LNG's Evolution Technology, commercial developments

After 4 decades of development, the LNG industry has evolved from being a regional niche player to a commercially and technologically viable global energy business.

Described here are the main industry themes and drivers from the early 1960s to the present as well as emerging developments that are shaping the industry's future.

Technology

Four distinct periods mark the progress of LNG technological changes; future developments are built on these periods.

First generation-1960s

Given the current focus on providing new LNG supplies to the US, it is ironic that the US was the first international LNG exporter, with a shipment in 1959 by Constock (Chicago Stockyard-Conoco LNG venture) from Louisiana to Canvey Island in the UK on a converted cargo carrier, the Methane Pioneer.

The Royal Dutch/Shell group of companies (Shell) has been active in LNG since this first cargo and in 1960 acquired a 40% share in Constock, which was then renamed Conch International Methane. Conch subsequently concluded an agreement to import LNG from Algeria to the UK, and the first truly international LNG project was born.

Conch held a 40% shareholding in Compagnie Algerienne de Methane Liquide (CAMEL) and acted as technical leader on behalf of the shareholders in building the world's first large-scale liquefaction plant in Arzew, Algeria. The CAMEL plant started up in 1964.

Technip-Air Liquide provided the design of the cascade liquefaction process that used three separate cooling cycles: The propane cycle cools the gas to -30° C., the ethylene cycle takes the gas down to about -100° C.; and the methane cycle cools it to a liquid ready for transport at -160° C.

This first plant used steam turbines to drive the compressors and seawater cooling for the condensers. It had a total capacity of about 1.1 million tonnes/year (tpy) divided over three trains. Shell, via Conch, provided plant operations staff and advice until the business was nationalized in 1976. The plant still operates today.

Conch was instrumental in solving many of the early industry problems associated with carrying a liquid at -160° C. The company conceived of the LNG "membrane" tank, allowing efficient and effective onboard LNG storage and developed the world's first in-ground LNG storage facility, which was subsequently used at the LNG loading terminal in Algeria.

Conch also designed the storage tanks for the world's first purpose-built commercial LNG tankers. These two 27,500-cu-m LNG ships, the Methane Princess and the Methane Progress, provided the UK with nearly 100 MMscfd of gas (about 700,000 tpy), or 10% of the UK demand at the time.

In 1969, the first baseload LNG plant to supply Asia-Pacific markets delivered its first cargo to Japan. This 1.4 million-tpy plant in Kenai, Alas., applied Phillips Petroleum Co.'s Cascade cycle. It was similar to that used in the CAMEL plant but was much larger, with a single-train capacity greater than the total of the three trains at CAMEL.

This plant was the first to use gas turbines as the prime movers; the heat exchangers were a Phillips-designed, plate-fin variety. An updated version of the Phillips process called Optimized Cascade is used in the Atlantic LNG plant in Trinidad, which began operating in 1999.

In conversion of natural gas to a liquid occupying 1/600th the volume, three key elements are the compression needed in the refrigeration cycles, the power to drive those cycles, and the main cryogenic heat exchangers (MCHE) to transfer the cold to the incoming natural gas.

Over the next 3 decades of development, technology improvement has focused primarily on these components.

Second generation-1970s

The 1970s opened with the start-up of the Exxon Corp.-led Marsa el-Brega plant in Libya. This plant was the first to use the less-efficient but much simplified single mixed-refrigerant cycle (SMR) designed by Air Products & Chemicals International Inc. (APCI). The objective was to reduce the number of compressors and heat exchangers.

The plant consisted of four 750,000-tpy liquefaction trains, each designed around a single spool-wound MCHE and compressor string. This was itself a major departure. Rather than the classic cascade refrigeration approach of using a mix of separate progressively colder refrigeration cycles, the SMR solution utilizes a single cycle but a mixed refrigerant (methane, ethane, propane, etc.), in which the condensation and evaporation occur over a wide temperature range from ambient down to the required -160° C.

Two more greenfield plants quickly followed.

In November 1972, the first plant on the Skikda site in Algeria began operating. Also an SMR cycle, it consisted of three Technip-designed trains of 1 million tpy each, a one-third increase in train size from Marsa el-Brega.

Starting up just 1 month earlier in the Asia Pacific was Shell's Brunei plant (Brunei Liquefied Natural Gas; BLNG), the largest plant yet built, with five trains of more than 1 million tpy each and a total 5.5 million-tpy capacity.

Shell's approach from the beginning has been to evolve the technology further with each new plant. For Brunei, the major innovation was first application of the propane precooled mixed refrigerant process (C3-MR), in this case an APCI design, which had a thermal efficiency near 90%, a dramatic improvement over the earlier SMR process.

BLNG was only the second plant to be built that used APCI's novel spool-wound aluminum heat exchangers and the first to go with the new much larger design, which in conjunction with the largest available compressors determined the size of BLNG's individual process trains. The main compressors remained steam-driven (Fig. 1).

Optimal train size was significantly increased in 1977 when Indonesia joined the ranks of LNG exporting countries with the start-up of the two trains in Bontang of 2 million tpy each with much larger MCHEs. Indonesia's state oil company Pertamina and Roy M. Huffington Inc. (Huffco) were the technical leaders for this project.

A year later, the Mobil Corp.-led Arun project came on stream. This project was the first to use gas turbines since Kenai nearly 10 years earlier and employed a dual-shaft gas turbine design (GE Frame 5) and a slightly modified version of the by-now-universal C3-MR process.

While the various projects in the 1970s used numerous process licensors, engineering and construction contractors, and equipment vendors, versions of the C3-MR liquefaction process were to dominate the industry for 3 decades, with only the Skikda plant in Algeria and Trinidad as exceptions.

On the turbine front, gas quickly won out over steam, becoming the new industry standard as such turbines became sufficiently reliable and available in increasingly larger sizes. Connecting the gas turbine directly to the compressor shaft provides advantages in fuel efficiency and simplicity, although the shift from steam to gas turbines was motivated primarily by reduced costs resulting from the absence of the steam generating equipment, steam cycle water-treating facilities, and reduced overall plant cooling requirements.

Third generation-1980s

The early 1980s found the industry experiencing its first major growing pains.

After a year in which worldwide LNG deliveries rose by a third and sales revenues rose by nearly 60%, the LNG market was shaken by pricing disputes, breaches of contract, closures of two US LNG receiving terminals, and the cancellation or delay of several major projects, all as a result of the 1979 oil price shock.

Only two new greenfield LNG plants got off the ground in this decade:

- MLNG Satu, built in cooperation with Malaysia state oil company Petroliam Nasional Bhd (Petronas). This first Malaysian plant had taken its final investment decision in 1978 and was well under construction as the last of the steam-driven greenfield plants.

- The Australian Northwest Shelf Project (NWS). This plant began operating at the end of the decade in June 1989. Shell was plant technical advisor and heavily involved in all aspects of these projects.

All other growth during the 1980s was from expansion of existing plants: Arzew, 1981; Skikda, 1981; Bontang, 1983; and Arun, 1983 and 1986. Such expansions typically enjoy a 25-30% cost advantage over greenfields.

The main technological innovation during the 1980s was the air-cooling used in the Shell-designed NWS plant. Air-cooling was applied because of environmental restrictions on the use of water-cooling in this location. But with the concept proven here, it has been subsequently applied elsewhere for both environmental and cost reasons (Malaysia and Trinidad).

Fourth generation-1990s

One of the key challenges of the early 1990s was to reduce costs further by maximizing the shaft power from the gas turbines to the compressors and pushing the train size boundaries harder. The biggest step in this regard was taken with Shell's updated C3-MR design for the expansion of the Malaysian plant (MLNG Dua) that came on stream in early 1995.

This plant was the first to make use of the massive 80-Mw GE Frame 7 gas turbines, replacing the four Frame 5 turbines (28 Mw) of the earlier NWS design with a single Frame 7 and a Frame 6. The Frame 7 turbine drives the two compressors of the mixed-refrigerant cycle from a single shaft. The Frame 6 drives the propane precooling cycle.

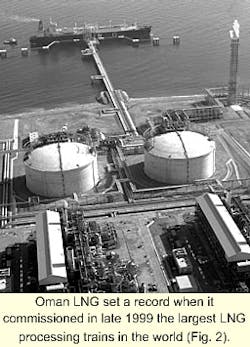

Shell further enhanced this design for Oman LNG (OLNG; Fig. 2), setting a record when it was commissioned in late 1999 as the largest LNG processing trains in the world, with capacities in excess of 3.3 million tpy each.

The motivation to use these Frame 7 single-shaft machines is a 15-25% reduction in unit capital cost ($/Mw) and a 10-15% reduction in fuel consumption.

After nearly 20 years without a new LNG train being constructed in the Atlantic Basin, 1999 saw the start of the two-train Shell designed Nigeria plant and the single-train Atlantic LNG (ALNG) project in Trinidad.

ALNG introduced a new approach, which has subsequently been followed elsewhere in the industry. Although the multi-train plant had become the norm for greenfield projects, supported by the arguments for reliability of supply and economy of scale, the Atlantic LNG project in Trinidad has demonstrated that an alternative one-train approach is possible and can be economically attractive under the right circumstances.

Atlantic LNG reduced costs with a novel project-implementation strategy that extended the contractor competition to include technology selection, front-end engineering and design, and actual procurement and construction. The project also benefited from existing infrastructure with the plant being built on the site of an old refinery and next to existing chemicals plants.

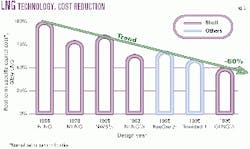

These past 4 decades of continued technical innovation and evolution resulted in a 50% real term cost improvement (Fig. 3).

Two subsequent expansion projects currently under construction represent the last of the 1990s design evolutions. For both, the Shell-designed MLNG Tiga (3.9 million tpy) and NWS4 (4.2 million tpy) trains, a second Frame 7 replaces the Frame 6 in the propane precooling cycle, further increasing the capacity.

One additional key development for NWS4 is the first introduction of aluminum spool-wound MCHEs manufactured by Linde AG in Germany, thus challenging APCI's 30-year dominance. The added competition for the design and manufacture of this key component will further reduce costs and stimulate innovation.

Next generation

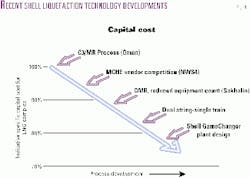

Over the past 2 years, Shell reviewed the entire LNG design and construction process, focusing on cost and schedule, and applied what it learned to the latest technology. The result is the latest Shell design.

This is an air-cooled plant based on the proprietary Shell DMR (dual mixed refrigerant) process that will be first used in the Shell-led Sakhalin Energy LNG plant in Russia, currently in the project specification phase.

In the Shell DMR process, a mixed refrigerant is used for the natural gas pre-cool (replacing the propane cycle) as well as gas liquefaction. This novel process reduces the overall equipment count of the train by about 30% compared to a conventional C3-MR train and provides greater operational optimization.

As shown in Figs. 1 and 4, the Shell GameChanger plant is a dual string, single-train configuration of 4.5-5 million tpy. This design has a lower unit cost than the existing best in class two-train benchmark (Oman: $200/tonne) and is significantly less than the best in class single-train plant (Trinidad: $235/tonne).

It can be built in a typical greenfield location in fewer than 30 months. The short construction schedule, large train capacity, and reduced equipment count of the plant all combine to boost overall project economics substantially.

Consistent with Shell's emphasis on reducing greenhouse gases, this design also greatly reduces LNG plant CO2 emissions with 40% improvement over the cascade process and 20% improvement over the current best C3-MR technology.

Floating LNG

The idea of constructing floating LNG (FLNG) plants dates from the first LNG supply plant on a river barge in South Louisiana in 1951. Only in the past few years, however, has FLNG matured into a credible alternative, stimulated by Mobil's design proposal in 1995 (OGJ, June 30, 1997, p. 66), and driven by the increasing desire to develop major gas fields further offshore and in deeper water.

An FLNG plant brings together in one location a much greater range of equipment, skills, and experience than a conventional onshore development. This makes the task particularly difficult and few companies have viable in-house designs at this stage. Shell is one of them, using a slightly modified version of the GameChanger LNG design.

The overall cost-savings potential can be as much as 30% for a 4-6 million tpy FLNG plant over a one-train onshore plant supported by separate offshore development, gas processing, and pipeline links.

In addition to eliminating substantial amounts of hardware, FLNG also avoids the problems of site selection and preparation and such location issues as local cost of skilled labor, disturbances, and environmental impact, among others.

Shell believes at least one FLNG will begin construction within the next few years.

Commercial developments

When compared to the technical developments already described, the first few decades of LNG commercial development appear relatively stable. A business model was quickly established based upon long-term contracts of 20 years or more with rigid terms covering take-or-pay commitments at 90-95% of contracted quantities.

The only significant change to this model has been in pricing. Some early contracts were at fixed prices, but buyers agreed to revise these in the wake of the 1972 oil price shock. Thereafter, all contracts have been indexed to oil in varying degrees.

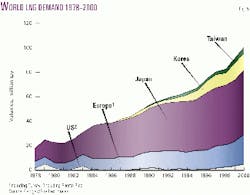

Higher prices made it more difficult for LNG to compete in markets with pipeline-gas alternatives. Consequently the growth focus moved almost exclusively to the Pacific region markets of Japan, Korea, and Taiwan for the next 2 decades.

Further refinements to the pricing formula were made after the oil-price collapse in 1986 so as to limit the impact of oil-price volatility on the business. These commercial structures have served the industry well with global sales exceeding 100 million tpy last year and steady growth (Fig 5).

Recently, however, a number of issues have emerged to challenge all aspects of the LNG business status quo.

Supplies

The first of these challenges has been an unintended consequence of the story of continuous technical evolution described previously.

In the 1990s, the combination of innovation in technology and project-implementation strategy produced a series of dramatic cost reductions in Qatar, Trinidad, and Oman. The extent of this surprised the commercial world and gave developers the economic freedom to commit to build the plant with less than the full production sold under long-term contracts (Oman and MLNG's Tiga).

In addition, virtually every new LNG plant has a gradual build-up profile with its customers, on top of which the available plant capacities have consistently exceeded design capacity by some 10% or more.

Although much of this excess capacity has subsequently been sold under short and long-term contracts, as much as 10 million tpy of surplus plant capacity has typically been available at any one time in recent years. This capacity has been used by such buyers as Korea Gas Corp. (Kogas) to cover peak winter demand and most recently by several buyers partially to cover the shortfall that arose when the Arun plant in Sumatra was forced to close by the activities of the Free Aceh separatist movement.

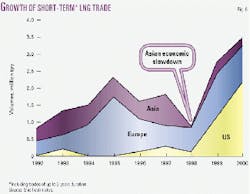

The growing confidence in the short-term market may tempt buyers to postpone their next long-term commitments. Nevertheless, both sellers and buyers still generally prefer the security of long-term arrangements to justify the massive LNG infrastructure costs. Although representing only a small portion of globally traded LNG, this short-term trade has gradually been growing (Fig 6).

Led initially by such players as Australia, it was quickly dominated by surplus capacity from the Middle East. With the exception of the usual extra Korean winter purchases, this short-term trade was almost entirely from the Pacific Basin to Europe and increasingly the US, voyages that were previously considered noncommercial.

The past few years have seen the entry of three new Atlantic Basin LNG buyer countries: Greece, Puerto Rico, and the Dominican Republic. Although all small purchasers, they represent a break from the old dedicated model. All are supplied with what could be considered surplus capacity from existing projects.

In the special case of Puerto Rico, Cabot Corp.'s full 60% share of the first train in Trinidad was originally intended for the company's Everett, Mass., receiving terminal. Cabot, however, very quickly used its destination flexibility to shift some of the volume to supply the new Enron Corp. power plant and LNG terminal in Puerto Rico.

In another step out, BP PLC sold 720,000 tpy of LNG to the Dominican Republic without specifying its source. While BP has a strong supply position in Trinidad and shipping options, it is a clear departure from the past.

Markets

Other drivers for change come from the market.

Much of the recent surge in new developments is powered by the dramatic increase in gas-fired power generation, but that business is also undergoing enormous change. All around the world, the electricity-supply business is being privatized or at least liberalized. Many generators now have to compete daily or even hourly to sell electricity, and distributors no longer enjoy monopolies.

More challenging still, the new buyer may be an independent power producer (IPP) with only one plant. No longer do they have the protected markets and multiple-fuel flexibility that would enable them more easily to commit to the inflexible delivery patterns of LNG contracts.

Hence, buyers are now seeking more flexibility, which in turn may increase the size and liquidity potential of the short-term market.

In the vital new markets of India and China, IPPs will be key customers.

Recent events in Dahbol, India, where Enron and the Maharashtra State Electricity Board are embroiled in yet another dispute highlight the difficulties that will have to be overcome. Even in Japan, gradual market liberalization is beginning to reduce buyers' long-term planning abilities and willingness to make new take-or-pay commitments.

But perhaps it is the US market that could have the biggest impact on the LNG business.

Energy shortages there have been well publicized. The shortage of pipeline gas caused prices to rise dramatically and provided the first-ever quarter in which US natural gas spot prices were higher than in Japan. The US benchmark Henry Hub price was consistently higher than $5/MMbtu last year.

LNG regasification terminals that had either been mothballed (Elba Island, Ga., and Cove Point, Md.) or operating at low levels (Lake Charles, La., and Everett, Mass.) since the breakdown of the long-term deals from Algeria in the 1980s are now almost fully committed and are being restored to nameplate capacity, or greater, over the next few years.

More importantly, these terminals are no longer dominated by a specific integrated project but offer opportunities for various market players to purchase capacity. A good example is Cove Point, where the 5.4 million-tpy regasification capacity was awarded in equal amounts to Shell, BP, and El Paso Corp. in an open bidding round last year.

In the US market, LNG makes up only about 1% of the supply and faces no measurable volume risk. Therefore, take or pay is not really an issue for the buyer so long as the LNG price is indexed to a liquid marker, such as Henry Hub.

Although the old supply contracts from Algeria and more recently Trinidad remain, it is too early to say what sort of terms will apply to the new contracts that will fill these re-activated terminals and the new ones being proposed on both the east and west coasts.

All these developments are pulling the market towards more flexibility, a process that was already being driven by a supply push, described previously.

Shipping

One of the reasons that the short-term market has not grown more quickly has been the shortage of surplus shipping. The traditional pattern was for ships to be dedicated to individual contracts and in large measure controlled by LNG sellers.

Kogas was the first buyer to break the mould in a systematic way by pursuing a broad based FOB purchasing strategy to kick-start the Korean LNG shipbuilding industry. The emergence of Korean shipbuilders has significantly lowered shipping costs.

In the past 5 years, new 135,000-cu-m LNG carrier prices have fallen by nearly 50% in real terms. Prices seem to have bottomed out, however, and are slowly increasing in response to robust order books.

With 30 LNG carriers currently on order, a near 25% increase of the current global fleet, reports suggest that most shipyard slots are now occupied through early 2004, and shipping remains a constraining factor for short-term growth in LNG trade.

To mirror the rise in uncommitted liquefaction capacity, major players have moved to secure uncommitted shipping capacity. Where off-take patterns are less predictable, control of the means of delivery is vital.

With 15-20 new LNG carriers now on order without specific project dedication, Shell (with four ordered), BP (between three and five), and others are recognizing that whether a particular project proceeds, there are sufficient projects in development that some of them will succeed and employ the ships.

But some orders are purely speculative, based on expected opportunities from an increasingly flexible market, and this could result in overbuilding. In this way, a segment of the LNG shipping industry could gradually become part of a more typical commodity shipping business, which may develop in parallel with the dedicated project business.

Structures

Traditional LNG buyers were not only serving monopolistic markets with a portfolio of customers and suppliers, they were also state or quasi-state companies capable of offering financial security to the string of investments involved in the dedicated supply chain. This enabled the shareholders to finance the projects with bank debt.

In the new markets now being targeted by LNG, such as India and China, financial powerhouses simply do not exist to anchor new projects and underwrite the necessary investments. While some lenders are slowly warming to alternatives to the traditional model, a mechanism will have to be developed that protects them from too much downside price risk under a straight merchant model.

Alternatives being pursued by the industry require much greater involvement and investment by the sellers in the downstream, coupled with an increasing role by buyers in the midstream and even upstream as exemplified by Osaka Gas Co. Ltd.'s share of the Timor Sea Sunrise project. The outcome of this is likely to be some very different project structures.

Among others, we have seen Kogas take a 5% shareholding in Oman LNG and in Qatar's Ras Laffan Liquefied Natural Gas Co. Ltd. (RasGas). India's Petronet LNG Ltd. will take a 5% shareholding in the RasGas II expansion, and conversely, RasGas has been offered a 10% downstream shareholding in Petronet's planned terminal at Dahej. Shell's plan to develop a LNG terminal and infrastructure at Hazira in NW India is another example of this trend.

As individual players, rather than projects, take on downstream development risk and make early commitments to shipping and regasification terminal capacity, they will likely wish to capture the benefits accruing from that investment risk by seeking control of their own equity volumes better to integrate value they have personally created along the chain.

Pricing

Although there are now more factors than ever influencing the growth in the short-term LNG trade, it has been on the industry's radar screen for almost a decade. The reason for this has been the preoccupation with the emergence of a so-called "spot" market, which could undermine the relative price stability both buyers and sellers have valued.

Few in the industry now believe that movements of LNG representing only a few percent of the total worldwide gas trade will result in the global "commoditization" of gas prices. Pipeline gas and interfuel competition will continue to be the dominant influences.

Yet it is likely that the increased trade between the Pacific and Atlantic Basins and the arbitrage opportunities between the gas-led US and oil-led European markets will lead to more price transparency.

What makes US gas pricing particularly interesting is the transparency and ubiquity of Henry Hub as a reference price and the fact that it is traded in such a deeply liquid futures market. This allows buyers and sellers of pipeline gas or LNG to agree to link a price to Henry Hub and then each separately to adjust their pricing exposure using the futures or associated derivatives markets.

Increasingly, we will see mid to long-term deals for LNG from West and North Africa and even Asia Pacific linked only to Henry Hub. The US West Coast may provide an exciting new opportunity for shorter-term sales and balancing of supply outlets. The high summer air-conditioning load of California could help offset the heavy winter seasonality of the current Korean trade.

Yet, despite all this recent US focus, it is not obvious that pricing mechanisms existing in Far East buyer contracts will change in the near future. After all, Far East LNG is indirectly priced on a spot basis already, via a basket of commodity crudes, and hence linked to the price of oil products with which their LNG still competes on a marginal demand basis.

The authors

Robert Ryan is vice-president for gas business development for Shell International Exploration & Production, The Hague. In the 1990s, he worked in Shell International Gas on LNG projects in Nigeria, Malaysia, and Australia. Previously, he held various petroleum engineering and business management roles on the exploration and production side. Ryan holds a mechanical engineering degree (1981) from Ohio Northern University, Ada, and is a registered professional petroleum engineer in Louisiana and mechanical engineer in Ohio.

Colin Bowkley is a business development manager for Shell Gas and Power, London. He has more than 20 years of experience on commercial issues related to downstream gas development, including involvement in the Nigeria LNG project. Bowkley holds a degree in economics from Cambridge University and a business diploma from Manchester Business School.

Peter D.A. Baruch is a technologist in the LNG and gas processing group in Shell Global Solutions, The Hague. He has worked for Shell 3 years in LNG plant design providing technical advice to operating LNG plants. Baruch is a graduate of Sheffield University, England, and an associate member of the Institute of Chemical Engineers.