Cost estimating challenges face frontier projects

As the oil and gas industry explores new regions, the role of cost estimating to support the projects becomes more challenging.

Cost estimating for the most part is a specialized field whose end product (the estimate) is sometimes controversial and subject to debate and question.

The cost estimator has two primary roles of responsibility in support of clients, first to provide customers with an objective and unbiased opinion of the project cost and second to provide a review and validation of all costs and estimates prepared by third parties to insure completeness and conformance to industry and historical norms.

This is not as simple as it sounds. At times it becomes difficult even in regions where we have some knowledge base and historical reference.

Frontier developments for the most part are very large and complex undertakings that tend to grow in scope over time. Defining these prospects is usually a slow process having considerable premise fluctuation during the project definition phases. Predicting costs accurately for these projects is the challenge for today's cost estimator.

Frontier regions

In global oil exploration, an area is considered a frontier with respect to estimating when it meets three main criteria:

- The area has not been developed due to geographic challenges.

- The area has not been developed due to technological barriers.

- The owner or partners have no operating experience in the region.

A frontier by this definition can be either onshore or offshore. Remoteness of an onshore development and its proximity to marketing outlets is an example of a geographical challenge.

In offshore development the new frontier is "deepwater." While this holds the greatest promise for new oil discoveries it also holds great technological challenge as we go into ever deeper water. Ultradeepwater, 10,000 ft of water or more, along with arctic regions will be the next frontiers for offshore developments.

The third element, experience in the region, is critical to understanding the pitfalls of constructing and operating a facility in an unfamiliar area. Good in-country/region data are hard to obtain for a frontier area and may be misinterpreted by a new operator or owner company. Also, this information is seldom shared as it may provide another producer with a competitive advantage should they consider a development in the same region.

Project trends to avoid

In order to understand the task of estimating projects in frontier regions, it is first important to understand the nature of project work and the challenges of predicting a realistic cost early in the project phase.

In a "generic" composite of actual in-house project costs executed within the US Gulf Coast (Fig. 1), all facilities were onshore petroleum facilities co-located near existing units, comprising battery limits (ISBL) and offsite facilities (OSBL). The cost curve in Fig. 1 shows a common estimating trend, a pattern of increasing costs from one development phase to the next.

This trend occurs whenever project premises have been inadequately defined for that estimating phase, but this was not revealed until the next estimate phase was completed. This trend occurs even in stable regions like the US Gulf Coast and is highly probable in frontier regions where the risk is greater and project complexities and uncertainties abound.

Most common ailments or root causes are optimistic estimates and schedules, lack of experienced personnel, lack of time, lack of money, and poor execution.

Optimistic estimates, those in which premises and costs have been tempered or poorly defined, are usually exposed over time. These usually appear after funds or commitments have been made to further define a possibly uneconomical project.

Once an early number is established, the client initially disbelieves any subsequent estimate that tends to be better defined and possibly more expensive. In addition, this can result in a loss of credibility between the client and estimator which once lost may take some time to regain. Establishing a realistic cost early is always the best course as "cost" is the primary driver of most projects.

Lack of experienced personnel, time, and money is a question of management commitment and availability-willingness to get the necessary resources.

Building an adequate staff is sometimes difficult, as the availability of experienced personnel within the industry has become strained due to years of downsizing. This staffing crisis becomes even more critical in frontier regions and for megadevelopments where more involvement by the owner is necessary.

Lack of time and money is an issue that may be difficult to resolve due to the nature of the business. Business needs and deadlines will at times dictate how much time and money can be spent to prepare an estimate.

Usually when time and money are limited the estimate is at greater risk of error. A well-defined project, however, does not guarantee project success. This is because execution is critical as well and depends on experienced and trained personnel.

Estimating paradox

Fig. 1 shows a failure to predict more realistic costs at the conceptual and feasibility phases.

These are important estimates and are key milestone costs for the business units to determine whether project funding should continue to the next phase.

It is becoming more important within the industry that these early estimates be as accurate as possible. This challenge is called the "estimating paradox." In order for an estimate to be accurate it requires sufficient time, resources, and money to properly define the scope of work.

The paradox occurs, and this is a recognized problem throughout the industry, when pressure is applied to limit the time, resources, and money at each phase due to business needs or other conditions. The results of this are estimates that may be prepared based more on assumptions than firm premises.

Deliverables

On the other hand, early estimates should not be overdefined to a degree that is excessive for that estimating phase. For example, mechanical flowsheets would not be required for conceptual or Level 5 estimate definition. The deliverables guideline for onshore and offshore projects outlines what information is needed for the different classes of estimates (Table 1).

The table shows that different deliverables are required for an upstream and downstream project.

Of the two, an upstream project is inherently more difficult to estimate accurately at an early stage due to the uncertainties (lack of information) associated with the reservoir.

For an upstream project, the reservoir production rate, total recoverable reserves, and well count are key cost drivers that impact all other costs. During early project definition reservoir data are usually incomplete and most often based on assumptions.

Estimation of downstream projects is somewhat more predictable due to absence of the reservoir parameter. The greatest area of risk in a downstream project with no new technology is the outside battery limit (OSBL), which usually has less definition than the main processing plant.

In addition to the phase deliverables, Table 1 items also make recommendations on contingency and the estimate accuracy range for that particular phase. The role of contingency and accuracy range are to a large degree misunderstood and misapplied.

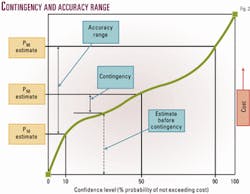

Contingency is a controversial but necessary allowance, and its definition varies from company to company. Contingency in Fig. 2 is the amount added to the base estimate to achieve a P50 cost.

The P50 cost is defined as having a 50% probability of either underrunning or overrunning the final actual cost. Put another way, contingency is an allowance for costs expected to occur but currently undefined and unknown. A common expression for this accounting is "known unknowns."

Examples of known unknowns are design errors or omissions, fluctuation in equipment-material pricing outside the escalation allowance, fluctuation in construction rates and hours, fluctuation in engineering hours, inconsistencies within the estimating method to capture all bulk materials and labor, and minor delays for any reason.

It should be noted that based on this definition, contingency does not allow for costs associated with scope growth or premises changes. This is generally accepted within the industry. The amount of contingency applied should be an owner-defined cost and responsibility and based on an empirical method, one which documents the process and provides some explanation-justification to support the allowance. Selecting contingency by "gut feel" should be avoided; however, at times a cost estimator's judgment may be the most objective option.

Accuracy range

Suggested accuracy ranges are shown in Table 1 and depicted graphically in Fig. 2. Simply defined, the lower and upper ends of the accuracy range represent the P10 and P90 probability values, respectively.

Based on this definition there is an 80% probability that the final project cost will fall within this range at completion. There is some misunderstanding concerning what accuracy range addressees.

There are few definitions on this subject, but an accepted definition of accuracy range states that it accounts for the following conditions: Minor modification to the original project premise without impacting plant capacity, location, or technology (CLT).

Within this definition the following may occur: minor premise changes, schedule delays, project execution changes, impacts of new legislation-regulations, estimate-design omissions, etc.

However, accuracy range cannot be all encompassing and able to address all conditions. Conditions that are outside the accuracy range include: major premise changes impacting CLT, force majeure events, political or labor unrest, terrorism, new legislation-regulation impacting CLT, etc.

Frontier projects may have some of these catastrophic elements lurking in the shadows, but many man-made events can be minimized with good planning and by maintaining good rapport with the local governments.

Estimating software

Estimation of some frontier prospects (conceptual and earlier), may involve the use of some in-house program or commercial estimating software systems for establishing initial costing.

Many good commercial systems are on the market for estimating both onshore process facilities and offshore oil and gas developments.

These "canned" software packages are good for multiple case options, what-if scenarios, and cost sensitivity studies. This is their strength and what they were designed to do: provide quick costs based on limited data and minimal engineering.

It is important to note when using estimating software that it is just another source of cost data. This cost data usually needs some level of interpretation and analysis to determine if the costs provided by the software are relevant and reasonable. Estimating software provides a good "starting point" for cost development. However, based on the project, other cost sources may be required to complete the estimate. The selection of any estimating software package should be based on user preference and needs.

Nontechnical deliverables

The information in Table 1 identifies what deliverables are necessary to estimate the plant or facilities portion of the project. These are called "technical" deliverables.

However, for any development and especially in frontier regions, defining only the technical deliverables is not enough. Many underlying issues still need to be resolved in support of the process facilities. Theses are called "nontechnical" deliverables or issues. The nontechnical categories along with their subelements are listed in Table 2.

Table 2 is a checklist of elements and issues to consider when venturing into any region, frontier or developed. Site, material, and labor issues must be defined and incorporated into the estimate and project plan as they will have a major impact on project outcome.

Issues that focus on understanding the local government's position and attitude toward the project are most important, since what the government will allow usually dictates the project's contracting and execution strategy.

New technology

Another element worth discussing is that of new technology and its impact on project costs.

New technology can provide breakthroughs that are designed to reduce costs, improve productivity, simplify operations, etc. However, new technology can be a project's "Achilles' heal" if it is untried, having no demonstration of reliability on a commercial scale.

A classic example is the Denver airport baggage-handling system. First of a kind or prototype systems can be high cost drivers for a project as they can elevate that portion of the project to more of a research and development exercise. An R&D effort within the confines of project work must be avoided as it will likely increase costs and delay scheduled completion.

It is advisable that projects that employ new technology provide additional schedule time for the product delivery, installation, check out, and start-up durations associated with the new system.

Some recommendations

The preceding comments are intended not to discourage anyone's efforts to generate a more accurate estimate at an early stage but only to raise the level of awareness and to provide some recommendations.

A suggested procedure for predicting costs in a frontier region more accurately focuses on a three-tiered approach to cost validation. These are:

- An independent assessment of the costs outside project influence.

- The application of historical metrics and norms for determining cost trends and relationships.

- Cost networking and research.

It is considered a best practice that an independent review and assessment of costs be made by cost estimators within the owner company free from project influence. By using this approach, an impartial review of the costs can be made to insure completeness of the estimate and identify activities that are outside the current estimate's scope.

An owner review also insures that the costs conform to historical norms and trends. The use of cost metrics by the owner is essential in this cost validation process.

Existing cost metric databases can provide a baseline of cost norms for "nonfrontier" developments that could then be adjusted for frontier regions.

Some activities will likely cost more in a frontier development than for a developed region. Identifying these activities is the application of the last two elements, networking and research.

Networking is establishing a link with cost professionals in other companies for cost consultation and data sharing. Establishing a network of contacts can be invaluable if that contact has experience in a region you wish to define. However, cost metrics are seldom shared without something of value provided in return.

Research can be used to develop a "risk profile" of the region or country proposed for development. The risk profile should concentrate on defining the major cost drivers of the project at a high level.

A generic example of a risk profile (Fig. 3) provides an approach for assessing the risk parameters of the major cost drivers of the project. The risk in this example is expressed as a +/- percentage around an average cost relationship or metric. The project-region used for assessing this "average metric" should be as compatible as possible to the proposed frontier development.

In-country research can be obtained over the internet through several websites. One common site is the US State Department country commercial guides at www.state.gov/index.cfm. This process does not guarantee success, but it will provide a way to better understand the region and possibly reduce the optimistic or poorly defined estimate from becoming a focal point for future business decisions.

The author

Phil McIntire is lead cost estimating engineer with Phillips Petroleum Co., Bartlesville, Okla., in the project services division. He has 26 years of estimating experience with a variety of onshore and offshore developments worldwide. He holds BS and MS degrees in construction technology from Pittsburg State University. E-mail: [email protected]