Power sector takes a downturn in Energy 50 2Q ranking

The latest ranking of the world's 50 largest energy companies, compiled for the second quarter 2001, was colored by some notable events:

- The downturn of the power sector.

- The emergence of South Korean and Japanese utility companies from their respective slumps.

- Merger and acquisition activity among some US and Canadian companies.

- The launch of Norway state oil firm Statoil AS's initial public offering.

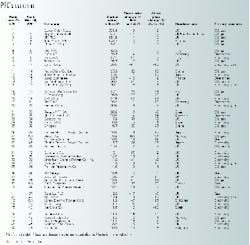

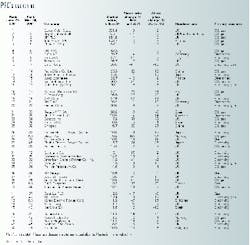

The most recent Energy 50 ranking-a quarterly assessment based on the companies' market capitalization-was released earlier this month by Petroleum Finance Co., Washington, DC (see table).

Best, worst performers

In addition to the aforementioned events affecting its quarterly rankings, PFC found that politics also played a major role in companies' performance during the second quarter.

For example, PFC noted that shares of Russian natural gas giant OAO Gazprom received a "major boost" following the Kremlin's replacement of Chairman Rem Vyakhirev with former Russian Deputy Energy Minister Alexei Miller. Gazprom is a newcomer to PFC's Energy 50 list, entering at position 39.

"Under Vyakhirev's leadership," PFC observed, "Gazprom was plagued with controversial management. Miller's appointment sent a signal to capital markets that the government, which owns 38% of Gazprom, is committed to shaping up the company."

Meanwhile, politics surrounding the power crisis in California affected the decline of some US integrated energy companies on the list, PFC said. "Allegations of unfair pricing through market manipulation-as well as the associated feuds among the power generators and federal and California authorities-have knocked previous market leaders into the bottom performance bracket" of the rankings.

"More specifically, uncertainty about the demands by California politicians for a multibillion-dollar refund to the state's consumers, newly implemented price caps, and concerns about re-regulation have eroded the value of many of the power companies with significant Cali- fornia exposure," PFC stated.

Among those companies affected were Calpine Corp., San Jose, Calif.; Duke Energy Corp., Charlotte, NC; and Enron Corp. and Dynegy Inc., both of Houston. Reliant Energy Inc., also of Houston, "suffered a fate similar to its peers in the power sector," PFC said, as that company fell out of the rankings.

This gap in the top 50 spots left by the US power companies, PFC said, was filled by the companies' Asian counterparts, which included Tokyo Electric Power Co. Inc., Kansai Electric Power Co. Inc., Chubu Electric Power Co. Inc., and Korea Electric Power Corp. (KEP). "KEP has essentially tracked the benchmark Korea SE Com- posite index, which was up 13.7% over the first quarter," PFC said. "The Japanese utility performance is in part attributable to a shift of capital into steady dividend, energy stocks in the Japanese markets."

Merger and acquisition activity also had an effect on the Energy 50 ranking. Notable deals included:

- Houston-based Conoco Inc.'s $6.3 billion (Can.) tender offer for Gulf Canada Re- sources Ltd., Calgary (OGJ, June 4, 2001, p. 36).

- Tulsa-based Williams Cos. Inc.'s 22% premium offer over a Royal Dutch/Shell bid for Barrett Resources Corp., Denver (OGJ, May 14, 2001, p. 38).

- Houston-based Anadarko Petroleum Corp.'s purchase of Gulfstream Resources Canada Ltd., Calgary (OGJ, July 9, 2001, p. 26).

Mid-cap NOCs

Following its June IPO, Statoil joined the ranks of the Energy 50 as a newcomer at number 27. Along with two other partially privatized national oil companies (NOCs)-Chinese firms 11th-ranked PetroChina Co. Ltd. and Sinopec, currently in position 25-Statoil forms part a small subset of companies that PFC refers to as a mid-cap peer group. Most interesting about the group, PFC noted, is that a majority of the members are former NOCs-or still have considerable government ownership-such as Petroleo Brasileiro SA, Repsol-YPF SA, and ENI SPA.

Statoil's IPO marks one of several steps the Norwegian government is taking to reform its energy sector. "The Norwegian government took an instrumental step in energy sector reform when it sold down the state's [direct financial interest] oil and gas assets, which Statoil previously managed without any compensation," PFC said.

"Given that the partially privatized companies have no prior accountability to capital markets and limited time to establish a track record with respect to targets, some of their metrics are surprisingly competitive with those of their more established peers," PFC said.

What will be most interesting to watch in future Energy 50 lists, at least in the medium term, is how these mid-cap oil companies will "differentiate themselves from each other," PFC said.