Oil, Gas, and the Internet 'E-transformation' of oil companies offers unprecedented value-creation opportunities

Two years ago, the term "New Economy" was most often used by people while predicting how all businesses-and our very lives-were going to be completely and forever changed by the internet.

They offered as proof the number of newly created web-based businesses and the number of dollars being poured into those businesses by individual and institutional investors.

How quickly things change. Just as it was considered forward-thinking to extol the virtues of electronic technologies and new electronic-business models, many of the business and technology prophets have switched to preaching a new version of the future: one that resembles the past, in that business cycles and recessions still exist, and one in which the wealth-creating potential of e-technology is considered to be significantly less than during the salad days of the dot-coms.

Although it appears, at least for now, that much of the initial expectations of the consumer-focused electronic-commerce opportunities may have been more hype than reality, and the same may ultimately be said of consortium-driven electronic initiatives, there still remain significant value-creation opportunities associated with the "e-transformation" of "old-economy" sectors.

Furthermore, a successful e-transformation represents the greatest value-creation potential for individual old-economy companies, including oil and gas firms.

In this article, we will attempt to put forth a convincing argument that supports this conclusion and suggest how oil and gas firms can prepare themselves for this transformation.

E-transformation defined

We define an e-transformed company as a company that has implemented a combination of aggressive deployment of e-business enablers and decapitalized itself of asset-intensive, low-margin, value-destroying businesses and supply-chain components. PricewaterhouseCoopers has developed a framework for identifying and assessing e-transformation strategies that we call MetaCapitalism.

MetaCapitalism involves taking a radically different viewpoint of what constitutes a business model and the approach to identifying, evaluating, and prioritizing strategic initiatives at the corporate, business-unit, and operational levels by adopting the following management principles:

- Expansive view of assets. Companies need to expand their concept of assets to include not only physical assets but also intangible assets. Companies need to understand how to identify key assets and to leverage those assets to create maximum shareholder value. Unique organizational capabilities, which are transferable, are sources of new opportunities. Critical skills that provide the basis for a competitive advantage within a specific market segment need to be nurtured. Reputation in terms of brand, customer relationships, and competitive toughness need to be protected and molded to fit the chosen strategies. Critical business processes need to be designed to create value for customers in ways that are competitively unique. Companies also need to consider the value opportunities that can be created from the information and knowledge that is developed and managed during the course of their operations.

- Active management of external relationships. Although achieving internal efficiencies will always be important for "old-economy" companies, an outward-looking perspective is required to capture the real e-transformation benefits. A company needs to actively manage and support each of its external relationships. Of course, companies must consider their relationships with customers, but they also need to devote the same intensity with regard to other external relationships, including investors, suppliers, service providers, government agencies, and the public.

- Continuous encouragement of innovation. There are limitations to how much value can be created through efficiency gains and other cost reductions. For one thing, it is very difficult to hold onto the cost reductions, as much of that effort is quickly competed away. In addition, there is only so much cost that can be realistically extracted from a company, unless innovative approaches are identified and implemented. For mature industries, the potential for innovation resides more in the area of business-model innovations than in significant product and process improvement.

- Proper evaluation of opportunities. Discounted cash-flow analysis is a great technique for evaluating certain types of opportunities, but applied in the wrong situations, it can lead to inappropriate decisions. DCF analysis is best applied to opportunities that have a relatively clear future, such as considering an investment to reduce labor cost. The analytically correct decision can be arrived at through the utilization of a standard DCF model and sensitivity analyses. But for opportunities facing a dynamic business environment, DCF lacks sufficient robustness. Deciding to change a firm's fundamental way of doing business requires application of a variety of decision tools, ranging from scenario planning to real options and game theory.

By applying the preceding principles, a company might completely shift its strategic perspective (Fig. 1)1

The emphasis of an e-transformed firm will tend to shift from physical capital to human and brand capital. The rationale for outsourcing activities that do not provide a source of competitive advantage-to a network of external service providers-will become more clearly justifiable. The external focus will result in a shift from pushing what can be made to making what customers need or want, when and where they want it.

The MetaCapitalism perspective will also provide a framework for developing alternative strategies for the future (Fig. 2).

The development and implementation of strategies through the perspective of the MetaCapitalism principles will allow companies to effectively utilize e-business enablers, optimize their portfolio of assets, and capture efficiencies available from external service providers. The result will be a more efficient and dynamic company.

Operating costs will be reduced because of more-efficient operations. Cost of capital will be reduced because of increased transparency to the investors and financial discipline. Assets and processes will be streamlined.

The capability to utilize and manage an array of external service providers-a value-added community of businesses-will be created.

Companies undertaking e-transformation will be concurrently applying value management principles, reengineering their core business processes, and implementing enabling e-technologies-all with the intent of developing and implementing innovative business models.

These elements represent a powerful mixture, which can lead not only to value creation in the short term but also establish organizational capabilities that provide potential for achieving sustainable competitive advantage and, therefore, long-term value creation. E-technologies provide the opportunities to build such a model but do not assure its success.

To stay ahead, the e-transformed company will need to continue to implement innovation.

Why does e-transformation provide the potential for sustainable value creation? The e-transforming company will need to develop sophisticated organizational capabilities that allow it to quickly take advantage of external changes and even drive external changes through the development of innovative business models.

Not only does the organization need to implement and utilize new technologies, it needs to make significant changes to the way it manages its relationships with external stakeholders, customers, suppliers, and service providers. It also needs to develop a culture that embraces cross-functional teamwork.

Most importantly, the company must attain the right balance between standardization and innovation. The solving of this paradox is the key to successful execution of e-transformation.

Oil industry application

The preceding might sound great from a theoretical sense, but is it really applicable to an asset-intensive, engineering-driven industry such as the oil and gas industry? We think the answer is yes, for the following reasons:

- E-transformation through a MetaCapitalism perspective is consistent with past management practices in the oil and gas industry, although not in a simple straight-line extrapolation of these practices. For instance, the industry has embraced a certain amount of outsourcing of back-office functions and is increasingly relying on an array of service providers in both upstream and downstream operations.

- Many oil and gas companies have implemented some form of ERP (enterprise resource planning) software and reengineered their business processes accordingly and are moving towards standardized technology infrastructure and applications. Together, these moves help position companies to manage an extended and increasingly virtual supply chain.

- Significant amounts of transactions take place in each part of the value chain, as well as between the parts of the value chain, and with the transactions come the creation and flow of information. Consequently, there are opportunities to digitize and automate the execution of the transaction. There are also innovative opportunities to derive value from creating the platform for the transaction, managing the transaction, and developing insights from the analysis of the resulting information.

We also believe that e-transformation offers the best opportunity for value creation. The oil and gas industry certainly meets the definition of an "old economy" sector. And, therefore, it has all the inherent characteristics that go along with a mature sector, plus some additional baggage that makes it tough to consistently create shareholder value.

Growth in the oil and gas industry is essentially tied to overall growth in global gross domestic product. In the future, the industry growth rate will be even slower than GDP growth rate, given that the energy intensity of the developed economies continues to decrease.

The developing economies have progressed to a point that they are starting to experience the same phenomenon. In the upstream sector, nonstate oil and gas companies have little control over supply, as even ExxonMobil Corp. accounts for only 3% of total world oil production. Furthermore, the low-cost producers have shut-in capacity, which means that the oil price is always susceptible to downward pressure.

In the downstream sector, there is excess capacity on a global basis, much of which nonstate oil and gas companies have little control over, because the bulk of capacity additions are occurring in Asia and the Middle East and are being driven by government policies and investment decisions. This is further exacerbated by the reluctance to shut down old plants, given the associated cleanup costs.

It is not surprising, then, that oil and gas companies have little ability to increase margins by raising prices.

So what can oil and gas companies do? Well, they certainly can control costs, and that is what they did in the 1990s with great success. However, it does not appear that this cost-reduction effort created much shareholder wealth.

A study by Goldman Sachs indicates that, with all of the cost reductions achieved in the E&P sector, 70% were passed onto the consumers, and when adjusted for inflation, industry earnings remained flat. This is not saying that individual companies did not enjoy success employing a cost-reduction strategy.

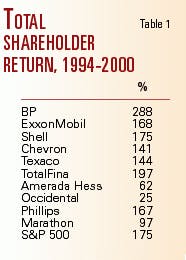

For example, BP PLC created significant shareholder wealth by focusing on cost reduction, high-grading of its asset portfolio through divestitures, and reduced capital spending. Collectively, however, the integrated oil companies have underperformed in comparison with the S&P 500 in terms of total shareholder return since 1985.

Furthermore, the degree of underperformance has been significant in all cases except for the collective performance of the three supermajors-BP, Royal Dutch Shell Group, and Exxon Mobil-as shown in Table 1.

To close this value gap, oil companies must take advantage of the opportunities being presented by the advent of e-technologies and not just the opportunities associated with reducing costs. They also need to take advantage of opportunities that will increase revenues, including the creation of new businesses that are information-intensive instead of capital-intensive.

An example is the initiative by Chevron Corp. in conjunction with McLane Co. and Oracle Corp. to create RetailersMarket Xchange.com, which offers a variety of e-commerce services to the highly fragmented convenience store and small retail-business sectors.

The value proposition is the potential to reduce costs in this $200 billion/year industry, to improve its marketing reach and effectiveness, and improve the efficiency of delivering products and services. For retailers, it creates access to more suppliers plus the scale of a networked economy to improve their operations and generate greater revenue.

It also provides a means for retailers to integrate their onsite operations with those of the suppliers.

'Tipping point'

Based on the actions and reactions of the various industry participants, it is logical to conclude that the industry is at its "tipping point."2

By this, we mean that the industry is on the verge of sudden and dramatic change, in which there will be a geometric increase in the adoption of e-business. Given the importance of the industry to the general welfare of the global economy, various economic, structural, and e-technology drivers significantly affect the oil and gas industry, such as:

- Economic drivers, including increasing volatility of oil and gas prices, tightening of oil and gas supplies, ongoing pressure to deliver increases in shareholder value, and growing awareness of the need for sustainable development.

Structural drivers, including increasing importance of natural gas (as environmental concerns are helping to drive a lighter energy mix), continuing technological advances in the upstream sector, ongoing influence of the Organization of Petroleum Exporting Countries, and increasing globalization of the industry.

- E-technology drivers, including escalating advances in underlying technologies, ongoing development of tools that support content management and real-time online customer service widening capabilities of transaction platforms that support e-commerce marketplaces, and increasing power of data-mining tools.

These drivers are changing the business environment of the oil industry and are forcing the oil companies to respond. The generalized response from the oil companies is centered around the following main developments:

- Ongoing optimization of asset portfolios through merger, acquisitions, divestitures, and alliances. The optimization of upstream portfolios is being driven by the desire of companies to realign asset portfolios to focus on operating assets for which they have the ability to derive returns exceeding their cost of capital. The adjustment to portfolios is an ongoing process. BP is currently adjusting its portfolio, for example, by selling its minority interest positions in places such as Kashagan field in the Caspian Sea while it concentrates on areas where it can achieve a dominant position, such as Crazy Horse field in the Gulf of Mexico. A similar optimization process is taking place in the downstream sector, with oil companies divesting refining and chemical assets that do not support their business strategies or are low-performing assets in terms of delivering value greater than their associated cost of capital.

- Further reliance on the value-adding community (VAC) of service providers. As a result of the increasing focus on core capabilities by the oil and gas companies, a sophisticated VAC that supports the oil and gas industry is being established. And as industry increases its reliance on outside service providers, the VAC continues to increase in scale and scope.

- Development and implementation of e-business initiatives. Oil companies are moving forward with their own initiatives. Consortium and private industry-focused e-initiatives are also being developed. These initiatives revolve around back-office and transaction support solutions and e-markets and are further described in Tables 2-3.

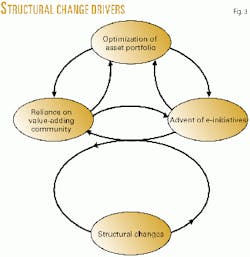

These developments are creating the basis for major structural changes to the industry, and these changes are likely to happen sooner rather than later, given the reinforcing dynamics among the developments.

For instance, the pressure to deliver shareholder value and the changing energy mix are accelerating the ongoing optimization of asset portfolios. The volatility of oil prices and the continuing technological advances in the upstream sector are creating even more justification to leverage the VAC of service providers. As the VAC continues to increase in capabilities, there is increased justification to further leverage the VAC, therefore creating a reinforcing cycle. In addition, the VAC's increasing capabilities further encourage oil companies to evaluate their asset portfolios, because the competitive advantage they may have enjoyed because of internal capabilities are being eliminated as competitors acquire similar capabilities from the VAC. This reinforcing nature between the reliance on the VAC and the adjusting of the asset portfolios is not a new phenomenon. What is new is the addition of e-initiatives, which will tend to further accelerate the process. The increasing connectivity associated with the e-initiatives enables further use of external service providers. The development of e-initiatives also create new types of assets and changes the relative value of physical assets, which leads to further changes to the asset portfolios. Fig. 3 illustrates the reinforcing dynamics associated with these developments.

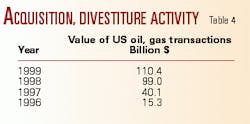

This acceleration process is already starting to take place. For instance, the acquisition and divestiture activity associated with the ongoing optimization of the upstream portfolios has accelerated sharply in the last several years (Table 4).

The addition of e-initiatives to the dynamic business environment establishes the conditions for more significant structural changes to the industry than is associated with the ongoing consolidation of the industry. There will be increasing pressure to outsource noncore activities and shed nonperforming assets.

Ongoing technological advances will lead to further digitization of industry transactions and information and allow for increased connectivity between external partners. These technological advances will also support the widening scale and scope of business-to-business activities.

Most importantly, it will further encourage the separation of ownership and operation and further reduce the economic justification for vertical integration.

The basis for determining the optimal level of integration is relative cost. If the transaction costs associated with organizing across markets are greater than the administrative costs of organizing within a company, activities should be coordinated internally. Advances in technology up until the 1980s reduced administrative costs relative to transaction costs, and the general pattern of development over time has therefore been expansion in the scope of companies.

However, the increasing connectivity is dramatically reducing transaction costs. Furthermore, there are oil industry-specific characteristics that also weaken the case for vertical integration, which include the following:

- Before the nationalization of the oil industry in the Middle East, the oil majors were in balance in terms of refinery production, marketing, and equity crude supply. This is no longer the case today, as most of the oil majors are now product-long in relation to equity crude. In fact, many of the divestitures of the refining sector can be linked to the desire to regain a balance between refining capacity and the sale of branded products.

- The potential difficulties surrounding an integrated model are becoming more relevant. There are differences in optimal scale of operation along the different areas of the value chain. If oil companies reduce their refining operations to match their oil production capabilities, they run the risk of operating at suboptimal scale in their refining and marketing operations. The upstream and downstream operations are also strategically different businesses. Managing across different businesses is a difficult challenge for top management. It also increases administrative costs, as it is difficult to design a corporate system that is appropriate for both types. It can also affect the valuation of the earnings gained from each operation. A case can be made that, for many integrated oil companies, underperforming refining and marketing operations are a drag on their share price, given that the refinery industry is perceived to be a low-margin commodity business with little growth potential.

- Vertical integration can also affect the company's degree of flexibility in reacting to changes in the market environment.

This may partially explain the current overcapacity situation in the refining sector. The integrated companies may feel they have limited flexibility to be more aggressive in closing down or selling marginal refineries because of the short-term financial effect on the valuation of the total firm, including the upstream operations. However, if the downstream operations were separate, Wall Street would be able to demand this rationalization more forcibly. Instead, the sector remains in a state of overcapacity, with continuous capacity creep, even as many of the refining assets provide returns less than the cost of capital.

- Even companies that remain integrated are managing each operation along the value chain-exploration and production, trading, refining, marketing-as separate strategic business units with the expectation that each meets its own financial objectives. The economic justification for vertical integration in the oil industry certainly seems less convincing when considering these characteristics in conjunction with the impact of decreasing transaction costs. Arguments, however, are still put forward in support of vertical integration, including one that the integrated oil majors will experience less variance in cash flows.

Arguments, however, are still put forward in support of vertical integration, including one that the integrated oil majors will experience less variance in cash flows, as the cash flows from the upstream and downstream sector are not necessary correlated. Furthermore, it is felt that an integrated oil company can derive additional value from equity crude oil, especially the crude oils that are more difficult to process, through proper alignment of its refining assets. In the past, many oil majors were also required to invest in refining assets of oil-producing countries as a condition of participating in the exploration and production sector. Finally, integration secures supply for the refineries and demand for crude oil. In the past, many oil majors were also required to invest in refining assets of oil-producing countries as a condition of participating in the exploration and production sector. Finally, integration secures supply for the refineries and demand for crude oil.

However, a case can be made against all these arguments:

- The validity of the desire to balance cash flows within a corporation is weak. This concept ignores both the role of the external capital markets and the tax advantage of using debt financing. Investing the free-cash flow generated by the more-profitable businesses into less-profitable businesses, rather than distributing it to the shareholders, sacrifices shareholder wealth. Conventional financial theory is that diversification by itself does not enhance the value of a company. Because investors can duplicate externally any internal diversification accomplished by a company, efforts to do so by management would not increase the company's value.

- For the most part, this holds true in practice, as most diversified companies do not outperform the market, and in many cases the market applies a discount to such companies. Our research indicates, however, that some diversified companies appear to be able to reduce systematic risk through effective balancing of diversified cash flows and therefore capture a market premium. This also appears to be relatively rare and difficult to achieve.

- It appears that the oil-producing countries will continue to open their industries to foreign investment, thus allowing participation of the oil majors with fewer preconditions. This trend goes hand-in-hand with the emerging attitude that the oil industry, like other components of the energy sector, should be regarded as no different from the manufacturing sector and thus should not receive protections, subsidies, and strict government controls.

- Currently, with the globalization of the oil market, the securing of crude oil for refineries is no longer the issue it was in the late 1970s and early 1980s. Almost the reverse is occurring, with some oil-producing countries such as Venezuela pursuing offtake agreements with refineries. This situation could change if the crude oil market becomes tighter. However, given that most of the majors do not have sufficient equity crude to supply their refineries, vertical integration would not completely resolve this issue.

The oil industry will look much different in the future, as the value chain has less of an orientation towards vertical integration and as it becomes more prevalent that ownership of a physical asset is separate from operation of the asset.

The disaggregation of the value chain will further enhance the potential for integrated oil companies to streamline their asset base, redeploy their resources to higher-potential opportunities, and focus on opportunities that best align with their unique capabilities.

This view of the future value chain for the oil industry is consistent with the segmentation and specialization that is taking place in the industry today. The last wave of megamergers has created three segments of integrated oil companies: supermajors, international majors, and the smaller regional companies.

These segments are becoming more distinct, given the differences in capabilities and strategic imperatives, and as these segments address their strategic imperatives, further specialization will occur. In the upstream sector, the larger oil companies are increasing focusing on deepwater and other opportunities where their technological and financial and risk-management capabilities allow them to create significant value.

As they increase their focus on the higher-potential opportunities, they are divesting assets and outsourcing operations of assets for which they do not have an operating competitive advantage. This creates opportunities for smaller E&P companies to become more specialized in their E&P operations.

Similar developments are taking place in the downstream sector. As the larger oil companies reduce their presence in the downstream sector through divestiture, smaller companies can fill the void and strengthen their competitive position.

Marathon Oil Co., through its joint venture with Ashland Petroleum Co. is an example of such a company. By building a strong regional presence in the refining and marketing sector, it has been able to generate solid returns on capital and free-cash-flow.

The disaggregation of the value chain will also create the potential for new market spaces and business models, including those that take advantage of the growing importance of managing information channels. Increasingly, there will be opportunities for niche players and other opportunistic entrepreneurial companies.

One such opportunity will be to act as a "virtual" oil company-a company that utilizes the VAC to perform all operational and transactional activities and retains only strategic activities in-house.

A further extension of this concept is a financial player, in which the company focuses exclusively on the trading of assets, crude oil and products, and associated financial derivatives and helps to create markets that supports such trading activities.

The entrance of new players and their different business models represents a threat to the established integrated oil companies. Companies that do not move to take advantage of the new opportunities will leave themselves open to being marginalized by the new entrants.

A case study

E-transformation represents the best opportunity to create extraordinary shareholder value.

After analyzing a number of the oil companies from a MetaCapitalism perspective, we created a financial model that discounted expected future cash flows based upon changes to the following economic value drivers: revenue growth, EBITDA (earnings before income tax, depreciation, and amortization) margin, working capital, capital expenditures, cash tax rate, and cost of capital. One such case study is illustrated by Fig. 4.

The bar on the left represents the current market capitalization of the company, which is calculated by multiplying the number of outstanding common shares by the current share prices.

Each of the successive "stairs" is the potential increase in market capitalization associated with the referenced MetaCapitalism scenario. The first six "stairs" are associated with transforming the existing business. The last two "stairs" are associated with new ventures that would be available to oil companies, as resources become available, as noncore activities are outsourced, and as underperforming assets are divested.

The cumulative affect from these scenarios is a market capitalization of about 2.5 times the current market capitalization. Given the market capitalization associated with the various integrated oil companies, such an increase represents a creation of shareholder value ranging from tens of billions to hundreds of billions of dollars.

What follows are brief explanations of each of the scenarios.:

Achievement of maximum ERP efficiencies. The value proposition associated with this scenario is that coupling various components of established ERP solutions with web-enabled collection and analysis tools will provide significant margin enhancement by lowering overhead and other controllable expenses. Key assumptions involved with this scenario include:

- A globally integrated ERP system provides consistent transaction efficiencies and the ability for continuous analysis, budgeting, and strategic planning.

- A well-constructed data warehouse with the appropriate access to information allows for consistent decision support across all business units.

- An e-value management framework that encompasses the strategic aspects (modeling and simulation, forecasting and planning, identification and selection of strategic initiatives) with the operational aspects (budgeting, business execution, and performance reporting and review) facilitates value creation.

- Instant and shared data result in transaction and analytical efficiency.

- The ability to generate a "virtual daily close" reduces market risk and provides "real-time" data points for decision-making.

- Portal solutions lower internal transaction cost and overhead requirements.

Further outsourcing of back office operations. The value proposition associated with this scenario is that outsourcing and web-enabling overhead functions will reduce selling, general, and administrative costs and free cash for additional value-creating investments. Key assumptions involved with this scenario include:

- Shared service centers are established in each of the major theaters.

- Back-office operations, including human resources (HR), purchasing, and financial operations for each of the business groups are outsourced.

- Offer-to-cash processes for refining and chemical business groups are outsourced.

- Web-based people-support platforms (e.g., HR, benefits, payroll) are employed.

Decapitalization of noncompetitive assets and operations. The value proposition associated with this scenario is that value can be created by reducing capital expenditures and leveraging cost efficiencies offered by the VAC. It also allows the company to respond to changing market conditions with greater speed and flexibility. Furthermore, it enables the company to focus on assets that provide a competitive advantage or effective control of the value chain. Key assumptions include:

- E&P operations, for which the company has no operating competitive advantage, are outsourced.

- Floating and portable production facilities are divested.

- The E&P asset base increasingly has a greater international focus, which will increase revenue growth and EBITDA margin.

- Nonstrategic refining assets and chemical assets are divested, while maintaining alliances and offtake agreements.

Ownership and operation of nonhydrocarbon processing assets, such as hydrogen generation, wastewater treatment facilities, and steam generation, are outsourced.

- Operation of the US and European retail networks is outsourced to a nonoil retailer, while maintaining branding and offtake agreements.

Utilization of e-markets for nonfeedstock requirements. The value proposition associated with this scenario is that employing electronically enabled tools and strategies and maximizing the use of supplier relationships will reduce life-cycle costs and create competitive advantages that will significantly improve the company's EBITDA margins and reduce working capital. Key assumptions include:

- Just-in-time inventory management of major spending category items (tubulars, construction materials, fluids, etc.) reduces inventory.

- Rationalization of suppliers leverages relationships where the company has significant purchasing power.

- Rationalization of demand leverages more-attractive purchasing opportunities.

- Utilization of web-enabled MRO (maintenance, repair, and operation) analysis, feedback, and solutions provides for remote problem-solving.

- Utilization of electronic markets for external utility requirements will allow for economies of scale and the ability to take advantage of marginal supply, which will result in reduced costs associated with external energy needs.

Optimization of downstream and chemical supply chains. The value proposition associated with this scenario is that managing both the downstream and chemical supply chains in an integrated fashion will increase margins and reduce working capital. Key assumptions include:

- Integration of feedstock procurement, operations, and distribution through the utilization of advanced planning and scheduling tools will increase refining and chemical margins and reduce working capital.

- Utilization of e-markets will provide an avenue for hedging and trading opportunities, which will result in improved margins and increased trading revenue.

- Utilization of a full complement of information and electronic technology at the refining and chemical facilities will optimize asset utilization and production yields.

Reduction in cost of capital. The value proposition associated with this scenario is that providing quicker information on improved operating results and modifications to traditional revenue streams and cost structure can result in cheaper capital in the equity markets. Key assumptions include:

- Improvements to reporting systems illuminates corporate performance at "e-speed," giving investors immediate insight into shareholder returns.

- Further increase in investment discipline-in terms of counter-cyclical investing, lower reinvestment rate, and better risk-management practices-helps decrease the market-applied cost of capital.

- Reducing the cash conversion cycle to mirror those found in the technology industry provides instant access to free working capital.

Development of energy services. The value proposition associated with this scenario is that by acting as the final point of contact to end-users of energy resources, the company can manage the energy requirements for major industrial and commercial customers, including the purchasing of energy. Key assumptions include:

- The development of energy services leverages the existing trading and hedging capabilities, the engineering knowledge, and the global infrastructure.

- Revenue growth is expected to be 30% for the energy services business unit.

- Capital expenditures of 8%/year in relation to the revenue generated supports the building of the service portfolio.

- Working capital of 1.0% of incremental revenue is needed to support the ongoing operations.

Development of financial services. The value proposition associated with this scenario is that by leveraging the company's strong balance sheet and global reach and scale, it can offer financial services to industrial and commercial clients, as well as consumers, and take equity positions in smaller companies. Key assumptions include:

- The company can built a portfolio of equity positions with other firms with leading-edge technologies and niche market positions.

- The offering of automotive and liability insurance and customer credit facilities (automotive and housing loans) provides additional revenue streams.

The estimated impact of these scenarios on market capitalization is a reasonable representation of the potential value that can be created through e-transformation.

First, the scenarios are based on e-initiatives that are currently possible with existing technology and the current business environment. Secondly, conservative assumptions are embedded into the financial calculations, e.g., the assumption that 70% of the benefits achieved from cost savings are passed on to the consumers, as has been the case during the previous decade.

Furthermore, the analyses only represent a subset of the scenarios that are available to oil companies-not included, for example, is the potential impact from oil companies more effectively applying new technologies in the upstream sector. In addition, there are a myriad of new ventures that oil companies could pursue that leverage information and knowledge residing within their organizations.

One such opportunity is that by utilizing information technology (IT) and leveraging its current understanding of and relationship with the driving public, an oil company could have the ability to virtually manage the entire value chain for automotive passengers.

Recommendations

While the oil industry is posed for significant structural changes in the near term, as the industry undergoes e-transformation, and the companies that adopt a MetaCapitalism perspective will be best positioned to created superior shareholder returns, there are certainly no guarantees of success with moving forward with such an expansive scope and scale of change, especially given the associated risk dimensions, which are summarized in Table 5.

To mitigate these risks, we recommend that companies utilize a framework that includes the following elements:

- Development of a framework to understand potential future developments in the industry. The drivers acting on the oil industry and actions and reactions of industry participants are creating a dynamic environment. With such an environment, it is inappropriate to expect a future that is a simple, linear extrapolation. Instead, companies should utilize a methodology that combines the concepts and techniques of scenario planning, game theory, and systems thinking. Utilizing such an approach will help companies understand the relationships between the key industry and technology variables and their associated uncertainties. It will also identify the key indicators of the future that will require ongoing monitoring, as these indicators will provide an early warning of the need to reassess the strategic direction. Most importantly, the companies will develop new perspectives of future opportunities and understanding of how they can influence future industry developments.

- Assess each aspect of the business model. Companies need to objectively assess each element of their current business models in order to identify capabilities and intangible assets that could possibly be leveraged to create new value. The assessment needs to consider the current strategies (corporate, business unit, operating, and functional strategies) and how the company interacts with customers, suppliers, service providers, and internal and external stakeholders. It also needs to identify the capabilities and resources that are critical to the current competitive position and those capabilities and resources that could support the pursuit of new opportunities. The assessment also needs to consider the organizational infrastructure in terms of core business processes, culture, and management style, as well as the IT infrastructure.

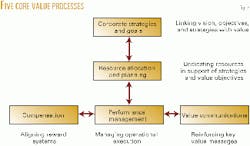

- Implement an expansive value management approach. This links together five core value processes, as shown in Fig. 5. The value management approach will provide the framework to align the strategic initiatives to the shareholder value agenda, focus the organization on the key drivers of value, set the operational targets needed for success, and communicate the strategy and the results, both internally and externally.

- Work backwards from a desired future. Implementation of these elements will help a company define the e-transformation strategic direction that is appropriate for its capabilities, competitive position, and risk tolerance.

The e-transformation strategic direction will provide the high-level description of new business concepts and the required modifications to the existing business model, organizational capabilities and infrastructure, and method of interaction with customers and external partners.

In developing the strategic direction, the organization will be able to identify the potential internal and external constraints that will need to be eliminated. This understanding, in turn, will lead to development of the required internal and external changes and the strategies to effect the changes.

Conclusion

E-transformation represents a significant value-creation opportunity for the oil and gas industry, especially integrated oil companies.

Companies that take a leadership position in the transformation of the industry will capture the bulk of the value-creation opportunities.

Once the e-transformation of the oil and gas industry is well under way, it will be very difficult for the followers to capture any significant benefits from operating efficiencies, as they will just be attempting to match the reduced cost structure of the leaders.

Furthermore, it will be difficult to overcome strategic advantages gained by the leaders, which may include superiority in certain parts of the value chain, dominance of certain market segments, and development of differentiated offerings. In addition, the leaders will also be establishing the organizational capabilities to support ongoing innovation and further strengthening of their competitive positions.

If the oil and gas history is any indication, once the relative positions are established, it is extremely difficult to dislodge the leaders.

The journey will not be easy or without risk, and some companies will be reluctant to move forward. However, the potential value will not be left unclaimed. Companies that will not or are unable to move forward will be transformed one way or another-the value will be created or it will be shifted.

Even after discounting the hype, it is apparent that e-transformation of the industry will ultimately have a significantly greater impact on oil companies than did the consolidation seen during the 1980s and late 1990s, as it will affect the existing value chain and thus provide the potential for new business models.

Acknowledgment

The author would like to express his appreciation to Brian Harry, Richard Kennedy, and David Jones for their input into developing the e-transformation scenarios.

References

- G.E. Means, D.M. Schneider, Meta-Capitalism, The E-business Revolution and the Design of 21st-Century Companies and Markets.

- Malcolm Gladwell, The Tipping Point.

The author

John Paisie is a principal consultant in Pricewaterhouse Coopers Global Energy practice with a focus on developing corporate and operational strategies. He specializes in assisting clients in undertaking strategic reviews and implementing major initiatives. Paisie has 10 years of experience working within the oil industry that included various management and technical positions. He also spent 31/2 years in the Middle East and 3 years in Asia. Paisie holds a BS in mechanical engineering from the University of Toledo and an MS from Purdue University.