Hype aside, renewable energy emerging as viable long-term energy industry business opportunity

Renewable energy development is beginning to emerge as a viable, long-term business opportunity for energy companies.

The subject of renewable energy presents the average businessperson or investor with a number of difficulties.

First, it is often associated with "new age" quirky thinking, when in reality renewables are the oldest and most proven form of energy generation.

Second, the subject suffers from overly extravagant resource-based claims that are far from realizable. (For example, the global wind resource is vast; however, the proportion that can be economically captured for power generation remains small.)

Third, it is full of inconsistency-in definition, description, and reporting.

A key aim of this article is to clarify the situation and provide a summary of the significant business opportunities likely to be presented over the next decade. In order to do this, we have examined each resource, the associated technologies for its exploitation, present levels of capital expenditure, and then developed capital expenditure forecasts by sector.

After stripping away the hype, what remains is a major industry that is developing strongly and offers considerable long-term business opportunities.

Drivers

Four key factors are driving the rapidly accelerating development of the renewable energy industries:

- Environmentally driven markets. These are generally the Organization for Economic Cooperation and Development countries that, in order to meet mandated emission targets emanating from the United Nations' Kyoto Protocol on climate change, will sharply accelerate their use of renewable energy. These markets are expected to provide the largest gain in the use of renewables in the short term and the largest short-term business opportunities.

- Energy-driven markets. These are particularly the Asian and other developing economies where demands for new energy are being propelled by population growth, industrialization, and urbanization. Government and industry are predisposed to meet new electricity requirements from renewable sources, which are indigenous and have relatively short installation timeframes. The energy demand from these markets is expected to overtake that of the OECD countries beyond 2002 and become a significant sector by 2007.

- The green consumer. The liberalization of energy policy and the rise of the political and "green" consumer are also driving greater demand. The break-up of state energy monopolies has spawned competition and allowed businesses and individuals to choose their provider of electrical services. In many markets, the options for industrial, business, and residential consumers include "green energy" programs. While still a minor part of the mix, green energy options will gradually increase awareness and attention and cause increased market demand from some customer segments.

- Economic drivers. The market is increasingly being influenced by traditional market drivers rather than by political forces. In some situations wind, biomass, and small-scale hydropower are becoming viewed as complementary to fossil fuels, not as a replacement, and there is also an observable trend among conventional energy producers to consider the use of renewable technologies.

Wind energy.

Over the past 6 years, wind energy has been the fastest-growing renewable energy source,1 with additional output growing at a compound rate of 30%. It is likely to maintain this position for the medium term, as some projects have now achieved output and economy ratings comparable with fossil and nuclear power.

Europe and North America have dominated wind energy developments over the past 2 decades. However, the past 5 years have seen the European region forge ahead in terms of installed capacity, and with the current economic and political situation, it is unlikely that this situation will change. While currently accounting for 73% of installed capacity, European growth has slowed slightly to 36%/year from over 40%/year. However, while other regions have grown faster, the large installed base of Europe has maintained its pre-eminent global position.

One interesting situation has been the development within Western Europe of offshore wind farms. Western Europe has a higher average population density coupled with a higher offshore wind resource than North America. This has made offshore wind a viable alternative for Denmark, Ireland, Sweden, Norway, Germany, and the UK. There is currently about 80 Mw of installed capacity offshore, all of it in Europe, with Denmark responsible for 63% and the Netherlands 16%.

There are, however, extensive development plans throughout the region that could lead to a massive increase in installed capacity by 2010. Among the UK, Denmark, the Netherlands, and Germany, there is the possibility of nearly 6,500 Mw of installed capacity, which, if realized, would make off- shore wind the fastest growing sector of the wind energy market.

In the US, huge tracts of sparsely populated land with good wind potential and suitable grid connections have made onshore wind generation the economic option.

Over the next few years, continued technological improvements, such as the development of 5 Mw turbines, should lead to further efficiency and output gains and see wind energy firmly ensconced as a commercial proposi- tion for large-scale, subsidy-free power generation.

Manufacturing wind turbines is becoming a significant business in some countries. For Denmark, an early pioneer in the sector, this has become the country's largest engineering export.

Solar energy

Solar energy is becoming a well-established business sector. The technologies can be characterized into two distinct groups: photovoltaic (Pv), or "active," and thermal, or "passive." Pv directly converts light to electricity, while passive systems use solar energy for direct heating or to generate electricity indirectly through a heat-transfer system. The passive use of solar energy is separated into solar heating and solar thermal electricity.

With 1 sq m of installed solar collectors saving 200-600 kw-hr/year of electricity-depending on the country, the type and quality of the installation, the weather conditions, and consumption pattern-it is projected that the solar collectors to be installed in Europe (mainly southern Europe) by 2005 will produce 14 million Mw-hr of solar thermal energy.2

There is no global estimate of the number of passive systems in use today, but there are an estimated 5 million -plus systems in use in developed nations.3

The major energy companies BP PLC and Royal Dutch/Shell Group are both significant players in the Pv solar technology sector.

Tidal, current-stream energy

Engineers have been trying for hundreds of years to effectively harness what is widely acknowledged as one of the great untapped energy resources of the planet-the energy associated with the movement of ocean tides and current streams.

However, most potential sites are poorly located with regard to prospective users and often in areas of high ecological value. But technological developments of the last decade coupled with the growing acceptance of the need for renewable energy should ensure that tidal and current-stream energy finally move out of their development stage and into commercial reality.

One extreme example is a 2.2 Gw tidal fence being planned by Blue Energy Canada Inc., Vancouver, BC, for the San Bernadino Strait off the Philip- pines. The project, estimated to cost $2.8 billion and take 6 years to complete, would be the largest tidal power plant in the world.

However, the main future of tidal and current stream energy schemes may lie in small-scale tidal power plants similar to the new generation of 3-5 Mw wind turbines that are being adapted to subsea use. With lower capital costs and a close matching of output to local demand (removing the cost of transmission), small-scale tidal power could have a very bright future, particularly in South America and the Asia-Pacific region, where grid connection is a major structural issue.

Wave energy

In the wave energy sector, a number of devices have been designed and deployed, but no one device has yet to reach either universal acceptance or widespread commercial use.

The last decade has, however, seen significant developments in efficiency and reliability that have brought wave energy from a conceptual to a development phase in its progress to commercialization.

There is also growing local, national, and international support for the fledging industry that should lead to competitive commercial applications before 2010.

The UK and Japan have dominated the development of wave energy devices over the past 15 years and currently account for over 60% of worldwide development expenditures.4

The UK industry has recently been boosted by the announcement that Europe's largest dedicated research facility is to be built at Blyth in Northeast England. 5 Containing a large converted dry dock, the facility is capable of testing full-size devices of up to 30 kw.

Geothermal energy

Perhaps the best-known example of geothermal energy use is in Iceland, where it is the second-largest source of energy. Reykjavik, with a population of more than 145,000, pipes hot water to every house at a cost lower than cold water.

The global potential is spread quite evenly across the regions, although realizable prospects are likely to be concentrated in Europe, Asia, and North America. However, as a result of an extensive research and development program, the US has the largest quantifiable resource.

Hydrothermal reservoirs are large pools of steam or hot water trapped in porous rock. To create electricity, the steam or hot water is pumped to the surface, where it drives a turbine that spins an electric generator. Because steam resources are rare, hot water is used in most geothermal power plants.

Steam and hot water power plants use different power production technologies. A standard geothermal power generation plant may have 6-10 producing wells and 1-4 injection wells costing $1.5-3 million each.

In the US, there are subsurface volcanic hot spots under Yellowstone National Park and Hawaii and intraplate extension with hot springs in the Great Basin of the US West.

California generates the most geothermal electricity, with about 824 Mw at the Geysers complex in northern California (much less than its capacity but still the world's largest developed geothermal field and one of the most successful renewable energy projects in history), 490 Mw in the Imperial Valley in southern California, 260 Mw at the Coso resource in central California, and 59 Mw at smaller plants elsewhere in the state. There are also geothermal power plants in Nevada, Utah, and Hawaii.

Due to environmental advantages and low capital and operating costs, direct use of geothermal energy has skyrocketed, with over 450,000 geo- thermal heat pumps installed. In the western US, hundreds of buildings are heated individually and through district heating projects with geothermal energy.

Biomass

It is estimated that biomass accounts for at least 15% of total world energy, and in some developing countries this figure rises to 35-50% of domestic energy supply.

The conversion of biomass for electric power generation is often referred to "bio-energy." Modern biomass usually involves large-scale plants and aims to substitute for conventional fossil fuel energy sources. It includes forest wood and agricultural residues, urban wastes, and biogas and energy crops.

Traditional biomass is generally confined to developing countries and small-scale uses. It includes fuel wood and charcoal for domestic use, rice husks, other plant residues, and animal dung. Industrial applications include combined heat and power, electric power generation, space-heating boilers in public buildings, domestic heating boilers, and decentralized energy applications.

Biomass plants have been installed across the world, burning a wide range of renewable fuels. India has a national program of typically small, 5 Mw plants. Plants in the US are burning wood processing residue and in the UK, straw and poultry litter. The UK's first-and the world's largest-straw- fired power station at Ely was built for capital outlays of $90 million and has an output of 36 Mw (see photo, this page).

While the North American market will remain significant, South America is likely to contribute most of the biomass energy growth in the Americas. Indonesia, India, and China will drive forward the Asian market for biomass electric power generation.

Small-scale hydro

Large-scale hydro is a mature industry that, while involving a renewable energy resource, is also generally regarded as having unacceptable environmental consequences. However, the small-scale hydro market is a different matter.

Small-scale (<10 Mw) hydro schemes normally involve a diversion of some of the flowing water rather than a complete holdback-and-discharge format of larger schemes. From being one of the earliest forms of power generation, it has for the past 30 years been overshadowed by the development of large-scale hydro schemes.

Improvements in turbine and generator efficiencies, particularly over the past 10 years, have seen small-scale hydro grow into a distinct industry. The extent of this transformation can be highlighted by the active involvement of major turbine manufacturers such as General Electric Co.

The small-scale hydro market has grown over the past decade to become a $2 billion/year industry. Through 1995-2000, small-scale hydro has been reassessed in many of its major markets, and new financial incentives have been put into place that are leading to increased interest and activity.

Asia-in particular China-is the backbone of the small-scale hydro industry, representing nearly 50% of expenditure, a situation that is likely to remain through 2010.

Assessing prospects

One of the major problems in assessing future investment in renewables is that, rather like the oil and gas industry, the number of "possible" projects is considerable, but in reality, many will never be realized, are totally uneconomic, or are the subject of indefinite delay.

A prime example of this is wind power, where the central overriding issue, as with many energy sources, is not performance but the level of practical exploitation and hence commercialization. Many factors can influence this: location, available technology, topography, grid connection, visual amenity, etc., as well as less quantifiable issues, such as public perception. Grid connection is a particular problem, as some of the world's best prospective sites are a considerable distance from existing transmission grids.

A number of estimates have been made of the worldwide exploitable resource of wind energy, all of which have become underestimates within a very short period of time as technological development has made com- mercialization more feasible at lower wind speeds and in more locations.

The technically exploitable wind energy resource was estimated in 1998 at 53,000 Tw-hr/year,6 slightly less than four times the 1998 world electricity consumption of 14,396 Tw-hr/year. This calculation was a composite of regional and national estimates from a number of agencies. It has been interesting to note that, almost without exception, every detailed local or regional analysis completed since then has estimated its resource at anything up to five times this World Energy Council estimate. This had led to speculation by a number of academic sources that the exploitable resource could exceed 200,000 Tw-hr/year,7 more than 13 times 1998 global electricity consumption and nearly 10 times the International Energy Agency projection of electricity consumption in 2020, 24,000 Tw-hr/year.

Capex outlook

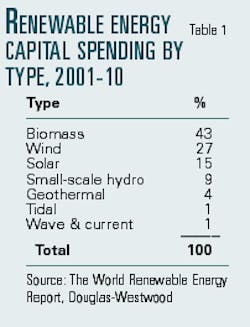

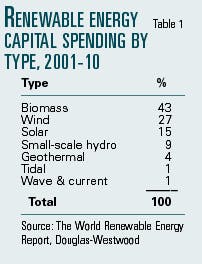

Douglas-Westwood's models indicate that, during 2001-10, the total world renewable energy market capital expenditure will grow from $15 billion/year to $40 billion/year, an average annualized growth rate of nearly 10%. We expect the capex over this period to total $272 billion.

Through 2004, we expect continual growth in output across all the renewable energy sectors. However, we forecast that the capex from 2005 will, for a brief period, effectively level. We believe that a reappraisal of the cost of "green" electricity and a reduction in the renewable energy market's ability to command premium prices will temporarily slow the rate of growth.

The leveling off in the market is likely to be temporary, and as we approach the end of the decade, the demand for electricity in the Asian region, particularly China, will act as a further spur to the renewables sector. The period of 2001-05 can be characterized as environmentally driven, while 2005-10 will be energy demand-driven.

Although there are variances in the forecast growth across the different sectors, the overall trend in expenditure is upward. With a higher ratio of planned and possible projects, wind and biomass are forecast to represent the most significant proportion of expenditures. With a combined expenditure during 2001-10 of $190.5 billion, these two sectors are forecast to represent over 70% of renewable energy industry spending.

Conclusions

Renewable energy is a significant global industry with an annual capital expenditure of over $15 billion. Contrary to the belief of many, the majority of this expenditure is for conventional industrial and power generation equipment, such as turbines, generators, switchgear, control systems, cabling, monitoring systems, etc.

Major companies such as ABB Group, GE, and Paris-based Alstom have been increasingly active across many of the renewable sectors and quietly building market share. The supply of commercial off-the-shelf equipment by companies such as these has been one of the key fundamentals in reducing the cost of renewable energy.

Many equipment suppliers now view the industry not as an embryonic niche but as a "normal" business sector. This step change in approach also means that much of the technological development within the industry is now coming from industrial research and development rather than academia. It is the engineers that are now putting a commercial reality into the world of renewable energy.

The commercialization of renewable energy is gradually feeding into the energy industry's planning process. It has been noticeable that energy companies are not only more optimistic about the renewables sector but that medium and long-term cross-sector planning is developing.

The industry is moving away from a project-by-project basis and into output planning within an integrated strategy.

Financiers and investors who are looking for a balance of projects and cross-sector risk management are also seeking to include renewables within their investment portfolios.

References

- World Energy Council.

- European Union.

- Douglas-Westwood computation of national statistics.

- Douglas-Westwood International Ocean Systems, July-Aug. 2001, pp. 26-27.

- World Energy Council.

- World Energy Council.

- Energieonderzoek Centrum Nederland.

The authors

Will Rowley has a background in management in the downstream sector with a number of organizations and has since gained considerable experience in business analysis. He is the author of a number of studies and published papers on the oil and gas industry. Rowley's business research activity also includes diversification studies for multinational oil industry manufacturing companies and work on energy business prospects in the UK, Czech Republic, and Slovakia. He holds an MBA and is a member of the Institute of Petroleum (IP).

John Westwood has, over the past 15 years, been responsible for more than 160 specially commissioned energy industry business studies. He previously spent 12 years working on offshore projects for many of the world's oil majors and has served on the boards of energy industry companies in the UK and Norway. Westwood is a member of IP, a Fellow of The Institute of Directors, and a member of the Society for Underwater Technology and has published over 50 papers on various aspects of the energy industry.

For further inquiry related to this article, the authors can be contacted at [email protected].