OGJ Newsletter

Market Movement

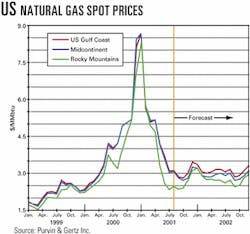

Natural gas price forecast lowered

Working natural gas in storage should peak near 3.15 tcf in October, triggering lower spot gas prices, said international energy consultant Purvin & Gertz in an Aug. 29 report.

"We now expect that the pipeline acquisition price of gas on the US Gulf Coast will remain fairly flat at an average of about $3.10/MMbtu in August and then slump below $3 during the 'shoulder months' of September and Oc- tober. Prices should then rise during the remainder of the year to a peak of $3.45 in December," Purvin & Gertz said. The consulting firm pro- jected Mid- continent gas prices averaging $3.05/MMbtu in August before dipping to a low of $2.70/MMbtu in October, followed by rising prices that will peak at $3.25/MMbtu in December.

In the Rocky Mountain region, the average pipeline acquisition price for natural gas was an average $2.45/MMbtu in August. Gas prices in the region are projected to slip about 10¢ in September and then increase to a peak of $3.20/MMbtu in January 2002, Purvin & Gertz said.

"We believe that the possible effects of high gas demand for electrical power generation will become increasingly muted as the summer draws to a close. However, the 'wild card' that could still affect prices is the remaining potential that a major hurricane might disrupt natural gas production from offshore platforms in the Gulf of Mexico," the consulting firm added.

Gas prices dropped earlier this year largely as the result of AGA reports showing that US gas storage levels had increased by about 100 bcf/week from the end of April through the middle of July. Although injection rates then slowed to about 80 bcf/week through the beginning of August, they remained about 20 bcf higher than average.

Injection rates slumped in mid-August because tropical storm Barry shut in 10 bcf of Gulf of Mexico gas production, the weather was unusually hot throughout the entire US, and NYMEX futures prices for September were lower than spot prices in early August, so some buyers may have pulled gas out of storage and used NYMEX futures to hedge their deferred spot gas purchases.

Rough near-term outlook for gas prices

A 12-region composite spot price index fell 7¢ to $2.89/MMbtu for the week ended Aug. 24 compared with $2.96/MMbtu the previous week and $4.40/MMbtu for the same time last year, said UBS Warburg.

"The composite could test the psychological $2.50/MMbtu mark sooner than later," analyst Ronald Barone said in an Aug. 30 research note.

"With August likely to come in near our $2.90 assumption (and a tweaking of monthly assumptions over the balance of the year), our $4.10 forecast should be able to withstand this turbulence," Barone said. "However, if the industry approaches November with supplies north of 3,200 bcf (and if there is any delay in the arrival of heating loads), our forecast could prove aggressive."

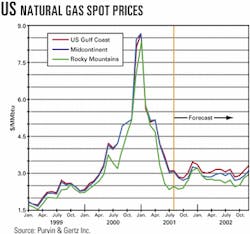

Refined products margins tightening

Markets for refined products are tightening, and that bodes well for US refiners.

In addition to continued robust demand for gasoline, the recent announcement by Citgo Petroleum that the crude unit at its 158,650 b/d Lemont, Ill., refinery will be down for as long as 6 months added strength to markets (OGJ, Sept. 3, 2001, p. 28).

In the weeks since the Lemont refinery crude unit was hit by a fire and a distillation tower subsequently experienced a structural failure, gasoline prices have risen across the US by more than a 10¢/gal. However, gasoline prices have spiked more than 40¢/gal in the markets most immediately affected-the upper Midwest, particularly the Chicago and Milwaukee areas, the primary consumers of the special ethanol-blend RFG produced solely for that area.

It is likely that the protracted downtime for the Citgo crude unit will spawn supply pressures that will ripple through markets into next year's driving season.

The Lemont accident points up yet again the extreme vulnerability of the US refining sector to any relatively minor operating upsets today. Last year, a couple of pipeline outages and a minor refinery outage spiked gasoline prices to their highest level since the Persian Gulf crisis-a level that was largely sustained until recent months, when refiners pulled out all the stops to produce more gasoline.

Given the continuing high utilization rate for US refineries, continued strong demand, and minimal fungibility of alternative supplies (both imports and blending stocks) to take up the slack, the current situation points to continued strength in refining margins.

Consequently, refiners are likely to delay the switch from gasoline to the production of heating oil because of the continuing robustness of the gasoline market. This could delay the stockbuild on heating oil a little later than usual, possibly contributing to heating oil tightness later this year.

Lehman Bros. analyst Paul Cheng points to the logistical constraints that will limit industry's ability to quickly replace the lost Citgo capacity via imports.

The US Midwest region's total refined product demand is about 4 million b/d, while its refining capacity is only about 2.8-3.0 million b/d, Cheng notes. Consequently, the region relies heavily on imports from the Gulf Coast to bridge the gap, especially during the driving season.

When that is coupled with the region's currently low stock level-less than half of what it is in terms of days of supply on the East Coast-the Midwest is shown to be especially sensitive to the slightest hiccup in supply, and there is little prospect of that changing soon, said Cheng.

The shutdown of Ultramar's 50,000 b/d Alma, Mich., refinery and Premcor's 80,000 b/d Blue Island, Ill., refinery during the past 2 years combined with continued demand growth has overstretched the region's product pipeline system, he said.

"As a result, we expect that Midwest refining margins will remain significantly above their historical mean, at least over the next 2-3 months, which, in turn, will provide solid support to refining markets across the nation (Midcontinent, Gulf Coast, and East Coast)," Cheng said.

Industry Trends

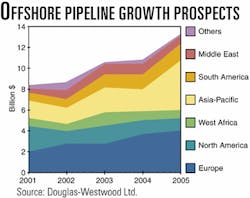

The value of the world's offshore pipelines market is expected to grow to $13.1 billion in 2005 from $8.1 billion this year, said UK analysts Douglas-Westwood and In- field Systems in a new report (see chart).

Recovery from the oil price dip of 1998 slowed the market in 1999-2000, but demand for offshore pipelines now will resume a long-term growth trend, according to the firms.

During 2001-05, the market will total $50.5 billion, compared with $38.2 billion in the previous 5 years, the report concluded.

Europe will continue to form the largest market in that time span, at 29%, but the largest future growth will be in the Asia-Pacific region, the report said.

Growth is expected to step up starting in 2004, due mainly to major gas lines planned in the Asia-Pacific region, said Barney Par- sons, analyst with Douglas-West- wood.

"Over the past 5 years, some 51% of pipeline kilometers has been laid in water depths down to 100 m. But a fundamental change occurred in 1999 as the amount of pipeline laid in depths greater than 500 m dramatically increased, and the indications are that deepwater activity will continue to grow," he said.

"Our view is of markets that show every chance of enjoying long-term growth prospects driven by the fundamentals of a continuing increase in demand for offshore oil and gas," he said. "This continues to be a market best suited to those able to operate on a global scale and make a corporate commitment measured in decades."

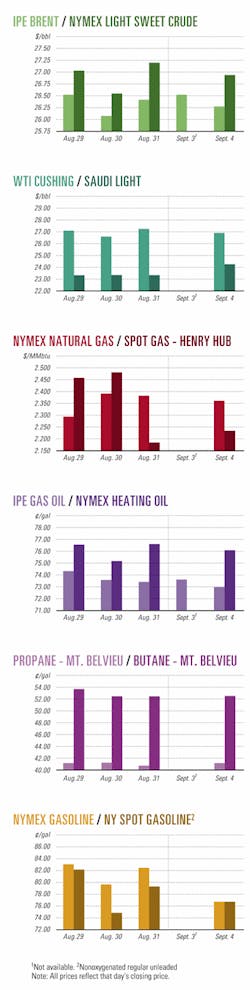

US drilling activity increased marginally late last month, but the number of mobile offshore rigs under contract continued to decline in the Gulf of Mexico, European waters, and around the world, industry analysts reported.

There were 1,252 rotary rigs working in the US during the last week of August, 1 more than the previous week and up from 1,019 the same time a year ago, said Baker Hughes.

The number of rigs drilling in the gulf increased by 6 that week to 140, the company reported.

However, ODS-Petrodata Group, Hous- ton, reported 5 mobile rigs came off contracts in the gulf this week with no new jobs waiting. That dropped the utilization rate 2.3 points to 72.3% out of the 213 available.

Another unit was idled in European waters, dipping the utilization rate there almost a full point to 96.1% with 98 mobile rigs contracted.

The result was a net loss of 6 rigs worldwide, pulling down global utilization one point to 84.8% with 554 units contracted.

Government Developments

STATE OWNED Polish Oil & Gas and Norway's Gas Negotiating Committee (GFU) have agreed on terms for delivery of 74 billion cu m (bcm) of Norwegian gas over 16 years.

The deal, which requires approval by government authorities, is expected to be signed soon. Due to start in 2008, deliveries would build over 3 years to 5 bcm/year and remain at that level until 2024.

If the volumes are insufficient to justify the proposed pipeline, the Norwegian gas producers can withdraw from the agreement.

GFU negotiated the deal on behalf of Statoil, Norsk Hydro, Norske Shell, ExxonMobil, and TotalFinaElf. It will be decided later which fields will supply the gas.

Thor Otto Lohne, Statoil vice-president for natural gas marketing, said, "This is a breakthrough for Norwegian gas deliveries to Poland. It is a good agreement, similar to others in Statoil's portfolio."

The contract replaces one for 500 million cu m/year from 2000-06 that POGC and GFU negotiated last year.

Poland used 11.1 bcm of gas in 2000, with Russia supplying 6.9 bcm of that total.

Statoil said one pipeline option would be a 1,100-km line through the Skagerrak Channel between Norway and Denmark, extending to Niechorze on the Baltic coast, where it would link with the Polish gas network.

That line also could supply Sweden and Norway's Grenland industrial region south of Oslo. Longer term, it also could supply Denmark.

CANADA's National Energy Board has increased its estimate of conventional heavy oil resources in the Western Canada Sedimentary Basin.

An NEB report said the assessed oil in place for the plays it studied has increased by 20% to 49.9 billion bbl, compared with 41.4 billion bbl in the board's 1999 supply and demand report.

The report said 21% of the discovered heavy oil resources and 12% of undiscovered resources could be recovered through application of existing technology and the potential for improved recovery through the application of future technologies.

The report continued, "The ultimate recoverable resources of heavy conventional crude oil in western Canada are thus estimated to be some 8.7 billion bbl, representing an increase of 8.2% compared with the 1999 report."

The report did not cover oil sands, only conventional heavy oil of less than 25° gravity. Both Saskatchewan medium and heavy oils were combined for the purposes of the report.

In 2000, western Canada produced 574,000 b/d of heavy oil, about 26% of national oil output. That was up 10% from 1999.

The report said western Canada light oil production continues to decline. It is currently 19% higher than heavy oil output, which will surpass it before 2010.

Quick Takes

FRANKLIN FIELD in the UK North Sea has come on stream, adding to production of jointly developed Elgin field, which came on stream in March.

TotalFinaElf said production from Elgin-Franklin fields should plateau at 140,000 b/d of condensate and 455 MMcfd of natural gas.

Franklin, on Block 29/5b, is 5.5 km from Elgin in 93 m of water. It has an unmanned platform, as does Elgin. Output from the fields is processed through a central platform.

Condensate from the fields will be exported by a 24-in., 24-mile line to BP's Marnock platform and moved ashore via the Forties pipeline.

Gas is exported via the new Shearwater Elgin Area Line to Bacton, where it is tied into the onshore gas transmission systems.

TotalFinaElf is operator of both fields through unit Elf Franklin Oil & Gas, in which TotalFinaElf has 77.5% interest and Gaz de France has 22.5% interest.

PHILLIPS PETROLEUM has signed a licensing agreement with Crown Central Petroleum and its subsidiary, LaGloria Oil & Gas, for the use of Phillips's S Zorb sulfur removal technology at two Texas refineries.

The license agreement is for the design, construction, and operation of units using the S Zorb process at Crown's 100,000 b/d refinery in Pasadena and at its 52,000 b/d LaGloria refinery in Tyler.

Design work for a 40,000 b/d unit at the Pasadena refinery will begin shortly. The unit is slated for startup in fourth quarter 2003.

Phillips's technology was developed to help oil companies comply with the EPA's Tier II and European Commission's Auto Oil sulfur limits. Beginning in 2004, US gasoline will have sulfur content phased down to a level no higher than 30 ppm on average.

A 6,000 b/d plant at Phillips's Borger, Tex., refinery has demonstrated the technology's ability to reduce gasoline sulfur content to levels below 10 ppm.

In other refining news, Sinopec signed a letter of intent with the Shandong provincial government to build a 200,000 b/d refinery in the Huangdao area of the coastal port city of Qingdao. The proposed plant would be designed to process Middle Eastern sour crude and is expected on line by 2005. Sinopec did not reveal whether it would seek foreign investment in the plant. The company owns three refineries in Shandong with combined capacity of 300,000 b/d, the largest being Qilu Petrochemical, with capacity of 160,000 b/d. In July, Sinopec bought 32 crude oil tanks and offsite facilities in Qingdao from the Port Authority of Qingdao, with capacity totaling 1.8 million cu m (OGJ Online, July 9, 2001).

PARTNERS in Azeri-Chirag-Gunashli oil fields off Azerbaijan have approved the 31 billion kroner ($3.5 billion) first phase of expanded development.

Field operator BP estimates reserves in the complex at 4.6 billion bbl of oil, said Statoil, a partner holding 8.56% interest.

Phase 1 will include a production platform with a design capacity of 400,000 b/d, a 30-in. oil pipeline to land, an extension of the Sangachal land terminal, and a gas and water injection platform.

The production start is slated for first quarter 2005. Completion of Phase 1 is expected to boost production to 500,000 b/d from 120,000 b/d. Plateau production could reach 1 million b/d by 2010.

Elsewhere on the development front, an ExxonMobil unit awarded Cooper Cameron's Cameron division a $100 million contract for subsea equipment to be installed in a deepwater oil field off Angola. Cameron will provide subsea trees, control systems, manifolds, and related services for Esso Exploration Angola's (Block 15) Kizomba A project off Angola. Initial delivery and installation is slated to begin late next year. Cameron also will provide systems engineering and project management, along with the modular equipment systems. Installation will require 23 subsea trees and related equipment.

WILLIAMS plans a $2.2 million expansion project to boost refined products transportation capacity in the Tulsa area by 6 million bbl/year.

The company will add new pumping capacity at its west Tulsa products terminal and replace a section of 8-in. pipeline under the Arkansas River with 12-in. line.

The expansion will relieve a bottleneck on the system caused by growing demand for gasoline, fuel oil, and jet fuel, particularly during peak demand months of April-October. Williams expects construction to be completed by May.

In anticipation of future demand, Williams plans to evaluate a proposed project that would increase annual pipeline capacity at Tulsa by another 18 million bbl.

Meanwhile, Piedmont Natural Gas has become a 33% equity partner of Greenbrier Pipeline, a proposed 263-mile interstate pipeline that would link multiple natural gas basins and storage to markets in the Southeast. A Dominion subsidiary owns 67% of the $497 million pipeline project, which Dominion announced in October 2000. The pipeline would originate in Kanawha County, W.Va., and extend through southwest Virginia and into Granville County, NC. Initial capacity will be 600,000 dekatherms/day of gas. A FERC certificate application will be filed in first quarter 2002.

INTEREST IN LNG and gas-to-liquids projects is picking up. BG boosted its investment in an India LNG project. BG bought Sea King Infrastructure group's 25% share of its Pipavav LNG port venture on the Gujarat coast for 3.75 billion rupees ($79.8 million), bringing its total share to 50%.

National Thermal Power holds 26%. Either the Gujarat state government or a financial institution is expected to pick up the remaining 24%.

The Pipavav LNG terminal is planned to have a capacity of 5.3 million tonnes/year (OGJ Online, May 12, 2001). BG plans to invest at least $770 million to increase capacity to 10 million tonnes/year.

In other gas processing news, Hunt Oil is leading a feasibility study that will examine the export of natural gas from the Camisea project in Peru. The study, which is expected to be completed by yearend, has identified LNG and GTL technologies as possibilities. California is seen as a likely market. Hunt Oil is a partner in both the development contract and the transportation and distribution contract for the Camisea projects. Pluspetrol and Tecgas are the respective operators (OGJ Online, Dec. 11, 2000). The study sees proven and probable reserves at 7.4 tcf in San Martin and Cashiriari fields and an additional 5.8 tcf recoverable potential in the Camisea area. It estimates Peruvian demand over 20 years at 3.5 tcf.

Syntroleum has an agreement with Chilean state oil firm ENAP and Advantage Resources International to study a 10,000 b/d GTL plant for Chile. The proposed plant, at the ENAP-owned Cabo Negro Industrial Park near Punta Arenas, would be supplied with gas delivered by pipeline from fields in Argentina and Chile. ENAP intends to sell GTL products to consumers in Santiago. Syntroleum said the study would be completed this year. If the study confirms expectations, ENAP and Advantage have expressed interest in obtaining a license for Syntroleum's GTL technology and beginning front-end engineering and design during the first quarter. Advantage and ENAP have explored for oil and gas in the Tierra del Fuego basin for 12 years. In 1991, they discovered a potentially significant gas field while looking for oil. The absence of a local gas market precluded further drilling and development.

TESORO PETROLEUM unit Tesoro West Coast, has inked a purchase and sale agreement to acquire 46 retail fueling facilities in Washington, Oregon, and Idaho from Gull Industries.

The transaction, expected to close in the fourth quarter, includes 37 retail stations with convenience stores and nine commercial card lock facilities.

The purchase will allow Tesoro to sell more of its gasoline and diesel production at retail, the company said, and it plans to convert the locations to the Tesoro brand.

Tesoro also is in the process of acquiring BP's refineries and associated assets, including marketing operations, in Mandan, ND, and Salt Lake City, Utah. After closing, Tesoro will operate five refineries in the western US with a combined capacity of 390,000 b/d. Tesoro's marketing system will include more than 600 branded retail stations, of which about 160 are company-owned.

STATOIL said the Byford Dolphin drilling rig has spudded an appraisal well near the Sleipner area of the North Sea to test the hydrocarbon potential of the B prospect on Block 24/12.

Statoil is the license operator with a 35% stake. The other partners are Petoro (formerly state holdings entity SDFI) 30%, Amerada Hess 20%, and Enterprise Oil 15%.

The well is being drilled on Production License 204, which was awarded in 1996. The blocks lie halfway between the Statoil-operated Sleipner fields and TotalFinaElf's Frigg field on the border with the UK Continental Shelf.

A well previously was drilled on the license, 24/12-3S. A small oil find was made there, but the proven reserves were not large enough to warrant development.

The well currently being drilled, 24/12-4, will test Paleolithic sandstone. It will be drilled to 2,300 m TD and is expected to be finished by mid-September.

In other exploration news, Harken Energy said its State Lease 14589 No. 3 well drilled in Lafourche Parish, La., has completed a production test at a rate of 2.5 MMcfd and 26 b/d of condensate with flowing tubing pressure of 1,600 psi. The well was drilled to 14,530 ft TD and has been completed in two lower zones of the Bol 3A formation at a depth of 14,500 ft. The well was drilled in Lake Raccourci field and is a replacement well to State Lease 14589 No. 1, drilled in 1997. Since first production, the original well produced 4.5 bcfe before experiencing mechanical difficulties.

Unocal reported encouraging news from two appraisal wells drilled at Ranggas prospect off Indonesia. Unocal Rapak said both wells encountered "significant" oil and gas pay. The wells were drilled in the southern part of the Rapak PSC area off East Kalimantan. Ranggas-2 had 155 ft of net oil pay and 18 ft of net gas pay. The well was drilled to 13,661 ft in 5,192 ft of water. Ranggas-2 is in the southern portion of the structure, nearly 1 mile southwest of the discovery well. Ranggas-3 encountered 306 ft of net oil pay and 123 ft of net gas pay. The well was drilled in 5,368 ft of water to 13,248 ft TVD. It is 3.4 miles north of the discovery well in the central portion of the structure.

Aera spuds California wildcat

Aera Energy and partner Ivanhoe Energy spudded a deep-gas test well on the Northwest Lost Hills prospect on Aug. 23. Nabors is drilling the well in an orchard in California's southern San Joaquin Basin (OGJ, Aug. 27, 2001, p. 30). The well is expected to take about 6 months to reach TD of 20,000 ft.