Recent studies show health, future of oil tanker industry

Midyear has seen release of three studies relating to petroleum and petroleum products tankers.

A study of accidental oil spills by the International Tanker Owners Pollution Federation Ltd. (ITOPF) indicates that the 1990s witnessed a clear reduction in the volume and frequency of accidental oil spills from tankers moving oil and products on the high seas.

Another review of historical tanker information, this time profitability data for the last 6 months of 2000, indicates that period marked the best tanker market in decades, reported Clarkson Research Studies, London.

Finally, Ocean Shipping Consultants Ltd. (OSC), London, in releasing a projection of product tanker markets to 2010, analyzed the effect of the recent International Maritime Organization (IMO) agreement on the phaseout of single-hull tankers. It concluded that the agreement will undermine the freight-market strength identified in the report by Clarkson Research.

Spill record

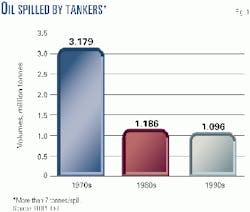

Data on accidental oil spills in the 1990s indicate the volume of oil spilled over the 10-year span was the lowest of the past 3 decades (Fig. 1).

The organization found that, although the total volume of oil lost from tankers in the 1990s was only about 10% less than for the 1980s, within the period itself the trend was noticeably downward.

A total of 189,000 tonnes of oil was spilled during the latter half of the 1990s in accidents involving spills of more than 7 tonnes. This contrasts sharply with the 907,000 tonnes lost in the first half of the decade.

One incident alone-the grounding of the Sea Empress off the Welsh port of Milford Haven in 1996-accounted for 72,000 of the 189,000 tonnes of oil lost in the 1995-99 period, or almost 40% of the total.

The positive trend has continued into the new millennium, said the organization's report. The oil spill accident of greatest significance for 2000 was the grounding of the oil tanker Natuna Sea off Singapore with the loss of 6,000 tonnes of crude oil.

Intertanko, the International Association of Independent Tanker Owners, Oslo, released the study and said "the challenges of maintaining this improving spill record are considerable. However, as the sinking of the Erika and the grounding of Sea Empress revealed, the stakes are so high that the industry can ill afford to drop its guard.

"Both incidents highlighted not only how much public outcry and political repercussions can stem from one pollution incident, but also that a decade of hard-won improvements to the oil spill graphs can be completely distorted by a single tanker accident."

The report said that, as the volume of oil accidentally lost from tankers continued to decline during the 1990s, levels of activity in crude oil and petroleum products tanker fleets increased in both tonnage and tonne-mile terms. In 2000, more than 2 billion tonnes of crude and refined products were carried by sea.

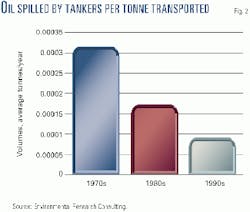

Intertanko said US-based Environmental Research Consulting (ERC) has combined historical records of cargo carried and volume spilled. The records show a steady decline in oil spilled by tankers per tonne transported over the past 30 years.

Decade-by-decade, the data show, 0.000094 tonnes (approximately 10 centiliters) were lost for each tonne delivered in the 1990s, compared with 0.000310 tonnes in the 1970s, effectively a three-fold reduction (Fig. 2).

If the continued decline in the volume of oil spilled in the latter half of the 1990s is taken into account, said the association, the year-by-year figures show an even more dramatic, six-fold decrease in the volume of oil lost per tonne transported, from 0.00030 tonnes in 1978 to 0.00005 tonnes today.

Accidental loss of oil from ships is not limited to tankers, said Intertanko. The fact that a large container ship can be carrying more oil, in the form of bunker fuel, than a fully laden coastal tanker "shows that the pollution risk is spread across the entire spectrum of shipping."

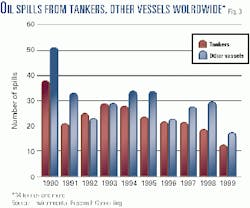

Intertanko said ERC has also compiled statistics that compare the number of major spills (34 tonnes or more) from both tankers and nontankers.

That record shows that, on a numerical basis, there have been consistently fewer major spills from tankers than from other types of ship during the 1990s (Fig. 3).

While the total volume of oil lost accidentally from tankers is still greater than from other types of ships, the viscous, persistent nature of heavy bunker-fuel spills can cause severe environmental damage, said Intertanko.

On a worldwide basis, moreover, accidental spills from tankers have accounted for less than 5% of all marine oil pollution during the latter half of the 1990s.

The emotive nature of oil spills means, however, that "the tanker industry will never be able to rest on its laurels," said the association.

Profit records

In its latest survey, published in late spring and reported in OGJ Online last month, Clarkson said a large proportion of the tanker fleet is trading on the spot market at rates between $30,000 and $80,000/day.

It said, "For the remainder of this year, the tanker fundamentals look reasonably solid. The fleet is expanding, but for the time being, world oil demand seems to be growing just as fast, and tanker owners are doing a good job of hanging onto the high ground they established last year.

"However, scrapping remains very sluggish and with [new construction the equivalent of] 12% of the fleet due for delivery by the end of 2002, the market is vulnerable to a supply-driven squeeze. So rates may start to be tested in the autumn."

Clarkson said the very large crude carrier (VLCC; 280,000-410,000 dwt) and Suezmax (150,000-280,000 dwt) tanker segments both maintained the high earnings levels of late 2000, while Aframaxes (80,000-120,000 dwt) were even stronger.

"However, the biggest improvement was for the products tankers, which surprised everyone during the closing months of 2000 by rocketing up to earnings levels of almost $40,000/day.

"That was quite extraordinary for ships that traditionally earned around $10,000/day."

Clarkson said the dominant feature of the tanker market last year was the switch of supply away from short-haul sources to the long-haul Middle East oil.

"World oil demand increased by 600,000 b/d, and long-haul Middle East exports increased from 12.1 million b/d in 1999 to 13 million in 2000. That was a 7.6% increase and quite a contrast to the 4.1% decline in 1999.

"During the same period, exports from the short-haul producers showed little growth. North Sea exports grew by 2.2% and the Caribbean by 1.9%. The only significant increase was in Africa, whose exports were up by 4.6%. However, the bottom line was a lot more long-haul oil being shipped, and consequently a multiplied impact on tanker demand."

Clarkson said that as of Apr. 1, about 55.6 million dwt of tankers were on order, and the 35.8 million dwt contracted in 2000 were the highest in more than 20 years.

It said 2001 should be another very good year for the tanker industry, since demand will expand by more than 1 million b/d while the fleet will expand only 0.7%.

But it noted that only 1.6 million dwt were scrapped in the first quarter. "In reality, the financial temptations of a tight market are likely to keep many of the old ships at sea, allowing the fleet to grow faster than suggested by our forecasts," it said.

Darker long-term

A marked slowdown in tanker scrapping levels was one of the effects OSC noted in its study Product Tanker Markets to 2010 of the final agreement reached on Apr. 27, 2001, on IMO phaseout of single-hull tankers.

This effect will combine with a slowing global economy and low product trade growth to undermine current freight market strength, despite an ongoing preference and premium, said OSC, for modern tonnage.

The adopted IMO phaseout schedule is more relaxed than previously proposed.

MARPOL tankers built in 1973 or earlier (about 600,000 dwt), for example, will be phased out by 2003, compared to slightly more than 3 million dwt under earlier proposals.

"MARPOL" refers to the International Convention for the Prevention of Pollution from Ships (1973), amended by a subsequent Protocol in 1978.

OSC expects scrapping levels to fall from 2 million dwt in 2000 to only 500,000 dwt in 2001, before rising to around 1.5 million dwt in 2002 and 1.8 million dwt in 2003 under OSC's most likely scenario (Base Case).

Newbuilding deliveries will rise significantly over the near term, reflecting a current orderbook of 6.4 million dwt, equivalent to 15% of the existing fleet.

Product tanker deliveries will average slightly more than 2 million dwt/year over 2001-2003, compared with 1.6 million dwt in 2000.

The implication is for a 4% rise in fleet capacity in 2001 to 44.3 million dwt, compared with a 2.5% decline noted in 2000. Fleet growth will slow over 2002-2003 (to around 1.4%/year) as IMO-induced scrapping volumes rise, lifting overall capacity to 45 million dwt by 2003.

Within the fleet, high levels of newbuilding deliveries as well as scrapping volumes imply a marked rise in the share of modern tonnage, with a concentration on the 35,000-40,000 dwt sector and, to a lesser extent, the 45,000-50,000 dwt sector replacing older small vessels.

Product trade developments

An expected slowdown in the world economy will limit seaborne product trade growth over the near term, said OSC, compounded by refinery surpluses in North Asia.

Also over the near term, South Korea will remain the dominant provider of products to such North Asian import markets as China and Japan.

Middle East exporters will face additional competition within Asia markets as new refineries in India and Taiwan come on stream.

Intraregional product trade will dominate trade movements in Asia, Europe, and the US over the forecast period, with Middle East exporters intensifying efforts to target long-haul markets in spite of tightening product specifications.

Key factors influencing short-term product tanker demand, according to OSC, include:

- Fall in Middle East product exports into Asia of slightly more than 200,000 b/d.

- Rise in Asian intraregional product movements of about 300,000 b/d due to refinery expansions.

- Strong rise in US product imports, bolstering short-haul volumes from Latin America, as well as medium-haul shipments from Europe and long-haul shipments from the Middle East.

- Rise in European intraregional product trade by slightly less than 130,000 b/d, supported by increased imports from the Middle East, North Africa, and the former Soviet Union (FSU).

Over the medium term, 2003-2005, increased product demand among the industrializing nations of Asia, particularly China and India, will boost long-haul product trade movements.

Deregulation in Japan and China will boost product import volumes, both from short-haul intraregional sources as well as long-haul imports from the Middle East.

Key factors influencing long-term product tanker demand include:

- Strong rise in long-haul Asian product imports from the Middle East.

- Continued growth in intraregional product movements in Europe, Latin America, and Asia.

Global product trade volumes will grow by around 0.4%/year over 2001-2002, accelerating to 1%/year in 2003 and improving significantly to around 4%/year over 2004-2005.

Long-term product trade growth will slow to around 1%/year by the end of the forecast period, with volumes rising from 501 tonnes in 2000 to 551 tonnes in 2005 and 611 tonnes by 2010.

While near-term prospects for large-sized tankers larger than 40,000 dwt appear mixed, said OSC, trade patterns will favor the 30-35,000-dwt sector.

The marked rise in Middle East product exports to Asia over the long-term period will boost demand for larger product tankers of more than 40,000 dwt, while demand for Handy vessels (30-40,000 dwt) will be sustained by increased intraregional movements worldwide.

Freight rates to 2010

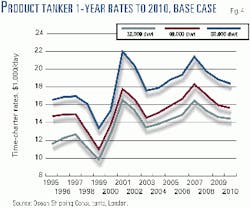

Time-charter rates of 1 year for a 32,000-dwt product tanker under OSC's Base Case will average $16,500/day in 2001, $15,500 in 2002, and $13,500 in 2003.

These compare with $12,800/day in 2000 (Fig. 4).

This trend, said OSC, reflects a steady rise in newbuilding deliveries in excess of IMO-implied scrapping volumes over the near term set against a background of modest product trade growth.

The sharp rise in scrapping levels over 2006-2007 will tighten freight markets over the medium-term period.

Time-charter rates for 1 year for a 32,000-dwt product tanker will rise to an average $16,500/day by 2007 before falling back to $14,550/day by 2010.

Alternative low and high demand scenarios imply significant changes to near-term freight rate developments compared with the Base Case, with a far deeper fall over 2002-2003 under the Low Case and a sustained period of relative freight market strength under the High Case.

For 2003, therefore, said OSC, comparative freight rates for a 32,000-dwt product tanker equate to $12,400/day in the Low Case and $15,320/day in the High Case against $13,500/day in the Base Case.

New LNG tanker ordered for US service

Tractebel North America Inc. believes the US LNG market will continue to grow as natural gas prices settle into a new higher range.

The energy arm of French company Suez Group (formerly Suez Lyonnaise des Eaux), Tractebel announced last month a long-term charter agreement for a new LNG tanker, reported OGJ Online.

It is scheduled for delivery in 2003 and will be the company's second vessel ordered in the past year. The latest carrier order comes on the heels of the first placed in November 2000.

Tractebel unit Cabot LNG owns and operates a import terminal at Everett, Mass. Only one other terminal is currently operating in the US at Lake Charles, La., owned by CMS Energy Corp.

The two other terminals, at Elba Island, Ga., and Cove Point, Md., are being reactivated. Earlier this year, El Paso Corp. said it is close to announcing plans to build a new terminal on the West Coast.

LNG shipping

While capacity is being expanded to receive LNG in the US, transportation capacity for LNG is constrained.

Tractebel will charter its new tanker for 20 years and have options to extend the charter for an additional 9 years. The company will use the tanker to load LNG from Trinidad and other supply sources for delivery into the Everett terminal. The LNG tanker will have a capacity of 138,000 cu m.

The market for LNG in the US had deteriorated for the past 15 years because of high costs to import the product compared to local prices of natural gas.

According to McKinsey & Co., the liquefaction, transportation, and regasification costs averaged about $2.53/MMbtu in the 1970s, not including the commodity costs. Meanwhile, natural gas prices hovered in the $2-$2.50/MMbtu range, smothering the LNG import market.

But the cost of LNG facilities, including tankers, has fallen, while the price of gas has increased. El Paso executives claimed at an analysts conference in March the cost to import LNG has fallen to $1.80/MMbtu. El Paso executives also noted the cost of new LNG tankers has fallen to about $160 million, compared to $250 million a decade ago.

With the price of natural gas in some producing regions overseas a fraction of what it is in the US, LNG can compete with US gas prices that average $3/MMbtu.