US gas demand decline led by lagging industrial use

Natural gas consumption is expected to decline 1.3% this year from a year ago, reflecting sharp reductions in industrial gas demand.

That's the forecast of the US Energy Information Administration. The US economic slowdown and the absence of any sustained and broad-based boost in fuel use from summer electricity demand have pushed up gas supplies, EIA said.

At the end of August, working gas in storage amounted to about 2.603 tcf, 19% above the low year-ago levels and 7.6% above the previous 5-year average.

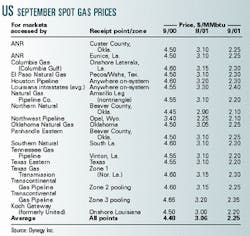

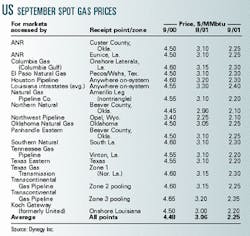

Agency forecasters said the current gas situation is one that few, if any, foresaw when stocks fell to extraordinarily low levels at the end of the heating season in March. Spot natural gas prices at the Henry Hub fell below $2.50/MMbtu during the closing days of August (see table), and the prospects for average prices well below $3 in 2002 have increased greatly, the agency said in its monthly September short-term energy forecast.

Forecast details

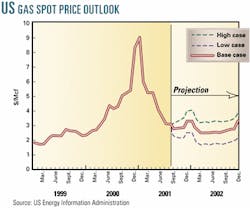

Forecasters said normal weather conditions and a modest recovery in industrial output during the forecast period are not expected to generate much in the way of new upward pressure on gas prices through 2002.

"We believe that production capability is more than sufficient to balance the US natural gas market without any significant price spikes over at least the next 15 months," the agency said.

Unless the weather is unusually harsh in the gas consuming regions of the country, EIA predicted that the spot price of gas will average under $3/Mcf this winter and well under that amount for all of 2002 (see chart). The average for 2001 is now projected to be about $4.20/Mcf.

Inventories remain robust

Next year, the agency said, it expects inventory and production conditions to remain "robust," resulting in a significant drop in the average annual wellhead price to about $2.65/Mcf or lower, if the fall and winter weather patterns turn out to be mild, crude oil prices stay stable, and the economy fails to muster at least a modest resurgence over the next few quarters.

The EIA estimated oil and gas prices reached parity on an average btu basis in August. With a projected decline in gas prices and relatively stable oil prices, natural gas prices should slip below the equivalent average delivered heavy oil prices as early as this month. Just last month, government forecasters did not expect the change in ratio to occur until the middle of next year.

It now expects coal prices to ease slightly this year as gas is more heavily used for power generation. Next year, coal prices should recede as coal stocks gain and natural gas prices continue to drop, EIA said.

Based on EIA data through May, the agency estimated total industrial gas use, including consumption by nonutility power generators, fell by about 280 bcf, or 6.5%, during the first half of 2001 compared with the first half of 2000.

Natural gas use related to electricity output by independent power producers as well as industrial and commercial cogenerators rose 23% in the first quarter and is estimated to grow by a similar amount in the second quarter, compared with 2000 levels. Excluding nonutility generator-related demand from the industrial category, EIA estimated industrial consumption fell by more than 600 bcf during the first half of 2001, a 22.5% decline from the first half 2000 total.

Forecasters said a preliminary estimate of 1.7% growth in dry gas production for the first 6 months of 2001, compared with the same period in 2000, may be too low be cause of unusually high retention of liquids in the gas stream and because of other short-run behavioral shifts in gas marketing that affected customary estimating techniques.