OGJ Newsletter

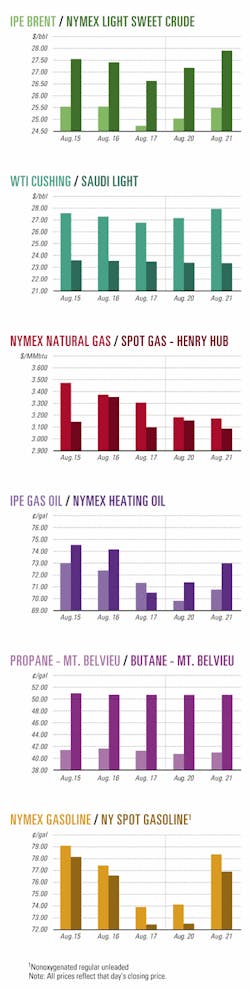

Market Movement

Natural gas storage surplus continues to build

The year-over-year surplus of US natural gas in storage continues to climb (see chart).

For the week ended Aug. 17, AGA reported injections of 86 bcf, vs. 50 bcf the week before, said Salomon Smith Barney. The figure compares with a 55 bcf injection a year ago and a 50 bcf injection in 1999. Gas storage levels now stand at 2.419 tcf, about 327 bcf higher than year-ago levels.

Coinciding with the release of these most recent figures, AGA revised upward to 50 bcf its initially reported 3 bcf injection for the week ending Aug. 10. The revision was attributable to the eastern consuming region, which was adjusted from a 12 bcf withdrawal to a 35 bcf injection, Salomon noted.

The most recent injection figures fell well within the analyst's 80-90 bcf forecasted range, it said. "Consequently, the adjusted pace of injections-adjusted for temperature, nuclear, and hydro supply variances-over last year remains in the 4-5 bcfd range that has persisted since mid-May," Salomon said.

Injections will have to average 1.6 bcfd higher than in 2000 for the rest of the season in order for storage levels to reach 3.2 tcf, it said.

Hurricane season forecast

Despite Tropical Storm Chantal dropping a heavy dose of rain over Mexico's Yucatan Peninsula early last week, at presstime, the storm appeared to pose no immediate threat to gas production in the US Gulf of Mexico, Salomon noted.

Salomon said that a report released out of Colorado forecast the current hurricane season to be "above average." Although not expected to be as active as in 2000 or the year before, the season, which extends through November, is forecast to contain 12 named storms-3 of which could be considered major hurricanes. The report forecast a 39% chance of a major storm making landfall along the Gulf Coast, Salomon reported.

"We would note that Gulf Coast hurricanes can often reduce natural gas demand-due to cooler temperatures and power outages-as well as disrupt supply," Salomon noted.

Gas market poised for weakened price period

Just how bearish should the US natural gas market be in light of rising domestic gas production?

While the effects of a decline in US gas demand owing to high prices, fuel-switching, and a slowing economy have already been well-documented, there is much greater uncertainty over the role of rising US natural gas production. Increased gas output has certainly been a factor, as record natural gas drilling activity has spawned a jump in wellhead production that has been estimated as high as 3-4% for the full year.

Lehman Bros., for one, suggests that the sharp rise in US gas production is beginning to have a significant impact on supply, perhaps partly offsetting the positive impact of recovering gas demand stemming from the price slump (OGJ, Aug. 20, 2001, Newsletter, p. 7).

Lehman Bros. also estimates that Canadian production is up about 8% from a year ago. Coupled with the continuing storage overhang and weak demand, the analyst contends the market could be headed toward a prolonged period of weak natural gas prices.

Meanwhile, Canadian natural gas exports to the US are projected to rise about 1.1 bcfd in the second half of this year, compared with the same time a year ago, said Raymond James & Associates.

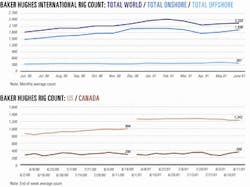

Drilling slowdown

However, there are also signs that gas-related drilling activity may have peaked for now. Even as the blistering heat wave in the US Midwest and Northeast buoyed spot gas prices above the critical $3/Mcf threshold, there are indications that a longer-term improvement is on the horizon, according to UBS Warburg.

It cites recent shrinkage in the US gas rig count, coming in response to the decline in prices. Earlier this month, the US gas rig count fell by 3 units to 1,047, compared with the recent high on July 13 of 1,068. This development "could suggest that the market has peaked near-term."

Even if drilling activity levels had continued to climb, eventually they would have hit a wall regardless of the price of gas. Infrastructure, equipment, and personnel constraints likely would have capped the industry's ability to keep ramping up production past the short term.

null

null

null

Industry Trends

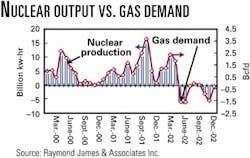

Increased nuclear power generation may be the driver behind the "exceptionally high" natural gas injection numbers seen over the last 3 months, according to Raymond James & As- sociates.

The fi- nancial analyst has un- earthed "compelling evidence" to support its theory. "For startersellipseincreased nuclear power production, as a supply-driven reaction to high electric power prices, has increased dramatically over the past 18 months," RJA said.

As year-over-year nuclear power production-related differentials have continued to rise, the need for gas-fired electric generation has been effectively offset, RJA reported (see chart).

"Relative to natural gas, nuclear power has reduced gas-fired electric [power] demand by 1.5-2.5 bcfd over the past 6 months and should peak at about 3.5 bcfd late this fall," the analyst said. "This, we think the market is beginning to understand.

"What the energy markets do not seeellipseis the fact that nuclear power production is about to reach a peak and then drop off dramatically through the course of 2002. In our minds, the nuclear mystery has been solved, and the death of the natural gas cycle could prove short-lived," RJA said.

LED BY PLUNGING energy prices, US consumer prices experienced the largest decline in 15 years in July, the US Department of Labor recently reported.

The Consumer Price Index, the government's main inflation indicator, fell 0.3% in July, its first decline since April 2000 and the biggest since April 1986. A 5.6% month-to-month decline in energy prices, the biggest since April 1986, accounted for much of July's decline in inflation. Other government reports suggested it's possible energy prices have done most of their unwinding for the year and could flatten or turn back up.

DOL reported gasoline prices slipped 11% in July, also the biggest monthly drop since April 1986. Nationwide, average pump prices have been falling since they peaked May 18 at $1.76/gal.

However, the US EIA, in a separate weekly survey, found gasoline and diesel fuel prices ticked up Aug. 13 for the first time in several months. Jonathan Cogan, an EIA spokesman, reported the US price of gasoline averaged $1.392/gal, compared with $1.376/gal the previous week.

Likewise, the average price of retail diesel fuel rose to $1.367/gal from $1.345/gal the previous week.

"The steady decline we have seen since May may have ended," Cogan said. "This is the first reversal we have seen in quite a while. But we can't predict a reversal in a trend we have been seeing based on 1 week's survey," he said.

Government Developments

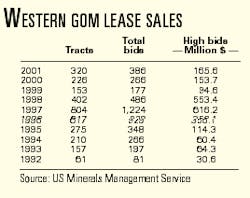

INDEPENDENT PRODUCERS and deepwater bids dominated the Aug. 22 federal sale in the western Gulf of Mexico, which drew $165.6 million in high bids for 320 tracts.

The sale was the fourth-largest federal lease sale in a decade in terms of the number of leases that drew bids (see table). The 386 bids submitted by 50 companies totaled nearly $190 million.

The top three companies in submitting bids were Kerr-McGee with 55, Spinnaker Exploration with 35, and Amerada Hess with 31.

The highest single bid was $8.3 million for Garden Banks Block 245, submitted jointly by Kerr-McGee, Amerada Hess, and Petrobras America. There was no other offer for that block. The second highest bid was $6.3 million by Shell Oil for Garden Banks 390.

UNOCAL has confirmed in SEC documents that the FTC is investigating a complaint alleging the company's reformulated gasoline patents are anticompetitive.

Separately, the US Office of Patents and Trademarks said it has opened an examination into the Unocal gasoline patents.

FTC would not comment on the investigation or when it might reach a conclusion.

ExxonMobil and the National Petro- chemical & Refiners Association had asked FTC to investigate the issue (OGJ Online, May 9, 2001).

ExxonMobil said, "We contend Unocal gained a monopoly over a legally mandated product, and there are antitrust issues."

Last spring, the Supreme Court upheld Unocal's reformulated gasoline patent rights by refusing to hear an appeal.

ExxonMobil and other oil companies have argued that Unocal participated in an industry-government consortium to develop cleaner burning gasoline and then used the information to obtain patents for RFG blending processes. Unocal denies the allegations.

Some refiners have agreed to pay Unocal's patent fees, but others are "blending around" the patents with less-efficient processes.

VENEZUELA is trying to gain support for its new draft hydrocarbon law, which has aroused industry concerns-particularly over those parts that reserve upstream activities to the state and sharply increase royalty rates.

Venezuela's US Ambassador Ignacio Arcaya, in a speech to the World Trade Center of New Orleans last week, claimed the new law would allow private firms operating in Venezuela to participate-for the first time since nationalization in 1975-"clearly and uncontrovertibly in 'primary activities,' that is, exploration, extraction, transport by special means, and storage of nongaseous hydrocarbons." Private firms will be allowed to participate in such activities as minority shareholders in state-private joint-venture companies.

Private companies currently participate in Venezuelan E&D, production, and integrated heavy oil ventures via risk or profit-sharing arrangements.

Quick Takes

BONGA FIELD DEVELOPMENT off Nigeria is advancing apace.

Single Buoy Moorings, a contractor for Shell Nigeria, has awarded Coflexip Stena Offshore International (CSOI) part of the installation package for Bonga field in 1,100 m of water 120 km off the Niger Delta's southwestern coastline.

CSOI's contract covers project management, engineering, procurement, transportation, and installation of three dynamic 2.3 km flexible oil offloading risers between the floating production, storage, and offloading vessel and a single point mooring buoy.

This will be the first use of flexibles this long as export risers, CSOI said, adding that the flexibles will be built during 2002. The offshore work is slated for 2003. The Shell unit-the project's operator-holds 55% of Bonga on behalf of Nigerian National Petroleum Corp. Partners are Esso 20%, Agip 12.2%, and Elf 12.5%.

In other development news, Bluewater awarded CSOI a contract for design and supply of subsea components and related services for development of Sable field in the Bredasdorp basin off South Africa. CSOI will design, supply, and install the subsea facilities at Sable, including production risers and umbilicals. CSOI also will install Bluewater's three-bundle mooring system and will install an FPSO in about 100 m of water. Plans call for Sable to be developed with four producers, one water injector, and one gas injector. Production start is slated by late 2002.

BP has submitted to authorities a 4.2 billion kroner ($470 million) development plan for Valhall Flanks field off Norway. The plan calls for an unmanned platform to the north and one to the south of the existing field development. The unitized Valhall field is on Blocks 2/8 and 2/11. The development will add 127 million boe to Valhall's estimated 950 million bbl of recoverable oil, with 420 million already produced. BP expects first oil in the first quarter of 2003. BP operates the Valhall unit with 28.09%. Partners are Amerada Hess 28.09%, Enterprise Oil 28.09%, and TotalFinaElf 15.72%.

Greka Energy reports success with its first development well. The newly established New York City-based independent tested its Haspel & Davis No. 1 well in Potash field in Plaquemines Parish, La., last week after directionally drilling the well to 10,604 ft TD beneath a large salt overhang in inland waters. The well, to be completed in an oil zone and a gas zone, has another eight pay zones behind pipe. Initial production in early September is pegged at 3 MMcfd and 350 bo/d. Prior to this well, Greka had conducted only workovers and redrills in Potash field.

CHEVRON HAS STARTED oil production from North Nemba platform on Block 0 off Angola.

North Nemba is expected to peak at 50,000 b/d of oil in second quarter 2002 and is projected to average 40,000 b/d for the year.

Nemba field, about 37 miles west of the Malongo terminal, is being developed through two production platforms, South and North Nemba. Both have gas compression facilities and secondary recovery through rich-gas injection.

The North Nemba drilling program includes nine producers and three gas injectors. Before crude production began, a gas injection well was drilled to minimize gas flaring during commissioning and start-up. The start-up comes only 18 months after the original topsides for North Nemba was lost en route from a South Korean shipyard. Chevron contractors fabricated a new topsides and related processing facilities in only 9 months.

Elsewhere on the production front, Shell E&P has begun production from Brutus field in the Gulf of Mexico. The Brutus tension leg platform is on Green Canyon Block 158 in 2,985 ft of water. Production was 25,000 b/d of oil and 35 MMcfd of gas from the first well. Shell expects peak production of 100,000 b/d of oil and 150 MMcfd of gas from the project in second quarter 2002. Gross ultimate recovery is estimated at 250 million boe. The eight-slot Brutus TLP will serve as a hub for future subsea developments. Shell owns 100% of the project.

Statoil has awarded Kværner Oil & Gas a 380 million kroner ($41.3 million) contract to boost gas treatment capacity on Gullfaks A platform in the North Sea. The project will boost gas exports by 4 million cu m/day starting Oct. 1, 2003. Design work was to have started immediately. Offshore modification will begin in 2002 and continue to fall 2003. The Gullfaks satellites' Phase II project is developing gas reserves in the Gullfaks South and Rimfaks satellites, which will be produced via Gullfaks A and C.

SINOPEC HAS LOWERED its refinery run target for 2001 by 2.8% to 105 million tonnes.

As of July 31, Sinopec had 6.5 million tonnes of oil stocks. Officials attributed the high inventory level to lower demand for products during the first half.

Sinopec wants to reduce the stocks to the normal level of less than 5 million tonnes by the end of the third quarter. Runs in the first half were 51.9 million tonnes, 0.2% higher than a year ago.

In other refining news, Citgo said its Lemont, Ill., refinery could be down for 6 weeks pending repairs to its fire-damaged crude unit. Citgo said the fire happened early Aug. 14, and a distillation tower experienced structural failure on Aug. 17. The total estimated loss is $25 million, Citgo reported. No injuries resulted from the fire or the structural failure at the 158,650 b/d refinery. Cause of the fire remains under investigation.

CHINA STATE FIRM CNOOC has signed an agreement to invest in a joint venture to develop a natural gas distribution network in Zhejiang Province. The agreement is with Zhejiang Energy Group.

The JV, Zhejiang Natural Gas Development (ZNGD), involves Zhejiang Energy Group, Nandu Group Holding, Zhejiang Power, and CNOOC.

ZNGD will construct, operate, and manage natural gas pipelines and the intraprovincial distribution of natural gas. It also will develop a gas-fired power plant and other related infrastructure.

In other pipeline news, TransCanada Pipe Lines and St. Clair Pipelines withdrew their applications to build part of the Canadian Millennium pipeline. Last month, TransCanada PipeLines said completion of the proposed $1.35 billion (Can.), 551-mile line from Dawn, Ont., to Westchester County, NY, could be delayed for more than a year due to regulatory setbacks (OGJ Online, July 10, 2001). Canada's NEB reported that the companies cited unexpected delays in regulatory approvals for the US Millennium Pipeline Project and uncertainties regarding marketing and commercial activities. In December 1998, St. Clair applied to construct and operate the Millennium West pipeline-a 36-in., 74 km Ontario line from Sarnia to Patrick Point. That same month, TransCanada applied to construct and operate the Lake Erie Crossing pipeline, which would interconnect with the Millennium West Pipeline at Patrick Point and extend 97 km across Lake Erie to connect with the proposed Millennium Pipeline Co. line in Lake Erie. The two projects together were known as the Canadian Millennium Pipeline Project.

MICROTURBINES are now burning methane gas from a closed landfill installation in Los Angeles, claimed to be the largest facility of its kind.

Capstone Turbine developed the microturbines for the 50-microturbine plant, which began operating Aug. 16. It's a joint venture between the Los Angeles Department of Water & Power (DWP) and the South Coast Air Quality Management District.

Each turbine generates 30 kw of electricity for a combined total of 1.5 Mw of electricity. Landfill gas that would otherwise be flared is harnessed via the landfill's piping network. The gas is used to power the microturbines, which in turn generate electricity. The $4 million project will also eliminate 10,000 lb/year of NOx emissions, equal to permanently removing 500 cars from southern California roads, said DWP.

In other alternate fuel news, two Japanese companies have acquired business development and technology licensing rights to ethanol technology from BC International. Marubeni and Tsukishima Kikai are interested in licensing and sublicensing the technology in Southeast Asia and Japan. They also acquired the exclusive sales and marketing rights for technology yet to be commercialized by BCI. BCI develops ethanol from organic waste or biomass. It owns pilot facilities for biomass ethanol technology development in Louisiana and plans to construct a commercial bioethanol manufacturing plant that will use sugar cane residue as a feedstock.

IN PETROCHEMICAL NEWS, BP said it will close its low-density polyethylene manufacturing operations at Wilton on Teesside, UK.

Citing difficult market conditions, BP said the plant, with a capacity of 100,000 tonnes/year, will cease production around Oct. 1. The plant will be dismantled and the land cleared in 2002.

BP will fulfill its commitments with LDPE supplied from other plants or under third party agreements.

Chevron Phillips Chemical and PDVSA unit Pequiven have signed a letter of intent for a feasibility study on whether to build a styrene monomer plant in Paraguana, Venezuela. The feasibility study, slated to be completed by yearend, will evaluate construction of a proposed plant having a capacity of 500,000 tonnes/year. If approved, plant operations could start in 2007. The proposed plant would use the infrastructure and feedstock streams of the Paraguana refining complex and would use Chevron Phillips Chemical's styrene marketing operations.

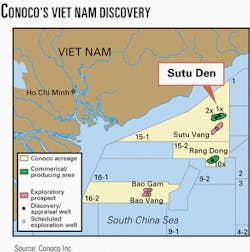

CONOCO HAS DECLARED commercial the Sutu Den discovery off Viet Nam. First production is expected in less than 3 years.

The decision was based on three wells on the Sutu Den (Black Lion) prospect, Conoco said. The discovery well, 15-1-SD-1X, flowed 12,600 b/d of oil from three zones; appraisal well 15-1-SD-2X flowed 11,032 b/d, based on combined well tests from two major pay zones in the fractured basement and Miocene reservoirs; and 15-1-SD-2X sidetrack well flowed 13,223 b/d of 36° gravity oil from the fractured basement.

The 1.15 million acre Block 15-1 is in the Cuu Long basin, 120 miles southeast of Ho Chi Minh City. The block is operated by the Cuu Long Joint Operating Co. Conoco owns 23.25%, Pet-rovietnam 50%, Korean National Oil 14.25%, SK 9%, and Geopetrol 3.5%.

In other exploration news, DNO Heather began drilling an exploration well on Block 2/5 in the UK North Sea. The well is 7.5 km southwest of Heather platform, also on Block 2/5, and aims for a target in the adjacent Block 2/4. DNO owns 100% of both blocks. The well will test oil potential of an Upper Jurassic structure at the western edge of the North Viking graben. If a discovery is made, it will be tied back to the Heather platform. F Shell Brasil, Texaco Brasil, and Petrobras have discovered oil in the Santos basin 125 miles southeast of Rio de Janeiro. The discovery well, 1-SHEL-4-JRS, is in 5,099 ft of water and was drilled to a depth of 13,485 ft. The well encountered 223 ft of net oil pay in Tertiary sands. Initial results indicated the oil is low-gravity crude. Operator Shell Brasil and Petrobras each hold 40% interest in Block BS-4 with Texaco Brasil 20%.