Commoditization of natural gas, growth of market centers, pervasiveness of risk-management tools, and electronic trading have revolutionized the US natural gas industry. These same factors have led to profound changes in the use of natural gas storage; these changes in storage have been more evolutionary than revolutionary.

This first of two articles on natural gas storage in the US reviews how these forces have changed the industry since inception; the concluding article next week reviews the past and current uses of storage by customer segment.

Two functions

Traditionally, regulated utility companies used most natural gas storage capacity; either pipelines or local distribution companies supported their utility obligation to deliver reliable natural gas supplies at the lowest practical cost. Originally, storage served two functions: baseload service, which is essentially seasonal storage service, and emergency back-up.

Baseload storage can hold large enough quantities of working gas to provide the bulk of customer requirements over and above long-haul pipeline deliveries. It typically provides one long, relatively steady, 90-135 day withdrawal season and one long, 150-200 day injection season.

Historically, most of these storage facilities have been in depleted reservoirs and aquifers in a market area. Although this design results in inflexible usage patterns, it tends to maximize pipeline load-factor utilization and protect against in severe winters.

Emergency back-up storage facilities deliver gas at high rates to meet an urgent need for a short time, either hours or days. Typically, peak storage can sustain deliverability only for limited periods.

They may also have a short turn-around, so that gas injection may not be restricted to a particular time of year. While some depleted fields in the market area have been used for this type of storage, in recent years it is being developed more often in caverns. (Turn-around is the capability of a storage facility to reverse injection and withdrawal.)

Today's storage facilities continue to serve these functions and provide even more flexible services to attract new customers. This has led to the development of more efficient, shorter duration, load-matching storage services that provide supply protection and flexibility at the least cost for LDCs and that enhance potential profitability for marketers.

Although Order 636 (1992) of the US Federal Energy Regulatory Commission brought about the end of pipeline companies' use of storage to support merchant transactions, it opened up the opportunity of marketers to use storage to support their activities.

Premiums for gas supply service margins have become highly competitive and are nearly as volatile as the underlying gas prices. The increasing industry use of the futures exchange of the New York Mercantile Exchange (NYMEX) enables buyers and sellers of gas to manage the risk of price volatility.

As the gas industry has expanded the use of financial transactions, storage capacity in well-located facilities has increased the opportunity to capture commodity-price volatility in the physical market. Storage clients also use storage to take advantage of location and transportation price variations that take place on a daily, monthly, or seasonal basis.

The use of natural gas storage has not so much changed as it has expanded. The traditional utility use is still very much in evidence. The majority of US storage capacity still ensures the availability of seasonal gas supplies.

Development of new storage facilities and increasing efficiency made possible by the competitive gas market have freed capacity for new uses. These new uses are adding a new dimension to the natural gas storage industry and represent a disproportionate share of new transactions. They are growing opportunities that receive a disproportionate share of the attention of the industry, but the traditional utility applications still command most available capacity.

The growth of the commercial uses of storage challenges anyone trying to draw conclusions from the available storage data. At any point in time, the amount of gas in storage represents a combination of the amount required to serve the traditional utility functions, ensuring the operational availability of natural gas, and the amount desired by companies seeking to make a profit from marketing opportunities.

Individual companies are making daily decisions about how best to meet their obligations and to maximize their profits. Utility and commercial uses of storage coexist, sometimes within a single company. There is no sharp line between inventory needed and inventory desired. Therefore, it is impossible to look at any particular inventory level, injection rate, or withdrawal rate and determine if it is "right."

The commercialization of storage creates new uses for storage gas and adds new participants to the industry. Judgments about inventory are made independently by many entities, each considering its own obligations and reaching its own conclusions about market conditions.

The results may be different but they are not inherently more risky. In fact, when coupled with increasing liquidity in natural gas markets, the new users of storage shift risk and costs away from captive customers. They allow end users and LDCs to control their supply mix and risk exposure more efficiently.

Industry evolution

The US Geological Survey first proposed the concept of underground natural gas storage in 1909 as a waste conservation measure. The first recorded North American underground gas storage facility was a depleted gas reservoir converted for storage service in 1915 in Welland County, Ont. In 1916, the first storage field in the US began operating near Buffalo, NY, at the depleted Zoar field. That field remains active today.

The early success of storing gas in depleted gas fields resulted in the gradual development of other fields as it was realized that utilities with access to storage possessed a powerful tool to serve demand. In fact, development of the entire natural gas industry was linked to the newly proven ability to provide reliable gas service year round to industrial, manufacturing, and residential users.

Long distance pipeline transmission systems first appeared on the national energy scene in the late 1920s and early 1930s. But the pipeline industry recognized that building pipelines with sufficient capacity to meet winter seasonal and peak demand was not only extremely inefficient, it was impossible. In the mid to late 1940s, nationwide economic expansion in Canada and the US greatly increased demand for energy.

New large diameter, long-distance natural gas pipelines were laid (and oil pipelines converted) to connect supply areas of Texas, Louisiana, Oklahoma, and Kansas to the large population centers of the Midwest and Northeast. Gas from the Permian basin in West Texas and the San Juan basin in New Mexico was connected to market outlets in California.

Canada's Western Sedimentary Basin production was linked first to population centers in Ontario and Quebec and later into the Pacific Northwest and Northern California. Storage capacity was added to complement the development of these expanding pipeline systems.

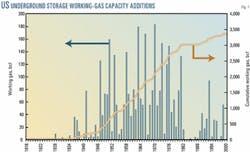

From 1941 to 1981, the number of new gas storage fields increased dramatically, with storage working-gas capacity increasing an average of 7.5%/year. Fig. 1 shows the rate of storage development in the US over the last 85 years.

As the market for natural gas service grew, so did the need for underground storage. Storage developers looked for additional geologic targets to allow injection of gas into storage during the summer and withdrawals in the winter to satisfy this need.

In 1941, Hope Natural Gas Co. developed storage in a depleted oil and gas reservoir in West Virginia. By 1946, Louisville Gas and Electric Co. had developed the first aquifer storage in Muldraugh and Doe Run fields in Meade County, Kent.

In 1970, the first salt cavern natural gas storage was opened in Mississippi by Transcontinental Gas Pipeline as a system supply backup for Gulf of Mexico production in case of disruption during hurricanes.

Through out this period and until the late 1980s, storage of natural gas was a purely utility as opposed to commercial function. Operational and economic requirements drove decisions to develop and utilize underground storage. The commodity price of natural gas was regulated from the wellhead to the burner tip. Pipelines and LDCs generally passed through the cost of gas and earned a profit based on their investment in the assets necessary to deliver it.

The economic value of storage was the regulated return on the asset. The operational value was immeasurably greater because storage was the tool that allowed daily and seasonal variations in demand to be balanced with supply. Underground natural gas storage provided pipelines and LDCs with seasonal supply, swing supply, and emergency supply.

For these utilities, the value of storage was the avoided cost of meeting their needs for these services through such other means as additional pipeline capacity, fuel switching, curtailments, and lost market. In most cases, storage was a cost-effective alternative.

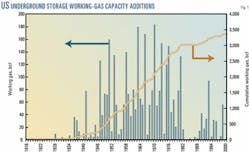

Fig. 2a shows that, until 1988, there was little or no commercial value to underground natural gas storage. That is to say, historically the regulated pricing structure for natural gas made it unreasonable to inject gas into storage with the expectation that you could sell it for a higher price when it was withdrawn.

The original open-access regulations were enacted in 1985 when the FERC issued Order 436, which began the transformation of the natural gas commodity market from a tightly regulated "cost of service" pricing structure to the free and open market in place today.

In 1992, the FERC issued Order 636, completing the transition to a deregulated natural gas commodity market and marking the end of most of the traditional pipeline merchant services.

Pipelines' access to storage was one aspect that the FERC paid particular attention to in Order 636. It felt storage provided pipelines an unfair competitive advantage by making the transportation component of firm pipeline sales service far superior to the service pipelines offered to unaffiliated shippers.

Since 1992, most new storage projects have received approval to charge market-based rates. These rates allowed pipelines to collect for project financing, which was not allowed with cost-based rates. Such market-based rates have been especially important in the development of new storage projects because they allowed the sponsors of those projects the flexibility to craft rates and terms of service tailored to their customers' needs.

Soon after Order 636 came a wave of announcements and proposals for new storage. From 1992 until 1994, various potential developers were evaluating 100 to 150 different storage projects of various types.

Many of the new storage developers were entrepreneurs with no ties to the traditional utility storage industry or unregulated affiliates of those utilities seeking an opportunity to earn market-based rates. Continuing this trend, approximately 60 storage projects have been proposed for completion over the next 5 years. Only a few of these proposed projects have been, or will be, able to demonstrate sufficient market support to be put in service.

Much more importantly, Order 636 required that the interstate pipelines do nothing to impede the development of a market or trading center or hub at any logical spot in the pipeline grid. (Often the most logical spots for market centers are near storage facilities.)

Fig. 2b shows monthly wellhead prices since January 1988 that sharply contrast with those in Fig. 2a. Seasonality and increasing volatility are clearly evident where they were absent from the earlier chart.

Previously, changes in the supply and demand balance for natural gas were not often reflected in the pricing, but with deregulation of the commodity these changes were reflected in the price. This development made the commercialization of underground natural gas storage possible. It was now possible to inject gas into storage with the expectation of profiting from price changes.

Deregulation of natural gas prices also promoted the evolution of risk-management tools.

In April 1990, the first futures contracts for natural gas were sold on the NYMEX. This futures exchange and the option to exchange a futures position with the physical commodity, along with over-the-counter products such as basis swaps, opened a new, time-based dimension to the gas market.

The expanding range of risk-management tools made it possible for commercial participants not only to profit from taking storage positions but also to guarantee that profit and manage their position over time to enhance that profit.

Hubs; market centers

Hubs and market centers have developed in a number of locations to take advantage of the interconnection of nearby pipelines (interstate and intrastate) or LDC main lines and sometimes storage facilities.

Also known as "market centers," hubs facilitated natural gas trading by providing greater flexibility to the shipper and the effective utilization of pipeline capacity at the lowest cost. Their interconnections allowed hubs to make gas from many supply sources available to many markets. Thus, they became ideal trading and pricing points.

FERC's Office of Economic Policy first actively promoted market centers in 1991. It indicated that the use of market centers provided greater efficiency, increased reliability, lower costs, and an increased number of options available to buyers and sellers.

The OEP considered development of market centers as a step toward its goal to foster a more flexible, competitive market for natural gas. Initially, 13 natural hubs were envisioned, but with the success of the Henry Hub, nearly 40 hubs were eventually promoted around North America.

Underground gas storage provides an important component of a hub service by acting as a daily source and sink for natural gas, thus promoting liquidity. The use of storage facilities interconnected to many pipelines allows fixed costs to be shared by a large number of clients in diverse locations. This allows the marketer to purchase gas for shipment, purchase capacity in the daily capacity-release market, balance at multiple points, and deliver at a competitive per unit cost.

The existence of hubs and market centers supports a robust and liquid natural gas market and where robust and liquid natural gas markets exist there is a profound impact on the utilization of natural gas storage. When gas market participants (producers, marketers, LDCs, and end users) are confident they can buy or sell the amount of gas they need at any time at the "fair market" price, the need to hold storage for utility purposes diminishes or vanishes.

A robust year-round liquid market eliminates the need to hold storage to manage swings in supply or demand. In such a market, price allocates supply, not the possession of storage capacity. The company that needs gas can buy it in a liquid market; those that have more gas than they need can sell it.

Where markets are reliably liquid, the decision to hold storage becomes a commercial one. Storage is not only used for operational balancing by utilities, but also for mitigating market volatility and reducing the impact of price spikes to customers during winter.

Paradoxically, although underground natural gas storage can be used to profit from gas-price volatility, it also tends to dampen that volatility.

When commercial users of gas storage observe that prices are lower than they expect them to be in the future, they will buy gas for injection. This effectively increases demand and tends to support the price of gas. Conversely, when prices are high, relative to expectations, these same storage users will sell gas and thus resist further price increases.

Of course, this mitigating effect on gas price volatility is limited by the available storage capacity (injection, withdrawal, and working-gas capacities) and the portion of that capacity being utilized for commercial as opposed to utility purposes at the time.

The complex interaction of storage and pricing can help explain the unusual storage fill and utilization pattern experienced in the 2000-2001 cycle.

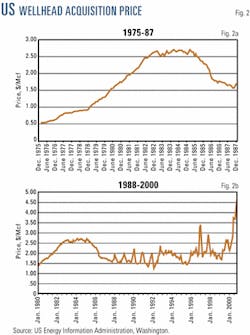

Many observers, early in the season, expressed concern that not enough natural gas was being injected into storage. Fig. 3a shows that injection rates in the 2000-2001 season were lower than in previous years.

In fact, storage users were acting rationally in response to the price signals in the market at the time. In the early part of the season, the cash market prices of gas were relatively high and the futures market had not risen as fast. Commercially motivated storage users deferred injections until later, when the market signals changed and they could profitably hedge their inventories.

It should be noted, however, that injections continued, albeit more slowly than previous years. This suggests that only a portion of storage decisions is commercially motivated.

At the end of the injection season, national storage inventories were in the low end of the historic range. Again, concern was expressed that the inventories were insufficient to make it through the winter.

In fact, the early part of the winter was colder than normal and storage inventories were drawn down heavily. But there was no shortage of natural gas for critical applications. In such critical market areas as the northeast, storage was in fact filled to the normal high inventory levels, despite the price, to ensure that sufficient inventories would be available to meet customer requirements in severe weather.

Commercial users who represent a smaller proportion of market area storage users were the segment of the market reacting to price signals. Across the country gas distributors were able to meet their obligations. In a very few cases, retail marketers failed to deliver gas for their customers, but these were price-related financial problems, not a failure of supply. In every case, the LDCs were able to deliver gas to the customers.

One implication of this is that the old rules regarding the quantities of storage required to meet seasonal load variations are no longer valid. A maturing market is creating more tools to meet demand.

In the future, optimal injection rates and inventory levels will be influenced by all of the traditional considerations of security of supply (weather-related demands) as well as market conditions and commercial contracting practices.

Figs. 3b and 3c further illustrates the impact of year-round liquid markets on gas storage.

The AGA conducts a weekly survey of storage operators across the country to gather information on inventory levels. The information gathered is reported for three separate regions:

- Producing Region - Texas, Oklahoma, Kansas, New Mexico, Louisiana, Arkansas, Mississippi, and Alabama.

- Consuming Region East - all states east of the Mississippi River, excluding Mississippi and Alabama but including Iowa, Nebraska, and Missouri.

- Consuming Region West - all states west of the Mississippi River, excluding Iowa, Nebraska, and Missouri, and those of the Producing Region.

Fig. 3b shows the weekly inventory levels in the Producing Region for each of the last 7 years. Fig. 3c shows the same information for the Consuming Region East.

In both cases, the graphs depict a generally seasonal pattern of storage usage. Inventories increase from April through October and decline from November through March. The pattern in the Producing Region (Fig. 4a), however, is much looser, reflecting a greater degree of variation in the use of the storage assets in this region.

In the last seven storage cycles, the peak inventory in this region has ranged from 97% of working-gas capacity to as low as 71% of capacity. The inventory levels at the end of the traditional withdrawal cycle have been as high as 55% of capacity and a low as 18% of capacity.

Even more telling is the fact that the data show times when there were withdrawals during the traditional summer injection season and injections into storage during the traditional winter withdrawal season.

By way of contrast, the Consuming Region East (Fig. 4b), exhibits a much tighter pattern of gas storage utilization. The peak inventory levels ranged from 99% full in the 1994-1995 season to a low of 92% in the 2000-2001 season. The timing and rates of injection are much more consistent from year-to-year in this region than in the producing region.

There are no instances where the data indicate that there were net withdrawals during any injection season nor were there any net injections during the traditional withdrawal season. This use pattern suggests that the storage in the region is primarily being used to support utility as opposed to commercial functions. There is little evidence of significant reactions to short-term or even year-to-year pricing fluctuations.

To a significant degree, these different storage utilization patterns reflect the differences in the market conditions in the two regions. The Producing Region has numerous actively traded and highly liquid market centers. The Henry Hub is the best known of these but many other points such as the Houston Ship Channel, Katy, Waha, Agua Dulce, Demarc, and Kosi exist across the region. There are active market makers working these points assuring that at some "market price" it is always possible to buy and sell gas. These markets are mature, transparent, and well reported.

Where these liquid market centers exist, LDCs and other users of gas that require reliable supply have options: They can buy gas in the competitive market when and as they need it at the market price. They can enter into a combination of term, swing, and spot contracts including whatever risk-management tools they deem appropriate at the time. They can own or lease storage capacity and use it in the traditional mode.

A rational utility or end user will only contract for storage capacity, however, if it believes it has the skills to use these assets and acquire gas more cheaply or more reliably than it could do on the open market. In other words, where there are mature competitive year-round markets for gas, rational users of storage have an incentive to use storage as a commercial asset or turn the asset over to those who will.

Even so, there is still a roll for the traditional utility use of storage for purposes such as supply security, flexibility, and load-factor management.

Similar market centers exist in the Consuming Region East such as Chicago and Leidy but with a significant difference. For a large number of LDCs and other users in this large and geographically diverse region, the markets are insufficiently liquid to ensure them of the reliable supplies they need, especially in the coldest days of the year.

For rational users requiring reliable supply in these areas, holding storage is a critical utility function, whether for their own use or that of their customers. Failure to maintain storage within the regulated utility in these circumstances could lead to market failure, supply disruptions, and unacceptable price movements.

Incomplete transition

Although there is clearly a transition in the use of storage from utility to commercial utilization, this transition is gradual, uneven, and incomplete and likely to remain incomplete for some time.

As indicated previously, there are clearly places where the traditional utility use of storage is efficient and appropriate. As gas markets mature, gas transportation becomes increasingly commoditized and pricing more transparent. It is reasonable to expect that existing and new storage will be increasingly used to maximize the value and efficiency of gas marketing and less as a supply of last resort for LDCs and other gas users.

Nevertheless, it is also reasonable to expect that the geographic distribution of reliable year-round market centers will continue to be uneven and imperfect. In the areas where market centers, downstream of storage, cannot be relied upon for secure supply, the parties requiring storage to meet seasonal loads, peaking requirements, and emergency supply will continue to need to hold and use their storage capacity as they have for many years.

In practice, the line between locations where liquid markets can be relied upon for secure gas supplies and where they cannot is defined by degrees. Even in South Louisiana, one might not rely on the liquidity at the Henry Hub during a hurricane.

If you needed gas in an emergency, you might not count on the market alone. Even in the Northeast, there are actively traded spot markets where buyers and sellers transact business even on the coldest days. An individual company, evaluating its own circumstances and considering its obligations determines how it will use the storage assets available to it.

The market has developed a tool to allow for the partial commercialization of storage assets, even those held by and for regulated utilities. That tool is the Agency Agreement, which, in its simplest form, allows a gas marketer to use the storage and transportation assets held by a utility.

The terms of these agreements vary widely. In some cases, the utility effectively turns over complete control of upstream assets in exchange for a city-gate delivered gas supply. Essentially, such an agreement returns the utility to the pre-Order 636 environment of as-required merchant delivered gas supplies except that the supplier is a marketer rather than the regulated pipeline.

In these cases, the compensation to the utility may come in the form of reduced demand charges, profit sharing with the marketer, a negotiated fee, or a lower delivered gas cost. The marketer gains access to the storage and transportation assets, which it can use to serve additional customers. The marketer can then commercialize the assets.

In other cases, the Agency Agreement calls for split control of the asset between the utility and commercial function. In these agreements, the utility maintains some control, such as specifying injection rates or target inventory levels, and the marketer is able to utilize the remaining flexibility to create value.

Typically, there is some profit-sharing arrangement between the marketer and the utility for the use of these assets.

These kinds of arrangements allow the utility to gain value or participate in certain marketing transactions that they could not do alone under their regulatory regime.

The marketer gains the opportunity to profit by commercializing as sets that would otherwise be unavailable.

Agency Agreements have two additional benefits.

- They allow for the gradual and limited transformation of access to storage capacity from utility use to commercial use. Individual storage facilities, and in fact individual storage contracts, can be split between these two different uses. Significantly, that split can evolve and be adjusted over time as the market evolves and changes.

- They reduce the pressure to overbuild storage and transportation assets. Without these types of agreements, marketers might contract for new capacity, while utilities hold on to existing capacity. Instead, Agency Agreements create a hybrid asset by sharing the same capacity and utilizing it more efficiently.

The existence of these agreements complicates things for observers of the industry. These agreements are often not reported or compiled. The reports available publicly only show the primary holder of storage capacity and in some cases the agent who has nomination rights, not necessarily who has use and control.

Therefore, it is difficult to determine directly who has control of what storage assets or how those assets are being used.

Industry-wide surveys have suggested that the amount of storage in use tends to be over reported because multiple parties can accurately claim differing degrees of control of the same capacity.

The commercialization of natural gas storage tends to promote the development of efficient gas markets that, in turn, promotes the further commercialization of storage. As marketing companies and other commercial users of storage gain the use of storage assets, they increase their trading activity around those assets.

To the extent that they have access to gas in storage in the peak periods, they will buy and sell gas whenever they can expect to earn a margin. As this activity increases, liquidity in the market increases and the opportunity for users to rely on the market for supply also increases.

This tends to make even more of the existing storage in the area available for commercialization. As indicated previously, however, this process does not inevitably lead to complete commercialization of all storage but rather to some equilibrium, which will vary, from area to area and from time to time.

Deregulation of retail gas markets and customer choice programs may also affect the rate at which natural gas storage use becomes commercialized.

These programs shift some or all of the responsibility for gas supply from the local utility to marketers, sometimes including an unregulated affiliate of the local utility.

As the responsibility for supply is shifted, so is the use and control of the upstream assets needed to deliver that supply, including pipeline transportation and storage. Since the marketers typically operate in a number of different market areas and without the constraints of regulatory control, they can use the assets in a more aggressive way than the individual local utility.

The author

H. C. Cates is vice-president of marketing for International Gas Consulting Inc., Houston. He has more than 20 years' energy industry experience with, among others, Phillips Petroleum Co., Texaco Inc., and Altra Energy Technol ogies Inc. Cates holds a BA from Yale University and an MBA from the University of Tulsa. He is a member of the Energy Association of Houston and SPE and formerly chaired the Natural Gas Supply Association's Federal Regulatory Affairs Committee.

Based on a report prepared for and distributed by the American Gas Association, Washington.