in the Perdido fold belt in 1996. It reportedly reached only about 11,254 ft compared with an objective of 22,000 ft. There were shallow shows, but drilling problems relating to wellbore competency required setting several more casing strings than originally planned.

Shell drilled 2 BAHA on Alaminos Canyon 557 earlier this year and released no data, but co-owner Burlington Resources Inc. took a dry hole charge in first quarter 2001.

Unocal encountered more than 300 ft of net pay in its first Trident well on Alaminos Canyon 903 in 9,687 ft of water, marking the first success in the Perdido fold belt. The well was successfully drilled under difficult conditions in only 66 days. The structure as mapped is large, encompassing as much as 10,000 acres under closure.

The authors

Steve Enger joined Petrie Parkman in 1997 as an analyst covering the integrated oil companies following a 16-year career with ARCO in a variety of technical and financial roles. He holds a BSc in petroleum engineering from the Colorado School of Mines and an MBA from UCLA.

Andy Logan joined Petrie Parkman in 2000 as an upstream oil and gas analyst. Since 1987 he has worked as a geologist, most recently for BP Amoco. He studied geology at Colgate University and has an MBA from the University of Colorado.