LPG trade patterns continue historic change in 2000

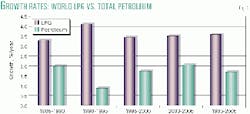

Worldwide LPG demand has continued to outpace total petroleum demand during the last several years. From 1985 to 2000, demand grew an average of 3.5%/year.

Purvin & Gertz expects this trend to continue and projects the average growth for LPG demand to be slightly more than 3.5%/year from 2000 to 2010.

Over the same time, the company estimates that petroleum demand will grow about 1.8%/year, up from the 1985-2000 average growth of 1.6%/year.

The strong demand growth for LPG has been driven by two main consuming sectors: petrochemical feedstock use and residential-commercial demand.

The increase in petrochemical demand resulted from increases in the "traditional" areas of North America and Europe and by "nontraditional" areas, most notably the Middle East. In the past several years, LPG use as a petrochemical feedstock has risen dramatically in the Middle East, as countries have tried to add value to their indigenous natural resources.

Growth in the residential-commercial sector has been especially prominent in developing economies, led by the rapid growth in India and China.

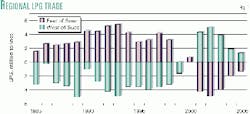

The additional demand, coupled with decreased exports from Middle East countries, has changed trade patterns in ways that will last longer than originally thought. Historically, the region of the world east of the Suez Canal ("East of Suez") has had a surplus of LPG and was a net exporter of product to the region west of the canal ("West of Suez").

High growth of LPG demand in the Far East, coupled with additional petrochemical demand in the Middle East, has made the East of Suez region a net importer for the first time in 2001.

Purvin & Gertz forecasts that these trade patterns will continue until 2005 when additional LPG supplies will reduce the need for the East of Suez region to import supplies to meet LPG demand (Fig. 1).

This change, along with increased price volatility, has led to questions about supply stability from many consuming countries, especially as LPG demand continues to grow in the eastern markets.

Shifting demand

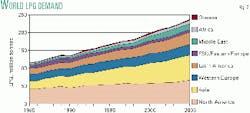

In 1985, global demand for LPG was approximately 116 million tonnes/year (tpy; Fig. 2). By 2000, this figure had grown to almost 200 million tpy. During the 1990s, world LPG demand increased an average of nearly 3.7%/year, compared with about 1.5% for total petroleum demand (Fig. 3).

The developing economies of the world continue to exhibit the most dynamic growth in world LPG markets. Asia and Latin America have demonstrated strong growth in LPG demand during the last decade, and much of this demand growth will continue, if at rates slower than the immediate past.

Of the 116 million tonnes of LPG consumed in 1985, approximately 23% of the demand was from East of Suez. By comparison, Purvin & Gertz estimates that world LPG demand in 2005 will be near 237 million tonnes, with 37% of the demand in East of Suez.

Growth rates for world LPG demand differ significantly in the various geographical regions of the world and have changed dramatically during the past several years.

During 1990-1999, the world average growth rate for LPG demand was approximately 3.7%/year. The Middle East had the highest growth in demand during this period, at almost 9%/year. Asia and Africa both grew at nearly 6%/year, while LPG demand in Western Europe grew at only 2% and North America growth was less than 3%/year.

Latin America increased its LPG demand at slightly more than 5%/year. In sharp contrast, regional demand in Eastern Europe and the former Soviet Union shrank by 5%/year, mainly from contraction of the regional economies.

Purvin & Gertz does not expect a dramatic change in LPG growth patterns during the next 5 years. From 2000 to 2005, the firm expects worldwide LPG demand to grow at near 3.8%/year, just slightly more than the average for 1990 through 1999.

Growth in the Middle East, Asia, and Africa will decrease from the rates seen during 1990 through 1999. Latin America will have the most dramatic change, with annual average growth falling to less than 3%/year during 2000-2005, from the average of almost 6% exhibited during 1990-1999.

LPG demand growth will become positive in the former Soviet Union (FSU) and Eastern Europe, a growth rate of more than 3%/year. During the same period, LPG demand in Western Europe should grow from 19 million tonnes in 1985 to more than 31 million tonnes in 2005.

In 1985, North America was the largest LPG consuming region at more than 40 million tonnes of total LPG demand. By 2005, this demand will increase to more than 65 million tonnes.

Asia picture

This figure will be eclipsed by overall demand for LPG in Asia, as this region takes over the top spot. By 2005, Asian LPG demand will approach 70 million tpy, up substantially from the 1985 figure of slightly more than 20 million tonnes.

This change in regional demand is extremely important given the changing East of Suez trade patterns. As the East of Suez region demand grows, even more LPG will need to come from the West of Suez region to fill this deficit.

With the decreased exports from the Middle East due to additional chemical feedstock demand, the Atlantic Basin will play a larger role in supplying the LPG needs of Asia. Within Asia, average growth 1990-2000 was approximately 6%/year. For the region as a whole, average growth will fall to less than 5%/year 2000-2005.

The Southeast Asia sub-region will witness an even more pronounced slowdown in growth. During 1990-2000, the regional average growth was 10%/year, and Purvin & Gertz believes this will decrease to only about 6%/year during 2000 to 2005.

China had strong growth of almost 20% from 1990 to 2000. Over the next 5-year period, LPG demand growth will fall to a more sustainable 6%/year.

The next largest growth rate was in India, with total LPG demand growth of more than 10%/year during the last decade. In the next 5 years, this growth rate will slow marginally but remain greater than 10%/year, considerably higher than the average growth rates for both Asia as a whole and the Southeast Asia region.

The more developed economies of Japan and Korea should see considerably lower demand growth for LPG than India and China. Over the last 10 years, average growth in Korea has been almost 8%/year, and Purvin & Gertz expects this to slow 3%/year during the next 5 years.

LPG growth in Japan will increase slightly, from the 1%/year demonstrated during the past 10 years, to an expected average rate of slightly more than 1% during the next 5 years.

Middle East growth

The Middle East is another region where LPG demand will grow faster than the world average. Demand from1990-2000 in the region increased by slightly more than 8%/year.

Saudi Arabia, the United Arab Emirates, and Qatar had growth rates higher than the average, due mainly to start-up of several large petrochemical projects that use LPG as a feedstock. The UAE exhibited demand growth for LPG of more than 16%/year during the 1990s, while demand in Qatar increased by an average of 35%/year during the 1990s.

From 2000 to 2005, demand growth in Saudi Arabia and Qatar should slow from the large growth rates during the last decade. Saudi Arabia will have average growth of 10%/year during the next 5 years, while demand growth in Qatar should fall to less than 5%/year.

For the region as a whole, LPG demand growth will average slightly less than 7% during the next 5 years. Several countries in the region, including Iran and the UAE, will continue to have healthy growth rates, but less than the regional average.

To supply their domestic consumption requirements, the countries of Asia have typically relied on term contracts with Middle Eastern LPG producers.

With growing demand in Asia and fewer supplies available from the Middle Eastern countries because of internal consumption of LPG, supplies from other sources are increasingly meeting demand. The growing LPG supplies from West Africa and Algeria are now filling this shortfall in Asian supply.

During 1999 and 2000, several large cargoes of fully refrigerated LPG were transported to the Far East from sources that had not been relied upon in the past. Increasingly, these imports will become much more prevalent to fulfill the needs of the East of Suez region.

End-use markets

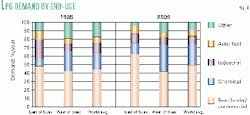

LPG demand by end-use sectors is changing rapidly in several countries and is one of the primary factors behind the changes in trade patterns.

In 1985, half of all LPG consumed East of Suez was consumed in the residential-commercial sector. The chemical end-use sector consumed only about 10% of all LPG demand. The auto-fuel market in the region used about another 10% of the LPG.

By 2005, these consumption patterns will change dramatically, as residential-commercial applications East of Suez will consume more than 60% of the LPG used in the region. Chemical markets will grow to consume around 12% of the LPG, while auto fuel and industrial applications of LPG will shrink.

Demand by end-use sector West of Suez will have some similar movements (Fig. 4).

In 1985, approximately 40% of West of Suez LPG consumption was in the residential-commercial sector, while approximately 25% was in chemical end uses. Industrial and auto-fuel uses combined for about 15% of total consumption.

By 2005, residential-commercial applications for LPG will remain relatively constant. Growth in the region will come from chemical applications, as this end-use will grow to more than 30% of total consumption. Auto fuel and industrial applications will remain at near 15% of total demand.

These consumption patterns demonstrate that residential-commercial and chemical end uses for LPG will continue to dominate the demand picture in the new century. In fact, they will both continue to increase as a percentage of the total demand for all uses of LPG.

By 2005, LPG demand for chemical production should increase to about 25% of world LPG use from approximately 20% in 2000. Residential-commercial end use should increase from slightly more than 40% of total LPG use to about 48% of total LPG use.

The industrial, auto fuel, and "Other" use categories will continue to play a less important and shrinking part of overall LPG demand.

Residential-commercial

Growth rates for various end uses of LPG vary significantly among geographic regions of the world. For residential-commercial end use, most markets are reasonably mature. Analysis by Purvin & Gertz indicates that growth rates for residential-commercial use of LPG in most areas of the world will remain in single digits, with only one region, Asia, growing at an average annual rate of more than 4%.

Asia will have a growth rate in this sector at slightly less than 6% during 2000-2005. Western Europe will have a barely positive growth rate in this end use over the same period, while demand growth in most other regions will be more than 3%.

In 2000, world average per capita consumption of LPG in the residential-commercial sector was approximately 15 kg/person, compared with slightly more than 10 kg in 1985. By 2005, Purvin & Gertz expects that world average to increase to almost 18 kg/person.

The largest growth areas in this category will be both India and China. In 1985, only 5% of total world residential-commercial LPG consumption was in these two countries. This consumption will grow to almost 25% of the world total by 2005.

East of Suez will exhibit the greatest percentage increase in residential-commercial use: The 1985 average per capita consumption of less than 5 kg will increase to almost 14 kg in 2005. In 2000, this figure was approximately 10 kg/capita.

The more mature markets in West of Suez will exhibit slower growth, to almost 24 kg/person in 2005, from the 2000 average of approximately 23 kg.

Purvin & Gertz's analysis indicates that approximately 47% of the total world residential-commercial LPG consumption of 118 million tonnes in 2005 will be East of Suez. In 1985, the region used only 26% of a 51-million-tonne market.

Chemical, auto-fuel markets

The chemical end-use sector should exhibit prolific growth rates, especially in the Middle East.

In 1985, total world consumption of LPG in the chemical markets was 23 million tonnes. Of this, only about 10% of the consumption was East of Suez. By 2005, this will change dramatically, as more than 21% of the petrochemical consumption of LPG will be East of Suez. This market segment will increase to more than 59 million tonnes by 2005.

East of Suez in general, the Middle East in particular, will exhibit much of the growth in petrochemical feedstock consumption, and this will continue to change world trade patterns for LPG.

Demand in the Middle East will have an average growth rate of almost 12%/year from 2000 to 2005 in this market segment. The Middle East started from a relatively small base for petrochemical consumption, which makes the overall growth rates look quite high as several expansions and new projects are brought on-stream.

The Indian subcontinent, Northeast Asia, and Southeast Asia should also increase ethylene capacity significantly during this time.

West of Suez chemical end-use will continue to dwarf significantly the East of Suez market. Growth rates East of Suez, however, are quite high compared with West of Suez. Between 1999 and 2002, the Middle East will have added almost 4 billion lb of ethylene capacity.

Chemical uses of LPG in Western Europe should have growth rates of nearly 7%/year over this same timeframe. Demand in North America will grow at slightly less than 4%, compared with the world average of 5% during this time. Asia, the FSU, and Latin America should see chemical-sector growth rates of 2-3%.

The auto fuel end-use category will grow strongly in several regions.

LPG demand in the Middle East and Africa will grow at 13-15%/year during the forecast period and, in the FSU/Eastern Europe, should also exceed 6%. The other regions will exhibit growth rates of near 4%/year during this time.

The percentage of LPG consumed in East of Suez markets for the auto fuel and industrial markets will remain relatively steady at 45% in 2005, compared to 40% in 1985. The overall world market in these segments will increase to 40 million tonnes in 2005 from 23 million tonnes in 1985.

The increases in LPG demand for auto fuel will be strongly driven by environmental factors, especially in those regions where urban pollution is significant. Several countries are contemplating the introduction of expansion of auto fuel use of LPG. India passed parliamentary legislation approving the use of LPG as auto fuel, and enabling legislation is in the works for its use.

Supply picture

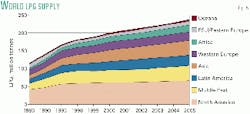

World LPG supply has grown dramatically since 1985 (Fig. 5).

That year, world LPG supply was approximately 114 million tonnes. Approximately 25% of this supply came from sources East of Suez. By 2005, Purvin & Gertz estimates that 37% of total LPG production of 237 million tonnes will come from East of Suez and supplies will grow in every region of the world.

Production increases will be particularly strong in Africa, Asia, and Latin America as new gas processing facilities continue to be built and refinery LPG production continues to increase. LNG will also continue to be a significant source of LPG in some regions.

With the surge in North American natural gas prices during the past year, many areas with stranded gas reserves may prove economically attractive for construction of additional LNG facilities. Also, gas-to-liquids (GTL) processes have had a renewed resurgence of interest, and several projects have been proposed worldwide.

LPG production from Latin America will grow approximately 5%/year from 2000 to 2005. Middle East LPG production should grow as slightly less than 4%/year, while supplies from Asia will increase by approximately 5%/year. The FSU could prove a major contributor for LPG, especially as Caspian Sea resources are developed and exported.

Regional projects

There are several new supply projects expected East of Suez during the next 5 years.

Projects in Qatar and Saudi Arabia will add more than 2.3 million tpy to world supplies by 2003. While LPG production in the region will increase, exports will decrease because of increases in domestic consumption of LPG.

Oil and gas producing areas of Southeast Asia and Oceania will increase LPG production significantly before 2005. Incremental production of almost 1.2 million tpy of LPG will come from the Timor Sea area, while Papua New Guinea and the Natuna Sea areas should each contribute approximately 600,000 tpy of LPG to world supplies by 2004.

Based on expected project start-ups, approximately 4.5 million tonnes of LPG will be added to world supplies from the region by 2005.

Several LPG supply projects are also expected West of Suez before 2005.

West Africa will be a prolific LPG producer as additional gas processing is brought on stream. For years, large volumes of natural gas have been flared in West Africa. New gas and liquids recovery projects being constructed will take advantage of these valuable resources and also improve the environment in the region.

In Nigeria, expansion of the Escravos and Nigerian LNG projects, along with additional processing facilities at Cawthorne Channel and Funiwa-Agbami, should add 1-2 million tonnes of LPG production, most of which will be aimed at the export market.

LPG supplies from Angola will also add appreciable amounts of LPG production in the region.

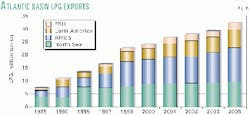

Algeria continues to ramp up LPG production West of Suez and will contribute an additional 2 million tpy of LPG production by 2004. Total regional exports from Africa will increase from almost 10 million tonnes in 2000 to almost 13 million tonnes in 2005.

The North Sea will continue to be a strong exporter of LPG. In 2000, the region exported almost 9 million tonnes of LPG and should grow to near 10 million tonnes by 2005. More than half of the new production will start up by the end of 2001.

South America will continue to add LPG production and export capacity, as almost 3 million tonnes of additional LPG production are expected from Argentina, Venezuela, and Bolivia before 2005, based on firm and probable projects.

In 2000, Latin America exported slightly more than 4 million tonnes of LPG. By 2005, total LPG exports from the region will increase to almost 7 million tonnes. Venezuela will supply the largest share of the increase, with Argentina also playing a significant part.

Recent legislation and additional interest in the opening of the Venezuelan gas industry to international investment will play an important role in the expansion of production capacity. Several new projects could be announced over the next several years as the legislation is changed to allow for more market-oriented policies.

The new supply sources will change the trade patterns for LPG. The Far East will remain the largest importing region in the world but will be importing LPG from increasingly diverse sources.

Imports and distributors will find themselves under ever-increasing competitive pressures as historical trade patterns are disrupted.

US implications

The trade patterns that are developing as a result of the new sources of supplies and new market development will increasingly affect the more mature markets in North America, most notably the US.

In the past, because of almost unlimited storage capacity on the US Gulf Coast, the US has attracted LPG that may be surplus in other regions. The US petrochemical industry has depended on these attractively priced cargos to help balance feedstock requirements for the ethylene industry.

US imports of LPG should increase during the next few years, as surplus quantities become available in other regions. In 1998, US propane inventories increased to an historical high of more than 76 million bbl as a result of large volumes of imports during the year. Due to heavy petrochemical use of propane, these huge inventories were drawn down below average levels by early 2000.

The increase in natural gas prices and the subsequent collapse of gas processing margins in late 2000 and early 2001 caused several interesting changes in the international LPG markets. With NGL prices in the US rising, arbitrage opportunities developed and Atlantic Basin LPG cargoes were shipped to the US.

Cumulative imports of LPG into the US in first quarter 2001 were more than 11 million bbl. In comparison, last year's imports for the same months totaled only 3.9 million bbl. LPG imports in 1999 and 2000 were low in comparison to the huge imports in 1998.

Imports and exports will play an increasingly important role in US LPG supply-demand balances. While the LPG surplus in the Atlantic Basin grows over the next several years, much of this product will be used to satisfy the growing deficit East of Suez and will be unavailable for import into the US (Fig. 6). High prices, however, could make imports to the US more attractive than the other netback opportunities.

Arbitrage opportunities in the Atlantic Basin will continue to occur, but opportunities from LPG trade between North America and the Far East may become more prevalent. Export capacity on the US Gulf Coast was increased in recent years to take advantage of this opportunity.

With a tighter supply situation in the East of Suez markets, the need for other supply sources has arisen.

The authors

Ajey Chandra is a principal in the Houston office of Purvin & Gertz Inc. After 12 years with Amoco, he joined Purvin & Gertz in 1998 and was elected a principal of the firm in 2000. He holds a BS in chemical engineering from Texas A&M University and an MBA from the University of Houston. He is a member of GPA and SPE.

Ronald L. Gist is a principal in the Houston office of Purvin & Gertz Inc., joining the company at the beginning of 1996. He began his career with E.I. DuPont de Nemours & Co. in 1971 after receiving both BS and MS degrees in chemical engineering from Colorado School of Mines. Gist is a member of the Southwest Chemical Society and is Purvin & Gertz's representative to GPA's statistical committee.

Ken W. Otto is a director in the Houston office of Purvin & Gertz. He joined E.I. DuPont de Nemours & Co. in 1977, then moved to Champlin Petroleum Co. in 1979 and served 4 years at Corpus Christi Petroleum Co. Otto joined Purvin & Gertz in 1986, was elected principal of the company in 1987, senior principal in 1990, and vice-president in 1997. He holds a BS in chemical engineering (1977) from the University of Texas at Austin.

S. Craig Whitley is a senior principal in Purvin & Gertz Inc.'s Houston office. He joined the company in 1993, working in market analysis of natural gas, LPG, and NGL markets. Whitley has a BS in chemistry and zoology from Northwestern Louisiana State University, Nachitoches. He is a member of GPA, International Association of Energy Economics, National Propane Gas Association, and is Purvin & Gertz's representative on GPA's international committee.