OGJ Newsletter

Market Movement

OPEC tries to navigate oil prices to $25/bbl; uncertainty prevails

OPEC continues to try to navigate oil prices between the Scylla of Iraqi supply surprises and the Charybdis of weakening oil demand.

The group's latest effort to micromanage oil markets has yielded a 1.5 million b/d cut, as expected. Not surprisingly, oil prices dipped a bit in response, just as they did when the Iraqis halted oil exports Dec. 1 over yet another dispute with the UN. Markets had already built in a discount in oil prices because OPEC had been telegraphing the move for some weeks now. The fact that oil prices fell instead of rising with news of a cut simply reflected the anticipation of some traders that the cut might track what price hawks in OPEC had been seeking: 2-3 million b/d.

The quota cut, the first from OPEC in 2 years, is slated to take effect Feb. 1. As with other quota changes in recent years, it excludes Iraq, still under an international sanctions regime with export sales governed by the UN.

However, the actual cut is likely to be less than the 1.5 million b/d official level as of Feb. 1-in large part because Saudi Arabia reportedly has already taken steps to trim its output by almost 500,000 b/d-about 1.2-1.3 million b/d, by some top analysts' conjectures.

Under the latest accord, reached last week at OPEC's ministerial meeting in Vienna, OPEC's production would drop to 25.2 million b/d. The cuts and new production levels break out individually, in b/d, as: Saudi Arabia, 486,000, to 8.189 million; Iran, 219,000, to 3.698 million; Venezuela, 174,000, to 2.902 million; UAE, 132,000, to 2.201 million; Nigeria, 123,000, to 2.075 million; Kuwait, 120,000, to 2.021 million; Libya, 81,000, to 1.35 million; Indonesia, 78,000, to 1.307 million; Algeria, 48,000, to 805,000; and Qatar, 39,000, to 653,000.

This move follows a year in which OPEC production quotas were ratcheted up, in several steps, by 3.7 million b/d to 26.7 million b/d.

Reactions

The immediate response from consuming nations was one of disappointment and concern.

The outgoing Clinton administration-after departing US Energy Sec. Bill Richardson undertook a futile whistlestop campaign to jawbone OPEC into a minimal cut if no cut could be avoided-called the reduction "a mistake."

Still, Richardson claimed credit for averting a much deeper cut than could have been possible, which he said would have undermined stability in global markets and hurt world economic growth.

IEA expressed concern about the cut as well, claiming such "unilateral efforts to set oil market prices simply aggravates volatility."

A mistake?

That theme was picked up by one key analyst, London-based think tank Centre for Global Energy Studies.

CGES contends that OPEC had lulled itself into a false sense of well-being after a year in which oil prices average over $28/bbl and oil demand showed no sign of weakening in response.

"OPEC appears to believe that the world economy can live happily with $30/bbl," CGES said last week. "It is wrong."

The analyst contends that OPEC seems to regard the $10/bbl fall in oil prices that began late last fall as the beginning of a collapse that must be reversed, rather than a correction from an unsustainably high level. However, CGES maintains that high oil prices in 2000 have already undermined economic growth prospects for 2001. It cites stock market analysts' forecasts of 1.1% in real GDP growth in the US in 2001, with a recession in the first half of the year, adding that "the outlook could be even worse, if oil prices do not fallellipse"

CGES estimates that global oil demand will climb by 1.3 million b/d "at most" this year, as economic growth stalls.

"If OPEC's pursuit of high oil prices undermines economic recovery in the second half of the year, demand growth could be even lower," the analyst said.

By cutting production, OPEC will prevent the rebuilding of oil inventories that the world needs, CGES contends: "Even with relatively low demand growth, the world will enter the winter of 2001-02 with stock cover just 1 day higher than at the start of this winter."

CGES reckons that, although oil prices may ease slightly over the summer, they will strengthen again near yearend as stock cover falls again.

"To avoid a serious slowdown in economic growth, the world needs oil prices below $20/bbl, but OPEC appears determined to keep them at $25/bbl," CGES said. "Eventually something will have to give."

More cuts later?

But another top OPEC-watching analyst sees a very real possibility of still further cuts on the horizon.

Middle East Economic Survey reports that OPEC officials have had an eye on the situation with Iraqi oil exports all along in the weeks leading up to the reduction announcement.

MEES cited comments by OPEC officials "that, if there were to be no serious production cut beginning in February, there would be a counter-seasonal stock-build in the first quarter, followed by a larger stock-build in the second quarter, leading to a serious decline in prices."

And Iraq remains a wild card. Baghdad had halted exports Dec. 1 in a dispute with the UN over a surcharge it sought to impose on tanker liftings that was not part of the UN-brokered oil-for-aid sales program. That slashed Iraqi production to 1.2 million b/d in December from 2.7 million b/d in November.

Given the status of Iraqi supplies and the production cut by the rest of OPEC, MEES estimates the potential first-quarter stock-draw at 900,000 b/d: "However, if Iraq returns to the market any time soon with the normal range of production of over 2.5 million b/d, this would more than offset the inventory draw-down that OPEC was hoping to create, necessitating a further cut in production in order to defend prices.

"Until Iraq returns to the market-and when that might be is anyone's guess-the OPEC 10 will have little choice but to proceed independently of Baghdad, because they are as much in the dark as anyone else."

Given the predilection that Saddam Hussein has for tweaking the US and UN, Iraq is likely to remain a wild card for the market in the months to come. It would be surprising if Saddam did not try to test the resolve of the incoming administration of Pres. George W. Bush. That, in turn, could see any production cuts by the OPEC 10 rolled back swiftly-and even the threat of a greater Iraqi supply disruption could add a premium to oil prices, propping them up by another dollar or two regardless of physical supply-demand fundamentals.F

Scoreboard

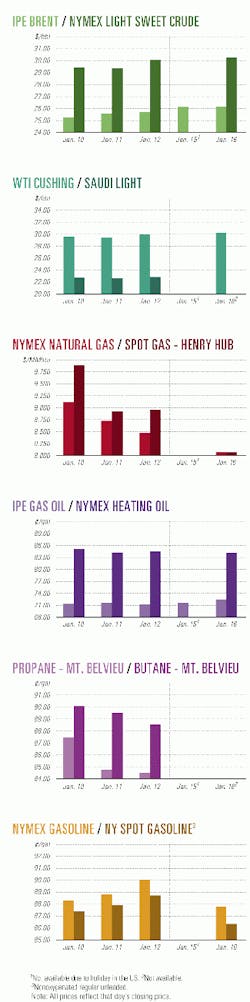

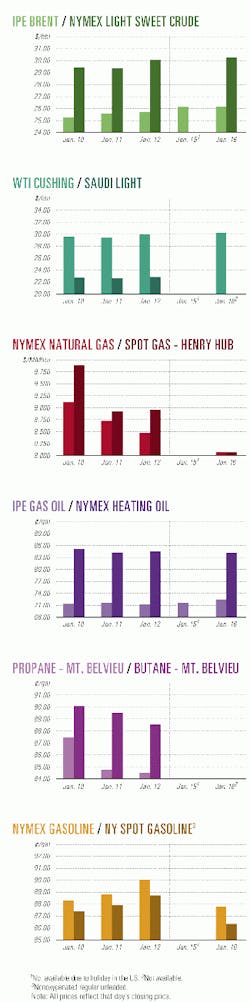

Due to a holiday in the US, data for this week's Industry Scoreboard are not available.

null

null

Industry Trends

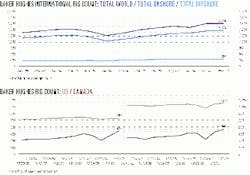

NAPHTHA OUTPUT IN THE ASIA PACIFIC REGIONS EXPECTED TO RISE IN 2001.

According to Energy Se curity Analysis Inc., naphtha refinery throughputs in Asia Pacific will increase by more than 2% in first half 2001 to average 1.8 million b/d (see chart). ESAI expects Asian refinery capacity to grow by 450,000 b/d in 2001, which will add to an estimated 4.5% growth in refinery throughput this year and increase straight-run fuels production.

"Demand for naphtha from the petrochemical sector has declined rapidly, and ESAI does not expect it to recover substantially, given the bearish prospects for ethylene in the Asia-Pacific region. Margin-driven cutbacks have begun in Thailand, South Korea, and Japan, while maintenance cutbacks have crimped demand in Taiwan," the analyst said.

The analyst predicts a slight growth in naphtha demand overall-primarily led by China-while most major consumers will have flat-to-declining demand requirements during the first half of 2001.

Global Marine says that 2001 WILL BE a boom year for offshore drilling.

The new year is shaping up as a boom year for offshore drilling, as energy companies pour recent record cash flow back into exploration and development, the head of Global Marine said.

Industry analysts are predicting a 20% increase in upstream spending this year, on top of a 19% hike in 2000. However, Robert E. Rose, president and CEO of Houston-based drilling contractor Global Marine, said: "A real potential exists for spending greater than that," with oil and gas prices sustained at higher levels than previously anticipated.

At Global Marine's press conference on the 2001 outlook for the offshore drilling industry, Rose scoffed at producers' claims that higher rig and service costs could dampen their spending plans for 2001.

"Higher rig rates might hurt the marginal prospects but not the good prospects," he said.

"There's no question that rigs and capital migrate to the prospects that are the best. Companies with the best prospects put the most money into them and attract the rigs," said Rose.

In addition, Rose said, "megamajor" oil and gas companies are expected to increase upstream spending this year. The biggest integrated international oil companies virtually "sat out" 2000 with relatively little drilling activity, while most were digesting previous mergers-"all but Royal Dutch/Shell, which was undergoing a reorganization," said Rose.

Government Developments

FERC CHAIRMAN JAMES HOECKER HAS LEFT THE COMMISSION.

Hoecker last week announced his departure effective Jan. 18.

Hoecker was named a commissioner in 1993 and reappointed to a 5-year term in 1995. Former Pres. Bill Clinton designated him as chairman of the five-member commission in 1997. Clinton nominated him to another 5-year term last November, and because that occurred while the Senate was in recess, Hoecker could have continued on the commission until next November.

Because there is an existing vacancy, Hoecker's departure will enable Pres.-Elect George W. Bush to fill two seats on the regulatory body, which governs interstate electricity, hydroelectric, and natural gas firms.

Bush likely would have designated a new chairman if Hoecker had remained. Hoecker gave no reason for his resignation and did not disclose his future plans.

Hoecker noted, "There are many dramatic new challenges for the FERC to address. It now becomes the task of others to plot the commission's future course."

Former Pres. Clinton will not designate the Arctic National Wildlife Refuge Coastal Plain a national monument, a spokesman said this month.

Alaska's congressmen had been concerned that Clinton might use the 1906 Antiquities Act to prevent development of the 1.5 million-acre coastal plain. They said the 1980 Alaska National Interest Lands Conservation Act precluded development unless Congress authorized it and thus blocked the president from creating more national monuments in the state unless approved by Congress (OGJ, July 17, 2000, p. 28).

Press aide Jake Siewert said that law "confers a higher degree of status, a wilderness status, to that land and specifically prevents oil drilling there. So we're not convinced that giving it a monument status would give it any additional legal protection."

He observed, "Congress has steadfastly opposed efforts to open ANWR throughout Democratic and Republican control in the Senate. So we think it's very unlikely that Congress will allow ANWR to be opened for drilling."

The National Ocean Industries Association is urging MMS to create a "viable" long-term leasing policy that includes considering acreage previously off-limits.

MMS late last month asked industry for input on a new 5-year plan for the federal offshore oil and natural gas leasing program.

The plan will determine where and when companies can lease parcels of offshore acreage on which to explore and produce oil and natural gas during 2002-07.

NOIA said MMS "must carefully examine" the option of including areas in the 5-year plan that have been subject to moratoriums in the past-areas likely to contain hydrocarbons that can be found and developed in a manner "consistent with our nation's highest environmental standards."

Quick Takes

Occidental Petroleum has signed an agreement with Yemen to explore Block 44 in Hadramaut province.

The block covers 6,335 sq km just north of Oxy's holdings in the Masila (Block 14) and East Shabwa (Block 10) operations, which produce more than 250,000 b/d of oil.

Oxy said it expects the geology of Block 44, in the Sanyun-Masila basin, to be similar to Masila's.

The exploration phase is expected to take 3 years, with drilling operations to begin in early 2003. The work commitment is divided into two phases.

The first calls for the acquisition of 300 km of 2D seismic data and for drilling one exploratory well. During the second phase, Oxy and partners will acquire another 200 km of 2D seismic and 150 sq km of 3D seismic and will drill an exploratory well.

Oxy, which operates the block, has a 75% working interest, and Ansan Wikfs holds 25%. The Yemen Co., Yemen's national oil company, has a 7% carried interest if commercial quantities of oil are discovered on the block.

Elsewhere on the exploration scene, more than 20 international oil companies are interested in six exploration blocks in Algeria, according to the country's Ministry of Energy and Mines. Last November, Algeria began a tendering process for four blocks in the Berkine basin in the southeast of the country, one in the In Salah region in the deep south, and a further block identified in the northeast. Of the companies that have met government requirement for the blocks, 11-including ExxonMobil, Marathon Oil, and Royal Dutch/Shell-would be newcomers to exploration and production in Algeria. Bidders already active in Algeria's oil and gas sector, noted the ministry, include Anadarko Petroleum, Amerada Hess, Burlington Resources, BP, BHP Petroleum, TotalFinaElf, Repsol-YPF, and Petronas.

Southwestern Energy and Energen Resources formed an exploration alliance in the New Mexico Permian basin. Under the deal, the companies jointly will explore Energen's 14,200 net acres in Lea and Eddy counties. The companies plan to drill two exploratory wells this year, with Southwestern as operator. Southwestern will pay the cost of the initial drilling program and will retain a majority working interest. The deal covers an 18-month initial period that expires July 1, 2002, with an additional continuous development phase afterwards.

Petroleum Development Corp. said it has concluded two farmout deals that will allow it to explore for and develop reserves on 57,000 acres in and adjacent to Grand Valley field in Garfield County, Colo. PDC said that, with the acquisition, it now controls 60,500 acres in the gas-prone Piceance basin of western Colorado. It said the main target is the Mesaverde at 6,500-10,000 ft. It drilled and completed 6 wells in the area last year. It plans to drill 18 more in the next 6 months. One farmout was for 4,000 acres northeast of the 7,500-acre leasehold PDC acquired in late 1999. PDC can drill up to 30 wells on the acreage before June 20, 2003. The second farmout was 53,000 acres north and west of Grand Valley Field.

Osaka Gas plans to purchase additional LNG from the Australian North West Shelf venture.

Osaka Gas signed a letter of intent to purchase another 1 million tonnes/year of LNG from partners in the Australian North West Shelf venture, said project operator Woodside Energy.

The Osaka agreement provides for the supply of the LNG over 30 years, beginning in mid-2004. The deal could be finalized by the end of March.

Osaka Gas, of the Kansai region of Japan, currently is taking 800,000 tonnes/year of LNG under a 20-year agreement that began in 1989. The company also said the deals further underpin the North West Shelf venture's proposed $2.4 billion expansion of its LNG operations. The expansion project involves a fourth LNG processing train at the onshore gas plant on the Burrup Peninsula.

Plans for the expansion include the construction of a 4.2 million tonne/year processing facility and a 42-in. trunkline linking the plant and the venture's gas fields 130 km offshore (OGJ Online, Dec. 21, 2000). Final approval for the expansion project is expected in the first quarter.

In other gas processing action, Statoil this month opened its Karst processing plant and Åsgard gas transport system. Karst will be Europe's largest natural gas treatment complex, said the company. According to Statoil, Norwegian gas deliveries to Europe will plateau in 2005, with exports of 70 billion cu m/year, of which 15% will come from Åsgard field in the Norwegian Sea. Gas from Åsgard is transported via a 707-km trunkline to Kårstø.

Duke is making plans to expand its Louisiana gas storage facility.

Market Hub Partners LP (MHP), a division of Duke Energy Gas Transmission, said it will expand its Egan, La., gas storage facility to 16 bcf from 12 bcf. MHP has filed with FERC for permits to begin the $9 million expansion. MHP expects to reach 16 bcf of working storage capacity at the salt cavern by 2005.

"A return to normal winter weather patterns and increased commodity volatility underscore the need for more storage capacity and deliverability," said Robert Evans, president of Duke Energy Gas Transmission. Duke said the expansion would enable companies to reduce costs from market fluctuations while increasing deliverability security.

In other storage news, China's Zhenhai Refining & Chemical has begun building a tank farm to accommodate more crude imports at its Zhenhai refinery. The facilities consist of three 100,000 cu m tanks. They are scheduled for completion in the third quarter of 2001. The company plans to add a 1.5 million tonne/year hydrotreater and a 1 million tonne/year delayed coking unit before 2005 to treat crude imports from the Middle East (OGJ Online, Dec. 26, 2000).

RUSSIA'S LUKOIL SIGNED A PRODUCTION-SHARING AGREEMENT WITH AZERBAIJAN'S STATE-OWNED SOCAR FOR APPRAISAL, INFILL DRILLING, AND REHABILITATION WORK IN ZYKH AND GOVSANY FIELDS IN AZERBAIJAN.

The first of two phases on the block, located on the southern Apsheron Peninsula east of Baku, will cost more than $200 million, said Lukoil. This is a more detailed version of an agreement signed last year (OGJ, Aug. 7, 2000, p. 36).

Zykh field was brought on stream in 1936, Govsany field in 1948. There are 15 wells operating in the fields, producing 250 tonnes/day of oil.

Lukoil estimates remaining reserves at more than 25 million tonnes. A feasibility study by Azerbaijani Research Institute pegs remaining oil reserves at 20 million tonnes. In a first phase of the project, Lukoil and SOCAR plan to work over existing wells, upgrade oil field infrastructure, and improve environmental safety. After they drill two appraisal wells, they plan to further develop the fields.

In other development work, Egypt's Burullus Gas has awarded a $56 million contract for an Eastern Mediterranean gas field development project. Burullus Gas JV awarded the Egyptian Deepwater Development Consortium a $56 million contract for the engineering, manufacture, testing, and delivery of a deepwater subsea production system for the Scarab-Saffron development project in the eastern Mediterranean, EDDC participant Kv

Topping production news this week, TrueNorth Energy plans a second phase to its proposed Fort Hills oil sands project that will double expected peak production to 190,000 b/d of bitumen and nearly double the project's cost to $2 billion (Can.). Recently TrueNorth and partner UTS Energy acquired oil sands Lease 8 adjacent to the original leases, 5 and 52, which were acquired in 1998 (OGJ Online, Dec. 20, 2000). All the leases are 90 km north of Fort McMurray, Alta.

TrueNorth said it estimates total mineable reserves of the project at 2.4 billion bbl, providing for a 30-year project life. The partners will file a regulatory application in the second quarter for development of the Fort Hills project.

TrueNorth expects the Fort Hills project to produce 95,000 b/d of bitumen in 2005 and reach peak output by the fourth quarter of 2008. UTS Energy holds a 22% interest in Fort Hills. TrueNorth Energy, an affiliate of Koch Petroleum Canada, operates the project, with 78%.

In other production action, Comstock Resources began production from three wells in the South Pelto-South Timbalier area of the Gulf of Mexico. On South Pelto Block 5, the OCS-G 12027 No. 5 is producing 28.4 MMcfd of gas and 925 b/d of condensate, and OCS-G 12027 No. 6 is producing 21.5 MMcfd of gas and 892 b/d of condensate. The OCS-G 13925 No. 2 on South Timbalier Block 11 is producing 22.9 MMcfd of gas and 320 b/d of condensate.

Pertamina has selected UOP TECHNOLOGY FOR its Indonesian Naphtha complex.

Pertamina selected UOP LLC to supply technology for a 52,000 b/sd grassroots naphtha complex at its 125,000 b/d Balongan refinery in Indramayu, West Java.

The naphtha complex, which will be designed to process a full range of naphtha, consists of a 52,000 b/sd naphtha hydrotreating unit, a 29,000 b/sd platforming unit, and a 21,000 b/sd light naphtha isomerization unit. The complex is expected to start up in January 2003.

The project is part of the Indonesian government's Blue Sky Program to phase out lead from gasoline and produce environmentally friendly fuels. The addition of the naphtha complex will allow an increase of unleaded gasoline capacity at the Balongan refinery to 107,000 b/sd from 59,000 b/sd.

Elsewhere on the refining front, partners in the VietRoss refinery project have selected Honeywell Industrial Control-an affiliate of Honeywell International-to provide distributed control systems and ancillary systems for the first refinery in Viet Nam. The VietRoss project is a Vietnamese-Russian JV founded by Russian foreign trade association Zarubezhneft and state-run company PetroVietnam. The groups expect to begin building the refinery next year in Dung Quat, Quang Ngai Province, in central Viet Nam. Honeywell will also provide emergency shutdown systems and training, installation, and site support services. When operational, the refinery will be able to process 6.5 million tons/year of crude into gasoline, jet kerosine, diesel, fuel oil, propylene, and LPG. F Algeria's Energy and Mines Minister Chakib Khelil this month opened a bidding round to build a refinery in the Adrar region in the south of the country. The refinery would be supplied by several small oil and gas fields in the Sbaa basin that hold reserves totaling 600 million boe. The contract to build the facility may be awarded to one company or a consortium that will either operate alone or in partnership with Sonatrach or with the Algerian state-owned oil company's distribution and refining subsidiaries, Naftal and Naftec. The selection process will take place in two phases: the first covering technical proposals, and the second, economic. The minister set an Apr. 30 deadline for technical bids, with offers due by Aug. 31. Contracts would be awarded by Sept. 30.

INGAA HAS EMBRACED EPA'S REVISIONS TO A 22-STATE PLAN TO REDUCE UTILITY AND INDUSTRIAL NITROGEN OXIDE EMISSIONS.

The revisions appeared on EPA's web site earlier this month. They answer a review of the plan ordered by the US Court of Appeals for the District of Columbia Circuit last March. The court had said EPA's state implementation plans (SIPs) on NOx reduction had failed to give adequate notice of an 11th-hour requirement that natural gas pipeline compressor engines reduce NOx emissions by 90% in 2007, using selective catalytic reduction (SCR) technology. EPA had included the requirement in the rule, known as the "SIP call," intended to reduce interstate transport of ground-level ozone, but INGAA contended it could cost the pipeline industry $4 billion and therefore should be fully debated before taking effect.

INGAA said that, in the new "SIP call" proposal, EPA agrees with the pipeline industry that SCR technology does not achieve 90% emissions reductions in natural gas pipeline applications and that low-emission combustion technology is a proven, readily available technology to reduce NOx emissions.