Company News: Burlington plans $2.1 billion Canadian Hunter purchase

A rash of recent international mergers and joint ventures have created a number of new companies that expect to advance their interests worldwide.

In one major acquisition, Houston-based Burlington Resources Inc. has offered to buy the stock of Calgary-based Canadian Hunter Exploration Ltd. for $2.1 billion, positioning the US firm solidly in Canada's Deep Basin area and other major Canadian producing areas and gaining a "crown jewel" of natural gas assets.

Amid other operating company merger and JV news:

- ChevronTexaco Corp. has received approval from Chevron stockholders for the merger of Chevron Corp. with Texaco Inc., comprising operations that now constitute one of the largest integrated petroleum companies in the world. The merger was first announced in October 2000 and received Federal Trade Commission approval last month.

- Toreador Resources Corp., Dallas, and Madison Oil Co., Toronto, will merge to create an independent international oil and gas E&P company.

- Three government-owned companies based in India have joined forces to form an international partnership for worldwide projects. The consortium of Oil & Natural Gas Corp., Indian Oil Corp., and Gas Authority of India Ltd. will operate in their areas of core competence, with ONGC specializing in exploration and production, IOC in products marketing, and GAIL in gas transport and marketing.

- Natural gas distributor Atmos Energy Corp., Dallas, has signed a definitive agreement to acquire Mississippi Valley Gas Co., Jackson, Miss., for $150 million plus the assumption of $45 million in debt.

- TransCanada PipeLines Ltd., Calgary, agreed to sell certain natural gas marketing and trading operations to BP Gas & Power, a unit of BP PLC. Terms were not disclosed.

- Plains All-American Pipeline LP, Houston, has agreed to acquire the Dollarhide pipeline system and the Midland tank farm from Unocal Pipeline Co., Sugar Land, Tex., for $2.6 million.

Merger and JV action continues apace in the service and supply sector as well. Among the latest transactions:

- French company Technip SA and Kazakhstan's national oil and gas transportation company Transport of Oil & Gas have created an engineering and construction JV company to be headquartered at Almaty.

- Saipem SPA, a unit of Italian company ENI SPA, has acquired the remaining 50% of European Marine Contractors Ltd. from Dallas-based Halliburton Co.'s Kellogg Brown & Root unit, giving the company full ownership of the offshore specialty company.

- Another international marriage involves Schlumberger Oilfield Services, a unit of Schlumberger Ltd., New York City, which acquired Phoenix Petroleum Services (PPS) of Inverurie, Scotland.

- John Wood Group PLC of the UK has acquired US-based Production Services Group to develop its operations and maintenance service business in the Gulf of Mexico.

- Clough Engineering Ltd., Perth, and Mermaid Marine Australia Ltd. have signed a memorandum of understanding to form a JV for shallow-water pipeline installation off Australia. The proposed JV intends to specialize in projects off northern Western Australia and the Northern Territory.

Burlington-Canadian Hunter

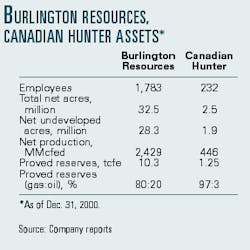

Burlington's acquisition of Canadian Hunter for $53 (Can.)/share will nearly double its investment in Canada and add a portfolio of attractive producing properties characterized by low operating costs, long-lived reserves, and promising exploration and exploitation potential.

Both firms are focused on gas production. Gas constitutes 97% of Canadian Hunter's reserves and 80% of Burlington's.

Burlington will gain reserves of 1.2 tcf of gas and 6.2 million bbl of oil, plus 2 million net undeveloped acres and extensive seismic data. Burlington allocated $228 million of the aggregate purchase price to the undeveloped acreage and seismic data and $250 million for processing plants and other infrastructure. In 2001, Burlington expects Canadian Hunter to have average net gas production of 430 MMcfd and 2,700 b/d of oil and condensate. Based on that, Burlington said its purchase cost equates to $1.27/ Mcfe of proved gas reserves.

The boards of both companies have approved the deal, which is expected to close later this year. Merrill Lynch Co. and Morgan Stanley Co. were financial advisors for Burlington and committed $1.9 billion (US) of the financing. CIBC World Markets Inc. and Goldman, Sachs & Co. advised Canadian Hunter.

Bobby Shackouls, Burlington chairman, president, and CEO, said "We have been studying Canadian Hunter's assets for some time, and they are the right fit with our North American natural gas strategy and our returns-based investing" (see table).

Steve Savidant, Canadian Hunter president and CEO, said, "Over the past 28 years, Canadian Hunter has grown into one of the most successful natural gas producers in Canada through its relentless pursuit of value."

Burlington said it would sell various properties that do not fit its asset profile and will continue a planned $1 billion stock repurchase program. To date, it has spent $694 million to repurchase 16.3 million shares.

After asset sales, Burlington said its gas reserves will expand 12% to 11.5 tcfe, based on Burlington's yearend 2000 reserves and Canadian Hunter's current reserves.

Burlington said it would gain "Canadian Hunter's dominant position in Canada's Deep Basin area, North America's third-largest natural gas producing area, which is only partially developed. Canadian Hunter holds interests in 1.5 million acres in the basin, which features 17 major producing horizons. It is similar to the San Juan basin in the US, where Burlington has utilized its conventional gas and coalbed methane expertise to become the leading producer."

ChevronTexaco

Chevron stockholders cast votes at a special stockholder meeting Oct. 9 in Houston approving the proposed Chevron-Texaco merger. More than 441 million shares, 99% of the shares voted, approved the common stock issuance, and more than 438 million shares, 68% of the shares entitled to vote, approved the name change to ChevronTexaco Corp. Dave O'Reilly, Chevron chairman and CEO, said "Our goal is to be No. 1 in total stockholder return among our industry competitors. With this merger, two companies with a long history of partnership will join together to create greater value for our stockholders and put us on the path to our goal."

ChevronTexaco will be headquartered in San Francisco until the second half of 2002, when the headquarters will move to San Ramon, Calif.

Meanwhile, Moody's Investors Service upgraded the long-term securities ratings of Texaco and its guaranteed wholly owned subsidiaries to Aa3 (senior unsecured) from A1, following completion of the $39 billion equity combination merger. Chevron's existing Aa2 long-term and Prime-1 short term ratings and those of its guaranteed subsidiaries were confirmed when the transaction was first announced. These have become either direct or guaranteed obligations of ChevronTexaco effective with the merger.

ONGC-IOC-GAIL

The Three Indian companies have agreed to form a partnership for overseas operations. They will work as a consortium in all future international ventures for oil and gas E&P, transportation, and marketing projects.

As a start, the trio has agreed to buy gas from any discoveries made by South Korean conglomerate Daewoo Corp. in Myanmar. Daewoo last year signed a production-sharing contract with state-owned Myanma Oil & Gas Enterprise for Block A-1 off Myanmar. The 960,000 acre block is off northwestern Myanmar near the border with Bangladesh in the Bay of Bengal. Daewoo has a 100% working interest in this block and was to reprocess existing seismic data during the first period of exploration (OGJ, Aug. 21, 2000, Newsletter, p. 9). No discoveries from this PSC have been reported, but a unit of ONGC was reported to be negotiating a farmout on the block with Daewoo.

"The first right of sale has already been signed between Daewoo and GAIL in the last week of September, and the purchase agreement will soon be signed by the ONGC-IOC-GAIL consortium," said Proshanto Banerjee, chairman and managing director of GAIL.

To import gas from Myanmar, GAIL would need to build a 550 km pipeline around the continental shelf of Bangladesh that will not require the permission of that country. Landfall will be at the port town of Haldia in West Bengal. Banerjee said, "We expect to invest around 30 billion rupees [$625 million] on the Myanmar-India offshore pipeline."

Toreador-Madison merger

The combined company formed by Toreador and Madison will retain the Toreador Resources Corp. name and will remain headquartered in Dallas.

The transaction will create an independent international oil and gas E&P company with a market capitalization of $100 million and combined proved reserves totaling over 15.28 million boe.

Under terms of the agreement, Madison shareholders will receive 0.118 share of Toreador common stock for each Madison common share. Madison shareholders will own about 32 % of the combined company and Toreador shareholders 68 %.

G. Thomas Graves III, president and CEO of Toreador, will serve in the same capacity for the combined company, and Madison will nominate candidates to fill three new positions on the Toreador board.

The merger is subject to regulatory approvals and the approval of shareholders, expected by yearend.

Atmos acquisition

Atmos agreed to buy Mississippi Valley Gas for $75 million cash and $75 million of Atmos common stock along with $45 million in Mississippi Valley's outstanding debt.

The transaction, subject to federal and state regulatory approval, is expected to be completed within a year. The acquisition requires Mississippi Public Service Commission approval.

In addition, the regulatory bodies of Colorado, Georgia, Illinois, Kentucky, and Virginia must approve the issuance of Atmos common stock.

"The acquisition...is expected to be modestly accretive during the first 12 months following the close of the transaction. However, the impact on fiscal 2002 earnings will largely depend on the time of the completion of the acquisition," said Ronald Barone, managing director of equities, natural gas and energy convergence research, for UBS Warburg LLC.

Atmos Chairman Robert W. Best said Mississippi Valley Gas will operate as a separate Atmos business unit and will remain based in Jackson, Miss.

Mississippi Valley operates a 5,500 mile distribution system and 335 miles of transmission pipeline. The utility owns two underground gas storage facilities at Amory and Goodwin in northeastern Mississippi with a combined working gas capacity of 2.05 bcf.

During the past 4 years, Atmos has more than doubled its size through a series of acquisitions. It distributes natural gas to about 1.4 million customers in 11 states.

TransCanada PipeLines

TransCanada's latest divestiture includes CanStates Gas Marketing, the contract to manage gas supply assets for SEMCO Energy Gas Co., and the gas marketing and trading operations associated with TransCanada's office in Omaha. The sale is expected to close in the fourth quarter, pending necessary regulatory approvals. Terms of the deal were not disclosed.

TransCanada plans to divest most of its gas marketing and trading operations, including its structured products business, and most of its gas transportation and storage contracts. Also included in the divestiture process is the netback pool business, which markets the aggregated supply from more than 500 Canadian gas producers.

TransCanada's CEO Hal Kvisle said, "We are progressing towards a complete exit from the natural gas marketing and trading business." He said TransCanada wants to concentrate on its core businesses of natural gas transmission and electric power.

Plains All-American

Plains All-American said the acquisition of the Dollarhide pipeline and the Midland tank farm will augment its gathering, marketing, and pipeline transportation operations in West Texas.

Harry Pefanis, Plains All-American president and chief operating officer, said, "We expect this transaction to be accretive to earnings per unit and cash flow per unit, generating an annual 15-20% return on capital."

The Dollarhide pipeline transports 4,500 b/d of oil to the Midland market. The acquisition includes 215,000 b/d of crude storage capacity along the system and in Midland.

In conjunction with the transaction, Plains All-American plans to enter into a connection agreement with a large independent producer that provides for the dedication of additional volumes to the system for an initial term of 5 years.

Both transactions are expected to close in the next several weeks.

Technip, Kazakh JV

Technip and Kazakhstan's Transport of Oil & Gas will hold 50:50 stakes in their new JV, Technip Kazakhstan.

The new company will provide engineering services for the construction of onshore and offshore oil and gas facilities with the support of Technip. It will seek participation in the supply of main oil and gas projects in western Kazakhstan, particularly cross-country crude oil and gas pipelines.

Technip Kazakhstan intends to become a major player in Kazakhstan, helping with the development of Tengiz, Karachaganak, and Kashagan fields.

Technip also said it also has finalized the acquisition of privately owned engineering and construction company UTC Projectos e Consultoria SA, Rio de Janeiro (OGJ Online, Apr. 18, 2001).

Saipem buys balance of EMC

Saipem's deal to purchase the remaining shares of European Marine Contractors, which is subject to antitrust scrutiny, gives Saipem 100% interest in the North Sea pipeline market specialist.

Saipem said the price is $115 million, which may increase as much as $27.5 million, depending on a formula linked to an external index.

The company said the acquisition will give it control over EMC's vessels, including the Castoro Sei and Semac semisubmersible pipelay vessels, and will enhance its capabilities in the deepwater trunklines market.

Saipem intends to move some of the EMC vessels from the North Sea to other regions, such as Southeast Asia, where it anticipates "strong recovery."

Schlumberger-Phoenix

The union of Schlumberger Oilfield Services with Phoenix Petroleum Services is expected to increase Schlumberger's global in-well monitoring and artificial lift services capability, said company officials.

No financial details of the acquisition were provided.

Phoenix Petroleum Services provides tools, technologies, and techniques to optimize production from artificial lift wells, particularly those using submersible pumps.

Wood Group in GOM

The Wood Group's acquisition of Production Services Group is part of Wood's strategy to develop its operations and maintenance service business in the Gulf of Mexico.

Former PSG companies Coastal Production Services, Production Systems Inc., ProSafe Inc., and RMC Technology Corp. will now trade as Wood Group Production Services, they said.

The acquisition announcement said that PSG Pres. David Pilgrim and his management team will continue with the new company. Bill Edgar is chairman and CEO of Wood Group Engineering & Production Facilities.

PSG Group, with annual revenues of about $40 million, employs more than 420 people working offshore and at facilities in Texas and Louisiana. The Wood Group's earlier acquisitions this year include the Colombian company Procesos Y Disenos Energeticos SA, Lovegreen Turbine Services Inc., and H&L Accessory Inc. in the US, and Bexton Australian Pty. and Bexton Holdings Pty. Ltd. of Australia.

Clough-Mermaid

Clough will provide management and engineering resources to the Clough-Mermaid JV and will transfer its current Australian shallow-water business to the partnership, while Mermaid will provide management resources and preferred access to its pipe stringing and tow facilities. Mermaid will also transfer its current business opportunities to the JV.

The JV will be able both to bottom-tow pipe from shore and to lay pipe at sea. Mermaid will acquire a 50% interest in Clough's Challenge specialist lay barge by issuing 6.5 million shares to Clough in return for the $5 million (Aus.) stake.

Shareholders of both Clough and Mermaid must approve the proposal. Deloitte Corporate Finance will release a guiding report for shareholders soon, said Clough.

Although the proposed JV will first specialize in projects off Western Australia and the Northern Territory, it will consider other projects on a case-by-case basis as well.