Cuts in crude oil production set to take effect this month by members of the Organization of Petroleum Exporting Countries will depress oil tanker shipping rates as they drive up world crude oil prices.

Reducing the net amount of oil potentially exported from the Middle East increases competition among tankers working in the region, forcing some into other geographic markets and thereby depressing tanker rates in those regions.

These are the major conclusions of a mid-year analysis of the effects of OPEC's action earlier this summer by Clarkson Research Studies, London.

The analysis coincides with mid-2001 US crude oil and refined products import data issued by the US Energy Information Administration that showed imports set first-half-year records.

Demand decline

The analysis noted that 61% of OPEC's output, excluding Iraq, is potentially exported from the Persian Gulf. Assuming all OPEC members export the same proportion of their supply and that all of the 1 million b/d cut is in exports, it said, 610,000 b/d will then be removed from the Persian Gulf export market, equivalent to a single very large crude carrier (VLCC; 200,000-320,000 dwt) every 3 days.

Over a month, this removes 10 VLCCs from that market.

Given that, through July 2001, 60% of spot crude oil trade out of the Persian Gulf has moved to the East, 21% to the US, and 5% to Europe, Clarkson estimated that total demand will fall by 0.49 million dwt/month until OPEC again reviews its output.

This equates to nearly 3% of total tonnage demand, meaning that 3% more of the world's tanker fleet will be seeking employment.

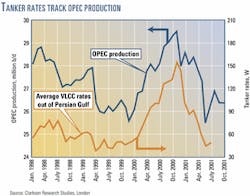

Clarkson's figures (see graph) show a strong historical correlation between OPEC production and Persian Gulf VLCC freight rates, denominated in world scale (W) increments.

The obvious result of supply cuts is that tanker rates fall, with non-VLCC sectors affected by the encroachment of VLCCs into Suezmax (120,000-200,000 dwt) markets, and so on down the sectors as rates for the larger vessels fall.

Suezmax markets will also suffer from fewer Nigerian cargoes, and Aframax (80,000-120,000 dwt) and Panamax (60,000-80,000 dwt) markets will be affected in Far East and Caribbean areas by Indonesian and Venezuelan cuts, although the volumes involved here are relatively small, said the study.

Thus the recent recovery in the tanker markets may be stunted and VLCC rates might even fall back to the high W30s where they were in June when Iraq cut supply by 2.9 million b/d.

("World scale," or "W," refers to the system used by the tanker industry to equate freight rates around the world to the same daily vessel earnings rate, incorporating especially bunker fuel cost, port charges, and voyage distances.)

The study finds some hope, for the tanker industry, in North Sea and Black Sea exports were set to increase in the second half of 2001. The extra cargoes will mainly benefit Aframazes and Suezmaxes, leaving room for VLCCs to parcel up cargoes in West Africa and the Eastern Mediterranean.

Long term; US imports

But in the long term, said the Clarkson analysis, by removing 1.3% of world oil supply from the market just before the high demand season, OPEC could unintentionally prolong the global economic malaise, thus limiting oil demand growth.

In addition, should the Northern Hemisphere winter be especially cold this year, stocks that at mid-year were only within satisfactory range will quickly be depleted, which will bolster oil prices further.

Retarded economic and oil demand growth will limit long-term tanker demand growth.

In the very long term, said the analysis, high oil prices encourage energy diversification as the market avoids being exposed to the volatility of the oil markets. Consumers are moving towards such "cleaner" sources as natural gas and renewable fuels. Oil is going to make up a decreasing proportion of total energy sources in the future.

In the meantime, the US Energy Information Administration reported on US crude oil and refined products imports for the first half of 2001. Most imports into the world's largest market for crude oil and refined products arrive by oceangoing tanker.

EIA said that, by late July, US crude oil stocks stood 11.1% higher than at the same time in 2000. The stock level was nearly identical to the 5-year average, however.

US crude oil imports averaged 8.9 million b/d at the end of July, the first time in 6 weeks that US crude oil imports had fallen to less than 9 million b/d.

On the other hand, US crude oil imports averaged 9.1 million b/d during first half 2001, the highest first-half-year average recorded and 5% greater than at the same period in 2000.

US oil product imports averaged 2.7 million b/d during first half 2001, also the highest first-half-year average recorded and 26% greater than the same period in 2000.