Moving to ethanol use instead of MTBE to have major impacts

A move away from the use of methyl tertiary butyl ether to the use of ethanol as a blending component in gasoline would have a profound impact on a number of petroleum-dependent industries.

The agricultural and agricultural processing industries, for example, would be "dramatically transformed" by the substitution of corn-derived ethanol for MTBE due to the increase in ethanol demand, according to a report released late last month by New York City-based ratings firm Fitch IBCA, Duff & Phelps.

The effects of such an oxygenate switch on the refining and marketing sector, meanwhile, would be "mixed," while chemical producers would experience a primarily negative impact from the swap, Fitch said.

Fitch added that the credit impact of these three industry segments would likely be "modest," with the bulk of the financial impact manifesting itself through "potentially increased capital expenditure requirements."

In addition, any alternate oxygenates that would take the place of either MTBE or ethanol would not have a significant chance for adoption, Fitch said.

Impact on agriculture

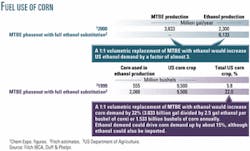

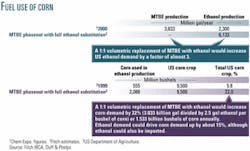

In its report, Fitch calculated that a 1:1 volumetric replacement of MTBE with ethanol would increase ethanol production capacity from about 2.3 billion gal/year to roughly 6.1 billion gal/year (see figure).

"Ethanol capacity would have to increase dramatically to meet blending requirements if federal legislation mandating a 2 [wt] % gasoline oxygen content is not lifted, as MTBE is banned at the state level," the firm said.

Fitch reckoned that the impacts of either partial or complete replacement of MTBE by ethanol on the agricultural and agricultural processing sector would likely include:

- The potential increase of US corn demand by as much as 15%-an amount that could be enough to send corn prices higher.

- The phaseout of the ethanol subsidy-so long as the use of MTBE was banned entirely, and ethanol was made the replacement oxygenate.

- An increase in ethanol imports would likely offset any benefits of increased US ethanol demand.

If new plants were constructed to aid in meeting increased demand for ethanol as an additive, Fitch observed that the amount of corn required to serve as feedstock for increased ethanol production would have to rise "dramatically."

"The US currently exports roughly 20% of its corn production," Fitch reported. "The widespread adoption of ethanol would significantly decrease corn exports and probably result in significantly higher corn prices, which could, in turn, undermine the economics of ethanol as a motor fuel."

Furthermore, Fitch said that any adoption of ethanol as a replacement oxygenate would have to be completed in phases, since "production capacity and logistics simply [would] not allow such a rapid rollout.

"Nevertheless, in a 2 to 3-year time frame, significantly increased ethanol usage could have a meaningful effect on corn prices, which would benefit corn producers but would cost an estimated $2-3 billion in subsidies," Fitch continued.

Impact on R&M sector

Fitch based its mixed outlook for refining and marketing businesses on the basis that the downstream sector has been cognizant of the potential ban on MTBE for a number of years.

"In response, refiners have sought out alternative uses for the vast array of equipment currently used for MTBE production," the firm reported.

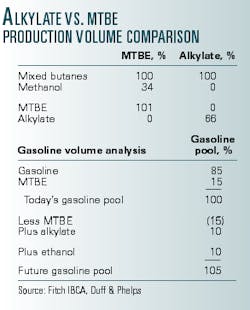

As an example of their perceived foresight, Fitch noted the conversion of some refiners' equipment from the production of MTBE to that of alkylate.

Fitch observed: "A conversion to alkylate would only make up for a maximum of two thirds of the lost volume from elimination of MTBE. This is because methanol is not used in the alkylation process, so the finished volume of alkylates is ultimately reduced byellipseone third vs. MTBE production (see table)."

Although this conversion process would offset volume reductions in the short term, refiners would have to incur capital expenses for the equipment alterations.

Fitch made the following conclusions regarding the effects that converting to ethanol would have on refiners:

- In the near term, the reduction in supply of a large-volume gasoline additive would tighten gasoline supplies, thus helping refining margins.

- In the long term, demand for crude oil and refinery utilization rates would decrease due to the substitution for gasoline by ethanol.

- New ethanol supply sources-and particularly imports-would likely emerge to help meet increased demand.

- Refiners could face new capital expenditure requirements to offset ethanol's higher Reid vapor pressure, especially if federal standards are not loosened.

Impact on chemical sector

Fitch noted that an ethanol-MTBE additive swap would have an overall depressive impact on the chemical industry. There are two main factors behind this finding:

- A potential ban on MTBE would significantly reduce methanol demand, which would most heavily impact "high-cost" producers in the US. With limited amounts of new methanol capacity expected in the near term, methanol supply and demand are presently in balance. Therefore, methanol supply and demand may not be as severely affected as anticipated.

- Most negatively impacted would be those chemical companies with MTBE plants, which would likely be shut down in the event of an all-out ban on MTBE. MTBE plants might then be converted to produce such fuels as synthetic gasoline.

"Based on a 3% global growth rate for methanol demand," Fitch said, "it appears methanol demand" will grow by close to 1 million tons/year.

In conclusion, Fitch noted that a ban on MTBE-although certainly striking a blow to high-cost producers-would "by no meansellipsesound the death knell of the North American methanol industry."

Alternate adoption

There are other alternate oxygenates that could be substituted even for ethanol, Fitch noted, but none that would be readily adopted for various reasons.

Tertiary amyl methyl ether and ethyl tertiary butyl ether would likely face similar groundwater issues as MTBE.

Meanwhile, tertiary butyl alcohol could be used, but the substance is not in sufficient supply to meet potential demand.

And the organometallic octane enhancer MMT-although containing oxygen-is not commonly thought of as a proper source of oxygen.