Global merger action dominated by Canadian, US gas deals

Canadian and US oil and gas companies this year have dominated the number of worldwide acquisitions involving natural gas.

That's the key finding of a report released late last month by IHS Energy Group. IHS Energy is a wholly owned subsidiary of Information Handling Services Group Inc. (IHS Group), Engle wood, Colo.

IHS Energy used its Petroleum Economics and Policy Solutions (PEPS) transactions database to highlight certain upstream trends. Database transactions include company takeover deals, the purchase of acreage and reserves, and swaps and selected block awards, IHS Energy noted. Values are also placed on exploration acreage.

"Since many oil and gas companies increase their reserve holdings through acquisitions of other companies' assets or by taking over entire companies, analysis of takeover trends is a key indicator of industry activity and financial health," IHS Energy said.

Continued upward trend

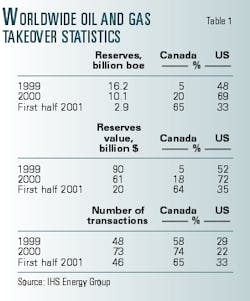

"The trend towards North American gas takeovers started in 2000, when 74% of worldwide [gas] takeovers were located in Canada," IHS Energy said. Also in 2000, the US accounted for 69% of the worldwide takeover gas reserves volumes and 72% of the worldwide gas takeovers' value (see table).

Based on data for the first half of 2001, Canadian firms' acquisition of gas reserves accounted for 65% of worldwide takeover transactions, which represents a "dramatic shift away from US takeover activity" in terms of total reserves and total value of reserves, IHS Energy reported. "US takeover activity decreased to 33%, on a reserves basis, and 35%, on a value basis, in the first half of 2001, while Canadian takeover activities escalated," IHS Energy reported.

Also worth noting, IHS Energy said, was the rise in the average price paid for Canadian reserves acquired through take overs: "In the first half of 2001, the average price paid for Canadian reserves acquired through takeover was $6.75 [US]/boe. This compares with an average price of $5.56/boe in 2000, and $4.88/boe in 1999," IHS Energy said.

The firm discovered a similar upward trend with respect to the average value of reserves acquired through takeovers in the US. Reserves acquired through take overs in the first half of 2001 were valued at $7.05/boe. In 2000, this value was $6.28/boe and was $6.05/boe in 1999.

"This shows a narrowing gap between the average value of US and Canadian takeover reserves during the period of 1999 through the first half of 2001," IHS Energy said.

Significance of deals

IHS Energy said that the increase in reserve values in North American take overs was "a direct reflection of the in creased demand for gas supplies in the US."

In first half 2001, IHS Energy estimated that roughly 85% of the reserves in US takeovers were gas, while in Canada, about 50% of takeover reserves were gas.

During the first half of this year, the deal with the "most significant single impact on the overall takeover statistics," according to IHS Energy, was Tulsa-based Williams Cos. Inc.'s acquisition of Barrett Resources Corp., Denver (OGJ, May 14, 2001, p. 38). Williams gained a net 2.1 tcfe of proved gas reserves in the deal at an average price of $1.33/Mcfe, IHS Energy said.

Also significant in the US was Denver-based Westport Resources Corp.'s purchase of Belco Oil & Gas Corp., New York City, in a deal estimated at $7.95/boe (OGJ Online, June 11, 2001).

Meanwhile, major Canadian takeovers in the first half included Conoco Inc.'s purchase of Gulf Canada Resources Ltd., Calgary, at an estimated cost of $6.20/boe (OGJ, June 4, 2001, p. 36).