Independents use hedging more to lock in high gas prices

US independent oil and gas companies have responded to the recent spikes and increased volatility in oil and natural gas prices by stepping up the practice of price hedging to shore up earnings and capital spending.

Hedging can be a tricky practice to manage, and guessing wrong on price can do a lot of damage to a company's bottom line. The depth of the recent plunge in US gas prices caught virtually everyone by surprise, so some producers have succeeded nicely with what historically might have seemed high-priced hedges. Others missed a golden opportunity.

But, in general, US independents are becoming more comfortable with the practice. While taking a breather from the wild price rollercoaster natural gas prices have been on of late, independents are devising new hedging strategies for coping with the vagaries of ever-more volatile commodity prices.

Increased hedging

US independents have watched natural gas prices drop from around $10/Mcf in December to about $3/Mcf in recent weeks. Oil prices also have fluctuated, as the world watches the Organization of Petroleum Countries work to maintain its targeted oil price band.

Hedging is one strategy that independents use to try to lock in oil and gas prices as they strive for predictable cash flows to support exploration and development spending plans.

"Companies have been doing more hedging on gas recently than they have done historically," said Robert Morris of Salomon Smith Barney. "Companies took advantage of high gas prices for two reasons: One, they anticipated that prices would fall. Two, they wanted to protect their spending."

But with gas prices falling substantially, companies have grown more reluctant to hedge. Morris said he believes companies probably have finished most of the hedging planned for the rest of this year going into early next year.

Hedging involves using a variety of financial instruments such as futures contracts and options. The idea is to manage risk and ensure more predictable cash flow, although any company using hedging is apt to be questioned-and sometimes criticized-about the practice by some investors and analysts.

Timing is everything when it comes to hedges, said Fadel Gheit, analyst with Fahnestock & Co.

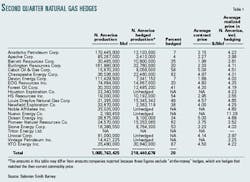

The gas volumes being hedged this year and the prices involved are "all over the lot," he said (Table 1). "Some companies have hedges. Some of them have not hedged. Those who hedged at higher prices look good. But a year ago, companies who had hedged gas paid a penalty when the price went up," Gheit said.

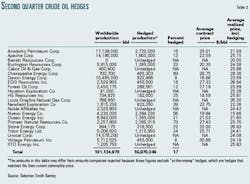

Although gas prices have attracted the most attention this year, Simmons & Co. International analyst Mark Meyer said, "People have quietly gone on with their oil hedging programs [Table 2]."

Meanwhile, Meyer suspects some independents are looking back and hoping for another high price opportunity so they can hedge. "I think $10 gas taught everybody a lesson about demand and locking in prices."

Morris also said he believes some independents waiting for a summer price spike were caught by surprise and missed out on hedging when gas prices fell.

John Myers of Dain Rauscher Wessels considers hedging to be a positive step this year: "Clear- ly, the markets are worried about where the commodity prices are going in this weak economy."

Hedging can help take the risk out of a company's cash flow, Myers said, adding that XTO Energy Inc., Fort Worth, and Chesapeake Energy Corp., Oklahoma City, have been among the most aggressive in gas hedging recently.

Chesapeake

Chesapeake has hedged all of its production for the rest of the year at an average New York Mercantile Ex- change price of $4.60/Mcf. During the next 30 months, it has its gas hedged at an average NYMEX price of $4.15/Mcf.

Aubrey K. McClendon, Chesapeake chairman and CEO, said the hedging "virtually ensures our company will generate more than $1.2 billion of cash flow and $350 million of net income during 2001-03.

"We believe, over time, the trend in gas value will be upellipsein the meantime, we will all have to remember that natural gas has more trading volatility than any other commodity in the world. This volatility will increase in the years ahead," McClendon said during a conference call on second quarter earnings. He said the decline in gas prices might not be over yet because gas storage levels are higher than normal for this time of year. "We suspect there may be a second leg down in September or October," he said.

Chesapeake has no formal, predetermined hedging strategy but closely monitors and reacts to the market as it deems best, McClendon said, adding that Chesapeake started its hedging program in January.

In a cost-cutting measure, Chesapeake has decided to reduce its drilling capital expenditures during the next 12-18 months by $125 million. McClendon said he expects other producers also will cut their drilling plans in response to high service costs.

XTO

Meanwhile, XTO announced a goal of increasing gas production 20%/year during 2001-02 and boosting its proved reserves to 3 tcfe by yearend 2002 from 2.5 tcfe in late 2000. It has locked in an average NYMEX price of $4.30/Mcf on 90% of production through March 2002.

Gary Simpson, XTO vice-president of investor relations, said this year marks the largest position on hedging for XTO, adding that the company wants to maintain cash flow of a total $900 million-1 billion for 2001-02.

"When you talk about hedging, it's a different answer for every different company. We worked with specific facts at hand about our company, given a specific market in a specific time frameellipseIt's never about trying to outguess the market. You can't make a company with hedging," Simpson said.

"We were fortunate to get an early layer of hedgingellipseIt's been a year-long process of adjusting the dataellipseAs we get a new deck of cards going into next summer, then we will decide if we will extend our hedging program," he said.

EOG

EOG Resources Inc., Houston, was totally unhedged on natural gas during 2000 and through March 2001, but it has since implemented hedges in response to market changes.

As a result of the 2001 and 2002 transactions in place at June 30, a pretax gain of $35.3 million was recognized, EOG reported.

"The very high prices for the first quarter were unsustainable and sowed the seeds for a loss in natural gas demand that we are dealing with today," Mark G. Papa, EOG chairman and CEO, said upon releasing second quarter earnings.

Meyer said EOG has hedged 29% of what Simmons & Co. projects to be its US gas production for the third quarter at an average NYMEX price of $4.12/Mcf and 26% of its estimated fourth quarter US gas production at an average NYMEX price of $3.93/Mcf.

In Canada, EOG has hedged 3-5% of its second half 2001 production at NYMEX-equivalent prices of $3.30-3.50/Mcf, Meyer said. On oil, he estimates EOG has hedged 17% of what he estimates as its third quarter production at $26.50/bbl and 9% of its fourth quarter production at $26.60/bbl, again both average NYMEX prices.

Apache

Apache Corp., Houston, has revised its hedging strategy over the years from a general base hedging strategy to an acquisition-position strategy, said Thomas Mitchell, Apache controller.

"Trying to pick a price is really a difficult thing. You're never right. You need to have something to anchor it in," Mitchell said. "Our hedging is based on specific assets. We haven't hedged when it's been the low part of the cycle."

Apache focuses upon the rate of return from its acquisitions in the first 3 years after the deal.

"That is where the heart of the risk is," Mitchell said. "We started this hedging program in earnest a year ago. We felt some risk without a hedge support."

For example, Apache hedged production on the acquisition of Fletcher Challenge Energy Ltd., which it bought with partner Shell Overseas Holdings Ltd.. Apache acquired assets in Canada and Argentina for $630 million in that transaction, which closed in March.

Other acquisitions in which hedging was implemented were Apache's acquisition of Canadian properties from a Canadian affiliate of Phillips Petroleum Co. for $490 million and its acquisition of Gulf of Mexico interests from Occidental Petroleum Corp.

The Occidental deal closed in August 2000, and the Phillips deal closed in December 2000.

Mitchell said Apache protected the economics of these transactions by using hedges that preserved the potential for significantly higher gas prices. The strategy added to Apache's per-share earnings and cash flow.

Harvard Business School noticed Apache's hedging strategy and has made it the subject of a case study on risk management.