OGJ Newsletter

Market Movement

Oil demand growth in second half uncertain

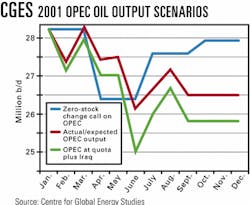

OPEC has repeatedly cut output targets in an attempt to match the seasonal call on its oil, "micromanaging the market" to prevent oil stocks from rising and consequently lowering prices, said Centre for Global Energy Studies.

The latest 1 million b/d production cut became effective this month. CGES said the new target should bring OPEC's output down to 25.8 million b/d in September-assuming 2.6 million b/d output from Iraq. CGES anticipates 500,000 b/d of "leakage".

The cut comes at a time when the need for OPEC oil is set to rise for seasonal reasons, even with weak underlying demand growth of 0.6% in 2001.

"As a result, stocks will have to be drawn down at a rate of 600,000 b/d in the third quarter and 1.4 million b/d in the fourth quarter, creating upward pressure on oil prices in spite of the weak demand-growth environment," CGES said (see chart).

The worsening economic outlook in Asia has prompted CGES to revise downward its forecast of incremental global oil demand growth in 2001 to 440,000 b/d.

"Prices should strengthen over the winter as stocks are drawn down. At some stage in first quarter 2002, OPEC may need to act as quickly to prevent prices from overheating as it did this year to prevent them from collapsing," CGES noted.

Oil price outlook: volatile stability

DRI-WEFA sees the short-term outlook for oil markets as one of "relative" price stability.

Such stability is relative because the forecast encompasses a high potential for volatility stemming from perceived or real mismatches in supply and demand-especially uncertainty about demand.

DRI-WEFA said OPEC's latest production cut will be offset by a weak global macroeconomic performance.

While demand rises in the second half, as it always does, the scope of that increase is uncertain. International Energy Agency has ratcheted back its forecast of demand for the seventh time this year and now sees worldwide demand rising by only 500,000 b/d in 2001 (OGJ, Aug. 20, 2001, Newsletter, p. 5).

DRI-WEFA said OPEC's most recent production cut sent a signal to markets that is expected to buoy its targeted marker oil price close to $25/bbl through January.

Other analysts have expressed concern that the OPEC action could mean a spike into a range near $30/bbl (NYMEX futures contracts) this fall and winter, but DRI-WEFA sees the cut as being necessary to keep oil prices from falling while overall demand remains weak.

By yearend, DRI-WEFA's forecast pegs the OPEC marker basket as struggling to meet the $25/bbl threshold that OPEC (and the Saudis in particular) wants. As yearend approaches, under this forecast, rising seasonal demand should be offset by rising non-OPEC production and stepped-up quota cheating from OPEC.

DRI-WEFA's forecast calls for global demand growth of 1.3% this year, more than IEA's forecast.

"Severe uncertainty reigns about macroeconomic performance over the next 2 quarters, as what had been seen as a temporary pause in the internet sector has now spread to telecoms, hurting a number of Asian economies and raising the specter of contagion," DRI-WEFA said. "Outside of oil-exporting economies, demand is expected to be weak and, in some areas, negative during the third quarter."

The two major pitfalls ahead for any upside forecast of oil prices are questions over the state of the global economy and the continuance of OPEC cohesion.

If, in fact, the US economy is starting to show real signs of recovery, the ripple effects are likely to be felt in Asia and Latin America-the currently worrisome trouble spots-as an improvement would tighten markets quickly in response to increased demand and an urgent need for restocking.

As for OPEC cheating, DRI-WEFA contends that this remains "more anticipated than actual."

Meanwhile, Saddam Hussein is likely to exploit tensions in the Palestinian-Israeli conflict while he also continues to test US resolve militarily in Iraq. He could again pull his oil-for-aid supplies off the market.

During the next 6 months or so, the average oil price likely will be about flat with what it is today. But there are apt to be a lot of jagged lines on that graph between now and then.

null

null

null

Industry Trends

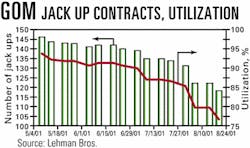

GULF OF MEXICO DAY RATES continue to weaken after already taking a measurable drop downward, contend analysts for Lehman Bros.

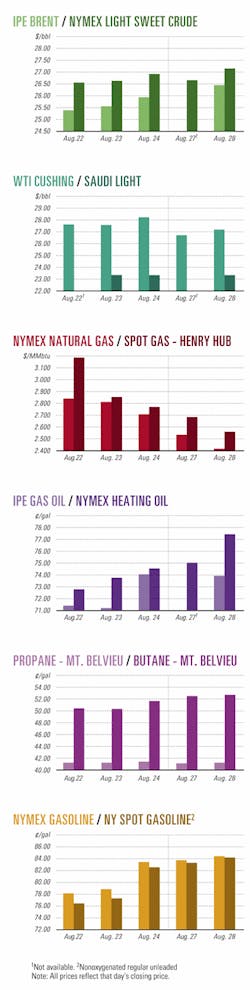

"We believe rates will continue to slide near-termellipse The Gulf of Mexico could firm by the late fourth quarter; however, we believe it is more likely that we will not see a significant pick-up in demand until 2002," Angelina Sedita and James Crandell said in an Aug. 20 research note (see chart).

Sedita and Crandell said the slowdown in drilling activity stems not only from declining natural gas prices but spent exploration budgets.

"Assuming gas prices hold, we believe most of the independents will be back in force next year with fully loaded budgets. Gas prices remain attractive by historical standards, and we believe the long-term macro recovery remains intact. Any slowdown in gas drilling activity today will only help to tighten supplies for tomorrow," they said.

But international day rates have exceeded the analysts' expectations.

All regions continue to be strong with demand rising, and day rates are escalating, with demand particularly strong in the Middle East and the Far East.

Five rigs already have left the Gulf of Mexico for work elsewhere. Gulf Marine and Noble Drilling each moved two rigs, while Chiles has moved one.

In addition, Transocean Sedco Forex is expected to move two out of the Gulf of Mexico to West Africa, India, or the Middle East, the analysts noted, adding, "The company will move the rigs without a contract, which is clearly a bold move; however, the strength of the international markets continues to surprise us, and incremental rig demand continues to build.

WEATHER DERIVATIVES are attracting more energy company interest.

Aquila has formed a strategic alliance with Australian investment bank Macquarie Bank to expand the global market for weather derivatives into Australia and New Zealand.

Aquila will assist Macquarie in the creation of a web-based weather-derivative pricing engine based on Aquila's existing model. Users can structure and price customized weather hedges worldwide.

Aquila recently formed a similar alliance with Mitsui Marine, a Japanese insurance company. The Kansas City-based wholesale distributor of electricity and natural gas has marketed weather derivatives in Europe for years.

Meanwhile, in a separate announcement, Williams announced a $10.6 million alliance to expand the University of Oklahoma's meteorology programs.

Williams will receive exclusive weather analysis and forecasts that executives say will provide "a globally competitive advantage" in energy marketing and trading.

Williams Chairman, Pres., and CEO Keith Bailey said, "With weather being the No. 1 driver of volatility in gas and power markets, we expect to see a significant return on our investment."

Government Developments

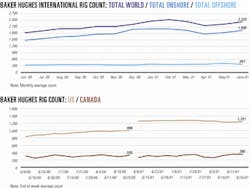

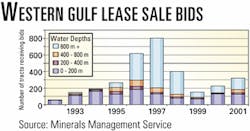

THE AUG. 22 LEASE SALE in the western Gulf of Mexico "didn't prove to be as spectacular as one might have thought," said J. Marshall Adkins, an analyst for Raymond James & Associates (see related story, p. 41).

"While the turnout certainly wasn't a bust, it was nowhere near the heydays of the 1996-98 period," Adkins said in a research note. "Perhaps near-term natural gas prices caused producers to keep the tension on their purse strings, or maybe they are just not searching for new prospects."

Total blocks bid on this year came in at 320, which was up nearly 42% over last year's western gulf sale but barely half of the 1996-98 average. Much of this difference reflected fewer bids on deepwater blocks (see chart).

"Clearly, the tempered level of spending on deepwater blocks was a large part of the reason that the total amount of high bids were only one third of what they averaged [in] 1996-98. How- ever, it is still surprising that overall spending this year was only up less than 10% over last year," Adkins said.

Producers were unwilling to spend as much money per block this year as they have in the past. The average price per deepwater block declined by nearly 45% over last year. In the shallow water, pricing was about flat, he said.

"With operators generating record levels of cash flows and running out of prospects, it would seem necessary to reload the prospect inventoryellipse[and] that doesn't appear to be the case," Adkins said.

PRODUCING US STATES received a record amount of mineral revenues-$656 million-during the first half of the year for their share of revenues collected from oil, gas, and other mineral development on federal onshore and offshore lands.

"If the current price and production trends continue, this will be an all-time record year," said Interior Sec. Gale Norton. "The money goes directly to the state treasuries, where they have full control over how it is used."

This year's 6-month amount surpassed last year's by $294 million. The total distributions for 2000 set a record at $800 million. The MMS collects and distributes the money.

States and the federal government share the mineral revenues from federal lands: 50% goes to the state, 40% to the Reclamation Fund for water projects, and 10% to the US Treasury. One exception, Alaska, gets a 90% share, as prescribed by the Alaska Statehood Act, an Interior release said.

Quick Takes

TOPPING REFINING NEWS, TotalFinaElf let three contracts worth a total 13 million euros to Bouygues Offshore unit Camom for three scheduled refinery shutdowns.

Camom, along with partner GTI Electro- mechanical, is already well into the 7-month preparation phase of its 8-month contract to shut down a unit at the 300,000 b/d Anvers, Belgium, refinery. That project is scheduled to be completed in October-November.

Camom also will work on two units at the 150,000 b/d Grandpuits, France, refinery. That project will take 10 months, including a 9-month preparation phase, to be completed in Feb- ruary-March 2002.

The company also is to work on four units at the 200,000 b/d Feyzin, France, refinery. That project will take 11 months, including a 10-month preparation phase, and is scheduled to be finished in March-April 2002.

WILLIAMS has hired Houston-based Chemical Market Associates Inc. (CMAI) to perform an international marketing evaluation as part of an Alaskan petrochemical feasibility study.

The planned study will gauge the economic feasibility of building gas processing and NGL enhancement facilities in Alaska as a catalyst for petrochemical development (OGJ Online, May 25, 2001).

The company is assessing numerous opportunities associated with a proposed pipeline to move Alaskan gas to the US Lower 48.

"Our preliminary analysis of the development of Alaska North Slope [natural gas] liquids indicates that extracting and cracking ethaneellipseto provide feedstock for a petrochemical plant is economically feasible under certain conditions," the firm said. "The portion of the study that CMAI is doing is one component of our formal evaluation that will analyze the global petrochemical markets."

Williams said it has formed a dedicated team to address issues related to an Alaskan natural gas pipeline, NGL extraction and enhancement, and regulatory, government, and community affairs.

In other petrochemical news, Methanex and BP have decided to proceed with construction of the $400 million, 1.7 million tonne/year Atlas methanol facility in Trinidad and Tobago. At the same time, Methanex postponed reopening of its Medicine Hat, Alta., methanol facility indefinitely. Methanex increased its interest in the proposed Atlas plant recently, bringing its holding to 63.1% (OGJ Online, July 5, 2001). BP will hold the remaining interest. Atlas will be built next to the existing Titan plant, in which Methanex holds 10%. Market delivery is expected by early 2004. Methanex said its equity contribution to the project will be about $100 million. The Vancouver, BC-based company will market the Atlas plant's production, half of which is already committed to Methanex, BP, and Air Products & Chemicals. Methanex said, "Atlas, with its very low capital and operating costs, will provide us with another outstanding production hub. Atlas is strategically located with abundant natural gas reserves and duty-free access to both the United States and Europe." Methanex announced plans in May to shut down its Medicine Hat methanol plant for 3 months starting July 1, to "balance production levels with global customer requirements." Now it says the plant's cost structure is noncompetitive. "Methanex expects to realize annual plant fixed and capital maintenance cost savings of approximately $10 million (US), as the plant will be mothballed and the plant's 95 employees relocated to other Methanex facilities or terminated," the company said.

COLUMBIA'S state oil firm Ecopetrol, PDVSA Gas, and Texaco inked a nonbinding memorandum of understanding to conduct a feasibility study to evaluate the construction of a natural gas pipeline linking Colombia and Venezuela.

The proposed 200 km line would connect Texaco's and Ecopetrol's infrastructure in the Guajira region off northeastern Colombia to Lake Maracaibo, Venezuela.

The three companies will form a project team to conduct the study over a 6-month period to determine the scope of the export project and pipeline construction budget.

If the project is deemed commercial, the parties will determine their participation in a joint development agreement for the pipeline's construction and a supply agreement for the sale of Colombian gas to Venezuela.

In other pipeline news, a draft accord on pipeline planning through the Northwest Territories is scheduled for release by mid-October, Canada's National Energy Board reported. The Pipeline Working Group, composed of the boards and agencies responsible for assessing and regulating energy developments in the Northwest Territories, will submit a progress report to the Ministry of Indian Affairs and Northern Development in early October. The draft cooperation plan will be submitted for public comment prior to approval by policymakers, NEB said. Parties with an interest in the MacKenzie Valley route have met since November 2000 to coordinate the review process for northern gas development. Work is currently under way on the elements of the draft cooperation plan, including information requirements for and establishment of clear linkages between the environmental assessment and regulatory review, regulatory procedural rules, resource sharing, and assurance of enhanced public access.

PetroChina plans to build a $36 million natural gas pipeline linking the northern city of Cangzhou and Zibo City in Shandong Province in the east. The 209 km, 508 mm line will move gas from PetroChina's Dagang field in the north to industrial users in Shandong Province. The pipeline is expected to come on line in first half 2002. PetroChina has signed contracts with Shandong customers to deliver 340 million cu m/year. The company is negotiating with Sinopec unit Qilu Petrochemical in Zibo, to shift fuel use from oil to gas. Qilu's projected use is 710 million cu m/year. PetroChina has a new gas pipeline between Dagang and Cangzhou. In the first half, Dagang produced 201 million cu m of gas, up 5% from the same period last year.

IN ALTERNATE FUELS action, Millennium Cell-a development-stage company that has created a proprietary technology to generate and store hydrogen-has signed a joint development agreement with Air Products & Chemicals.

The hydrogen generated and stored through this technology could be used in fuel cells or directly in internal combustion engines.

The agreement outlines the development of Millennium's process for converting sodium borates to sodium borohydride.

Millennium's proprietary 'hydrogen-on-demand' system generates hydrogen from sodium borohydride, leaving a sodium borate solution.

"Improving the efficiencies of recycling the sodium borate back to sodium borohydride is a keyellipsebusiness objective," the company said.

KINDER MORGAN plans a $16.3 million expansion project at its Houston-area liquids terminals.

The project will expand tank storage capacity at Kinder Morgan Liquids Terminals' Pasadena and Galena Park, Tex., facilities by 830,000 bbl from their current 16 million bbl. It will also enhance docking facilities and modify pipelines to accommodate loading and unloading capabilities.

The Pasadena-Galena Park complex is close to other pipelines, including the Colonial, Explorer, TEPPCO, Seaway, Longhorn, Eagle, Equilon, and Reliant systems.

"With customer growth and refinery expansion expected to continue, this program will allow us to enhance our service capabilities and prevent logistical bottlenecks in the Houston hub," Kinder Morgan said.

The company acquired the terminals in March, following its purchase of US product pipelines and liquids terminals from GATX (OGJ Online, Dec. 1, 2000).

Elsewhere in storage news, Sonatrach has awarded Sofresid, a subsidiary of Bouygues Offshore, a turnkey contract for the expansion of the Mesdar oil terminal in Algeria. The 42 million euro contract covers engineering, procurement, construction, startup, and commissioning of a pumping station for the Mesdar terminal near the giant Hassi Messaoud fields complex. This new pumping station will enable the transportation of 12 million tonnes/year of oil, which will be expandable to as much as 18 million tonnes/year. The Mesdar terminal will receive, store, and dispatch the crude coming from the fields through a 26-in. pipeline, called OH2.

Energy merchant Aquila and ArcLight Energy Partners Fund will jointly purchase for $220 million a company that is building a natural gas storage facility in northern California. Western Hub Properties owns the Lodi gas storage facility, one of two merchant storage facilities in the state. Aquila CEO Keith Stamm said the facility will help meet demand as gas-fired power plants come on line in 2002 and 2003. The Lodi project, scheduled to be completed in December, will store 12 bcf of natural gas with a planned injection rate of 400 MMcfd and withdrawal rate of 500 MMcfd. As a result, the facility will be able to cycle its inventory up to six times per year, compared with cycling rates of one or two times per year for most existing storage facilities. In January, independent power producer Calpine Corp., San Jose, Calif., said it had entered into a long-term firm agreement for daily deliverability at Lodi equal to about 20% of its western region peak-day gas requirements in 2002.

GLITNE OIL FIELD-the smallest Norwegian continental shelf discovery to be developed independently-has been brought on stream, said field partner Statoil.

The Norwegian firm said the Glitne development was based on the experiences gained from the North Sea's small Yme field, where production ceased earlier this year. As with Yme, another company is operating and producing oil from Glitne.

Glitne is on Blocks 15/5 and 15/6, about 40 km northwest of Sleipner field. Owners are Statoil 68.9%, TotalFinaElf 21.8%, and Norsk Hydro 9.3% (OGJ Online, June 28, 2000). Yme is on Blocks 9/1, 9/2, and 9/5 (OGJ Online, Nov. 23, 2000).

Petroleum Geo-Services (PGS) is producing Glitne from its Petrojarl 1 ship. Glitne contains around 25 million bbl of recoverable oil and has an estimated production life of up to 3 years, depending on oil prices.

PGS said initial peak production, about 40,000 b/d, would be moved to shore with the Petroskald shuttle tanker.

Among other production milestones, the first shipment of upgraded crude oil from the $790 million Cerro Negro extra-heavy crude oil upgrader complex in eastern Venezuela left port for the 182,500 b/d Chalmette, La., refinery late last month, said project partner ExxonMobil. The Venezuelan complex, which is at the eastern end of the Orinoco oil belt, started up in July. The 8.5° gravity crude produced at Cerro Negro is diluted with naphtha and transported by pipeline 190 miles to the port of Jose, where it is upgraded into a 16° gravity synthetic crude (OGJ, Jan. 22, 2001, p. 37). The upgrader's installed processing capacity is 120,000 b/d of extra-heavy crude, which it converts to 108,000 b/d of upgraded crude and byproducts such as sulfur and coke. Cerro Negro is an association formed by PDVSA 42%, ExxonMobil 42%, and Germany's Veba Oel 16%. ExxonMobil-led joint venture Operadora Cerro Negro operates the project on behalf of the partners. Production from the field began in October 1999 at an initial rate of 50,000 b/d of undiluted crude from 35 horizontal development wells.

Failure of a weld in Åsgard field prompted Statoil to shut down the Åsgard B platform in the Norwegian Sea until mid-October and postpone test production from another field. Earlier this year, Statoil discovered 72 weak welds in hubs on Åsgard field. It determined that only 24 of the welds had to be repaired. The flowline that leaked was one Statoil had considered unnecessary to repair. Because of the incident, Statoil has decided to repair the remaining 48 welds. Last month, Statoil said the leak from a gas flowline between Åsgard B platform and the Åsgard A ship prompted the temporary shutdown of Åsgard B and a reduction of production from Åsgard A (OGJ Online, Aug. 15, 2001). Condensate production from Åsgard B amounts to about 45,000 b/d, while gas output is dependent on customer nominations, said Statoil. Oil production on Åsgard A will be reduced to 145,000 b/d from 165,000 b/d as a result of the shutdown. No estimate was given on when the vessel could return to full production.