Kerr-McGee hedges deepwater GOM strength with broader global portfolio, onshore US gas acquisition

Kerr-McGee Corp. continues to broaden its offshore exploration and production portfolio around the world while it consolidates its deepwater Gulf of Mexico base.

Since 1947, the Oklahoma City-based company has sought to set the pace for exploration in the Gulf of Mexico. Kerr-McGee was the first company to drill a well out of sight of land, on Ship Shoal Block 32 in the gulf in November 1947.

Today, the deepwater gulf remains Kerr-McGee's core area of exploration, and the company ranks as the top US-based independent leaseholder in the gulf.

It also has a core E&P area in another offshore stronghold: the UK North Sea. And it is wading into the Asian offshore theater with a burgeoning program in the South China Sea.

But Kerr-McGee took a big step toward strengthening the third leg of the E&P "stool" that comprises its core upstream businesses when it acquired HS Resources Inc., San Francisco, establishing the firm as a top player in the sizzling onshore natural gas play in the US. Kerr-McGee completed that $1.7 billion acquisition in early August (OGJ Online, Aug. 7, 2001).

In addition, the company has producing fields in the South China Sea and onshore in the US Midcontinent, Ecuador, Indonesia, and Kazakhstan.

While Kerr-McGee prefers to identify itself as an E&P independent-a course it hewed to since exiting the refining-marketing business some years ago-it still retains a comfortable niche in the titanium dioxide pigments business, where growth prospects remain attractive.

Exploratory focus

Kerr-McGee attributes its exploratory program success to focusing on the most attractive projects in proven core areas, then building up its leasehold positions, working interests, and capital investments through partnerships and strategic al- liances in those core areas.

"We continue to emphasize the offshore because we have the technical expertise and the talent to capitalize on that particular area," said Luke R. Corbett, Kerr-McGee chairman and CEO. "If you look at us today, we are the No. 1 independent, as far as leaseholds in the Gulf of Mexico [are concerned]. We are also the No. 1 independent with regards to deepwater leaseholds in the Gulf of Mexico. In addition to that, we emphasize the UK sector of the North Sea as a core areaellipse and we are the No. 1 independent with regards to operations in the UK sector of the North Sea. So those are two core areas that you will see us continue to emphasize."

Regarding the Gulf of Mexico deep water, Corbett noted, "Strategically, we look within the prospective basins there, and essentially, we are leveraging our success to high-quality prospects and high-potential trends-where we understand the play concepts-and we'll take meaningful working interestsellipseso that when we have a discovery, it will have a significant impact on our company and certainly create value for our shareholders. We do the very same thing in the UK sector of the North Sea.

"In addition, we've leveraged our deepwater talents in the deepwater basins around the world," Corbett continued. "You'll see us [off] Gabon, Brazil, Nova Scotia-just to name a few. So, we are quite active in other countries around the world, again based on our deepwater technology and understanding of what makes the deepwater basins work."

In 2000, Kerr-McGee's reserves totaled more than 1 billion boe-an increase of 18% from the previous year. Production last year averaged about 207,000 b/d of oil, and natural gas sales averaged 530 MMcfd. At yearend 2000, the company held an average interest of 52% in about 58 million gross acres worldwide. Of these, about 32 million acres were in high-potential deepwater-greater than 1,000 ft-trends around the world.

Gulf of Mexico arena

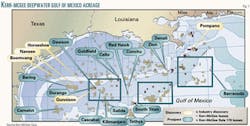

Drilling successes and acreage acquisitions during 2000 solidified Kerr-McGee's position as the leading independent in the deepwater gulf. By yearend 2000, the company held interests averaging 64% in 314 blocks covering 1.7 million acres in the gulf.

The company further consolidated its leadership role in the gulf at the latest western Gulf of Mexico federal lease sale. It was the top bidder in Sale 180, participating in 55 bids. Kerr-McGee and partners were the high bidders on 42 blocks, with the company incurring a total net exposure of $32 million for all apparent high bids. Award of all the new blocks would increase the company's total gulf leasehold by 236,655 acres to nearly 3 million gross acres.

"These new leases complement our existing prospect inventory in the deepwater gulf and fit our strategy to build core operating areas within high-potential trends," said Corbett. "We will operate 90% of these high-bid blocks with an average working interest of about 80%, allowing us to continue to enhance our successful exploration and development program."

One of Kerr-McGee's first ventures into the deepwater gulf was the Pompano project, which began production in 1994 from a fixed platform in 1,300 ft of water. In 1996, Neptune field was developed with the world's first production spar in 1,930 ft of water, followed by Baldpate field in 1998 with the installation of the first articulated compliant tower in 1,650 ft of water.

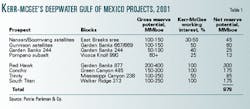

In late 1999 and early 2000, Kerr-McGee made several deepwater discoveries in the Nansen, Boomvang, and Gunnison areas.

Nansen and Boomvang were discovered in 1999 on East Breaks Blocks 602 and 643. Gross reserves for the area are estimated at 200 MMboe. The world's first two truss spars, which will link to oil and gas export lines, are being built, and first production is slated for early 2002.

Gunnison field, discovered in 2000 on Garden Banks Block 668 in 3,150 ft of water, has the potential to become the processing hub of another core area. Gross reserves for the field are pegged at 150-250 MMboe, and appraisal drilling is under way (Table 1).

"The discoveries of the Nansen, Boom- vang, and Gunnison fields support Kerr-McGee's deepwater strategy of focusing on multiprospect areas on trend with major industry discoveries," the company said. "The goal is to reduce development costs through sharing of infrastructure."

In 2000, the Gulf of Mexico accounted for about 27% of the company's oil production and 55% of its natural gas sales volumes. With a 5-year inventory of drillable prospects in the gulf, Kerr-McGee plans to drill 11-13 exploratory wells this year. These prospects will expose the company to about 1.5 billion bbl of potential gross reserves.

Onshore US

Onshore production in the US continues to play a major role in Kerr-McGee's operations. The company's primary focus is onshore exploitation and development of natural gas reserves.

Last year, 32% of the company's natural gas sales and 9% of net oil production came from US onshore fields. About 75% of Kerr-McGee's onshore production is along the Texas Gulf Coast, in the Permian basin of West Texas and southeastern New Mexico, and in Oklahoma.

The acquisition of HS Resources has provided Kerr-McGee with a singular opportunity to dramatically boost its US gas reserves base and to better balance its overall oil and gas portfolio, Corbett noted: "This transaction fits our strategy to build a balanced portfolio of quality oil and gas assets that offer meaningful upside potential. It adds long-lived natural gas reserves, concentrated near one of the fastest-growing energy markets in the US, and creates another core operating area for our company that provides lower-risk exploitation opportunities.

"In addition to quality assets, the acquisition brings us a very successful exploration and production team that adds value for our company, and we plan to retain substantially all of the HS Re- sources' operating personnel."

Proved reserves acquired in the deal are estimated at 1.3 tcfe, purchased at a cost of $1.10/Mcfe. In addition, Kerr-McGee acquired gas gathering systems, undeveloped acreage, and other assets valued at about $300 million.

The acquired reserves increased Kerr-McGee's proved US gas reserves by 77% and increased the company's reserve life for US natural gas by about 2 years. Kerr-McGee's total proved reserves will increase by 20%. The acquisition also changes the ratio of oil to gas in the company's re- serves mix to 57:43 from 64:36. In North America, Kerr-McGee's natural gas production will jump to 59% of its overall hydrocarbon production stream as its US gas sales climb by more than 45%

HS Resources had been the largest operator in the Wattenberg field area in the Denver-Julesberg basin of northeastern Colorado, working the prolific trend for almost 20 years.

"An amazing number of opportunities are available in this field," said Lonny Towell, Kerr-McGee vice-president of acquisitions. "That's what makes it such a valuable addition to our portfolio. HS Resources has identified more than 10,000 projects to optimize future value. These in- clude new wells, deepening of existing wells, recompletions, and stimulating production by fracturing a producing formation. Each is defined precisely on a schedule that shows in detail the work required, the costs, and the expectations. They're accomplishing 500-600 of these per year."

Wattenberg wells produce from as many as six reservoirs at depths of 4,000-8,000 ft.

HS Resources extended its Wattenberg operations to en- compass field services, gas gathering, and gas processing in an area covering more than 600 sq miles, in a bid to bolster control of costs and operating efficiencies.

"HS Resources can move quickly because they use both their own and contractors' equipment," Towell said. "They are relentless in their efforts to control costs. Rather than shopping for the standard, they set the standard in well service."

The Wattenberg assets offer the potential to add more than 800 bcf of gas from probable and possible reserves, said Kenneth Crouch, Kerr-McGee senior vice-president, oil and gas exploration and production: "In addition, HS Resources has a successful exploration program along the gulf coasts of Texas and Louisiana that will supplement Kerr-McGee's existing onshore operations in that area."

North Sea

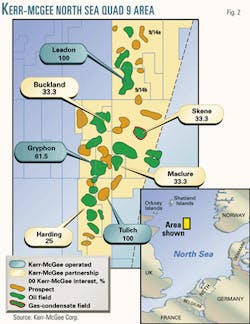

In 2000, the North Sea accounted for 57% of Kerr-McGee's oil production. "The focus in this area is on continued growth through the lower-risk exploration of mid-sized targets, exploitation in and around producing fields, and acquisitions in existing core areas," the company said.

Two important core areas for the company are the Janice and Gryphon fields. Janice came on stream in 1999, and production from the field began 17 months after receiving government approval. With a 50.9% interest in the field, Kerr-McGee developed the 72 MMboe field with a floating production unit in 240 ft of water.

In 1993, Gryphon field was discovered, with Kerr-McGee holding a 61.5% interest. The field was developed using the North Sea's first permanently moored floating production, storage, and offloading facility. The company set a UK North Sea record for fast-track development, with first production starting 10 months after government approval.

In January 2000, operations in the area surrounding Gryphon field were expanded with the company's acquisition of Repsol-YPF SA's North Sea upstream business. Shortly thereafter, the company discovered Leadon field on Blocks 9/14a and 9/14b-15 miles north of Gryphon field. The company obtained Block 9/14b through the acquisition of Gulf Canada Resources Ltd.'s North Sea assets in 1998, and in 1999 it ac- quired the adjoining Block 9/14a.

The Leadon project is among the largest development projects currently under way in the UK North Sea. Kerr-McGee is developing the Leadon area-a multifield development that includes Birse and Glassel fields-using subsea horizontal wells tied back to an FPSO.

Combined reserves for the fields are estimated at 120-170 MMboe, with initial production slated for 2002. The company, which holds a 100% interest in Leadon, operates the blocks.

"When we bought Gulf Canada Resources, the upside potential associated with that acquisition was Leadon it- selfellipseas a prospect," said Corbett. "They had certain ideas, but they saw [the pros- pect] as a small accumulation. Our geoscientists, based on our experience, actually saw that we had this [much larger] kind of opportunity. We drilled, we were right, and now we are developing that field and, as a matter of fact, the ships are being outfitted in Newcastle-on-Tyne [UK].

"Hopefully, we'll sail out some time in the fourth quarter and start commissioning and hookup procedures there. But that's one of the few times, and [I] think that it may be the first time, where an independent's been ableellipseto say we are developing a 100 million bbl oil field in the North Sea 100%."

Other non-US E&D

Other non-US exploration opportunities expanded significantly in 2000 for Kerr-McGee, namely in China's Bohai Bay and in larger deepwater blocks off Canada, Benin, Morocco, and Australia. In 2000, the South China Sea and the company's onshore producing fields in Ecuador, Indonesia, and Kazakhstan accounted for about 7% of its oil production.

"About half of what we do now is international," said Corbett. "Particularly if you consider the UK sector of the North Sea as a international project area. We did a basin analysis some 15 years ago. We went and looked at all the sedimentary basins around the worldellipsethere are some 630 basins out there. We moved it down to about 100 that made sense for Kerr-McGee, then we prioritized that to about three dozen."

"So, at any point in time, you'll see us move in and out of international basins only because that is when the opportunity presents itself," Corbett added. "If it meets our strategic plan, meets our matrixes, we understand the play concept, and we can have meaningful impact in that area, you'll see us move into those countries. You saw us move recently into Morocco [and] Nova Scotia. Those are areas where we have looked at, touched, and felt for some period of time, and the opportunity presented itself."

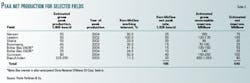

In China's Bohai Bay, Kerr-McGee holds over 1.4 million acres in shallow water. The company in 1999 made a second discovery on Block 04/36 with estimated reserves of more than 100 million bbl of oil. Another Bohai discovery, on adjacent Block 05/36, was made in 2000. Appraisal drilling is under way at both blocks to evaluate the discoveries, and production could begin as early as 2003 or 2004 (Table 2).

"Our relationship goes back to '93-'92 with the Chinese-and we've just had a great relationship on the professional level with the Chinese," Corbett said. "They've worked well with usellipseAll with the drilling activity that we've accomplished over there, they've been our partner. They have worked with us hand in hand. They pay their bills, so from a partner standpoint and a JV standpoint, we've had a great relationship."

In Australia, Kerr-McGee's deepwater holdings are about 9.9 million acres, with interests of 25-50%. The company has a 11.2% interest in the Bayu-Undan gas reinjection-liquids development in the Timor Sea. The $1.4 billion project in the Zone of Cooperation between Australia and Indonesia was slated to start production in 2004 but recently hit a snag over legal, fiscal, and tax issues with the East Timor government (OGJ, Aug. 6, 2001, Newsletter, p. 9). Reserves for the area are estimated at 3 tcf of gas and 300 million bbl of condensate and NGL.

Chemical business

In addition to its successful oil and gas E&P operations, Kerr-McGee is the third-largest producer and marketer of titanium dioxide pigment, which is an opacifier and whitener for paint, plastics, paper, and various other consumer products. In 2000, the inorganic white pigment accounted for 91% of the chemical unit's operating profit of $185 million.

The company operates six plants, in Hamilton, Miss., and Savannah, Ga., in the US; Kwinana, Australia; Uerdingen, Germany; Antwerp, Belgium; and Botlek, the Netherlands.

During the past 3 years, acquisitions and plant expansions have practically doubled the company's pigment business. In 2000, production capacity rose by 60% to 535,000 tonnes/year with the acquisition of pigment plants in Georgia and the Netherlands.

Kerr-McGee's largest pigment facility, located in Mississippi, has the capacity to produce 188,000 tonnes/year by using the company's proprietary chloride technology.

"The proprietary chloride technology is one of Kerr-McGee's most valuable assets," the company said. "Chloride-process pigment represents about 70% of the production from the six plants, which have combined gross capacity of more than 600,000 tonnes/year."

Growth strategy

This year, Kerr-McGee budgeted $1 billion for field developments and other capital projects, compared with the $651 million spent on capital projects in 2000. An additional $205 million is budgeted for exploration expenses. The company plans to drill 30-35 exploratory wells worldwide-including 10-15 in water depths greater than 1,000 ft-and at least 10-12 appraisal wells are planned around the world.

"Three years ago we reestablished ourselves with a new strategic plan, and we decided at that point that we wanted to be an upper-quartile independent E&P player and we wanted to be an upper-quartile inorganic chemical participant-titanium dioxide pigment being our main product," said Corbett.

"We put a plan together to accomplish just that, and over the last 3 years, I think that, if you followed us, you've seen that, through a series of acquisitions, mergersellipseexpansions, some trades, and some swaps, we've accomplished that. We've gone from about $3.2 billion in assets to almost $8 billion in assets today, with two high-quality businesses-oil and gas exploration and production and titanium dioxide pigment."

"We continue to follow our strategic plan. Certainly, we are capable of responding to outside influences, and we modify that from time to time," Corbett continued. "But our mantra is speed, clarity, and focus. You will hear our whole team talk about those three words: Clarity in the sense that we know what our mission and purpose is and that is to create value for all our shareholders; focus in the sense that we believe we can be an upper-quartile player in both exploration and production and in titanium dioxide marketing and production; and speed in the sense that we not only have the discipline to make good decisions, we can do that in a very timely manner."

"...Our mantra is speed, clarity, and focus. You will hear our whole team talk about those three words: Clarity in the sense that we know what our mission and purpose is and that is to create value for all our shareholders; focus in the sense that we believe we can be an upper-quartile player in both exploration and production and in titanium dioxide marketing and production; and speed in the sense that we not only have the discipline to make good decisions, we can do that in a very timely manner."

Chairman, CEO

Luke Corbett