OGJ Newsletter

Market Movement

Natural gas price forecasts revised

Energy analysts continue to revise downward their natural gas price forecasts (see related story, p. 32).

Financial analyst Raymond James & Associates said that any rebound in natural gas prices could take longer than originally expected.

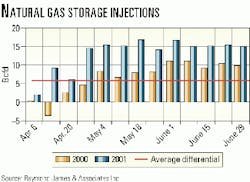

RJA's price forecast reduction comes after maintaining one of Wall Street's "more bullish" natural gas price forecasts during the past 2 years, RJA contends. "Although supply and demand fundamentals appear to be tight, and prices re main well a bove the historical average, rapidly ri sing natural gas storage in ventories have recently put significant downward pressure on na tural gas prices (see chart)."

And while RJA expected a "significant" build in storage inventories-particularly during the first few months of injection season-it said that it couldn't have predicted the magnitude of the injections.

"Since the beginning of the refill season (Apr. 1), storage operators have injected an average of 13 bcfd of gas into storage, which compares to 7 bcfd during the same period last year," RJA said.

"These larger year-over-year injections have pushed current inventories up to 185 bcf above last year's levels. Based on what appears to be continued demand-side weakness, we now expect volumes of gas in storage to approach historically normal levels [3 tcf] by the end of the injection season, effectively relieving storage concerns before next winter.

"This is important because concerns regarding a potential winter gas shortage have driven prices during the past 2 years," RJA said. As a consequence, the analyst lowered its natural gas price forecast for the third and fourth quarters as well as its estimate for 2002.

Meanwhile, UBS Warburg-while also revising downward its natural gas price forecast for this year and next-looked beyond 2002 in a recent research note.

"Looking farther out, we remain positive on the pricing environment for the next 3-5 years, as natural gas remains the fuel of choice for most homeowners, commercial [and] industrial businesses, and the hundreds of thousands of megawatts of new power generation capacity expected to come online over the next decade," it said.

"At the same time, growth in overall US deliverability should remain restrained from continued rapid wellhead decline rates, rig count limitations, and declining quality of each incremental well being drilled and the long lead time necessary to bring on new, higher-impact frontiers," the analyst said.

Oil prices jump as OPEC orders another cut

US energy futures prices jumped last week in instant reaction to a surprise announcement that OPEC would reduce its oil production by 1 million b/d effective Sept. 1.

Traders expected OPEC members to take such action at a special meeting in early August and had already factored such a reduction into next month's prices, analysts said. But in an unprecedented move, OPEC ministers decided on a production cut through a flurry of telephone conferences last week, foregoing their usual face-to-face meeting (see related story, p. 40).

Such quick action to stop the market's recent downward spiral emphasizes the organization's determination to keep oil prices within its targeted range of $22-28/bbl, analysts said.

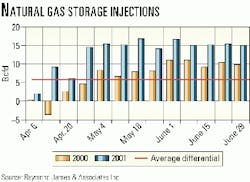

OPEC's decision triggered a July 25 rally on NYMEX that boosted the September contract for benchmark US light, sweet crudes by 53¢ to settle at $26.84/bbl, while the October contract rose 52¢ to rest at $26.42/bbl. Unleaded gasoline for the August delivery jumped 3.05¢ to 75.1¢/gal, while heating oil for the same month rose 2.1¢ to 70.87¢/gal. The August NYMEX contract for natural gas surged 30.6¢ to $3.28/Mcf.

In London, IPE futures prices for North Sea Brent crude improved but were little changed from midday levels on July 25. Some brokers and analysts of that market expressed doubt that OPEC's third production cut this year will be sufficient to keep prices within its target range. The September Brent contract closed at $25.25/bbl, up 35¢ for the day after trading at $24.95-25.45. The August IPE natural gas contract dropped 6.4¢ to the equivalent of $2.76/Mcf.

OPEC's average price for its marker basket of seven crudes gained 32¢ to settle at $23.78/bbl July 25.

null

null

null

Industry Trends

THE RECENT DECLINES IN NATURAL GAS PRICES - AND E&P COMPANY STOCK PRICES - HAVE BEEN CAUSING MUCH ANGST AMONG PRODUCERS AND ENERGY INVESTORS ALIKE.

This was one of the observations of Ray mond James & Associates, prompting the analyst to ponder if industry will enter "1998 all over again." The fear of this happening, however, is not entirely justified, RJA noted.

"Some pockets of the business will almost certainly experience a slowdown, while others should remain strong as long as natural gas prices hold generally above $3.25/MMbtu," RJA said.

"Specifically, we expect to see earnings weakness in companies with exposure to the shallow-water Gulf of Mexico-such as drillers, offshore construction, fabrication, and boat companies. Likewise, companies that may suffer from any weakness in drilling activity, including rig component manufacturers, tubular manufacturers, and drill pipe manufacturers.

"...Recent data through the second quar ter would suggest that drilling permits in the gulf have rolled over on the exploratory side," RJA said (see chart).

On the other hand, land drilling contractors, E&P companies with a heavily non-US portfolio, and deepwater Gulf of Mexico contractors should hold their own as long as natural gas prices remain above the marginal threshold.

MEANWHILE, THE SLIDE IN US GAS PRICES IS HAVING NO EFFECT ON THE PROLIFERATION OF NEW LNG PROJECTS.

Partners in the Nigerian LNG project plan to invest $7.5 billion to add three production trains to that facility on Bonny Island.

Construction of the first addition to the plant's original two trains is already under way, with start-up planned for October 2002 (OGJ Online, Apr. 16, 2001).

After completion of the third train and associated facilities, NLNG expects it will be able to process 1.5 bscfd of gas-equal to more than half of the gas currently being flared in Nigeria.

India, which wants to buy about 10 million tonnes/year of LNG, is targeted to receive output from the third train when it comes on stream, officials said. NLNG is working to secure markets for the additional LNG it will produce from the fourth and fifth trains.

Another worldscale LNG project is planned by the Sakhalin Energy consortium, led by Royal Dutch/Shell, which said it approved an $8.9 billion scheme to build the world's largest LNG plant at Sakhalin Island, off Russia's Pacific coast.

The plant, which is expected to be built by 2006, will produce as much as 9.6 million tonnes/year of LNG. The entire output will be shipped to Japan, South Korea, and Taiwan.

Government Developments

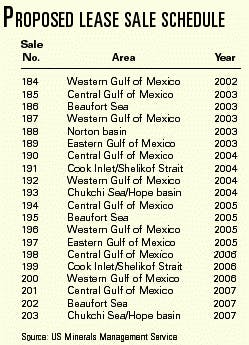

MMS HAS RELEASED ITS DRAFT OF THE OCS LEASE SALE SCHEDULE FOR 2002-07.

The proposed schedule includes plans to hold 20 sales for acreage off Alaska and in the Gulf of Mexico but does not include any area currently under congressional moratoriums or presidential withdrawals. Those areas are off the East and West coasts and in parts of the eastern gulf (see table).

The schedule calls for the usual annual central and western gulf sales and eastern gulf sales in 2003 and 2005. An eastern gulf sale planned for December has been controversial, prompting Interior Sec. Gale Norton to slash the acreage offered by 75% (OGJ Online, July 12, 2001).

The two planned eastern gulf sales would involve only the reduced Sale 181 acreage covering 256 blocks.

After reviewing pub lic comments on the draft plan, MMS will prepare a proposed program and issue a draft environmental impact statement, both of which will be opened to public com ment. Plans call for the final program to be issued in the spring and to be effective June 30, 2002.

Thomas Michels, director of public af fairs for the National Ocean Industries As sociation, said, "The schedule is quite good. It's slightly more aggressive than the last one, offering 20 sales as opposed to 16."

He said the Norton basin sale off Alaska in 2003 could prove interesting: "They will offer leases on a tract-nomination basis rather than open the whole area.

"A large reason they're having that lease sale is to supply the needs of the people in the western part of Alaska. That's going to be an interesting prototype that might work later in other offshore areas."

MMS said the Norton basin acreage was offered "to make resources available for use by local communities and industries." It said the sale could occur as early as 2003 or as late as 2007, based on consultations with interested and affected parties.

One sale has been held in the Norton basin, but there are no active leases (OGJ, Mar. 21, 1983, p. 48). MMS said six exploration wells were drilled in the area, but no commercial discoveries were an nounced. It estimated potential resources at 20-30 million bbl of oil and 1-1.6 tcf of gas.

Quick Takes

STATOIL HAS AWARDED KVÆRNER AN 80 MILLION EURO CONTRACT TO UPGRADE ITS MONGSTAD, NORWAY REFINERY.

The contract calls for engineering, procurement, and construction work that will revamp the 200,000 b/d plant to comply with new European fuel specifications for 2005.

The project, slated for completion by yearend 2002, consists of a grassroots gasoline hydrodesulfurization unit and modifications to the existing refinery using technology from ExxonMobil, Shell Global Solutions, and Merichem.

Mongstad Refining operates the refinery. Statoil owns 79% interest and Norske Shell Raffinering, 21%.

In other refining developments, Statoil sold its 15% equity stake in Malaysian Refining Co. (MRC). Petronas acquired an additional 8% equity, boosting its ownership to 53%. Conoco Asia bought Statoil's oth er 7% equity, giving the Conoco unit 47% ownership in MRC. The share transfer process is expected to be completed by Sep tem ber. MRC was incorporated in May 1991 as a joint venture of Petronas, Conoco, and Statoil. MRC owns the second refining train at Petronas's refinery complex in Sungai Udang, Melaka. The train, PSR-2, has a capacity to process 100,000 b/d of crude.

TOPPING GAS PROCESSING NEWS THIS WEEK, PARTNERS IN AUSTRALIA'S NORTH WEST SHELF VENTURE AWARDED THIESS A $20 MILLION (AUS.) CIVIL ENGINEERING CONTRACT FOR THE FOURTH LNG TRAIN AT THE PLANT ON BURRUP PENINSULA.

Woodside Energy, venture operator, said $485 million (Aus.) worth of contracts previously were awarded for the $1.6 billion, 4.2-million-tonne/year train (OGJ Online, June 1, 2001).

SHELL IS INVESTING IN A WYOMING WIND FARM.

Shell Renewables' US unit, Shell WindEnergy, agreed to acquire its first commercial wind farm from developer SeaWest WindPower.

The wind farm, comprising 50 1-Mw Mitsubishi wind turbines, is slated for construction this summer, with generation to start in October.

PacifiCorp, a unit of ScottishPower, negotiated a power purchase agreement to buy all the power produced from the wind farm.

David Jones, Shell WindEnergy director, said the acquisition marks Shell Renewables' entry into the US market. Currently, Shell has a 4-Mw experimental wind farm in Britain and another 4-Mw experimental wind farm in Germany.

In other alternate energy news, Texaco Energy Systems and Energy Conversion Devices jointly formed Texaco Ovonic Battery Systems, a company targeting commercial production of advanced nickel metal hydride (NiMH) batteries for hybrid electric vehicles and electric vehicles.

Texaco plans to spend more than $150 million "over the next few years" on the NiMH battery business. General Motors has designated Texaco Ovonic Battery Systems as a preferred supplier for its NiMH battery requirements.

EL PASO ENERGY PARTNERS HAS INSTALLED A TENSION LEG PLATFORM IN THE GULF OF MEXICO.

The Prince TLP stands in 1,450 ft of water on Ewing Bank Block 1003. El Paso Energy Partners owns and manages the platform along with oil and gas pipelines in Prince field 120 miles south of New Orleans. Oil output will begin later this quarter via the Poseidon pipeline, of which El Paso owns 36%.

The platform will aggregate production from oil and gas developments in the Ewing Bank and Green Canyon areas of the deepwater gulf trend.

It includes the first mini-TLP hull constructed to support producing wellheads and has a displacement of 14,400 tons, a hull weight of 3,500 tons, and a payload of 6,000 tons.

In other development news, partners in Lakshmi field off India awarded an $80 million field development facilities contract to a consortium of Clough Engineering of Australia and Hyundai Heavy Industries of South Korea. Partners in the field 260 km north of Bombay are Cairn Energy India, ONGC, and Tata Petrodyne. Clough will be responsible for all onshore work for Lakshmi, including construction of a gas treatment plant. Hyundai will handle the offshore facilities segment of the contract.

KUWAITI OIL MINISTER ADEL K. Al-SABEEH SAYS HIS COUNTRY PLANS TO BUILD TWO NEW PETROCHEMICAL PLANTS.

The plants, estimated to cost $3.4 billion total, are expected to be built by the end of 2005. Al-Sabeeh said the private sector would be allowed to invest in either project.

One plant, estimated at $2 billion, would produce 850,000 tonnes/year of ethylene, 450,000 tonnes of polyethylene, 650,000 tonnes of ethylene glycol, and 70,000 tonnes of propylene.

A leading international company would invest in this plant, while the local partner would be Kuwait's Petrochemical Industries Co. (pic), Al-Sabeeh said, although he did not name the international company.

The second plant, which PIC would also partly own, would produce 650,000 tonnes/year of paraxylene and 500,000 tonnes of styrene. The cost of this plant was estimated at $1.4 billion.

In other petrochemical news, Sinopec Beijing Yanhua Petrochemical, an affiliate of China Petroleum & Chemical Corp., plans to complete in October a 250,000 b/d expansion to its ethylene capacity, giving it a 700,000 b/d nameplate capacity, the biggest in China. Yanhua will shut down its 450,000 tonne/year cracker Aug. 3-5 as part of the work.

The shutdown will reduce the plant's ethylene production by 5% from last year to 460,000 tonnes this year. The 3.8 billion yuan expansion involves two crackers and the revamping of six existing crackers. Work on the expansion began in August 1999.

Texas Petrochemicals has completed modifications to its butadiene extraction systems, boosting production capacity by 33% to 1.2 billion lb/year. It did not reveal the cost of the modifications. TPC, which specializes in C4 hydrocarbons, claimed the increase made its Houston plant the largest butadiene extraction plant in the world. It said it could further increase capacity of the existing system, although it has 500 million lb of idle extraction capacity available. TPC said it plans to continue its measured butadiene production growth, timed to coincide with the growth in market demand. TPC Pres. and CEO Bill Waycaster said the increased capacity fulfills contractual commitments to existing and new customers. "We have balanced this increase in sales with increases in commitments for new feedstock supply from our crude butadiene suppliers," he said.

Chevron Phillips Chemical, in partnership with Solvay Polymers, selected Air Products & Chemicals to supply a hydrocarbon and nitrogen recovery system for a new polyethylene plant at Chevron Phillips Chemical's Cedar Bayou facility in Baytown, Tex. The plant is expected to come on stream in late 2002. Chevron Phillips Chemical and Solvay Polymers will own the plant 50:50 and will share its production of general purpose blow molding, high-density, polyethylene resins. Air Products executives said their proprietary technology eliminates polluting air emissions typically associated with flaring or burning plant offgases.

SHELL EXPLORATION AND PRODUCTION HAS SIGNED CONTRACT EXTENSIONS ON TWO CHILES JACK UPS for work in the gulf of mexico.

Shell signed 9-month extension contracts after having employed the Chiles Magellan and the Chiles Columbus on a well-to-well basis. The Magellan, which has worked for Shell since May 2000, will start its contract in August. The Columbus recently began working for Shell and starts its contract in September.

In other drilling news, Karachaganak Petroleum Operating awaits arrival of Parker Drilling's Rig 216, which departed the Port of Houston this month for Kazakhstan. It's the third of three land rigs Parker is contributing to the six-rig SaiPar joint venture under a long-term contract. The rig is expected to arrive in St. Petersburg, Russia, in early August, where it will be transferred for rail shipment to northwestern Kazakhstan. Anticipated spud date for the rig is mid-October.

TotalFinaElf unit Elf Petroleum Iran has awarded KCA Drilling a $50 million contract for development drilling in Doroud oil field off Iran. The 3-year agreement involves drilling or workovers using two drilling units belonging to state-owned National Iranian Drilling Co. KCA, the UK drilling arm of Abbot Group, said it would upgrade and modify the drilling units. KCA has an option for a third drilling unit. Drilling in the field, on Kharg Island in the Persian Gulf, is slated to start by late December or early January.

BG GROUP DISCOVERED MORE NATURAL GAS IN THE LEMAN AREA OF THE UK NORTH SEA.

The find, called Rose R2, is on Block 47/15b in the Leman sand play fairway 55 km east of the Easington terminal and 8 km northeast of Amethyst field. BG Group said the discovery well flowed on test at a maximum sand-free rate of 30 MMscfd of gas and 90 b/d of condensate through a 68/64-in. choke. These rates were constrained by the testing equipment, and the discovery has yet to be fully evaluated.

In 1998, BG drilled the first well on the block to test the Rose East prospect with the 47/10-6 deviated well, which flowed gas at a rate of 27.3 MMscfd.

Elsewhere in the UK North Sea, Amerada Hess and Ranger Oil UK agreed to a £21 million joint drilling program to evaluate oil and gas discovered 14 years ago in the Beechnut area of the UK North Sea. Amerada will direct an exploration and evaluation campaign on Blocks 29/9a South and 29/9b that will involve drilling an appraisal well on the Beechnut North prospect and exploring Beechnut South prospect.

Amerada said the wells would be drilled starting in late August from a single location, with provision being made for a further sidetrack to appraise the second of these targets if deemed appropriate. A rig was being sought for the 120-day program.

Beechnut is in one of the so-called "cluster" areas that the government-industry task force Pilot's undeveloped discoveries workgroup identified last July. As operator of Block 29/9b, Amerada began development discussions that led to the agreement to revisit the area. Amerada's reserves estimates for the Beechnut area were not disclosed.

Amerada said development scenarios being studied in the expectation of a successful drilling program include a tieback to the nearby Ranger-operated Kyle facilities on Block 29/2c, being produced via the Maersk Curlew FPSO.

In other exploration action, Gulf Indonesia Resources said its third and fourth wells on the Ketapang production-sharing contract area off East Java found hydrocarbons. The Jenggolo-1 well flowed on test at a rate of 3,600 b/d of oil through a 7/8-in. choke from perforations at 6,272-6,300 ft. A second test from perforations at 5,806-5,854 ft yielded a flow rate of 5 MMcfd of gas through a 1-in. choke. A third, at 4,780-4,804 ft, registered a rate of 4 MMcfd through a 1/2-in. choke. Payang-1 well flowed 17 MMcfd of gas through a 1-in. choke from perforations at 4,822-4,854 ft. The first well in the four-well program on Ketapang had gas shows and minor oil shows but was not tested. The second, Bukit Tua-1, flowed at a combined rate of 7,250 b/d from two tests (OGJ Online, Mar. 27, 2001). Two shallower zones in the Bukit Tua-1 well flowed a combined 6 MMcfd of gas. Gulf Indonesia is contract operator of Ketapang and is 50:50 partners with Petronas Carigali. Gulf Canada owns 72% of Gulf Indonesia. Conoco has offered to buy Gulf Canada for $4.3 billion in cash (OGJ Online, May 29, 2001).