OGJ Newsletter

Market Movement

OPEC may have cut production one time too many

Are oil markets headed for another price spike in the second half, thanks to the latest OPEC cut?

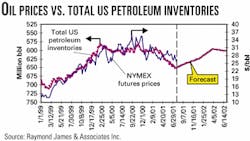

Raymond James & Associates analyst John Gerdes said a dramatic build in second quarter petroleum inventories initially appears to supports the view that the oil market is oversupplied.

"However, looking behind the numbers, it becomes apparent that we may again experience an undersupplied market condition in the upcoming heating season," he said.

Given a historical correlation between oil inventories and oil prices, RJA modeled projected changes in oil inventories as a guide to the future direction of crude prices (see chart).

Demand typically rises during the second half, Gerdes noted. Compounding the situation is that the second quarter oil inventory build "appears to have been artificially inflated by significantly higher year-over-year oil product imports," he said.

Gerdes foresees "the potential for an upward surprise in oil prices over the next 6-8 months and the potential need for OPEC to increase oil output in the fourth quarter."

RJA's price forecast calls for $25/bbl NYMEX crude in the third quarter and $26/bbl in the fourth quarter, climbing to $29-30/bbl early next year.

"In addition, stronger crude oil prices should translate to higher residual fuel oil prices and increase the likelihood of fuel switching to gas, correspondingly increasing the longer-term bullish prospects for gas prices," Gerdes said.

Will fuel-switching bolster gas prices?

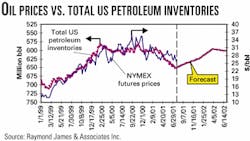

The $3/MMbtu floor for natural gas prices continues to hold, thanks to a brutal heat wave scorching the US Midwest and Northeast.

How long that floor holds remains largely up to the weather and the prospect of continuing firm oil prices spurring fuel-switching back to gas from fuel oil. Record power loads in the Midwest in the past few weeks have weighed heavily on the rate of gas injections into storage but not enough to keep the year-to-year storage surplus from growing again.

For August, US average spot prices are estimated at $3.06/MMbtu, only 2¢ more than last month and a startling 67¢ below the same time a year ago. Even a record heat wave affecting a number of key market hubs could only buoy prices a little bit.

What's been especially surprising is the failure of industrial gas demand to rebuild, suggesting the lingering effects of the economic slowdown as well as the fuel-switching situation.

It's likely that the oil production cut that OPEC announced for Sept. 1 will have some effect in the fall, as oil prices strengthen more when those cuts filter through the system into October. As heating oil stocks are built up in anticipation of the heating season, look for that component of the market to tighten again. The overall effect of increased demand will be to lift both crude and heating oil prices, making natural gas more attractive by comparison. Some analysts are predicting a return to $30/bbl NYMEX crude as early as this fall, so that prospect may spawn a flurry of fuel-switching back to gas.

The rebound in industrial demand will then recoup some of the lost demand natural gas has seen this year. Another contributing factor that could nudge gas prices back up would be if cooling loads continue to stay strong in the Midwest and Northeast. Even if injection rates drop down to the usual seasonal level of 50 bcf/week in the weeks to come, the US gas storage surplus could easily remain at 400 bcf year-on-year. Absent weather events or oil price shocks affecting gas supply or demand, respectively, and thus causing the rate of injection into storage to throttle back more, the market is likely to see gas storage end the heating season next year well into surplus.

Pace of gas storage injections remains strong

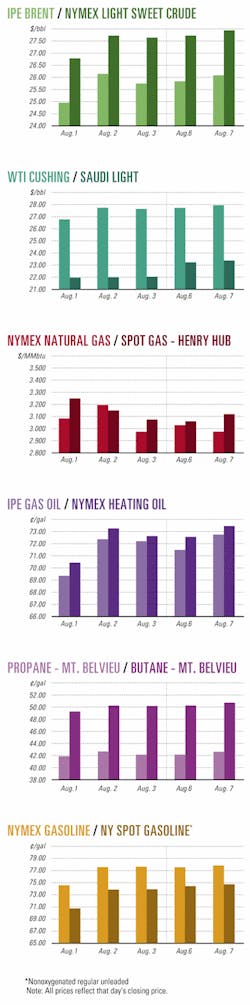

Robert Morris of Salomon Smith Barney said the adjusted pace of gas storage injections, adjusted for temperature and nuclear and hydro supply variances, vs. last year has remained at the 4-5 bcfd level that has persisted since mid-May.

AGA reported injections of 80 bcf for the week ended Aug. 3, compared with injections of 65 bcf the same week last year, 45 bcf in 1999, and 77 bcf in the previous week.

null

null

null

Industry Trends

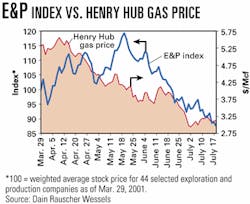

PRODUCERS' STOCK PRICES ARE DROPPING AS US GAS PRICES FALL.

That word comes from Dain Rauscher Wessels: "Exploration and production companies' stock prices continue to trend lower in 2001, as plunging natural gas prices and lofty service costs portend less-than-stellar profit margins in the second half."

Meanwhile, the drop in gas prices has brought a softening in rig demand. "This is especially true in the overheated plays onshore and in the Gulf of Mexico. With any luck, a softening in activity, and therefore service costs, will follow."

Higher service costs mean producers are spending more to accomplish the same amount of drilling.

"What intrigues us more will be the outlook for 2002," the analyst said, adding that fall budget meetings for 2002 capital outlays "should be an indicator of managements' outlook for service costs and commodity prices going forwardellipseWe believe the reigning commodity prices of the day will greatly steer the budgeting process."

Dain Rauscher Wessels has forecast gas prices averaging $3.15/Mcf in the third quarter. "We would expect capex budgets in 2002 to be down from 2001 levels. This would be in line with our flat-to-lower cash flow expectations" for 2002.

HIGH US GAS SUPPLY COUPLED WITH SOFT DEMAND COULD PROLONG WEAK GAS PRICES.

Thomas Driscoll, Lehman Bros. analyst, said increasing gas storage inventory might partly offset the positive impact of recovering gas demand.

"If we see continued evidence of strong supply growth over the remainder of the year, we should expect to see a prolonged period of 'weak' natural gas prices ($2-3/Mcf) and lackluster E&P share-price performance," he said.

He predicted the overhang of gas storage could approach 700 bcf by the end of the year, adding that gas storage levels are climbing because of higher drilling activity.

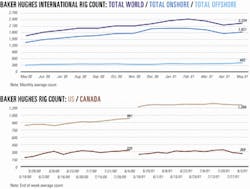

"The rig count may need to fall to below 700-800 rigs to cause gas production to contract," he said, noting that as few as 700 gas rigs might be needed to keep production flat.

Baker Hughes's weekly rig count as of Aug. 3 showed 1,047 rigs drilling for gas in the US.

Meanwhile, Robert Morris of Salomon Smith Barney said second quarter results from 36 of the 40 largest public producers have confirmed his previous assessment that US gas production will be up around 3.5% over 2000.

Government Developments

PERU'S ENERGY MINISTER WANTS PETROPERU PRIVATIZATION COMPLETED BY THE END OF 2003.

Jaime Quijandria made that announcement upon taking office as Peru's new energy and mines minister. The privatization involves the petroleum and electric power sectors. Some 40% of Peru's electric power sector remains to be privatized.

Quijandria said he has a tentative privatization schedule, although he has yet to discuss it with the government's privatization commission.

The government-owned Petroperu assets to be privatized are the 200,000 b/d North Peruvian pipeline, the 60,000 b/d Talara oil refinery, and the smaller Iquitos, Conchan, and Milagros refineries.

A US firm and a Latin American company have already expressed interest in buying Petroperu's refineries, officials said (OGJ Online, June 22, 2001).

Many of Petroperu's assets, including oil fields, were privatized in the mid-1990s. But the state oil company continues to operate its remaining properties and recently expanded into gasoline stations buying fuel exclusively from the Talara refinery.

ALASKA HAS SCHEDULED AN OCT. 24 NORTH SLOPE, BEAUFORT SEA LEASE SALE.

The Alaska Division of Oil and Gas said the North Slope areawide sale will offer 1,225 state tracts totaling 5.1 million acres between the Canning River and the Arctic National Wildlife Refuge on the east and the Colville River and National Petroleum Reserve-Alaska on the west.

The southern boundary is the Umiat Meridian baseline, and the northern border is the Beaufort Sea coastline. Leases will be for 7 years, and minimum bids are $5/acre. About 700 tracts will carry a one-sixth royalty and the rest one-eighth.

The Beaufort Sea areawide sale will offer 573 tidal and submerged tracts totaling nearly 2 million acres between the Canadian border and Point Barrow.

About 125 of those tracts will be offered for 10-year terms and a one-eighth royalty. The rest will be for 7 years and a one-sixth royalty. The minimum bid for all Beaufort tracts is $10/acre.

US INDUSTRY QUIETLY ACCEPTED A 5-YEAR EXTENSION OF IRAN-LIBYA SANCTIONS.

President George W. Bush has signed a 5-year extension of the Iran-Libya Sanctions Act. The original 1996 act, which allowed the US to punish companies or countries that invest more than $20 million/year in the oil sectors of Iran or Libya, would have expired Aug. 5 (OGJ Online, Aug 3, 2001).

Upon signing the act, Bush said sanctions should be reviewed frequently. The administration had sought only a 2-year extension. But the measure passed by overwhelming margins in both the House and Senate, allowing Congress to override the president's action if necessary.

Meanwhile, industry groups said little in reaction. "We don't have to react to everything that Congress and the president do. Our position is well known," said an API spokesman.

Quick Takes

THE BOHAI CENTURY FPSO IS SET TO DEVELOP AN OIL FIELD OFF CHINA.

One of the world's largest floating, production, storage and offloading (FPSO) vessels, the Bohai Century was designed and built in less than 2 years. The vessel, 287 m long and 51 m wide, has a shallow draft of 14 m.

Texaco and partners say completion of the FPSO brings the development of the Qinhuangdao (QHD) 32-6 oil field closer to production, slated for start-up this year.

This month, the FPSO will be towed to the field 20 km off northeastern China. The QHD 32-6 project is a partnership between CNOOC, Texaco, and BP.

Dalian New Shipyard constructed the hull, and China Offshore Oil Engineering constructed the topsides. The FPSO is designed to process 80,000 b/d with oil storage capacity of 1 million bbl. CNOOC will operate the field with a 51% interest. BP and Texaco each have a 24.5% interest.

Elsewhere in China, Sinopec said a recent horizontal well has upgraded the production capacity of Jiannan gas field near southwestern China's Chongqing City.

Sinopec unit Jianghan Oilfield drilled Jianping-1 to 4,646 m in late July. It flowed 210,000 cu m/day of gas. Sinopec said it is China's longest horizontal well, with a displacement of 1,046 m.

The combined Jianghan-Jiannan fields, in central China's Hubei province, produce 91 million cu m/year of gas and 870,000 tonnes/year of crude.

In other development action, Total Libye, a TotalFinaElf subsidiary, has awarded two turnkey contracts for facilities in Field B on Block 137 off Libya to two consortiums. The field was discovered in 1975 and confirmed in 1998. Total Libye serves as operator with 37.5%. Partners are Libyan National Oil Corp. 50% and Wintershall 12.5% (OGJ Online, Feb. 5, 2001). A $54 million contract covers engineering, procurement, construction, and installation of a 1,700 tonne platform with a three-story deck and 6,200 tonne jacket. The consortium handling this contract consists of Bouygues Offshore, Rosetti Marino-Bouygues joint venture Rosbos, and Stolt Offshore. The platform will be able to produce 35,000 b/d of oil. Delivery is expected in late 2002. A second contract awarded to Doris Engineering covers engineering, procurement, construction, and installation of a cable drum, mooring system, and topsides for the FPSO. Equipment delivery is scheduled for mid-2002.

SPINNAKER EXPLORATION DISCOVERED GAS AND CONDENSATE AT ITS STIRRUP PROSPECT IN TEXAS GULF OF MEXICO STATE WATERS.

The Mustang Island 861 No. 1 was drilled to 17,123 ft in 54 ft of water 25 miles south of Corpus Christi.

After stimulation, one sand flowed on test at a rate of 21.1 MMcfd of gas and 130 b/d of condensate at more than 11,000 psi flowing pressure. Two other sands were tested and found pay, but results were not disclosed. The well tested Middle Frio sands.

Spinnaker said it established the geologically oldest production on the continental shelf west of the Mississippi River. Additional drilling will be required to delineate the discovery. The well has been shut in pending design and fabrication of a production platform, related facilities, and a flow line.

In other exploration news, Canadian Natural Resources (CNR) said a recently drilled well in the Ladyfern area of British Columbia is capable of producing more than 100 MMcfd from the Slave Point formation. The d-74-G/94-H-1 well is similar in productive capability to the c-82-G/94-H-1 well, tested in May at 150 MMcfd. Ladyfern came on stream May 17 (OGJ Online, June 18, 2001). Production from the area is limited by pipeline capacity; the c-82-G/94-H-1 well is producing only 55 MMcfd. This year, CNR expects to spend $78 million (Can.) on the Ladyfern area, where it holds 100% interest in 30,000 acres of undeveloped land.

EGYPT AND LIBYA HAVE FORMED A $100 MILLION OIL AND GAS PIPELINE COMPANY.

After more than 5 years of negotiations, the two countries created the Arab Co. for Oil & Gas Pipelines to transport crude to Egypt and gas to Libya.

Egypt's General Authority for Investments approved formation of the joint company. Work was to begin immediately on fixing the route of the proposed pipeline.

Egyptian Petroleum Minister Sameh Fahmy said Libya's National Oil Co. and EGPC would each provide 50% of the capital for the new firm. Fahmy said initial investment would be around $20 million.

Libyan oil would be refined in Cairo and Alexandria. Egypt, which estimated its proven gas reserves at 50 tcf, wants to become a gas export hub.

In other pipeline happenings, Shell Petroleum Development awarded a consortium led by Stolt Offshore a contract for offshore pipelines associated with construction of Shell's gas gathering system off Nigeria. The consortium includes DSNL, a subsidiary of the Adamac group of companies in Nigeria. Construction of the system involves installation of 88 km of 24-in. pipeline from Forcados-Yokri fields to the Bonga OGGS riser platform and 18 km of 16-in. pipeline from South Forcados to the riser platform. A 264 km, 32-in. trunkline, including 8 km onshore, to connect to the Bonny Island LNG plant, also will be installed. This is the largest trunkline to be constructed off West Africa to date, Shell said.

Sonatrach awarded a $70 million contract to ABB Lummus Group for the extension and renovation of oil pipeline pump stations in Algeria. The project, scheduled to be completed in 30 months, is part of government efforts to increase Algeria's crude oil transportation capacity to 1.5 million b/d by 2004, compared with less than 1 million b/d currently.

Ecuador and Peru have resumed talks on the possibility of Petroecuador using surplus capacity in Peru's 200,000 b/d North Peruvian pipeline to pump crude oil from its fields near Peru's northern border to the Bayovar marine terminal on Peru's north coast. Petroperu currently uses one third of the pipeline's capacity, transporting oil from Blocks 1AB and 8, both operated by Argentina's Pluspetrol. The two blocks' production in June averaged 59,230 b/d. The pipeline project discussions were revived when energy officials from Peru, Ecuador, and Colombia met Aug. 6 to discuss interconnection of power lines among the three countries.

DYNEGY PLANS TO BUILD A SECOND NATURAL GAS PROCESSING PLANT IN CHICO, TEX.

The 150 MMcfd facility will be built next to an existing plant and will bring capacity at Chico to 250 MMcfd. Commercial operation will begin in second quarter 2002.

Dynegy executives said the new plant is a response to processing opportunities from increased drilling and production activity in the Barnett shale formation in North Texas. Through long-term contracts, Dynegy has the right to gather, compress, and process gas volumes from more than 100,000 acres in the Barnett shale province.

In other gas processing developments, the Statpipe joint venture led by Statoil has tentatively awarded M.W. Kellogg a gas plant upgrade contract. The Statpipe system links fields off Norway to the continental European gas market. The 70 million kroner ($7.75 million) contract is to provide engineering, procurement, and construction assistance for a proposed capacity upgrade at the Karst gas processing plant near Stavanger. Final sanction of the upgrade is expected this month. The upgrade will be needed to handle the reception of rich gas from Mikkel field in the Norwegian Sea, beginning in 2003. The field has received gas production approval, though the plan of development and operation is still being prepared. Statoil has 25% interest in Statpipe. Other partners are Petoro (formerly the state's direct financial interest) with 33.25%, TotalFinaElf 12%, ExxonMobil 12%, Norsk Hydro 10%, Royal Dutch/Shell 5%, and Conoco 2.75%.

PETROCHINA PLANS TO BUILD THREE CATALYTIC REFORMERS AND SIX HYDROTREATERS.

In a restructuring of its downstream division, PetroChina has outlined a construction program while it also plans to close several refineries with a combined capacity of 320,000 b/d by 2005 (OGJ Online, July 31, 2001).

The nameplate capacities of the three reformers are: 12,000 b/d each at Jinxi Petrochemical Corp. and Dalian Petrochemical Corp. and 6,000 b/d at Daqing Petrochemical Corp., all in northeastern China.

The capacities of the six diesel hydrotreaters are 8,000 b/d at the Liaohe oil field refinery, 10,000 b/d at Huabei oil field refinery, 24,000 b/d at Fushun Petrochemical Corp., 20,000 b/d at Jinxi Petrochemical Corp., 10,000 b/d at Yumen refinery, and 9,000 b/d at Karamay refining-petrochemical complex in the northwest.

In other refining news, US EPA has ordered Motiva Enterprises to take several steps to protect public health and environmental safety following a refinery fire and sulfuric acid spill July 17 in Delaware City, Del. EPA ordered Motiva to properly drain sulfuric acid from tanks, to continue monitoring wastewater to prevent acid discharges, and to provide federal regulators with an inventory of the contents of all tanks at the refinery. Motiva also is required to implement several long-term measures, including a detailed study of the extent of contamination from the spill, removal and treatment of contaminated soil, and a rigorous tank inspection and repair program.

Valero Energy took down a 62,000 b/d FCC unit at its Houston refinery Aug. 9 for unscheduled repairs. Valero said the repairs, estimated to take 8 days, involve the FCC's faulty electrostatic precipitator. Other segments of the 124,000 b/d refinery will continue operations, and arrangements have been made to supply customers during that downturn.

CHEVRON BEGINS PRODUCING TYPHOON FIELD IN THE US DEEPWATER GULF OF MEXICO.

Chevron USA expects Typhoon field to reach production of 40,000 b/d of oil and 60 MMcfd of gas during the fourth quarter.

The field is in 2,100 ft of water on Green Canyon Blocks 236 and 237 off Louisiana.

Typhoon field was discovered in June 1998, and its commercial life is estimated at 5-8 years. The project was completed in 18 months from project sanction to commissioning.

Typhoon is produced through a tension leg platform operating four wells via subsea completions. Production is moved through gathering lines that tie into existing pipelines.

Chevron operates Typhoon with 50%, and BHP Billiton Ltd. owns 50% (OGJ, Apr. 10, 2000, p. 39).

Elsewhere on the production scene, Iranian government officials expect within a month to finalize negotiations on a $359 million buy-back deal with PetroIran Development. The arrangement would triple production from Foroozan field and Esfandiar field off Iran to 150,000 b/d by the end of 2005. Bijan Namdar Zangeneh, Iran's petroleum minister, earlier reported that PetroIran would partner with BHP Billiton to develop the fields. PetroIran is a subsidiary of National Iranian Oil Co., acts as operator of certain fields off Iran under a buy-back investment system designed to allow foreign firms develop new fields and rebuild others devastated during the 1980-89 Iran-Iraq war.

China plans to spend 50 billion yuan ($6 billion) over the next 5 years to boost production in the Bohai Sea. CNOOC will drill 1,100 production wells and build 50 platforms and other offshore facilities to boost production to 400,000 b/d by 2005 from the current 72,000 b/d. Bohai Sea production is projected to peak at 700,000 b/d by 2010. China started to explore the Bohai Sea in 1965. As of June 2001, CNOOC and its foreign partners had discovered 3 billion tonnes of oil reserves in the Bohai area.