NEW ZEALAND POTENTIAL-1: Taranaki basin yielding large oil and gas discoveries

Exploration opportunities in New Zealand are growing as existing fields enter a decline phase. New Zealand imports two-thirds of its liquid energy requirements and is encouraging petroleum companies to expand their exploration activities.

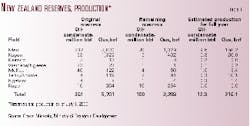

With estimated remaining reserves of 100 million bbl of oil and condensate and 2.2 tscf of gas in producing fields and 12%/year consumption, new discoveries are needed to fill the fuel gap looming by 2010. The majority of the oil produced is exported, mostly to the Australasian region as crude and refined product.

An existing methanol plant (using approximately 93 bcf/year), gas pipeline infrastructure, and new power generation stations set for construction on the north island mean gas will remain a valuable commodity for companies investing in New Zealand in the next decade.

In the Taranaki basin, New Zealand's only producing province, the majority of new entrants have been small to medium-size independent petroleum companies. Added to these, major corporations such as Shell and Conoco continue to participate in exploration opportunities.

Due to enhanced exploration technology, attractive fiscal terms, existing petroleum facilities and infrastructure, higher oil prices, and significant untested exploration potential in both structural and stratigraphic trapping mechanisms, the basin is experiencing another drilling boom.

Explorers have been rewarded for their efforts with several recent large discoveries as the pace of drilling surges. Many believe the Taranaki basin is now entering a new cycle of intense exploration scrutiny.

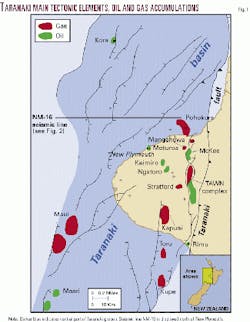

The Taranaki basin, on the west coast of the north island, contains all of New Zealand's currently producing fields (Fig. 1) but in a global sense is underexplored compared with other rift complexes of its size and potential. With a northeasterly orientation and partially overlain by Quaternary volcanic rocks of the Taranaki Peninsula, the basin takes in more than 100,000 sq km and consists of several depocenters containing as much as 9 km of Cretaceous-Cenozoic sediments.

Exploration history

Although 1865 marked the first well in New Zealand near New Plymouth, results of drilling were disappointing the next 90 years except for minor production from Moturoa.

Success finally knocked when the Shell, BP, and Todd (SBPT) joint venture, using New Zealand's earliest seismic reflection survey, kicked off the modern petroleum era in 1959 with the discovery of gas and condensate in its first well, Kapuni-1. Fourteen years later, SBPT delimited giant offshore Maui gas and condensate field.

New Zealand's first significant oil discovery came in 1979 when Petrocorp tested 1,000 b/d of 43° gravity crude at McKee-2. Successive discoveries in 1982-86 by Petrocorp included Kaimiro, Ahuroa, and Tariki (gas and condensate), and Waihapa/Ngaere (oil) fields.

New Zealand Oil & Gas (NZOG) drilled the offshore Kupe South oil-gas-condensate discovery in 1986 and Ngatoro field onshore in 1991. In the latter discovery well, NZOG tested Miocene sands bypassed by another operator.

Although noncommercial at the time, Tricentrol's Moki-1 (1983) and Arco's Kora-1 (1988) oil discoveries established the validity of new play concepts in the basin. Wildcat drilling in the Taranaki basin waned in the early 1990s until the arrival of a new cast of explorationists.

Recent exploration

Encouraged by higher oil prices and recognizing favorable fiscal terms, numerous foreign players have waded into the New Zealand exploration fray in recent years.

Two new entrants, US-based Swift Energy Co. and Westech Energy Corp., were successful in their inaugural Taranaki basin wells.

After testing at rates up to 1,525 b/d of 44° gravity oil from multiple Oligocene sandstone and carbonate reservoirs, Swift Energy is delimiting a major new oil and gas find at its Rimu prospect that may contain four to six times the 27 million bbl of oil equivalent reserves proved to date. The Rimu discovery was doubly sweet for Swift Energy as it marked the company's first international drilling venture as operator. Partners in the Rimu consortium include Antrim Oil & Gas Ltd., Calgary, and the Marabella Enterprises subsidiary of Bligh Oil & Minerals NL, Brisbane.

Plans to quickly put this 3,600-4,200 m deep find on-stream are proceeding as the company begins designing a production and processing station near Hawera less than 2 years after spudding its first well in New Zealand. The 3,500 b/d, 10 MMcfd facility should be operational by yearend 2001.

Additionally, at this writing industry eagerly awaited results of Swift's Kauri wildcat spudded in May and targeting a structure immediately south of Rimu. In mid-June, Swift had drilled the well to 3,157 m and encountered hydrocarbon shows of varying quality in several zones. Swift planned further evaluation.

Following its recent gas finds in New Zealand's East Coast basin, Westech Energy's initial wildcat in the Taranaki basin tested hydrocarbons from a Miocene slope-basin fan play. Located only a few kilometers from Kaimiro and Ngatoro fields, Windsor-1 flowed gas from 2,200 m.

Other recent successes

Last year an international consortium including operator Fletcher Challenge Energy, Shell Petroleum Mining Co., Todd Petroleum Mining, and Preussag Energie tapped one of the larger petroleum accumulations in New Zealand with its Pohokura drilling program.

Discovered on the doorstep of the Motonui methanol facility and estimated to hold almost 1 tscf gas and 50 million bbl of condensate, Pohokura is under delineation after acquisition of a new marine and transitional 3D seismic survey. Maximizing the rig's testing equipment, Pohokura-2 flowed at a rate of 30.7 MMscfd of gas and exhibited greater than normal condensate content of 87 bbl/MMscf from Eocene sandstones at 3,600 m.

Unrestricted gas flow rates may be four to five times the test flows. Pohokura is the first economically viable offshore petroleum find north of the Taranaki Peninsula and continues a succession of hydrocarbon accumulations paralleling the north-trending Taranaki fault and Tarata thrust zone that form the basin's eastern margin.

Another relatively recent participant in Taranaki is Indo-Pacific Energy Ltd., Wellington. The company was recompensed in full this year when Goldie-1, a new pool discovery just west of Ngatoro field, tested 600 b/d of oil from Miocene sandstones at 1,650 m. The well flowed premium light sweet crude with lower than normal wax content and pour point temperature below 40° F. Indo-Pacific trucked oil from Goldie-1 to the Omata tank farm within 2 weeks of the completion of flow tests.

New Taranaki players

Other players involved in recent Taranaki basin drilling programs include GEL Exploration Inc., Houston, and Discovery Geo (Australia) Corp., Dallas. Neither was successful in its initial New Zealand well.

GEL Exploration has continued a strategy of taking farmouts on various blocks with future drilling commitments throughout the basin, and Discovery Geo plans to punch two more wells after it found encouraging hydrocarbon indications in Warea-1 near Cape Egmont.

Another new explorer on the New Zealand petroleum scene is EEX Corp., a Houston independent and operator of an offshore license north of the Taranaki Peninsula. After reprocessing over 700 line km of 1974 2D seismic data with marked improvement, EEX is acquiring one of the largest aeromagnetic surveys flown in New Zealand to assist in the definition of numerous fault-bound structures on the permit.

Even the grand dame of New Zealand's petroleum industry, Maui field, is not without recent success as operator Shell, Fletcher Challenge, and Todd reported excellent flow rates of more than 10,000 b/d of oil from Eocene sandstones at 3,000 m from the MB-7 well.

In addition, Shell, Todd, and OMV Petroleum Pty. Ltd. of Austria plan to develop the 1998 discovery at Maari 20 km south of Maui field. Several development scenarios are being evaluated for Maari, which contains reserves of 25-60 million bbl.

Hot drilling pace

Following on the heels of 10 wells in 1999 and 22 wells last year, companies indicate the trend is climbing as 27 exploration, appraisal, and development holes are planned for 2001 in New Zealand.

In the 23 years preceding 2000, the Taranaki basin experienced an average of three wildcats drilled per year. However, drilling activity is rising dramatically as 8 exploration wells were concluded in the basin last year and 12 are planned for 2001. This activity has resulted in an excellent exploration success rate of 28% for commercial discoveries from 1998-2000.

The dynamic drilling rate is keeping rig suppliers and service companies busy as additional personnel and materials enter the country to keep pace with demand. Accelerating the tempo, marine and land 2D and 3D seismic acquisition programs and aeromagnetic surveys are under way or planned in 2001.

Petroleum reserves

New Zealand's resource picture shows remaining reserves of 100 million bbl of liquids and 2.2 tscf of gas with about 12 million bbl of liquids and 216 bscf of gas produced in the previous 12 months from July 2000 (Table 1). Production from recent discoveries at Rimu and Goldie-1 as well as a recompletion in old Moturoa field is not included. The average onshore field size is some 70 million bbl of oil equivalent.

Nine fields are on production in the Taranaki basin. Maui field accounts for 78% of the oil and 73% of the gas produced in the country.

As Maui approaches its 30th anniversary, new energy resources are being sought to reverse the trend of declining liquids production. The recent achievements at Rimu and Pohokura will certainly assist the endeavor, and the government's policies encourage increased drilling.

Fiscal regime

Long recognized as one of the most attractive countries in the world in which to explore, New Zealand is risk free politically and offers an open commercial environment.

Its fiscal policies allow companies to take home 53% average of the profit on production after deducting all royalties and taxes, according to a study by Daniel Johnston & Co., Dallas consultants.

Robertson Research of the UK ranked New Zealand third best in the world after the UK and deepwater Gulf of Mexico for division of profits between the government and company.

As with many international destinations, New Zealand has well defined environmental and indigenous peoples' requirements. If environmental and local cultural concerns are adequately met, permitting times of seismic surveys and drilling programs are generally minimal.

The government owns all naturally-occurring oil and gas, and the Ministry of Economic Development allocates permits to explore for hydrocarbons.

Two methods are utilized to issue permits, the acceptable frontier offer (AFO) and the blocks offer. The AFO method allows exploration groups to submit bids any time over unpermitted areas, whereas Blocks Offers or bidding rounds are advertised over specified areas and a deadline for submittal of competitive work program bids is established. Both AFO and Blocks Offer bids are evaluated on the basis of technical merit of proposed work programs.

Due to interest in Taranaki basin open areas, the Ministry of Economic Development plans a blocks offer in 2001. These areas are to include both onshore and marine acreage throughout the basin's producing regions. Technical data are available from the ministry.

Geological setting

The Taranaki basin has a complicated morphology due to varied tectonic events and is composed of superimposed sub-basins, normal, reverse, and overthrust faulting and areas of uplift.

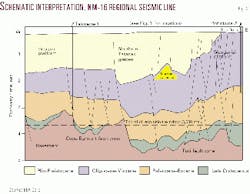

The main structural development of the Taranaki basin occurred in the Late Cretaceous, some 80-65 Ma (Fig. 2). This timing is coincident with the opening of the Tasman Sea between proto-Australia and New Zealand and was expressed by the growth of the western margin fault blocks, uplift of the passive margin along the basin's eastern edge, and activation of fault blocks.

Post-rift sagging resulted in compaction and drape of the section over pre-existing structure through Paleogene time. By early Neogene, the basin had infilled with sediment and lost expression as a rift. Miocene volcanic activity along the Cape Egmont fault zone provided localized uplift and heating events in the central and northern parts of the basin. Compressional events associated with the formation of the Taranaki thrust fault gave rise to deformation resulting in thrust anticlines, generally confined to the eastern and southern parts of the basin.

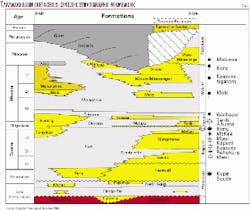

The stratigraphy of the Taranaki basin consists of a Cretaceous-Cenozoic succession of terrestrial and marine sedimentary and volcanic rocks overlying basement composed of Paleozoic-Mesozoic granites, basalts, andesites, and metasediments. King and Thrasher divided the Cretaceous-Cenozoic section into four megasequences that are based on seismic mapping, which are in part lithostratigraphic, chronostratigraphic and tectonostratigraphic (Fig. 4):

- Late Cretaceous syn-rift sequence (Pakawau Group).

- Paleocene-Eocene late-rift and post-rift transgressive sequence (Kapuni and Moa groups).

- Oligocene-Miocene foredeep and distal sediment starved shelf and slope sequence (Ngatoro Group) and Miocene regressive sequence (Wai-iti Group).

- Plio-Pleistocene regressive sequence (Rotokare Group).

Hydrocarbon elements

The Taranaki basin contains a complicated system of petroleum elements, some not fully understood as most wells have been drilled on highs or along basin flanks with few penetrating the depocenters. More active evaluation of the deep sub-basins may be the key to unlocking the secrets of this enormous rift system.

Source

The most important source intervals include Cretaceous synrift terrestrial coaly facies, Paleocene organic-rich marine mudstones, and Eocene terrestrial/estuarine coaly sequence. The majority of hydrocarbons found in the Taranaki basin are from terrestrial sources with minor marine contributions; however, an exception is the oil tested from Kora-1 in the Northern Taranaki graben, which is typed to a Paleocene marine mudstone. Oils derived from the terrestrial facies are generally 30-40° gravity and waxy with low sulfur, nickel, and vanadium content. The oil tested at Kora displayed higher sulfur and lower wax contents and lower pristane/phytane values than its terrestrially-derived counterparts.

Petroleum generation

Modeling suggests that oil generation occurred in a southeast to northwest succession from the Late Cretaceous section as it entered the peak oil generative window during Late Paleocene to Early Miocene time. It is believed the sedimentary section below 5,000 m is currently in the mature-overmature generative phase for the Late Cretaceous sourcing intervals.

Paleocene-Eocene source rocks probably reached peak generation during the Late Miocene to Early Pliocene, or about 10-5 Ma, and after the formation of most structural trapping mechanisms. Migration is thought to have moved upward through the section along numerous basinal faults during periodic Cenozoic tectonism affecting the basin. Gas chimneys and shallow gas anomalies near major faults support this hypothesis.

Reservoir/seal couplets

Hydrocarbons have been tested in every chronostratigraphic level in the Taranaki basin except the Cretaceous, which cannot be discounted as it exhibits high porosities in certain regions.

The Cretaceous has only been penetrated by a handful of wells, but significant shows were recorded in Maui-4. As reported by King and Thrasher, gas-condensate and oil deposits are found in reservoirs of Paleogene age, whereas commercial reservoirs in the Neogene are primarily oil accumulations.

The majority of oil and gas found to date in the basin is contained in sandstone reservoirs of Eocene age; however, the field size distribution statistic is greatly skewed by giant Maui field and may not accurately reflect the New Zealand petroleum resource picture.

The oldest reservoirs delimited thus far are fluvial sandstones of the Paleocene Farewell formation in Kupe South field. The formation exhibits porosities in excess of 20% and is unconformably overlain and sealed by impermeable Oligocene shales. The oil-bearing 'F sands' reservoir section in Maui field is the coastal plain equivalent to the Kupe South interval.

Coastal and tidally influenced estuarine sandstones of the Eocene Kaimiro, Mangahewa, and McKee formations contain much of the basin's petroleum resources. Shoreline, barrier bar, estuarine, and coastal plain sandstones, sealed by marine shales of the Turi formation, reservoir hydrocarbons in the Maui, Kapuni, Mangahewa, Pohokura, and Stratford fields.

The coastal Mangahewa formation 'C sands' in Maui display porosities as high as 27% and permeabilities approaching 2,000 md. The shallow marine sandstones of the McKee formation, found in the northeastern region of the Taranaki Peninsula, produce oil at McKee field. A thin interval of the youngest Turi formation shales acts as seals for the McKee reservoirs.

Oligocene Otaraoa formation reservoirs include glauconitic sandstones of the Matapo member and shelf turbidites of the Tariki sandstone member. The Tariki sandstone member produces gas and condensate in Tariki and Ahuroa fields and is the primary reservoir from which hydrocarbons have been tested in the Rimu discovery. In addition, fractured carbonates of the Tikorangi formation form prolific reservoirs in the Waihapa-Ngaere field. Seals include Oligocene and early Miocene tight carbonates, marls and shales.

The regressive sedimentary system that dominated the Neogene formed at least two turbidite reservoir systems, the Moki and Mount Messenger formations. Hydrocarbons have been tested from the Moki formation in Moki-1 and Ngatoro-3 with significant shows reported from other wells. The shallow Mount Messenger formation, overlain by impermeable mudstones of the Manganui formation, produces petroleum in Kaimiro and Ngatoro fields and exhibits porosities ranging from 14-25% and average permeabilities of 135 md.

Although their heterogeneous nature is a cause for concern, the volcaniclastics of the Late Miocene Mohakatino formation are proven reservoirs at Kora. Even the shallow sands in the Pliocene Matemateonga formation at Moturoa produce oil and the Mio-Pliocene Urenui formation flowed hydrocarbons at Cheal-1 and Ngaere-3.

Traps

The Cretaceous-Paleogene rifting phase and later Miocene reactivation developed numerous anticlines, rotated fault blocks and horsts in the Taranaki basin. These constitute the most significant trapping mechanisms in the basin and include the largest hydrocarbon accumulations found to date. Drape over these high blocks also contribute to the entrapment of petroleum.

Sandstones and fractured carbonates in detached thrust sheets associated with the Tarata reverse fault have long produced in the Taranaki basin. Cenozoic basin and slope fans are undergoing closer scrutiny as targets and several wells have encountered petroleum in volcaniclastics. Although difficult to discern, stratigraphic and diagenetic trapping mechanisms are also valid play concepts, elements of which have been encountered in previous drilling but not fully evaluated on their own merit.

New Zealand potential

New Zealand's Taranaki basin is experiencing an escalation of wildcat wells as the number of companies entering the search for petroleum continue to increase. The efforts of recent drilling programs have resulted in several petroleum discoveries, two of which are among the country's largest accumulations.

Successful step-out and wildcat endeavors indicate much is still to be learned about petroleum entrapment in the basin. Interest in the upcoming licensing round is growing as companies expand their international portfolios.

Opportunities for entry into the New Zealand petroleum scene are numerous; farmouts, acquisition of divested properties from Shell's purchase of Fletcher Challenge Energy, participation in the next license round, and utilization of the Crown Mineral AFO mechanism for frontier shallow and deepwater basins.

The Taranaki basin, twice the size of the North Sea's prolific Viking graben, has experienced only 114 wildcats, with only 50 offshore, since 1955. As most drilling has focused on the structural highs, complex structural-stratigraphic and diagenetic play concepts have been barely tested.

Several Neogene submarine sand systems have been penetrated and produce hydrocarbons where located over high blocks but have not been investigated in the depocenters. Many of the deeper features in the source kitchens have never been drilled, and the difficulty in obtaining good quality seismic data in the northern volcanic province and along the complex eastern margin means the Taranaki basin will continue to provide exploration challenges, and rewards, for companies willing to invest in New Zealand.

Acknowledgments

This article was initiated and funded by Crown Minerals, Ministry of Economic Development, which administers petroleum exploration in New Zealand. The author is grateful to EEX Corp., Houston, for allowing publication of newly reprocessed seismic data and to the directors, Mac Beggs and Glenn Thrasher, and staff of GeoSphere Exploration Ltd., and Dave Bennett, Indo-Pacific Energy, for critically reading this manuscript.

Next: Numerous play types evident in Taranaki basin

Bibliography

Crown Minerals, "Explore New Zealand petroleum," Ministry of Economic Development, Wellington, 2000, 48 p.

Hamilton, T.M., "Basis for EEX's entry into exploration in New Zealand," in 2000 New Zealand Petroleum Conference Proceedings, Crown Minerals, Ministry of Economic Development, Wellington, 2000, pp 15-19.

King, P.R., and Thrasher, G.P., "Cretaceous-Cenozoic geology and petroleum systems of the Taranaki basin, New Zealand," Institute of Geological and Nuclear Sciences Monograph 13, 1996, 244 p.

Stagpoole, V., "A geophysical study of the North Taranaki basin," unpublished PhD thesis, Victoria University of Wellington, 1997, 245 p.

Wood, R.A., Funnell, R.H., King, P.R., Matthews, E.R., Thrasher, G.P., Killops, S.D., and Scadden, P.G., "Evolution of the Taranaki basin-hydrocarbon maturation and migration with time," in 1998 New Zealand Petroleum Conference Proceedings, Crown Minerals, Ministry of Economic Development, Wellington, 1998, pp. 307-316.