Independents and deep water rule western Gulf of Mexico lease sale

The eastern reaches of the Garden Banks area drew the largest concentration of bids at the Aug. 22 sale of US federal oil and natural gas leases in the western Gulf of Mexico.

Discoveries, developments, and infrastructure now dot the northeast portion of Garden Banks, and companies came to the sale to advance development and exploration aspirations there.

Bidding by independent companies and deepwater potential dominated the sale, which drew $165.6 million in high bids for 320 tracts out of 4,114 offered.

The 386 bids submitted by 50 participating companies totaled nearly $190 million, officials reported. It was the fourth largest federal lease sale in a decade, in terms of the number of leases that drew bids.

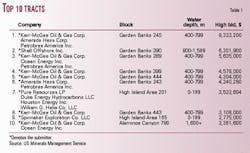

"This sale saw spirited bidding activity by the independent oil and gas companies. The top three companies in submitting bids were independents: Kerr-McGee Oil & Gas Corp. (55 bids), Spinnaker Exploration Co. (35 bids), and Amerada Hess Corp. (31 bids)," said Tom Kitsos, acting director for the Minerals Management Service (MMS) which conducted the sale in New Orleans.

Bids on 272 blocks faced no competition. By water depth, 125 bids went for blocks in 0-199 m of water, 18 for blocks in 200-399 m, 41 for blocks in 400-799 m, 93 for blocks in 800-1,599 m, and 43 for blocks in 1,600 m or more.

Garden Banks activity

The stiffest competition and the highest bids were for blocks in the deep waters in the Garden Banks area out to 800 m water depth, MMS officials reported.

The highest single bid was $8.3 million, $1,445/acre, for Garden Banks Block 245, submitted jointly by Kerr-McGee, Amerada Hess, and Petrobras America Inc. There was no other offer for Block 245, formerly held by Shell Offshore Inc. It is southeast of Amerada's undeveloped Northwestern discovery in 1,261 ft of water on Block 200.

The second highest bid was $6.3 million by Shell for Garden Banks 390, one of the four blocks drawing the most bids during the sale. It lies 2-5 blocks east of Cooper and Llano fields.

Three other bids were submitted for that block, and the next highest was only $516,000, said officials at Andersen-formerly Arthur Andersen Inc.-in its first internet webcast of a federal lease sale.

Other blocks drawing top bids included: Garden Banks 289, $5.6 million by Kerr McGee and Ocean Energy Inc.; Garden Banks 399, $4.6 million, Kerr McGee; and Garden Banks 444, $4.3 million, Kerr McGee.

Block 289 adjoins Block 245 to the south. Block 399 is in the northwestern part of Garden Banks and diagonally northwest of Block 444.

Garden Banks Blocks 204 and 205 generated the most competition with six bids each. Westport Resources Corp. was the top bidder for Garden Banks 204 at $1.1 million, beating out the closest competing bid of $750,000 by LLOG Exploration Offshore Inc.

However, LLOG Exploration submitted the high bid of $2.1 million for Garden Banks 205, fending off a joint offer of $1.3 million by Noble Affiliates Inc. and Walter Oil & Gas Corp. and a $1.2 million bid by Newfield Exploration Co. Amerada Hess acquired LLOG Exploration earlier this year.

Blocks 204 and 205 are southwest and south, respectively of Block 161, now operated by Devon Energy Corp. Devon acquired Pennzoil Exploration & Production Co., which cut more than 220 ft of pay in three intervals at a wildcat drilled on Block 161 in late 1996 (OGJ, Feb. 3, 1997, p. 34).

Company summaries

Kerr-McGee was the biggest spender at the sale, its 55 bids totaling $37.5 million, including 41 apparently successful high bids totaling $32 million.

"These new leases complement our existing prospect inventory in the deepwater gulf and fit our strategy to build core operating areas within high-potential trends," said Luke R. Corbett, Kerr-McGee chairman and chief executive officer. "We will operate 90% of these high-bid blocks with an average working interest of about 80%, allowing us to continue to enhance our successful exploration and development program."

Kerr-McGee is the largest independent leaseholder in the Gulf of Mexico, as well as in its deep waters. If awarded those additional blocks, Kerr-McGee will hold interests in 377 deepwater blocks in the gulf and will operate more than 75% of those leases with 51% average working interest.

Anadarko Petroleum Corp. was apparent high bidder on 26 tracts, all for 100% working interest, mostly in the southeastern Port Isabel and southwestern Alaminos Canyon areas. Twenty-two of the leases are in the Alamo minibasin, where Anadarko has proprietary 3D seismic coverage and sees exploration potential. Anadarko holds 330 gulf leases including 69 deepwater blocks.

Ocean Energy and partners, apparent high bidders on 17 blocks, said they were strengthening positions near existing exploratory holdings. Ten blocks are near Ocean's Red Hawk wildcat drilling on deepwater Garden Banks Block 877, and four blocks are in Alaminos Canyon near Unocal's Trident discovery on Block 903 in the Perdido fold belt.

Kerr-McGee described Red Hawk, about 20 miles east-southeast of Conoco Inc.'s Magnolia discovery on Block 783, as a geologic play similar to its Gunnison discovery 100 miles west on Garden Banks Block 668 (OGJ Online, Apr. 24, 2001).

Unocal Corp. units were apparent high bidders on five shelf and 12 deepwater blocks, some of them on trend with Trident, where it will soon spud an appraisal well. The Alaminos Canyon bids were $221,876-255,776/block.

Unocal also said it plugged a wildcat on the Ponza prospect on Keathley Canyon Block 774, held confidential since March for competitive reasons. The well reached its objectives and cut hydrocarbon zones but does not appear to hold commercial pay, Unocal said. Evaluation of data from Ponza continued.

Spinnaker's bids included 11 for deepwater tracts.

Gap, royalty bidding

MMS officials reported bids for some blocks in the extremely deep waters of the so-called "western gap," an area delineated by a new US-Mexico boundary agreement. However, no bids were submitted for the 53 "gap" tracts held over from the central gulf lease sale in March (OGJ, Apr. 9, 2001, p. 36).

"We also saw some bidding that was in response to our deep gas initiative in shallow water," Kitsos said. As in the earlier central gulf lease sale, the federal government is offering a royalty suspension on the first 20 bcf of gas production from below 15,000 ft subsea on those western gulf leases.

MMS officials will now evaluate the high bids on each block to ensure the public receives fair market value before awarding a lease.