Production Report: Understanding US SEC guidelines minimizes reserves reporting problems

Oil and gas executives need a clear understanding of the US Securities and Exchange Commission (SEC) reporting guidelines to help minimize problems that can cause costly filing delays, embarrassing restatements of reserves and income, and, in some cases, intense agency scrutiny and disciplinary action.

Likewise, the investing public needs to understand the guidelines to know the limitations of the reserves figures in quarterly and annual reports and filings.

The SEC is the gatekeeper of information disclosed to the investing public by reporting companies. The SEC staff's rulemaking on disclosing proved oil and gas reserves holds public issuers accountable for adhering to consistent, across-the-board reporting standards. The aim is to provide a sound basis for the investing public to make company-to-company comparisons.

SEC-case reserves, however, seldom, if ever, reflect an accurate view of an oil and gas company's value or provide an all-inclusive summary of the upside potential. In any case, corporate management and the investing public should understand SEC reserves reporting regulations.

Interpretive guidelines

Many experienced professionals believe enforcement of SEC regulations has never been more stringent. At the same time, staff petroleum engineers at the SEC have recently issued interpretive guidelines that expand and clarify the rather outdated reserves definitions issued by the agency in 1979.

The recent definitional directives were brought about by the staff's recognition of technology changes in the industry and observations that industry does not understand or uniformly apply the definitions. The SEC staff recognizes that growing reservoir-evaluation practices-such as the increased use of 3D seismic, numerical simulation, and probabilistic assessments-give rise to a new set of reporting issues that require periodic clarifications.

The SEC responded by expanding its staff in 1999 to include specialists qualified to evaluate the effects of technology on reserves assessments. Evaluation tools spawned by innovative technology often facilitate more complete analyses thus enhancing full disclosure and providing the investor with better information. Because full disclosure is in the interest of the SEC, the commission is striving to be current with new methods and technologies.

The staff also is interested in a standardized measure of both reserves and discounted future net cash flow and in ensuring all publicly traded companies are playing by the same rules.

The SEC believes that periodic clarifications of the expanded, increasingly specific definitions will bring uniformity. The staff's actions are prompted by its desire to minimize confusion about reporting requirements.

The SEC began issuing guidelines on proved reserves definitions in the Federal Securities Laws, the Energy Policy and Conservation Act of 1975 and Rule 4-10(a) of Regulation S-X. It also periodically issues staff and accounting bulletins and interpretive guidance.

SEC posts its latest interpretations on the internet address: www.sec.gov/divisions/corpfin/guidance/cfactfaq.htm#P279_57537.

Reasonable certainty

The SEC's underlying principal for classifying and quantifying proved reserves rests on the concept of "reasonable certainty." It maintains that proved reserves are more likely to be revised upward than downward over time.

The SEC staff investigates many facets when deciding whether reserves in filings are reasonably certain to be produced. The initial consideration given to any application is whether supporting technical documentation is adequate to quantify and classify reserves. If the application does not have a sound technical basis, the staff typically requests supplementary material or asks to discuss the filing's technical merits.

The staff has the right to review any reserves filings, including annual 10-K reports as well as initial public offerings (IPOs), and supplemental issuance of securities. Much of the effort, however, is directed in reviewing applications for issuing securities.

The reasonable certainty guideline applies to any variances in the requirement that existing economic and operating conditions, as of the date of the report, be used in the report. The staff accepts only known, determinable, projected changes to existing conditions. These changes include contracted product prices, operating costs, production methods, recovery techniques, transportation and marketing arrangements, ownership and entitlement terms, and regulatory requirements.

SEC definitions allow the designation of proved reserves if economic producibility is supported by either actual production or a conclusive formation test. The SEC has been looking more closely at the tests to ensure that rates are sustainable and economic in the context of the well's location. It will likely challenge a short-duration test in a remote location without available infrastructure as inconclusive, and the company may need to present additional technical data before the staff accepts the location as proved.

The SEC often makes exceptions to the requirement for a flow test if the reservoir in question appears to be productive based upon log and core analyses and is analogous to another reservoir in the same field.

The staff limits the area it is willing to accept as proved to one "legal location" offsetting a commercially productive well down to the lowest known hydrocarbon (LKH). For an area beyond one location away from a proved location, the staff is quick to refer to a section from the SEC definitions that states "proved reserves for other undrilled units can be claimed where it can be demonstrated with certainty that there is continuity of production."

The SEC's only exception to this rule is when a region of the reservoir lies between two commercial producing wells and communication is demonstrated between those wells.

The concept of "one legal location away" is common in the US where well spacing is mandated. Well spacing outside North America, however, is typically predicated on drainage radius considerations, not regulation.

Past guidance

The SEC staff recently clarified what it is willing to accept as the correct interpretation of Accounting Series Release No. 257 that deals with assigning reserves on the basis of log and core data.

Past guidance read, in part, "In certain instances, proved reserves may be assigned to reservoirs on the basis of a combination of electrical and other type logs and core analysesellipse" Industry has often operated under the assumption that, in some instances, logs alone were all that were necessary to set up proved reserves based on analogy to similar reservoirs in the same field. From SEC's viewpoint, both log and core data are required to demonstrate that a reservoir is analogous to another one that has produced during a conclusive formation test.

Because this rarely happens, in most cases, a conclusive formation test in a new reservoir has to be documented before reserves can be booked as proved. This is a particularly a hot topic in deepwater exploration and development in the Gulf of Mexico and other areas where physical flow tests typically are not conducted. Those operators typically gather sufficient data on rock quality, fluid properties, and pressures to obviate the need for a flow test.

Industry is more amenable to the staff's recent clarification on what to classify as proved undeveloped (PUD) reserves based on improved recovery techniques.

Historically, the general understanding was that an enhanced oil recovery (EOR) pilot or actual full-scale operation needed to be conducted in the reservoir for which a company booked proved reserves. If EOR is shown to be effective in the same formation in the immediate area, then the SEC may allow proved reserves to be booked in the new area, assuming the reservoir characteristics are equivalent or more favorable.

Filing problems

At a recent Society of Petroleum Evaluation Engineers (SPEE) forum, SEC staff cited examples in which reserves estimators did not successfully clear the hurdles necessary to classify volumes as proved. In worst-case scenarios, the SEC expressed uncertainty that the stated reserves actually exist, because it suspected that the estimator was too optimistic based on the supporting data.

Another common problem is that some economic assumptions do not represent current economic and operating conditions. For example, if a sales market and contractual obligation does not currently exist, then the definitions disallow proved reserves.

The SEC staff also takes issue with the perceived unwillingness or inability of companies to move forward with PUD projects. The SEC may questions that reserves are "reasonably certain" to be produced if year after year a company defers the same projects with no compelling explanation.

Additionally, the SEC may question the validity of the project's reserves if management has not made a substantial financial commitment, does not have an apparent source of funds, or lacks the permits or concessions necessary to legally pursue the project.

Probabilistic reserves assessments

The SEC staff has progressed in its understanding and willingness to adopt probabilistic reserves assessments for filing purposes. The SEC currently has chosen not to issue confidence criteria associated with proved reserves estimated statistically. Although the SEC does not prohibit the use of probabilistic assessments, it insists that the other limiting criteria of the definitions are applied, such as restricting proved reserves to the level of lowest known hydrocarbons (LKH).

The commission recognizes that the inconsistency in deterministic assessments, especially performance-based projections, sometimes represent the median estimate. Conversely, the 1997 SPE/WPC definitions specify that probabilistic proved reserves should have at least a 90% confidence of occurrence. In a hands-off approach, the SEC is challenging industry to resolve this inconsistency.

The SEC staff also recognizes that probabilistic aggregations can yield higher reserves for a reporting entity than simple addition so that a straightforward reconciliation of this for financial accounting purposes is necessary.

Forum-based case presentations

For some time, SPEE members have recognized the need for an industry platform to foster discussion with the SEC and to periodically address hot-button issues with the SEC engineers. To that end, SPEE sponsored a forum in October 2000 where industry presented several cases for discussion between the agency and those in the evaluation sector.

The following sections lay out a general outline of each case and the discussion outcomes.

Gulf of Mexico attic oil

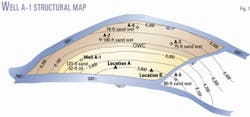

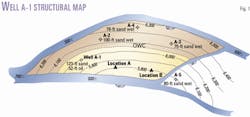

The Gulf of Mexico attic oil case centers on common questions regarding the booking of PUD reserves. It involves a Well A-1 (Fig. 1) that logged an oil-water contact (OWC) in the clean thick A sand (Fig. 2). Other well penetrations are low on structure and penetrate the aquifer.

High-quality seismic supports the structural interpretation and seismic amplitude limits conform to the structure and the mapped sand limits.

A complete set of openhole logs is available on the well but cores were not taken. The A sand has not produced on this block but is a major producer in nearby blocks. In offsetting fields, the A sand has been found to contain highly undersaturated oil and no gas caps.

The SEC staff was asked if proved reserves could be assigned to the A sand in this well with definitive pay indicated on the log but no test or cores. The response was no. Either a test or both a log and cores are necessary.

Another question was whether one can use a slightly deeper zone in the commercially productive Well A-1 as an analogy to prove this zone to be productive. Based on the presented data, the staff said it would allow the analogy, assuming the comparison of the log responses was favorable to the A sand.

Would the A Sand then be considered developed or undeveloped? The staff said that if most of the capital was already spent, then it would be developed. In this case, the well already was drilled and lacked only a relatively inexpensive recompletion. But the SEC has not provided any specific guidance regarding total expenditure percentages required to be considered developed.

Then the staff was asked if Location A and Location B could be categorized as proved even though Location B was not a direct offset to a productive well? It said that it considers only Location A as proved because Location B was not a direct offset to a productive well.

A final question was whether the reserves above the highest known hydrocarbon could be called proved. The staff said it would allow the up-dip reserves to be classified as proved if the engineering evidence for an undersaturated reservoir was compelling based upon the data from the offsetting fields.

FSU development

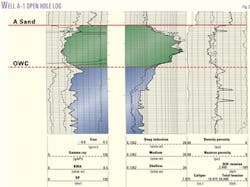

The Former Soviet Union (FSU) development case highlights the stringent guidelines on booking PUD locations and involves an onshore field discovered several years ago in the FSU. After drilling 47 delineation wells, the developers of the field left it dormant.

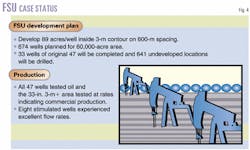

After license transferal in 1997, a company proposed a development plan for the field and began work on a small scale in 1999. The plan calls for developing the area within the 3-m contour of a net pay isopach map on 600-m spacing or 89 acres/well (Fig. 3).

The area inside the 3-m contour is 60,000 acres, permitting 674 wells. Of the original 47 wells, 33 are inside the 3-m contour and will be completed. This leaves 641 undeveloped locations for full development (Fig. 4).

Extensive geologic work indicates the sand is continuous over the entire interval. The oil-water contact has been located and is below the base of the sand and outside the 3-m contour limit. The depositional model and 2D seismic indicate the sand is continuous throughout the development area.

Of the 47 wells, all have tested oil and the 33 within the 3-m contour have all tested at commercial rates. Eight of the 33 wells have been stimulated and are producing at economic rates through an existing pipeline. Other analogous fields in the surrounding area have already been developed in a similar fashion to the subject field with favorable results.

The company is considering the possibility of selling publicly traded stock and would like to book all undrilled locations inside the 3-m contour as proved.

At the SPEE Forum, the SEC staff said it would challenge any location booked as proved beyond direct offsets to existing proved completions unless certainty of production beyond that limit could be demonstrated. They indicated if pressure data between wells showed continuity, then the applicant may be able to book reserves beyond one location away from existing proved wells.

The staff indicated that in some situations, a proved well could have as many as eight direct offsets, including diagonal offsets.

International oil company

In a developing nation, a company made a large onshore oil discovery from an existing infrastructure. This small, publicly traded independent oil company was installing a pipeline and fully developing the discovery. The company also was delivering 5,000 bo/d to a local refinery by truck, and after installation of the pipeline, it projected a production of 25,000 bo/d.

The operator obtained the necessary pipeline permits and construction was scheduled for completion in 6 months. The company had prepared its annual 10-K filing and faced several decisions as it prepared to disclose its proved reserves.

The first issue is what net price to use in the report, assuming oil traded at $20/bbl reference price on the date of the report. Delivery to market by truck cost $5/bbl yielding a net price of $15/bbl, and the transportation tariff for future pipeline deliveries will be reduced to $2/bbl, yielding an $18/bbl net price.

Can the lower net price be used in the report even though the condition did not exist as of the report date? The SEC staff said it would allow the forecast change in net price because it considers the adjustment both fixed and determinable.

Some consider the use of yearend oil prices (i.e. the reference price on the date the report was issued) to be less meaningful to investors than a consensus forecast or a historical average price because of significant volatility in the markets. The staff was aware of these concerns but maintained that the SEC was obligated to enforce the requirements of FASB that call for a standard measure that can be used for both historical and company-to-company comparisons. However, FASB requirements for yearend prices may not yield valuations with marketplace significance.

Given that the pipeline is not yet in place, can the operator project production up to the 25,000 bo/d even though it does not represent current operating conditions as of the report date? Within the last few years, some believed that the SEC insisted that facilities must be in place to book proved reserves to uninstalled projects. The agency had questioned several filings because of the lack of necessary facilities for production.

At the forum, the SEC staff said that the facilities do not have to exist before booking PUD reserves. Furthermore, the reserves must be economic, including all pertinent capital costs. If gas sales are involved, a valid gas contract must be in place.

Booking proved reserves under production sharing contracts (PSCs) was also discussed (Fig. 5). Generally, to book the reserves, the producer must have the right to extract the oil or gas and be exposed to some risk through participation in exploration or development activities. Additionally, the contractor must have the legal right to produce at the date of the estimate and the reserves must be recovered within the contractual terms.

The SEC staff has stated that the economic interest method should be used to determine the volume of PSC reserves to book. That is, the share of profit-hydrocarbon revenue is divided by the appropriate hydrocarbon price to calculate the volume entitlement.

The SEC and industry are scheduled to discuss a case study on PSC reserves-booking issues at an SPEE forum in late October 2001.

Other cases

Although 3D seismic data has greatly reduced prospect risk in many exploration plays, the SEC recognizes that seismic amplitude anomalies are insufficient to differentiate productive from non-productive sands.

A case was presented showing that an operator had identified five amplitude anomalies and two were related to stratigraphic features that had produced commercially. Although the operator took every possible measure to reduce the risk of misinterpreting the seismic and the prospect's probability of success was reasonably certain, one could argue, the SEC staff said it would not allow the three amplitude anomalies to be called proved.

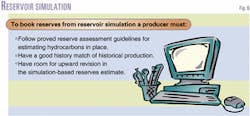

Reservoir simulation is another technology that may assist reserves assessments if properly conducted (Fig. 6). The SEC staff will allow reserves derived from simulation to be reported if two conditions are met. First, the proved reserves assessment guidelines must be followed in estimating hydrocarbons in place. Secondly, the SEC requires a good production history match. Additionally, room must exist for upward revision in the simulation-based reserves estimate.

After considering one simulation case at the forum, the staff indicated a willingness to permit volumes outside the lowest known hydrocarbon limit (LKH) to be included as part of the proved reservoir volume. The SEC has indicated a willingness to permit volumes below LKH to be considered proved if the applicant presents compelling data-for example, analogous 3D seismic indicators observed in nearby, geologically similar producing reservoirs with supporting log and pressure data.

In the subject case, the operator used pressure data to calculate gradient curves in the reservoir and aquifer. The operator then inferred by extrapolation that the gas-water contact was significantly below the LKH.

Consequences of noncompliance

The SEC engineering staff looks closely at assets that are material to a company's filing to ensure that guidelines for proved reserves have been followed. Frequently, a questionable reserves assessment delays the acceptance of the filing and often culminates in the SEC asking the company to restate the reserves estimate to comply with guidelines. Often the company has already announced performance results, so that a retraction may lead to investor suspicion of management practices.

The following excerpt from the SEC quite succinctly specifies the chain of civil liability involved in issuing reserves estimates: "The SEC staff reminds professionals engaged in the practice of reserve estimating and evaluation that the Securities Act of 1933 subjects to potential civil liability every expert who, with his or her consent, has been named as having prepared or certified any part of the registration statement, or as having prepared or certified any report or valuation used in connection with the registration statement. These experts include accountants, attorneys, engineers, or appraisers."

The future

The SEC appears to be committed to maintaining a dialog with industry to clarify the regulations and keep up with emerging technologies. The agency has indicated a willingness to participate in additional reserves forum discussions.

As probabilistic evaluations grow in number, industry increasingly will be interested in working with the SEC to develop specific guidelines for probabilistic approaches to reserves determination. As industry continues to work with regulatory agencies, the differences among various reserves definitions will tend to narrow.

Perhaps we are heading toward universally accepted definitions.

Acknowledgments

The authors thank those who prepared and presented cases at the SPEE forum including Ace Alexander, Joe Blankenship, Chap Cronquist, Carter Henson, Larry Nelms, Robert Rasor, and Danny Simmons. Also thanks go to Mike Wysatta for his help in preparing this article.

The authors

Thomas L. Gardner is a petroleum engineer at Ryder Scott Co. LP, Houston. He has conducted economic evaluations and reservoir studies of international oil and gas properties for 15 years, and has prepared numerous petroleum reserves estimates in accordance with US SEC and Canadian Policy 2-B guidelines. He previous worked for Exxon Co. USA. Gardner has a BS in petroleum engineering and an MBA, both from Texas A&M. He is a member of SPE and SPEE.

D. Ronald Harrell is chairman and chief executive officer of Ryder Scott Co. LP, Houston. He joined Ryder Scott as a reservoir engineer in 1968, became vice-president in 1970, director in 1980, and president in 1998. Harrell has managed reservoir engineering and geological studies worldwide, including property evaluations for acquisitions and divestitures, financing, reservoir management, gas supply analysis, gas storage studies, and litigation support. Harrell has a BS in petroleum engineering from Louisiana Tech University. He is a member of SPE and SPEE.