Reed-Hycalog: US rig fleet utilization hits 20-year high

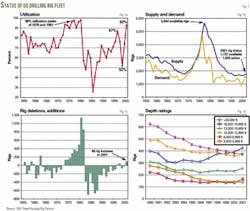

US land and marine drilling rig fleet utilization hit a 20-year high of 93% in second quarter 2001, up from 74% last year, according to the 49th annual Schlumberger Ltd. Reed-Hycalog Rig Census, presented at the recent International Association of Drilling Contractors annual meeting in New Orleans (Fig. 1a).

After a 2-year decline, the available rig count increased by 86 units, or 5%, to 1,722 rigs available in 2001, up from last year's record low in the 49-year history of the census of 1,636 rigs available (Fig. 1b).

John Deane, vice-president of drilling technologies with the Schlum berger Oilfield Services in Houston said, "The decline in the number of rigs that began 19 years ago has leveled off and begun an upturn" (Fig. 1c).

Reed-Hycalog officials counted 1,593 active rigs during the 45-day census period, up 31% from last year and the highest tally since 1990.

The Reed-Hycalog census counts all rigs active at any point within the 45-day survey period, which ran from May 5 to June 18, and is always higher than the weekly tally of working rigs by Baker Hughes Inc. The Baker Hughes rig count for June 15-the last full week of the Reed-Hycalog survey period- showed 1,266 rotary rigs drilling in the US and its waters, up from 871 during the same period in 2000.

Like others in the industry, Deane attributed the dramatic increase in active rigs to high commodity prices, primarily gas. Gas was in the range of $4.25/Mcf and oil was trading at $28.50/bbl, when the census was conducted.

Deane pointed out that economic conditions clearly have changed since the rig census was taken in the second quarter of the year, with rig utilization trending lower as gas prices have dropped and with the economic uncertainty brought on by the terrorist attacks of Sept. 11.

Even with recent drop in commodity prices and economic downturn, said Deane "The census taken at the same time every year should reflect the general trends of our industry." Deane predicted next year's Reed-Hycalog census will reflect modest growth of about 3%, or 54 additional rigs available, primarily due to the current momentum within the industry.

Utilization will drop to 85%, clearly downward, but still robust; "well above the historical census average of 73%," Deane said.

Rig deletions, additions

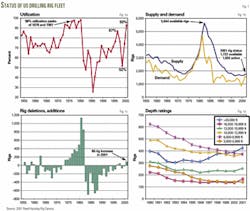

In the 2001 census, 182 rigs were added to the fleet, while 96 were re moved (Table 1). Most rigs added to the fleet were assembled from component parts. Deane said, "Despite the age of the rig fleet, as market conditions improved, rig owners were able to repair or assemble needed rigs quickly."

Rig additions included 105 assembled from components, 56 brought back into service, 12 moved into the US, and 9 new builds.

Excessive capital expenditure required to keep rigs operating resulted in most of the deletions, with 36 rigs removed from service-4 fewer than last year. Remaining deletions included 28 stacked longer than 3 years, 23 auctioned or cannibalized for parts, 6 moved from the US, and 3 destroyed.

Comparing the 2000 and 2001 censuses, deletions or additions to the fleet by rig type included an increase of 82 land rigs, for a total of 1452; 9 fewer inland barges, for a total of 38; 4 more floating rigs, for a total of 37; 1 more offshore platform, for a total of 43; 8 more bottom-supported rigs, for a total of 152; and 9 more offshore stationary rigs, for a total of 195.

Clearly there is a trend of increasing the fleet's capability for drilling at greater depths, primarily through upgrades of existing rigs. Since 1996, the number of rigs capable of drilling deeper than 20,000 ft has increased in 2001 by 113 units to 424, from 311 rigs, an increase of almost 23 rigs/year (Fig. 1d).

All categories of rigs in the 2001 census rated for depths in excess of 10,000 ft increased by 100 rigs, while rigs rated for depths 9,999 ft or less dropped by 14 rigs. Following is the rig depth-rating distribution for the 2001 census (Fig. 1d):

- 424 rigs capable of drilling deeper than 20,000 ft, a gain of 32 rigs.

- 161 rigs rated to 16,000 to 19,999 ft, a gain of 27 rigs.

- 254 rigs rated to 13,000 to 15,999 ft, a gain of 23 rigs.

- 373 rigs rated to 10,000 to 12,999 ft, a gain of 18 rigs.

- 371 rigs rated to 6,000 to 9,999 ft, a loss of 10 rigs.

- 139 rigs rated to 3,000 to 5,999 ft, a loss of 4rigs.

Consolidation

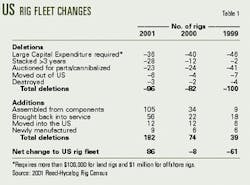

"Mergers and acquisitions in the drilling contracting industry have not let up and have continued for more than a decade," said Deane. As rig owners merged, the number of contractors declined to 191, down 17 from last year (Fig. 2a).

Deane added, "There were almost 700 rig owners back in 1987 and we're down to less than 200 now." Large contractors (those with 11 or more rigs) continue to gain more control of the total rig fleet, now owning 73% of all US-based rigs.

According to Deane, there are only 13 drilling contractors (those with 20 or more rigs) who currently control 62% of the drilling rigs on the market.

Concerns

In a survey conducted in conjunction with the rig census, drilling contractors reported "crew availability" as their No. 1 concern in 2001.

Deane explained, "Although drilling contractors have enjoyed improved market conditions lately, the instability of the industry has left an acute shortage of qualified labor. With the need to put rigs back to work, not even improved rig rates can bring back the lost generation of exper ienced help."

Reed-Hycalog reported that every contractor responding to the survey reported higher rig rates this year, but still rig rates came in as the No. 2 concern.

Deane said, "Contractors continue to hope for rates that will allow necessary maintenance and capital improvements to their rigs, training and safety programs for their labor force, as well as a reasonable profit."

Thirdly, drilling contractors were concerned about the availability of rig parts, according to Deane.

He indicated that the number of rigs left that can be auctioned for parts has dwindled, making further growth of the rig fleet from cannibalized parts more difficult.

Future plans, trends

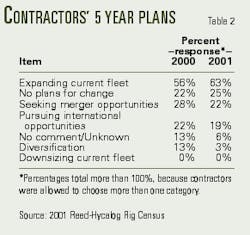

"These rig census data and contractor survey reflect a very optimistic outlook with expectations that commodity prices won't dip too low," said Deane. "As a matter of fact, 63% of rig owners anticipate expanding their fleets over the next 5 years" (Table 2).

According to Reed-Hycalog, about 25% of the respondents didn't think much would change for them; 22% said they would seek merger opportunities. About 19% reported that they would pursue international opportunities.

Also indicative of the drilling contractors' optimistic mood is the fact that none of them had plans to downsize his fleet.