Market Movement

OPEC likely to act to calm markets

While world oil markets are volatile for now, in the wake of last week's terrorist attacks in Washington, DC, and New York City, OPEC can be expected to supply added liquidity to the market immediately.

So says PIRINC Pres. Larry Goldstein:"OPEC will not wait. It will put oil out in advance of the needs," he said in an interview. He said crude oil markets have remained calm throughout the crisis.

When the US retaliates, Goldstein predicts it will be "massive." To avoid a shock to oil markets, Goldstein contends OPEC will act appropriately now to provide a cushion. Sources say the US has already received assurances from Saudi Arabia and other key OPEC players.

Inventories are low but sufficient, Goldstein said. If consumers remain calm, there should be no problems in gasoline and heating oil markets. "The calm has to permeate down to the distribution markets and to end-use consumers," he said. "There is little cushion for a sudden run on stocks. Consumers could create the problem."

Meanwhile, physical deliveries and transactions involving crude oil are functioning smoothly but at a reduced volume. International markets such as London's IPE are providing the physical markets some price transparency.

Because NYMEX remained closed at presstime last week, physical trades of crude in the US are taking place by fax, e-mail, and telephone, Goldstein said. The financial markets are unable to clear transactions, and there is little hedging or any other financial-type transactions taking place, he said.

Short-term uncertainty looms

World oil markets face great uncertainty in the aftermath of the terrorist attacks. The investment community is, in effect, waiting to react to the US government's response.

Crude prices rose on European markets, while NYMEX, located near the destroyed World Trade Center towers, was not expected to reopen before Sept. 17, if then. UBS Warburg oil analyst Rick Jones said equity investors and oil market speculators will weigh price risk pending US retaliation. Until that happens, trading activity will be muted.

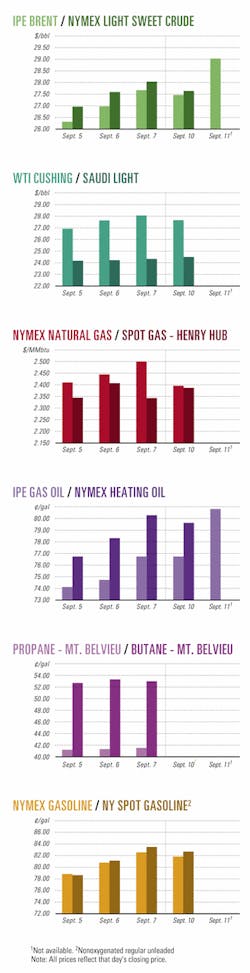

At IPE, Brent near-month crude peaked at $31.05/bbl on Sept. 11. Although prices peaked at $29.50/bbl in early trading on Sept. 12, that day's session closed at $28.02/bbl.

In the US, with NYMEX closed, some limited trading proceeded on US-based electronic exchanges.

Enron Online, along with online markets operated by Aquila and Dynegy, were open for buying and selling physical gas and power for a few hours the day after the attacks. Trading took place by telephone and over the electronic platforms.

Uncertainty drives up energy prices

Some analysts contend the attacks will drive up energy prices at least for awhile.

"Anytime you have a significant event with a dangerous impact, tantamount to the Persian Gulf crisis or any number of events in the past, it always generates market concerns that trigger a precipitous price increase," said Raymond E. Ory Jr., of the Houston office of consultants Baker & O'Brien.

US newswire services were reporting gasoline pump prices as high as $4-5/gal in some areas of the country late Sept. 11 (see related story, p. 32).

Still, Ory said, "The energy market will stabilize again. I wouldn't want to guess how long it will take, but the market will work itself out in a relatively short time from a business standpoint."

Marshall Adkins, analyst with Raymond James & Associates in Houston, also expects an immediate price spike in oil markets. "The knee-jerk reaction will drive the price up for the short term. The long-term impact depends on who did it," he said.

If the culprits were associated with a member country of OPEC or a country close to OPEC nations, the long-term impact could be strong, depending on how the US retaliates. But it is more than likely the responsible parties are associated with Afghanistan, Adkins said, which means there is not likely to be a long-term impact on prices.

Demand effects, market perceptions

However, oil price rises are not inevitable, said Leo Drollas of London-based Centre for Global Energy Studies. Although an attack by the US on a rogue state could cut supplies, there could also be a significant slump in US demand. International air travel will suffer hugely, as it did during the 1990 Kuwait invasion. "People didn't go anywhere then. The same will probably happen," Drollas said.

Meanwhile, Ory said the outcome depends to a large degree on market perceptions. "If everyone becomes concerned about future supplies and starts topping off their gasoline tanksellipseit could become a self-fulfilling prophecy," he said.

"Although this terrorist attack is horrific, it's really a political and a human crisis. No oil production or energy consumption is affected," Ory said.

null

null

null

Industry Trends

THE US OIL INDUSTRY did its best to rebound in the wake of the Sept. 11 terrorist attacks on the World Trade Center in New York and the Pentagon in Washington, DC.

By late morning on Sept. 11, nonessential personnel at much of Houston's massive concentration of refining and petrochemical complexes were sent home after those plants earlier in the day went on heightened security. Precautions being taken by refineries included the reduction of traffic into and out of the facilities, especially deliveries, according to one industry source. Spot-checking of personnel exiting the facilities also was increased.

ExxonMobil said, "We have taken all appropriate security measures. This has not affected any of our manufacturing such as refineries or chemical plants."

Chevron said it also had increased its normal comprehensive security program. "We have no reports of any problems at any of our facilities," the company said.

Texaco said, "There have been no problems. We have well-established security and emergency preparedness programs. We have placed all our facilities on a heightened state of awareness, and operations continue uninterrupted.

"All of our operations are business as usual," Williams Cos. said of the company's pipelines and natural gas processing plants.

Similarly, pipeline companies were taking extra precautions. El Paso Corp. said emergency response plans were in place at the company's pipelines, field offices, gas processing facilities, and power plants. "Everything has been secured," the firm said.

Downtown Houston office towers, meanwhile, including the headquarters of Shell Oil, Enron, and El Paso Corp., were closed for the day Sept. 11.

NPRA in Washington reported no petroleum-related terrorist incidents or threats. And API headquarters had received no reports of any petroleum-related damages or threats

Meanwhile, an energy-related US summit of African leaders was rescheduled, the Washington-based Corporate Council on Africa (CCA) announced. Confirmed participants included 13 presidents, three prime ministers, the OPEC president, and the US Secretary of Commerce. Confirmed delegates included more than 1,400 people representing 53 African nations.

The US-Africa Business Summit, slated for Philadelphia, was postponed until Oct. 30-Nov. 2 from its original dates of Sept. 16-20.

"Our nation and the world need time to mourn, and many attendees would have encountered considerable travel and other logistical difficulties. We therefore believe that all participants in the US-Africa Business Summit will be better served by this postponement," said CCA President Stephen Hayes.

Alyeska Pipeline Service Co., meanwhile, said fears of a potential terrorist attack prompted the closure of its Valdez terminal for 13 hr the day of the attack.

Alyeska said, "Military officials considered a Korean Airlines plane inbound to Anchorage a threat to the terminal, and the Coast Guard requested that Alyeska evacuate the terminal." It said military jets escorted that airliner to Whitehorse, Yukon Territory.

The Alyeska terminal had three tankers in port at the time. One departed on schedule and two tankers finished loading and sailed. The Coast Guard ordered three inbound tankers to remain out of the port.

Government Developments

MEXICO plans to offer multiple service contracts by next spring to speed exploration and production.

That word came from Raul Muñoz Leos, Pemex director general, during a Sept. 6 speech in New York to analysts and investors.

The Mexican constitution limits the role foreign investors can play in the oil industry, with ownership of reserves restricted to the state-owned oil company (OGJ, May 7, 2001, p. 58).

Nevertheless, Muñoz Leos believes contracts could be structured to entice investments by either service companies or major integrated oil companies.

Muñoz Leos wants to see foreign companies spend $2 billion/ year building Mexican crude and gas production. Pemex has called for $33 billion invested in oil, gas, and petrochemicals over 5 years.

During that time, Muñoz Leos hopes to double crude production to 4 million b/d and to at least double gas production.

He said Mexican President Vicente Fox intends to redouble efforts to convert Pemex from a government bureaucracy to a market-driven enterprise.

NOVA SCOTIA is expected to consider a proposed energy strategy this fall, government sources said

Emera, the parent company of the provincial electric utility and part owner of the Maritimes & Northeast Pipeline, called for opening the province's power markets to competition and for local involvement in Nova Scotia's expanding natural gas industry.

The company also called on the provincial government to appoint a minister of energy to work with other provinces as well as to "ensure the right regulatory climate exists to protect the public interest, while encouraging a thriving natural gas industry."

Prompted by the discovery of large natural gas deposits offshore, the Canadian province began soliciting comments and recommendations in the spring on an energy strategy that is expected to cover all aspects of the industry.

US STATES should consider developing a model process for speeding the permitting and siting of natural gas pipelines, said a working group of state utility regulators and elected officials.

The gas industry has said a prospective shortfall in pipeline capacity would limit its ability to meet a projected rise in demand. The working group said the existing infrastructure was not planned to meet the rate of gas consumption growth expected in the next decade, particularly demand driven by electric power generation.

The study said barriers to pipeline construction include duplication at several levels of government.

The group included representatives from the National Association of Regulato- ry Utility Commissioners, IOGCC, FERC, the departments of Energy and the Interior, AGA, and INGAA.

The National Petroleum Council has estimated that more than 38,000 miles of new gas transmission lines will be needed, along with 263,000 miles of new distribution lines.

Quick Takes

CONOCO awarded two engineering, procurement, construction, and installation contracts for its $1.6 billion Belanak natural gas development off Indonesia.

The company made the awards under its South Natuna Sea Block B production-sharing contract along with state oil firm Pertamina.

The first contract, worth $587 million, was awarded to Brown & Root Indonesia for construction of a floating production, storage, and off-loading vessel. The FPSO, which will be installed and production-ready by late 2004, will process as much as 350 MMcfd of gas for export, 100,000 b/d of oil and condensate, and 23,000 b/d of LPG. The 1,000-ft vessel will have storage capacity for 1 million bbl of oil, which will be offloaded to tankers for onward transportation.

The second contract, worth $157 million, went to J. Ray McDermott Indonesia for two wellhead platforms and associated pipelines and an oil-offloading buoy.

The contracts support two separate gas sales agreements, both supplied by the Conoco-operated PSC. The first is a 22-year contract between Pertamina and Singapore's SembCorp Gas for the long-term delivery of gas to Singapore. The second agreement is a 20-year contract between Pertamina and Malaysian state oil firm Petronas for the delivery of gas to Malaysia.

Belanak is expected to yield ultimate production of 600 bcf of natural gas and 100 million bbl of oil, condensate, and LPG.

FPSO vessels continue to proliferate among offshore production facilities.

Norway-based floating production contractor Bergesen Offshore has awarded a $95 million contract to ABB Group to build and operate the oil processing systems on two FPSO vessels.

The Berge Hus FPSO will be ready for operation in January 2002, with capacity to process 160,000 b/d of liquids. The Berge Helene will be ready for operation in summer 2002, with capacity to process 60,000 b/d of oil.

ABB will design and build both oil processing units, including control and automation systems, and run them for 4 years or longer. Neither company disclosed the identity of any pending field development projects associated with the two FPSOs.

ABB has provided and is operating the processing module for the Sendje Berge FPSO at Ceiba field off Equatorial Guinea.

MORE NATURAL GAS could be flowing from South Texas into Mexico from a new international pipeline by the first quarter of 2002, if a new expedited process works as expected.

Tidelands Oil & Gas unit Reef International has filed for construction and operating permits for a 12-in. gas pipeline, a 6-in. propane and butane pipeline, and a 6-in. standby line from Eagle Pass, Tex., into Piedras Negras, Mexico.

The pipeline will deliver product to Conagas, the Piedras Negras local gas distribution company, and certain industrial users, Tideland said. The company already has another proposed international pipeline "on the drawing board," it said.

The US exported an estimated 64 bcf of gas to Mexico in 1999, up from 53 bcf in 1998, according to the US government, with most of it flowing through the Samalayuca pipeline, which crosses the border east of El Paso, Tex. The pipeline serves power plants near Ciudad Juarez, Mexico. Mexico is expected to be a net gas importer through 2015 as the country switches its power plants to natural gas from residual fuel oil.

Natural gas producers in South Texas have been eager to serve Mexico's growing gas demand. The North American Free Trade Agreement set Mexico's tariff on imported gas at 10% beginning in 1993, with an annual 1% reduction through next year.

The Eagle Pass-Piedras Negras pipeline crossing is essential to meet the growing energy demand of the region, Tidelands said, and represents the first step in refocusing Tidelands operations into a major transporter and processor of natural gas and propane and butane into Mexico.

In other pipeline action, Algeria and Nigeria established a steering committee to supervise the proposed trans-Sahara gas pipeline project between the two nations. The announcement was made after Algerian and Nigerian energy officials met in Algiers. The 4,000-km line would cost $5-7 billion and would move Nigerian gas from Abuja fields to the Algerian port of Beni Saf, in the northwestern part of the country. Volumes were not disclosed (OGJ Online, Apr. 26, 2001). Algerian Energy and Mines Minister Chakib Khelil noted the project is supported by the presidents of the two nations and was endorsed at a meeting of African energy ministers at Algiers in April. Rilwanu Lukman, Nigerian presidential adviser on petroleum and energy, said the project would enable the sale of Algerian and Nigerian gas to European markets, thereby bolstering opportunities to boost production capacity in both nations. The two countries also pledged to support the project with an extension of the trans-Saharan road and construction of a fiber optic line paralleling the pipeline to improve telecommunications.

Enron unit Transwestern Pipeline has received requests for more than 1.3 bcfd of capacity on its proposed 400-mile Sun Devil Pipeline expansion project, which would bring natural gas from New Mexico's San Juan basin to market in Phoenix, then to California by January 2004. "Sun Devil is an important project that will serve the gas-fired electric generation market in Arizona, which is the second-largest growth market in the US," Transwestern said. The company presently is working with shippers to finalize transportation agreements. It plans to apply with FERC early next year. The company also said its Red Rock pipeline project will make 150 MMcfd of gas capacity available for delivery into California in mid-2002.

TransCanada PipeLines and National Fuel Gas said they will proceed with development of the Northwinds natural gas pipeline project to supply the US Northeast. The 215-mile, 30-in. line would extend from Kirkwall, Ont., to BBuffalo, NY, and then follow a southerly route to the Ellisburg-Leidy, Pa., area. The 500 MMcfd line would cost as much as $400 million. The companies said the final route has not been selected, but it would use existing utility corridors to the greatest extent possible. The project design would also likely include construction of a tunnel to cross the Canada-US border, the companies said. The companies said Northwinds would allow US markets to draw from growing gas supplies at the market hub in Dawn, Ont. They said more than 3.5 bcfd of pipeline capacity and more than 870 bcf of storage capacity are linked to that hub. Northwinds, through interconnections along the pipeline route and in the Ellisburg-Leidy area, will have access to more than 5 bcfd of transportation capacity on interstate lines that supply major East Coast markets. TransCanada and National Fuel plan an open season this fall for service on the pipeline. Contingent upon the results of that offering, the companies would apply with FERC later this year and with the Canadian NEB in the spring. Construction will take up to 20 months. Completion is targeted for late 2004, with the final date to be determined once the regulatory review process is under way.

STATOIL said it will build a cavern for the storage of liquid propane at its 200,000 b/d Mongstad refinery near Bergen.

Last year, a rockfall in the existing cavern caused severe ice formation and reduced storage capacity. The Vestprosess partners, which operate the refinery, determined it would not be possible to repair the damage and decided to build a new cavern by November 2003.

Costs are estimated at 180 million kroner. Construction contracts will be signed by the end of October.

The existing cavern, which came into use 2 years ago, is 33 m high, 20 m wide, and has a storage capacity of 60,000 cu m.

"Although the cavern has been tight for the last year, we now have a much lower storage volume than we had planned," said Vestprosess Vice-Pres. John Stangenes.

The new cavern will be about the same size as the old one, and it will be built nearby in the refinery area. The Vestprosess partners blamed the ice problems on an error in construction and have reported the matter to their insurance company.

GAS-TO-LIQUIDS schemes abound in gas processing news this week.

Conoco has awarded a $5.3 million automation services contract to Honeywell's Industrial Controls business for its GTL semiworks facility under construction at Ponca City, Okla.

Honeywell will provide general contract services "to facilitate the rapid execution and deployment of automation solutions" for the $75 million demonstration plant, Honeywell said. The facility is being constructed to launch the commercialization of Conoco's proprietary GTL technology.

Front-end engineering was completed in May, and automation controls installation is expected to be completed by August 2002.

Meanwhile, Shell Gas & Power has selected a joint venture of Halliburton unit Kellogg Brown & Root and JGC as contractor for its first large-scale GTL project.

The next-generation facility will have a capacity of 75,000 b/d, requiring a gas intake of about 600 MMcfd. KBR and JGC will define engineering design for the plant, the location of which has not been determined. An investment decision is expected by yearend 2002, said KBR.

Shell plans to commit to as many as four GTL projects by the end of 2010, it said. JGC and KBR will design the plant to use Shell's proprietary GTL technology, the Shell middle distillate synthesis (SMDS) process. Work will take place over 18 months in London.

KBR noted: "Recent technical advances in the SMDS technology have created potentially attractive opportunities for the commercialization of large gas reserves in an environmentally sustainable manner."

Elsewhere in gas processing, Phillips Oil Co. (Nigeria) Ltd., said it signed a memorandum of understanding with coventurers Nigerian state oil firm NNPC and Nigerian Agip Oil Co. to develop an LNG plant in Nigeria. The MOU establishes a study team that will perform a conceptual evaluation of an offshore LNG facility, which would be nominally sized at 5 million tonnes/year. The plant, expected to be on stream by 2007, will be located in the Niger Delta area near the existing Brass River crude terminal at a water depth adequate for loading LNG tankers. It will use gas from onshore oil and gas fields operated by the companies. An existing LNG plant is on Bonny Island, east of the Niger Delta. In June 1999, operator Nigeria LNG Ltd. completed a two-train, 5.9 million tonnes/year plant at Bonny Island. Work is under way on the third train. Phillips did not consider trying to get an equity stake in the Bonny Island plant, the company said. "Phillips is not concerned about competing with the existing plant," a spokeswoman said. "Our project is going to come on line after they complete their plans for expansion, so we would not be competing for the same long-term contracts."

Canadian federal and provincial authorities have approved Taylor NGL's application to build a $45 million (Can.) ethane extraction plant at Joffre, Alta. The project was announced earlier this year (OGJ Online, June 20, 2001). The Joffre Ethane Extraction Plant (JEEP), will be near NOVA Chemicals' Joffre petrochemical complex. JEEP will process the fuel gas being used at the complex to recover ethane, propane, butane, and condensate. JEEP will be rated at 250 MMcfd and will have initial recovery of 10,400 b/d of liquids. Ethane will be sold to NOVA, and the other liquids will be marketed through a partner. Taylor said that, as of Aug. 31, it had completed the purchase of plant equipment, from TransCanada PipeLines, that is a good fit for the JEEP requirements. It constitutes 60% of major equipment necessary for the project. The used equipment will save money and time, said Taylor. Taylor will be awarding the engineering, procurement, and construction contract shortly.