Midyear Forecast: Drilling surges in US, Canada, increases in rest of world

A surge in drilling in the US this year could result in the largest number of completions in any year since 1987.

The Western Canada Sedimentary basin is enjoying a positive year.

For the rest of the world, rig counts and other information indicate marginal year to year increases in drilling in each region surveyed.

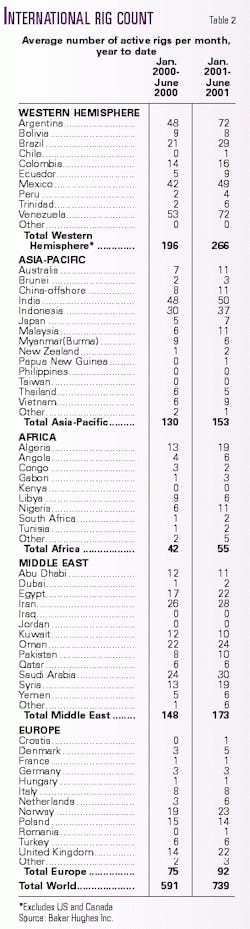

First half drilling levels increased on the year in the Western Hemisphere outside the US and Canada, Asia-Pacific, Africa, the Middle East, and Europe. Drilling was weaker than in first half 2000 in only a few countries.

Here are highlights of OGJ's midyear drilling forecast for 2001:

- Operators will drill 33,600 wells in the US this year, a large increase from the estimated 25,945 wells OGJ estimated were drilled in 2000 (OGJ, Jan. 20, 2001, p. 85).

- All operators will drill 4,832 exploratory wells of all types, a sharp gain from an estimated 3,049 such wells drilled last year.

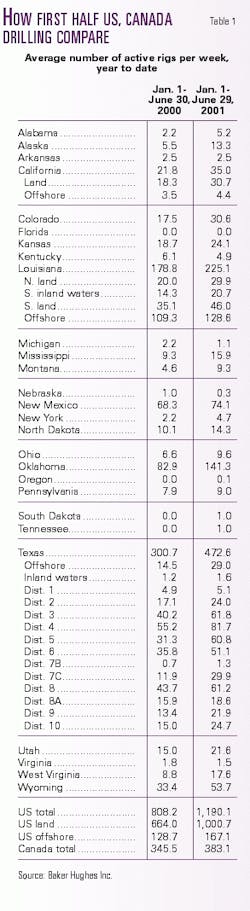

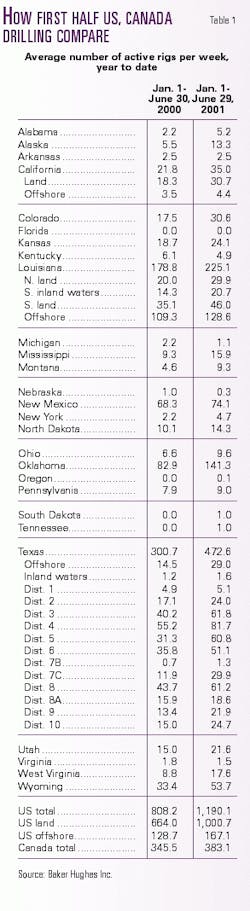

- The count of surveyed rotary rigs compiled by Baker Hughes Inc. will average 1,200/week this year versus 918/week in 2000.

- Operators will drill more than 17,500 wells in western Canada, up from an estimated 16,596 drilled there last year.

US drilling economics

OGJ forecasts that operators will increase total outlays for drilling and completions in the US by 36% to $32 billion this year.

This level of investment is expected even though year-average gas prices are practically unchanged from 2000 and year-average crude oil prices will have fallen slightly. As stated in the article that precedes this one, OGJ forecasts 2001 average prices at around $25/bbl and just under $5/Mcf.

With immediate wellhead revenues almost flat with those in 2000, operators will exercise a much higher reinvestment ratio this year than last.

OGJ's projection of an average 1,200 rigs/week would be a 31% gain from 2000, and a final total of 33,600 completions would be 23% higher than last year.

If attained, the 33,600 wells would make 2001 the first year with 30,000 or more wells since 1990 and the highest since more than 36,000 wells were drilled in 1987.

US drilling

Only a slight pickup in drilling in the second half of the year is forecast in most states and areas because equipment and crews are already nearing peak utilization.

Year 2001 began with close to 1,100 US rigs working, and the first half average is close to 1,200 units.

First-half figures show dramatically higher rig activity this year in Texas and Oklahoma and respectable gains in most of the other states. The Texas increase exceeded 50%, and Oklahoma's topped 70%.

Baker Hughes figures showed that an average of 170 rigs were drilling in Louisiana and Texas inland waters and all sectors of the Gulf of Mexico in the first half. Land drilling in the Texas and South Louisiana districts that border the gulf was up 42% in the first half.

In East Texas, where Bossier, Cotton Valley, and other plays buoyed rig employment in the first half of 2000, the gain in first half 2001 was 70% to 110 rigs.

Activity in Canada

The more than 17,500 wells to have been drilled in western Canada this year continue a rough trend established the past several years.

The Canadian Association of Oilwell Drilling Contractors has forecast the drilling of almost 19,500 wells in western Canada for the full year.

OGJ estimated that operators will drill more than 14,000 wells in Alberta and close to 1,000 in British Columbia.

The Canada eastern land figure of 134 wells for the year includes drilling in Ontario east through Newfoudland. The Canada eastern offshore estimate of 46 wells includes drilling on the Grand Banks, Scotian Shelf, Gulf of St. Lawrence, and Ontario portion of Lake Erie.