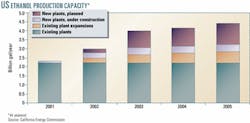

New ethanol production capacity intended to supply California

Based on proposed plant construction and expansions, annual US production of ethanol is expected to double to 4.4 billion gal by the end of 2005, staff members of the California Energy Commission reported late last month.

Currently, 44 firms produce 2.2 billion gal/year of ethanol at 57 facilities concentrated primarily in Illinois, Nebraska, Iowa, and Minnesota.

Expansions among those plants will add 633 million gal of production capacity within 4 years, if completed as scheduled (see chart). There are 13 plants currently under construction that will increase total US production capacity by another 387 million gal/year within the same period, CEC staffers reported. They said 33 more ethanol plants are in the planning stages among the 84 ethanol companies surveyed.

California the driver

The US ethanol industry is expanding "ostensibly in anticipation of California's huge need for the gasoline-blending fuel beginning in 2003," staff members said.

California currently uses 100-150 million gal/year of ethanol to replace methyl tertiary butyl ether as an oxygenate in gasoline. Gov. Gray Davis ordered MTBE to be phased out of California gasoline supplies by the end of next year after apparent leakage of the chemical contaminated water supplies in parts of the state. As a result, CEC estimates California's demand for ethanol will escalate to 660-950 million gal/year by 2003.

However, the ethanol industry will remain centered in the Midwest Corn Belt, because most existing and proposed plants use corn as a feedstock in huge volumes that are both difficult and expensive to ship long distances.

CEC noted that nearly all of the ethanol companies surveyed said they could ship their product by truck, while 77% can also use rail and 17% expect to move some ethanol by barge.

Although it indicates sufficient supplies of ethanol will be available to meet California's needs, the study did not examine the availability of corn or other feedstocks, ethanol costs, logistical challenges, permitting issues for new facilities, or the demand for ethanol in other states that also plan to phase MTBE out of their gasoline supplies.

Total replacement of MTBE in the US would require boosting ethanol production capacity to roughly 6.1 billion gal/year, said the New York City-based ratings firm Fitch IBCA, Duff & Phelps in a recent report (OGJ, Aug. 20, 2001, p. 33).