OGJ Newsletter

Market Movement

US natural gas market 'sound'

The underlying long-term fundamentals of the US natural gas market are "sound," despite its near-term signs of weakness. So said Simmons & Co. International.

The analyst noted these weaknesses are being caused by "price-sensitive demand and not increasing natural gas production." This long-term positive outlook is being driven by "the lack of significant supply growth combined with visible gas-fired power generation additions."

Simmons also noted that sizeable injections of gas into storage-particularly this early in the season-have "rocked" the confidence in the US natural gas market.

Simmons said, "The large storage injections experienced [in April-May] are most likely the result of weaker demand, since supply-side growth has been minimalellipseA large portion of this demand loss is temporary andellipselow gas prices will encourage much of this 'lost' gas demand back into the market through fuel switching back to natural gas.

"Assuming current refined product prices persist, gas prices may have to fall below $3.80/Mcf to effect this switching. Moreover, with 30,000 Mw of new gas-fired power generation expected online this summer, the incremental [third quarter] demand should be nearly 3 bcfd. This will stabilize the natural gas market and alleviate much of the fear currently permeating the market."

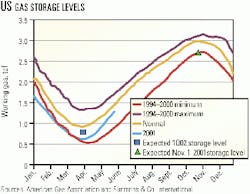

The analyst pointed out that the record-level injections that occurred in April and May suggest that injections for 2001 are running about 4 bcfd higher than the trailing 7-year average (see chart).

"The availability of an additional 4 bcfd for injection implies that supply and demand are out of balance compared to historical trends. This extra gas is due to either more supply, less demandellipse, or a combination of both," Simmons said.

In comparing injections for May of this year with those in May 2000 and 1999, Simmons noted a supply-demand balance shift of about 6 bcfd.

"Even though we do not forecast a complete return of price-sensitive demand components by yearend, forecast storage levels at the beginning of winter and ending [first quarter 2001] portend a tight market and firm natural gas prices," the analyst concluded.

Gas storage injection still strong

For the week ended June 8, AGA reported gas storage levels rose by 105 bcf, which was slightly higher than the anticipated level of 97-103 bcf, noted UBS Warburg.

"Once again, theellipseincrease in inventories was significantly greater than both the year-ago rate of a 78 bcf injection and the 5-year average rate of an 85 bcf injection," the analyst said.

UBS Warburg's estimates peg gas demand as falling by about 5 bcfd so far this year. Generally, this decrease in demand was driven by high gas prices in combination with a slowing economy, which has triggered the shutdown of industrial plants and fuel switching. "While this trend has continued through the early part of the storage refill season, demand should be bolstered by new gas-fired electric generating capacity coming online this summerellipseand [by] incremental gas demand caused by low hydroelectric supplies in the Pacific Northwest," UBS Warburg said.

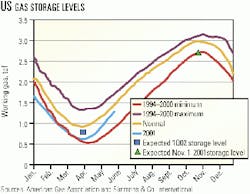

Gasoline prices remain in decline

Meanwhile, US gasoline prices have finally started to ease-not a moment too soon, given the start of the second quarter driving season and growing political pressure aimed at oil companies. Wholesale gasoline prices on the futures exchanges have come off their recent historic highs, and prices at the pump have softened as a result. That is largely due to the mad scramble by US refiners to make enough gasoline to rebuild stocks to an acceptable level, while imports of gasoline have risen in response to higher prices in the US.

Gasoline stocks have continued to build on the big ramp-up seen in May, when US inventories of gasoline topped year-ago levels for the first time since early March. Earlier this month, an unusually large stockbuild in US gasoline of 6.3 million bbl contributed to a further fall in next-month gasoline futures on the NYMEX. As of the week ended June 15, NYMEX gasoline had fallen by a total of 28¢ since peaking at $1.15/gal in May, while pump prices were down by 15-20¢ since the May peak.

UBS Warburg contends that this latest stockbuild "should put one of the final nails in the coffin of the thesis that pump prices will rise to $3/gal this summer."

null

null

null

Industry Trends

WITHIN 5 YEARS, 26 COMPANIES WILL HAVE DEEPWATER PROSPECTS WITH A COMBINED OIL AND GAS POTENTIAL TOTALING 20.7 BILLION BOE, reported energy analysts Douglas-Westwood and offshore data specialists Infield Systems.

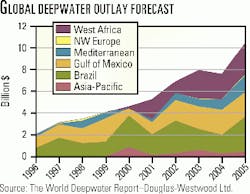

This could result in the growth of total annual deepwater capital expenditures to more than $10 billion in 2005 from the current $5 billion, they said in a new report (see chart).

The report projects a total of $38 billion in outlays for deepwater work in 2001-05.

In the past 5 years, deepwater reserves totaling 5.4 billion boe were brought on stream by 13 companies.

"Production from the shallow-water regions of the world is now in serious decline," said John Westwood, Douglas-Westwood director. "But below 500 m water depth, it is set to increase dramatically as the oil majors target more than 20 billion boe of reserves slated for development in 114 fields in Brazil, the Gulf of Mexico, and West Africa."

In addition to large reserves, another factor driving activity is the high productivity of the deepwater prospects.

In the past 5 years, Petrobras and Royal Dutch/Shell have bought on stream more than 1 billion boe of deepwater reserves. Within 5 years, Petrobras will have 3.3 billion boe of prospects, BP 2.5 billion boe, ExxonMobil 2.4 billion boe, Shell 2.3 billion boe, and the pending combination of Chevron and Texaco 1.5 billion boe.

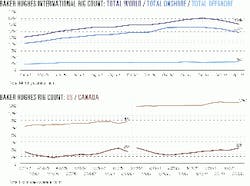

AS OF DECEMBER 2000, UPSTREAM EMPLOYMENT LAGGED 10.9% BELOW ITS RECENT PEAK, said two analysts at the Houston branch of the Federal Reserve Bank of Dallas.

"Job growth in oil and natural gas extraction remains surprisingly weak," Robert W. Gilmer and Albert Mitchell reported recently.

"Texas was down 13.4% and Louisiana down 16.4%. Lafayette, a major jumping-off point for offshore activity in the Gulf of Mexico, was 25.1% below its previous oil employment peak, and Houston remained 8.6% under its 1998-99 peak," the authors said, citing the latest available data from the Bureau of Labor Statistics.

Gilmer said fewer jobs exist because of oil company consolidations and also because technology has enabled the industry to employ fewer people.

"The decline in producer employment is part of a long-term trend," they wrote.

"Although productivity growth remains at work, the data strongly suggest that reduced job growth may be closely related to the string of mergers among the major oil companies," the report said. "This conclusion leaves us without a firm answer as to whether much oil-related job growth lies aheadellipsebut the possibility of more oil jobs in 2001 remains solid."

Government Developments

EIA HAS SHONE SOME LIGHT ON CALIFORNIA'S ENERGY WOES THROUGH A SERIES OF RECENTLY RELEASED REPORTS.

In one study, EIA reported that nearly 75% of the state's refining capacity could be forced to either reduce operating rates or shut down if rolling blackouts should affect the refineries' electric pow- er supply. The agency surveyed 13 of the state's 24 operating refineries.

Only 25% of the state's refining capacity is protected from outages either because of sufficient cogeneration capacity or because the refinery is in an electric utility service area that is not expected to be subject to rolling blackouts, EIA said.

Up to 27% of California's refineries' capacity could be forced to shut down completely if a rolling blackout happens in their assigned blocks, EIA said. And a refinery could take as long as 2 weeks to return to full operation following a power disruption.

In addition, if electricity outages were frequent, a plant might opt to stay down for longer rather than pay for repeated emergency shutdowns and restarts, EIA noted.

On June 28, the California PUC will consider a draft de- cision on whether to exempt the state's refineries from rolling blackouts this summer (OGJ, June 18, 2001, p. 7).

Another study, meanwhile, estimates 590 MMcfd more gas can be delivered to California by interstate pipelines than can be taken away by intrastate gas lines, more than double the 200 MMcfd estimated by the California Energy Commission.

The report comes at a time when controversy has boiled over with respect to why gas prices are higher in California than elsewhere and how much of it has to do with pipeline capacity and control of that capacity both inside and outside the state. City gate prices have been extremely volatile over the past year, rising as high as $60/MMbtu in December 2000.

Yet another EIA report stated California's natural gas transportation system could become more dependent on electricity to satisfy environmental restrictions, cutting throughput during power outages. New or retrofitted compressors powered by electricity will increase reliance on the electric grid.

EIA noted the Doggett compressor station on the Kern River pipeline will be converted to electric-driven compression from gas in the summer of 2002.

Pipeline company executives told EIA a 24 hr loss of electricity after the conversion will reduce throughput about 25%, or 350 MMcfd.

Quick Takes

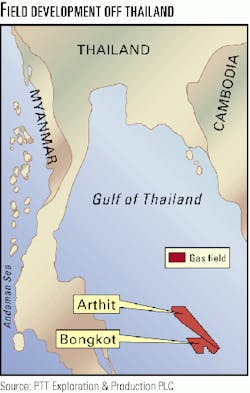

HIGH OIL AND GAS PRICES AND LAGGIN GAS DEMAND IN THAILAND have prompted some of that country's offshore operators to reevaluate prior field development plans.

In an approach similar to those taken by Chevron and Unocal (OGJ Online, Mar. 22, 2001), PTT Exploration & Production is gearing its exploration and development projects towards liquids.

The Thai state-owned firm is considering bringing crude and condensate on line early from Arthit-a promising Gulf of Thailand gas field. It had not expected to bring the field on flow until 2005, when gas demand was expected to strengthen (OGJ Online, Feb. 5, 2001). PTTEP said it also may choose to develop wells that yield more condensate than gas at Bongkot gas field, which it operates in the Gulf of Thailand (see map).

Incidentally, the European-Thai consortium now developing Bongkot field said it will purchase a tanker to store produced condensate after a tanker previously used for the purpose developed leaks and had to be replaced. The group considered building a concrete subsea storage tank, but it would cost $20-30 million more than the tanker. A 400,000 bbl floating storage unit will cost $50-60 million and take 1 year to install. Meanwhile, a temporary unit is in place.

The PTTEP-led consortium-which includes TotalFinaElf and BG-is trying to sustain production from Bongkot at 635 MMcfd of gas and 15,000 b/d of condensate (OGJ Online, Apr. 27, 2001).

Other development projects, meanwhile, are advancing apace.

Partners in Sable field off South Africa sanctioned that field's development, Pioneer Natural Resources said. Sable's operator, Soekor E&P, plans to begin production from the field in the first quarter of 2003. The field, in 100 m of water 95 km off the country's southern coast, will be developed using six subsea wells tied back to Glas Dowr, a Bluewater (UK)-owned floating production, storage, and offloading vessel. Bluewater will provide and operate the FPSO, which is capable of processing 60,000 b/d of oil, reinjecting 80 MMcfd of gas, and recovering gas liquids. Bluewater also will handle associated shuttle tanker operations. Initially, Sable field is expected to produce as much as 40,000 b/d of oil. At first, associated gas will be reinjected but could be produced later as part of a larger gas development project being evaluated, Pioneer said.

Trinidad East Coast Marine Area (ECMA) partners BG Trinidad & Tobago and Texaco Trinidad awarded Wood Group unit JP Kenny a contract for the front-end engineering design for offshore development of Dolphin Deep field off Trinidad. As part of field operator BG's plans to explore methods of expanding ECMA gas production, a JP Kenny team will head up the field's development using subsea completion technology and capacity upgrades to the existing Dolphin platform. The project marks the first use of subsea well technology off Trinidad, said JP Kenny.

Europa Oil & Gas and Ukrainian partner Zahidukrgeologia received a license to develop Niklovich gas field in western Ukraine. The field is 25 km from the Polish border and has reserves of 100 bcf in two main reservoirs at 1,200-1,500 m. On test, three suspended wells produced commercial quantities of gas with as much as 40 m of pay in Miocene sands. Commercial production is expected in 2003. Last October, Europa entered a development agreement with Rolls Royce Power Ventures, which foresees using a portion of Niklovich gas production to supply a proposed combined heat and power facility at Chelm, Poland.

IN AN EFFORT TO MEET INCREASING HDPE DEMAND, Chevron Phillips Chemical Co. said that it and Solvay Polymers will jointly construct a 700 million lb/year, high-density polyethylene (HDPE) plant at the Chevron Phillips's Cedar Bayou chemical complex at Baytown, Tex.

Chevron and Phillips will share production of general purpose blow molding HDPE resins; Chevron Phillips and Solvay will market their shares of production independently.

Engineering and procurement for the new plant-which will use Chevron Phillips technology-is under way with start-up operations scheduled for the fourth quarter of 2002.

Depending on market demand, the companies intend to build a second shared facility in 2005-07.

CALIFORNIA'S GROWING ETHANOL SUPPLU NEEDS ARE TO BE MET through a storage agreement signed between Williams unit Williams Bio-Energy and Kinder Morgan Energy Partners.

The announcement came 2 days after the US EPA denied that state's request to waive the federal oxygen content requirement for reformulated gasoline (OGJ Online, June 12, 2001).

The ethanol supplies are being delivered to California more than a year ahead of the planned MTBE phase-out, allowing refiners to switch from MTBE to ethanol ahead of schedule, Williams said.

Under the agreement, Williams will house 15,000 bbl of ethanol at Kinder Morgan's Carson, Calif., facility and make ethanol available for sale to the Los Angeles and San Diego markets by the fourth quarter.

Williams also committed to provide a minimum of 100 million gal/year to California by fourth quarter 2002. Williams produces 130 million gal/year of ethanol through its facilities at Pekin, Ill., and Aurora, Neb.

In other refining news, PetroChina plans to double to 10 million tonnes/year the refining capacity at Dalian West Pacific Petrochemical (WEPEC) in northeastern China's Dalian City. Over the next 5 years, PetroChina will build units designed to run imported Middle Eastern sour crude. WEPEC is owned by PetroChina, China National Chemicals Import & Export, and TotalFinaElf. Earlier this month, PetroChina began work on a 3.5 million tonne/year residual FCC unit at Dalian that is due for completion in 2002. It also plans to boost distillation capacity to 20 million tonnes from the current 7.1 million tonnes by 2005. Also under construction at Dalian is a 600,000 tonne/year reformer due for completion in December.

ROYAL DUTCH/SHELL PLANS TO SPEND UP TO $1 BILLION OVER THE NEXT 5 YEARS TO DEVELOP ITS RENEWABLE FUELS BUSINESSES with a focus on solar and wind energy.

Shell Renewables said it is concentrating development efforts on solar photovoltaic and wind power, which are "the fastest-growing sectors" in the global renewables industry (see related story, p. 20). The Shell unit's recent joint venture with Siemens Solar, in which the group has a 33% share, lifted Shell into the "top tier" in the photovoltaics industry, the unit said. The JV has a 15% global market share.

The company's key objective for the solar business is to expand in line with the market, currently growing 25%/year, Shell said.

In the wind business, Shell is concentrating on development and operation of wind farms and the sale of so-called "green" electricity. Shell is involved in two trial projects with a total 8 Mw of wind-generating capacity and is looking into projects in the UK, the Netherlands, Morocco, and the US totaling 400 Mw.

Elsewhere in alternate fuel news, Shell Oil Products subsidiary Shell Hydrogen US and United Technologies unit International Fuel Cells (IFC) formed a 50-50 joint venture called HydrogenSource. The South Windsor, Conn.-based JV will design, manufacture, and market fuel processing systems for commercial, residential, and transportation fuel cell power plants, as well as distribute hydrogen fueling applications for retail or commercial filling locations. The JV's management team will consist of executives from both parent companies. HydrogenSource said that, because the fuel is converted directly to electricity, a fuel cell can operate at much higher efficiencies than internal combustion engines, extracting more electricity from the same amount of fuel.

WESTCOAST ENERGY SAYS THE COMPANY AND ITS PARTNERS WILL INVEST $1 BILLION (CAN.) to double the size of the Maritimes & Northeast Pipeline.

M&NP already transports 530 MMcfd of gas from Sable Island fields off Nova Scotia to New England and Atlantic Canada.

Westcoast CEO Michael Phelps said the line's expansion is a high priority and that the Nova Scotian Shelf is a hot frontier play.

Phelps said the line would be expanded within 5 years through looping and additional compression to move 1.2 bcfd and that it could be further expanded by the end of the decade to handle 2 bcfd at a cost of another $1 billion.

Phelps said Westcoast and partners are in talks with Sable Offshore Energy, headed by Exxon- Mobil, about a second phase of gas development off Nova Scotia. It also is discussing plans with PanCanadian Petroleum, which has identified substantial gas reserves at its Deep Panuke field off Nova Scotia. Panuke has 1 tcf of reserves that could be brought into production by 2005.

In other pipeline action, ABB Group was awarded a $70 million contract to upgrade an Algerian oil pipeline owned and operated by state oil firm Sonatrach. The upgrade will increase capacity to 63,000 b/d from 46,575 b/d. The 290-km pipeline links Hassi Berkine oil field with the Haoud El Hamra terminal, 1,000 km southeast of Algiers. ABB is responsible for engineering, procurement, and construction of an oil stocking and dispatching center at Hassi Berkine and a pumping station at Nezla. The project, which is slated for completion in less than 2 years, will be designed and managed at offices in Milan, and construction will be carried out in Algeria by Sarpi, an ABB-Sonatrach JV.

Sinopec started construction of a 270-km crude oil pipeline in northern China that will link three refineries to the Huangdao terminal in Qingdao, Shandong province. The move will ease a domestic crude supply shortage, Sinopec said. The line, which is expected to reach completion in the fourth quarter, will link the terminal with Yanshan Petrochemical's 9.5 million tonne/year Beijing refinery, Tianjin Petrochemical's 6 million tonne/year Tianjin refinery, and Sinopec's 2.5 million tonne/year Cangzhou refinery. The three plants have previously operated on crude from Daqing, Liaohe, Dagang, Shengli, and Huabei fields.

Danish state oil and gas firm DONG will deliver 2 billion cu m/year of gas to Poland in 2003 through the proposed BaltPipe natural gas trunkline, following the recent signing of an export deal with the Polish gas company POGC. The deal-which hinges on Denmark's Dansk Undergrunds Consortium and DONG reaching agreement on increased gas deliveries from Danish North Sea fields-would see DONG export 16 billion cu m of gas to Poland to 2011. POGC and DONG, meanwhile, decided to form a consortium to build the 230-km line, which would extend from Danish Zealand to Poland's Baltic coast. The two companies expect Norwegian gas producers presently negotiating gas sales deals with POGC to join the consortium before March 2002. DONG said BaltPipe would call for investment of 2.5 billion Danish kroner. Final signing of the various agreements is planned July 6 in Poland.

Williams said it plans an expansion project on its Northwest Pipeline system that will deliver 276 MMcfd of gas to new electric power generation facilities in Washington state. The Evergreen expansion project is Williams's fourth major pipeline project in Washington and represents a $200 million investment. Williams said that the bulk of the investment will involve construction of compression facilities and 26 miles of line, which will be within existing rights-of-way in Skagit, King, and Pierce counties. Williams held an open season in December 2000 and plans to file an application with FERC in September. If the expansion is approved, an additional 90,000 hp will be installed at eight compressor stations along the Northwest system. Construction of the pipeline segment would begin next summer and would be completed in June 2003. Installation of the additional compression would occur in the fall and winter.

GAS-TO-LIQUIDS SCHEMES CONTINUE TO TAKE SHAPE.

Most recently, Qatar Petroleum and Exxon-Mobil announced plans to conduct a technical feasibility study for a GTL plant in Qatar.

The proposed plant would convert North field gas into low-sulfur diesel fuel, naphtha, and lubricant basestocks for export to world markets.

The study will provide QP with information on the use of ExxonMobil's proprietary AGC-21 technology in a GTL plant. The study will also identify and determine potential synergy opportunities with other projects and infrastructure in Qatar.

ExxonMobil, which has had a presence in Qatar since 1935, holds a 10% interest in the Qatargas LNG project and 25% interest in the RasGas LNG project plant.