Asia-Pacific regional refining, product market growing

By the end of the 1990s, expansion of distillation capacity in the Asia-Pacific region appeared to be continuing. During 2000 and early 2001, an additional 0.5 million b/d crude distillation unit (CDU) capacity expansion came online in the region, bringing Asia-Pacific's total expansion to almost 2.6 million b/d just within the past 3 years.

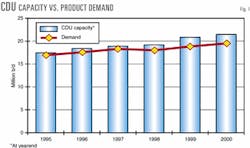

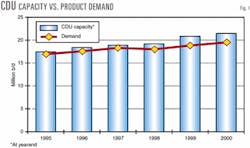

Although demand has rebounded from the 1998 slump, during the 3-year period the incremental CDU capacity additions dwarfed the incremental product demand of less than 1.2 million b/d (Fig. 1). Despite the large capacity increases, the Asia-Pacific region's total refining output was still less than total product demand, thus requiring some imports, mostly from the Middle East. Net imports, however, have been declining (Fig. 2).

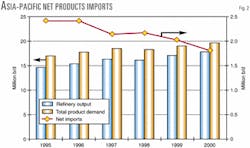

As Fig. 3 shows, during the late 1990s, the Asia-Pacific refineries' utilization rates peaked at 87% in 1997 but then declined due to the 1998 demand slump and the subsequent capacity expansion. The lower utilization rates toward the end of the decade indicated that there has been some surplus in the market.

This article concentrates on the supply side of the market, including the perceived economics of the Asia-Pacific refining industry.

Expansion outlook

Table 1 shows the concentrations of this past year's additions. BP Australia debottlenecked at its Bulwer Island refinery, increasing the distillation capacity at the refinery to 89,000 b/d. China and India finally took a break from CDU additions, but this seems to be only for the moment.

The Petronas condensate splitter at Kerteh also came online at 65,000 b/d. Pakistan's joint-venture Pak-Arab refinery came online early in 2001 and will help significantly decrease product imports.

Taiwan's Formosa Petrochemical Corp. (FPC) had its first 135,000 b/d distillation unit come online, with the other two 135,000-b/d units scheduled to come online in the next 12 months. Thai Petrochemical Industries also completed the 150,000-b/d addition to its Map Ta Phut refinery.

Downstream capacity additions increased relatively little compared with recent years. BP added 17,000 b/d of hydrocracking capacity at Bulwer Island, and China had some increases as well. FPC added a 69,000-b/d residual catalytic cracking unit along with some capacities of alkylation.

Distillate treatment and residual desulfurization increased somewhat, though mainly due to Chinese and some Indian efforts.

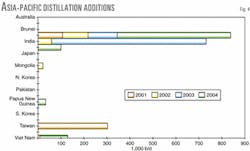

None of this, however, should be viewed as an end to the region's capacity growth; Fig. 4 shows what is expected through 2005. The only major CDU additions planned for this year are from the Chinese, with the bulk coming from Formosa Petrochemicals in Taiwan.

In 2002, there will be little CDU growth outside China and India, which will have minor increases. Mongolia hopes to add its first refinery sometime in 2002, but further delays could arise. Vietnam also has a small condensate splitter of 5,400 b/d that should be online in 2002. India will resurface in 2003 with nearly 700,000 b/d of firm capacity growth, 300,000 b/d of which will come from firm grassroots projects.

Beyond 2003, China will come back as the major player, adding nearly 200,000 b/d in 2004 and more than 300,000 b/d in 2005. In Indonesia, construction will most likely restart on the Tuban condensate splitter, slated for completion by 2005. Papua New Guinea and Vietnam will also join the ranks of Asia-Pacific refiners by 2005.

Fig. 4 contains only those projects likely to be completed by 2005, even though many other projects in the region have been discussed in various degree of detail.

While Fig. 4 does not include capacity closures or reductions, they will certainly continue to occur in the more developed Asia-Pacific refinery industries. Japan alone will shut down 140,000 b/d by the end of the year and reduce another 160,000 b/d of nameplate capacity. Nameplate capacity reductions should not be treated as capacity removals, however, because the capacity can easily be increased once margins improve.

Restructuring of the Japanese refining industry will continue, especially if the industry is to compete in an open market environment. This may translate to further reduction of up to 0.5 million b/d, and further plans will be revealed.

Australia will likely see the closure of two or more of its refineries by 2006 when the 50-ppm gas oil standard becomes law. In Singapore, ExxonMobil Corp. has effectively reduced capacity by 100,000 b/d this year, but again, that is only a reduction in nameplate capacity.

Firm additions in 2001-20 will likely be less than the regional incremental demand. By 2003-04, demand will surpass refinery capacity, suggesting that the supply economics may improve, i.e., there will be gradual improvements in refining margins. This assessment assumes that the current and forthcoming weak margins will deter new plans for capacity additions for a while.

Further, as fuel specifications are tightened, tentative plans for increases in sophistication should become firm. By 2003, incremental demand will be about 300,000 b/d larger than regional refinery capacity; incremental demand to remain 300,000 b/d over capacity through 2005.

Although many plans are on the books, the materialization of capacity expansion beyond 2005 will depend on the market situation. Although growth may not be as vibrant as it used to be, petroleum product demand in the Asia-Pacific region will continue to grow as the engine of global oil markets.

Increasing demand is not enough, however, to justify future capacity additions unless supply economics improve.

Supply economics

The economics of supplying petroleum products largely depend on the refining margins. The lower refinery utilization rates of the overall region indicate some surplus in the market, resulting in relatively weak refining margins. In the short run, the materialization of the additional capacity may deteriorate margins even further unless refinery runs are restrained.

Although each refinery faces its own market characteristics and may have certain advantages or disadvantages compared with its competitors, an assessment of gross refining margins (GRM) of a typical refinery in the international market can provide some indication of profitability of the business.

Even in the economies where profitability is not the objective, the international market prices and margins represent the opportunity costs of the refinery operation.

When GRMs do not warrant the long-term operation of a refinery, it will have to depend on other measures such as trade protections, e.g., higher import duties or government subsidies.

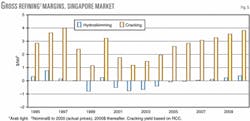

Fig. 5 shows historical and forecast gross refining margins in the Singapore spot market. Because everyone calculates margins differently, Fig. 5 is useful only to indicate year-to-year trends.

As shown, during 1995-97, GRM improved and thus provided the incentives for the refinery capacity additions. In 1998, GRM slid along with the slump in demand amid continued increases in refining capacity. Margins plummeted in 1999 before recovering in 2000.

The improvement was largely supported by a few unusual events that disrupted the supply. The fire that crippled Kuwait's 460,000-b/d Mina Al-Ahmadi refinery was by far the most influential; the incident may easily have increased cracking GRMs in excess of $1/barrel due to a tighter market.

Other incidents include the prolonged problems at Indonesia's 122,000 b/d Balongan refinery. This was amid higher demand that necessitated not only more imports but also forced Indonesia to enter into a crude processing deal with Shell Singapore's refinery in Singapore.

Another contributor to higher margins was a delay in the commissioning of Unit No. 2 at FPC in Taiwan. Mina Al-Ahmadi's distillation capacity is being slowly brought back on stream, although the crackers are not yet fully operational. The complete rebuilding of the refinery may not occur until 2003.

Still, the return of output from the refinery, together with the return of Balongan, which is now fully operational (leading to cancellation of the processing deal in Singapore), resulted in margins becoming soft in first quarter 2001.

GRMs will likely get worse before they get better when additional capacity in the short term materializes (Fig. 4). Once incremental demand catches up, gradual improvements will likely occur in GRMs. The reversal can start as early as 2003. This assumes that the current and forthcoming weak margins will deter new plans for capacity additions, especially for grassroots projects.

The authors

Widhyawan Prawiraatmadja is a senior associate and project director with Fesharaki Associates Consulting & Technical Services Inc. (FACTS), Honolulu, and is director of projects for East West Consultants International Ltd. He also is coordinator of the petroleum market and refining project of the East-West Center energy program. Prawiraatmadja also serves on the board of the Indonesian Institute for Energy Economics. Before coming to the US in 1989, he was energy division manager with PT Redecon in Jakarta. He holds an MA in economics from the University of Hawaii and a BS in industrial engineering from Bandung Institute of Technology, Indonesia.

Robert Smith is a senior associate at FACTS Inc. and a researcher at the East-West Center in Honolulu. He holds an MA in Asian studies from the University of Hawaii and a BA from Johns Hopkins University, Baltimore.