Market Movement

OPEC opts to 'sit tight'

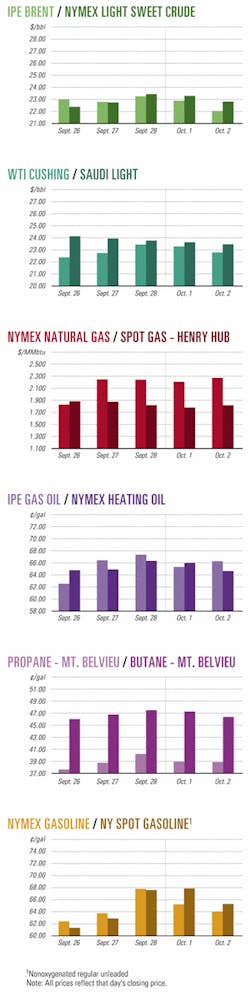

The uncertainty surrounding world oil markets is being underscored by concerns about the potential effects of an economic contraction-in the US and elsewhere in the world-as well as tumbling oil prices.

Mike Rothman, senior energy market specialist for Merrill Lynch, said that although "[oil] prices have fallen to levels that would normally elicit corrective OPEC action, the [recent] ministerial meetingellipseconcluded with an agreement to 'sit tight' for the time being and monitor developments in the Mideast following the Sept. 11 attacks on the World Trade Center and Pentagon. With OECD inventories standing at well below normal levels and global demand requirements about to rise seasonally, another production cut (which would have been the fourth of the year) presented risks of over-tightening the oil balanceellipseand propelling crude prices sharply higher."

And if worldwide demand for oil is weaker than forecast, the analyst said he would expect OPEC to remove additional barrels from the market to guard against sustained oil prices below $20/bbl.

Effects on oil demand, supply

There is no argument that oil demand growth-already anemic-has taken another severe blow due to the attacks last month on the US. But it is not a death knell.

The loss in expected aviation demand is indisputable, owing not only to fear of flying but also to sharply reduced flights because of increased security. But some semblance of normalcy is already returning to that sector. And that expected loss in jet fuel demand will be offset, at least in part, by a contraseasonal rise in gasoline demand as holiday travelers take to the roads instead of the air.

Meantime, another offsetting factor is an increased pull on heating oil demand to build inventories-partly out of security concerns and partly because of forecasts of normal (cold) temperatures in the US Northeast and Upper Midwest during the upcoming heating season. Still, while the net effect on demand looks negative, this view overlooks two things: the fast-approaching winter heating season, which will inevitably bring about a seasonal rise in demand for oil; and the continuing possibility of a major oil supply disruption.

Price outlook revisions

The events of Sept. 11 in the US have prompted most analysts to revise their previous outlooks on oil and gas prices, albeit not dramatically.

Lehman Bros. said, "Despite the increasing risk of a more severe global economic downturn, we do not believe that oil prices will crash below $20/bbl (WTI spot basis) over the next 12 months." Lehman Bros. went on to say that it expects worldwide consumption could "edge out" a slight increase of about 400,000 b/d in 2002, or a rise of 0.5%. This compares with an average growth rate of 1.4%/year during 1980-2000.

Lehman Bros. added that, because non-OPEC supply doesn't appear to pose any immediate threat to OPEC's market share and because OPEC member states' objectives seem in synch, it estimates oil prices over the next few months to trade in a "relatively tight range" of $20-24/bbl.

Early storage fill deflates gas prices

Meanwhile, US natural gas storage facilities have nearly been filled due to growth in domestic gas production paired with an increase in Canadian exports. According to Energy Security Analysis Inc.'s 6-month view of the North American natural gas market, the storage fill comes a month ahead of the traditional start of heating season drawdowns.

"High storage levels, increased supplies, lower demand, and warmer weather forecasts all continue to exert strong downward pressure on natural gas prices," ESAI said.

"As we consider the implications of several hypothetical finishes to the storage injection season, it is apparent that almost any plausible injection rate over the next 5 weeks will leave storage in all areas near or above maximum levels," said Mary Menino, senior analyst at ESAI.

"Right now, with natural gas storage at almost 87% full and about 5 weeks left in the prewinter injection period, we expect even larger contango to materialize between the November and December NYMEX contracts," Menino said.

"The value of storage capacity will continue to increase rapidly as producers reach the point at which production has to be throttled back and marketers reach the point at which purchases have to be renegotiated," she said.

ESAI sees tension building between the spot price, the NYMEX November prompt contract, and the latter's contango with the December contract as the storage injection season comes to a close.

"We expect the largest moves to be in the relation between the spot price and the November NYMEX price-that spread should widen," Menino noted.

null

null

null

Industry Trends

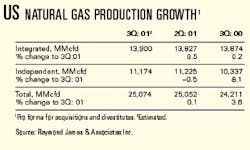

PRELIMINARY DATA from a sampling of US gas producers suggest natural gas production was "flat sequentially in the third quarter," according to Raymond James & Associates.

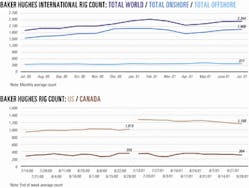

Based on a survey of 10 integrated and 23 large independent E&P firms-production from which represents nearly 50% of the US total-RJA found that gas production may have peaked with the rig count in the third quarter and could begin to show meaningful declines in the fourth.

"Furthermore," RJA noted, "with gas prices testing the $2/MMbtu level, the potential for E&P companies to begin shutting in some higher-cost, short-lived production is very real and could further reduce US production. This surprisingly quick supply response strongly supports our long-term bullish outlook for equilibrium Henry Hub natural gas prices of $3-5/MMbtu."

RJA added that, based on this preliminary data, US gas production would seem to be responding to the decline in drilling activity much quicker than expected.

"Most analysts agree that a softening rig count will ultimately lead to production declines. Historically, a supply response has lagged the rig count by 3-6 months. As a result, analysts expected to see production peak sometime in the fourth quarter of 2001 or early 2002," the analyst noted.

"However, our...survey suggests production reached a plateau in the third quarter even though the gas rig count did not peak until July [at 1,058 rigs]. Now, with the gas rig count falling, we may see a meaningful decline in US natural gas production as early as the fourth quarter," it said.

SMART WELL COMPLETIONS are slowly finding acceptance in the industry, the SPE annual technical conference was told in New Orleans last week.

Clark E. Robison, production manager for Weatherford Completion Systems, indicated that, depending on the definition of a smart completion, only about 60 are in place. The first was run in 1996.

He said the unknown reliability of the systems is often mentioned as a main barrier to more widespread use. Nevertheless, the systems have the potential for increasing production by optimizing the production profile, improving ultimate recovery, providing operational flexibility, eliminating intervention costs (that are considerable in deep water), increasing reservoir knowledge, and optimizing flow assurance problems caused by sand, paraffin, hydrates, and asphaltenes.

Other reasons for slow acceptance of the systems include relatively low intervention costs on land wells, potential needs of the systems that might never occur, and improved technology in 5 years' time.

Government Developments

US CONGRESS AND THE WHITE HOUSE are revisiting the role of the 544.7 million bbl Strategic Petroleum Reserve in light of the Sept. 11 attacks on the US.

US Rep. Joe Barton (R-Tex.) was to introduce a bill late last week to fill the SPR to its 700 million bbl capacity and to seek ways to expand it to 1 billion bbl.

Barton, chairman of the House Energy and Air Quality Subcommittee, held a Houston press conference Oct. 1 after touring the Big Hill SPR site near Beaumont, Tex.-one of four sites holding the nation's 544.7 million bbl reserve of oil (OGJ Online, Sept. 27, 2001).

Barton said that the federal royalty in-kind program could be used to fill the reserve to capacity, but if purchases on the open market are required, he would prefer that the US buy stripper oil in order to keep those wells from being shut in.

In pilot programs, MMS has been taking delivery of some federal royalty oil rather than taking the cash value of the production.

Barton said, "If we can get support of the [rest of] Congressellipsewe're going to put the additional 150 million [bbl] very quickly into the reserveellipseand we're going to try to make it possible to construct some additional capacity so we get it up to the full 1 billion bbl."

Getting the SPR to its full capacity could take as long as 5 years because of the need to construct capacity, Barton said. The US would expand existing sites and purchase one new site.

POSSIBLE US MILITARY ACTIONS in Afghanistan following the attacks last month on the US have depressed E&D activities in neighboring Pakistan.

Jamal Hassan, secretary of the Pakistan Petroleum Exploration & Production Companies Association, said parent companies of entities working in Pakistan have reduced foreign technical staff for safety reasons, affecting seismic surveys and drilling activity.

Hassan said BP, Lasmo, and Premier Oil kept most of their expatriate staff in the country, but other companies had pulled out most of their expats.

Production from existing fields continues uninterrupted, said Hassan.

BP is continuing normal production of 205 MMcfd of gas and 30,000 b/d of oil from its fields on the Badin blocks and on the Mehran Block in Sindh Province. It also is continuing a seismic survey without interruption.

Quick Takes

GAS PIPELINES are making progress in key North American markets.

El Paso Corp. (EPC) plans to build a $1.6 billion subsea gas pipeline-the Blue Atlantic Transmission System-from fields near Sable Island off Nova Scotia to markets in Canada and the northeastern US. The 1 bcfd pipeline would consist of 750 miles of 36-in. pipe.

E. Jay Holm, CEO of El Paso Eastern Pipeline Group, said the subsea configuration would offer several advantages over a land-based alternative, including "minimal environmental impact, significant reduction in community disturbances, and anticipated transportation rates substantially less than $1/deka- therm for firm deliveries to the New York and New Jersey markets, as well as reduced rates for deliveries to the province of Nova Scotia.

"Demand for natural gas in this region is expected to increase an additional 685 MMcfd by 2005, growing to an incremental 2 bcfd by the end of the decade," EPC said. EPC will open an office in Halifax and has retained a local firm for environmental studies. It is evaluating bids for project management services and plans to hold an open season before yearend to determine capacity demands.

EPC, which plans to file for construction permits by the end of 2002, said the line could be in service by fourth quarter 2005.

Meanwhile, Williston Basin Interstate Pipeline, Bismark, ND, announced plans Sept. 27 for a new gas pipeline-245 miles of 16-in. pipeline across Wyoming, Montana, and North Dakota.

The 80-120 MMcfd pipeline would extend from a point 14 miles north of Gillette, Wyo., to near Killdeer, ND, moving coalbed methane and conventional gas in central Wyoming and south-central Montana to interconnecting lines supplying midwestern markets. Additional capacity could be added incrementally, increasing volumes to as much as 200 MMcfd. Initially, the line will have three large compressor stations.

Route selection is nearly complete, surveying has begun, and Williston Basin Interstate will submit an application to FERC in October. Construction could begin as early as third quarter 2002, with service beginning late that year.

Updating other pipeline projects, CNOOC Petroleum & Chemical, with 30% partner Hainan Fuel & Chemical, says construction will begin in first half 2002 on its planned 256 km pipeline from Dongfang gas field in the South China Sea to Haikou City in Hainan province via Yangpu. The project was announced last year (OGJ, June 5, 2000, p. 63). Work is scheduled for completion in August 2003. The 490 million yuan ($59.2 million) pipeline will have 800 million cu m/year of natural gas capacity, expandable to 1.6 billion cu m/year. As much as 700 million cu m/year of gas is earmarked for power generation at Yangpu Power Plant and 100 million cu m/year for household consumption in Haikou City. CNOOC operates Dongfang field, which will start production in September 2003 with initial flow of 1.6 billion cu m/year, expandable to 2.4 billion cu m/year.

Thailand has approved a $1.55 billion, 875 km, offshore and onshore gas pipeline that Petroleum Authority of Thailand (PTT) will build to supply electric power plants in that country. The line would be the kingdom's third trunk line, moving up to 1 bfcd from PTT Exploration & Production's Arthit field and the Thailand-Malaysia Joint Development Area (JDA). Completion is expected in 2006. The system would consist of a 36-in. line 250 km from JDA fields northwest to Erawan field, operated by Unocal Thailand, and a 42-in. line 475 km north to an offshore location. From that point, a 36-in. line would extend 120 km to the Ratchaburi power plant 120 km southeast of Bangkok, and a 36-in., 70 km line would extend to the Bang Pakong power plant in Chachoengsao. In another development, PTT has retained an Osaka Gas Engineering consortium to draft a feasibility study for future gas transmission systems in the Gulf of Thailand.

JACK UP DRILLING RIGS with floating hulls operating in the UK North Sea should be classed as ships for income tax purposes, the UK Court of Appeal has ruled.

The decision, unlikely to have any financial implications for operators or for rig rates, will affect the way crewmembers are paid. It entitles them to seafarers' tax relief, which is likely to make working on jack ups financially more attractive for registered British taxpayers.

In other drilling news, Texaco is drilling, with its Shasta field No. 8 well, what it says is the first dual-gradient well using a subsea-mudlift drilling system developed by a joint industry team led by Conoco. The field is in 910 ft of water on Green Canyon Block 136 in the Gulf of Mexico. The system is the culmination of a 5-year, $50 million project that sought to eliminate the numerous casing strings required to drill many offshore wells with single mud-gradient drilling systems (OGJ, Aug. 16, 1999, p. 32). Another goal was to use a "green" system in which all fluids, gas, and cuttings from the well return to the surface. In the system, seawater is pumped from the rig down to seabed diaphragm pumps, which displace mud back to the rig and discharge seawater into the sea.

Pemex has awarded integrated multiwell contracts to a subsidiary of Precision Drilling for underbalanced drilling and separation services in southern Mexico. Northland Energy Corp. will provide controlled pressure drilling services and both vertical and horizontal separation systems to measure and separate well returns during drilling operations. Well characteristics in the region include depressurized oil reservoirs requiring foam and nitrogen gas, high-permeability gas wells, and overpressured and normally pressured wells prone to fluid losses. Drilling activity began in August on the 1 year project.

NORWAY has received nominations from 16 companies seeking blocks to be included in the 17th licensing round on the Norwegian Continental Shelf.

The Ministry of Petroleum and Energy aims to announce the blocks in December, and awards could follow before summer 2002.

The companies nominated 93 blocks in the Norwegian Sea. The ministry said that it will base offerings in the licensing round on these nominations.

Nominating tracts were Norkse Agip, Amerada Hess Norge, BP, Norske Chevron, Norske Conoco, DONG E&P, Enterprise Oil Norwegian, ExxonMobil, Fortum, Norsk Hydro, Paladin Resources Norge, Phillips Petroleum Norske, RWE-DEA Norge, Norske Shell, Statoil, and TotalFinaElf Exploration Norge.

Elsewhere on the exploration front, CNOOC Ltd. and Shell Exploration China have signed a joint agreement to explore options for developing oil and natural gas reserves on the Bonan Block in Bohai Bay off China. The companies will focus on commercializing gas reserves from the block, which contains several oil and gas fields close to several metropolitan areas of Shangdong Province. Its two key structures-Bozhong 26-2 and Bozhong 28-1-and three other fields are estimated to hold reserves of more than 160 million bbl of liquids and 300 bcf of associated gas. Hong Kong-incorporated CNOOC Ltd. is 70.6% owned by China National Offshore Oil Corp.

The US Minerals Management Service has requested information for three Beaufort Sea oil and gas lease sales proposed under the 2002-07 leasing program. It said it would prepare a single EIS for the three sales. The Beaufort Sea planning area is 3-60 miles off Alaska's northern coast in 25-200 ft of water. The call covers Beaufort Sea sales 186, 195, and 202, tentatively scheduled for 2003, 2005, and 2007, respectively. Comments must be received by Nov. 5 at MMS's Anchorage office. MMS also issued a multisale call in late September for information and a notice of intent to prepare an EIS for 10 lease sales in the western and central Gulf of Mexico (OGJ Online, Sept. 14, 2001).

DNO, Oslo, has agreed to farm into and assume operatorship of First Calgary Petroleums' Block 43 in Yemen. Previously, Canadian Nexen Yemen had agreed to farm into the block, but certain closing conditions were not satisfied, said FCP (OGJ Online, June 20, 2001). DNO will fund second exploration phase work through either declaration of a commercial discovery or the expenditure of $7.5 million. The commitment includes the drilling of two wells and acquisition of 500 km of seismic data. DNO will also pay lease bonuses of $600,000/year until earning obligations are met. FCP will retain 11.7% of the foreign contractors' interest in the block.

PETROBRAS is resuming development of Roncador field, off Rio de Janeiro state, with installation of an advanced production system in the same area where its P-36 semisubmersible platform sank earlier this year (OGJ Apr. 2, 2001, p. 32).

Production from the new Roncador production system-Module 1A Phase 1, with an installed capacity of 90,000 b/d of oil-is expected to start in August 2002.

Five of the six wells that were operated from the P-36 will be connected through the Brazil FPSO. The wells, wellheads, and subsea trees remained intact after the accident, enabling the field to be reactivated without large investments in subsea systems, officials said.

As the platform slowly sank, all flowlines were cut, so the lower segments connected with the wellheads could be re-claimed, although the risers and upper portions of the lines could not. Drilling rigs were positioned over the wellheads, and Petrobras reentered the wells at the christmas trees, injected hydrogen, and recovered oil from the cut flowlines before shutting in the wells again. Workers will connect those lines to a new riser system on a replacement platform to reestablish production.

Petrobras has started work on the Roncador Module 1A Phase 2 system. A team is working on development of new riser technology for installing the module in 1,700 m of water, compared with 1,360 m for the P-36.

In 2005, Petrobras expects Module 1A to be producing 180,000 b/d of oil, about 20% more than would have been produced by the P-36. x

Elsewhere on the production front, a consortium of Statoil, Shell, Halliburton, and Petrotech are researching a new downhole well-testing method that can eliminate the need for flaring. Statoil is heading the tests. The system uses a sampling, integrated logging device that allows well testing without producing hydrocarbons at the surface. It will be ready for use in first half 2003. The Research Council of Norway is providing financing for system development.

REFURBISHMENT of plant facilities is under way at two refineries.

Shell Chemical, Houston, plans to purchase and reconfigure a 77,000 b/d refinery in Yabucoa, PR, to produce feedstock that will be moved by tanker to its chemical plants in Deer Park, Tex., and Norco, La.

It also will produce gasoline, diesel, jet fuel, and residual fuels primarily for the Puerto Rican market, officials said.

Shell signed a letter of intent to buy the refinery from Sunoco.

Subject to various terms and conditions, the two companies are working to complete the transaction by Jan. 1.

Meanwhile, Preem Raffinaderi has awarded Foster Wheeler Energy a $34 million contract for engineering and procurement of a isomerization unit revamp at its Gothenburg, Sweden, refinery. The revamp of the existing Penex unit, the addition of a new Molex unit, and associated interconnecting services will debottleneck the existing isomerization process and improve the octane level of gasoline to meet requirements of future European Union gasoline regulations.

Work has begun and is due to be completed in summer 2002. The refinery has a capacity of 106,000 b/d.