OGJ Newsletter

Market Movement

Torrid storage injection pace deflating gas price expectations

Unless hot weather settles in soon, a blistering gas storage injection pace will begin to reverse expectations about exceptionally high US gas prices this summer.

In addition to the cooler-than-expected weather, some opportunistic marketers are jockeying to lock in highly attractive arbitrage spreads-exceeding 50¢/MMbtu before carrying and financing costs, according to UBS Warburg.

Together, these two trends are driving near-record rates of storage injection. Looking at American Gas Association data, operators injected 99 bcf of natural gas into storage for the week ended May 25. That's the fifth week in a row in which injection rates approached or topped 100 bcf. It compares with 118 bcf the prior week, 56 bcf at this same time a year ago, 71 bcf the same week in 1999, and the record of 120 bcf set June 23, 1994.

Overall, the US gas storage level stands at 1.281 tcf, vs. 1.274 tcf at the same time a year ago. Consequently, the overall year-to-year storage deficit-seemingly insurmountable just a couple of months ago-has changed to a 7 bcf surplus. That compares with deficits of 36 bcf and 99 bcf in the preceding 2 weeks.

UBS Warburg noted that the industry has not experienced a year-to-year surplus since Jan. 14, 2000.

"Looking ahead," the analyst said, "despite the expectation for solid peak-period power demands in the south-central and southwestern USellipse, the impact of mild conditions throughout several other key regions of the country, favorable NYMEX spreadsellipseshould facilitate expansion well into June."

Given comparable-week injection rates of 65 bcf/week last year and the prior 6-year average for the same week of 68 bcf/week, it is easy to envision the weekly injection rates of 67 bcf/week that would be needed to reach the minimal heating season level of 2.8 tcf come Nov. 1.

The abrupt turnaround in gas market expectations has knocked the wind out of the gas price sails, with spot prices falling below $4/MMbtu for the first time in many months and actually reaching a level a few cents below the same week a year ago.

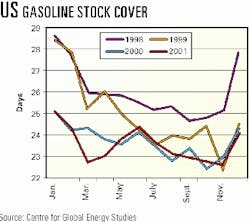

US gasoline stock cover woes

Will concerns over gasoline stocks and the resulting furor over high gasoline prices in the US compel OPEC to relent on its price hawkishness?

London-based Centre for Global Energy Studies thinks not. The think tank contends that the only thing that will trigger an output increase by OPEC is a higher crude oil price.

Despite the current worry over US gasoline stock cover, the situation is not as dire as it seems. At the end of March, CGES notes, US gasoline forward stock cover fell to 22.7 days' worth, almost 2 days fewer than the same time a year ago (see chart). That sparked fears over a possible gasoline supply crisis coming just ahead of the summer driving season. As a result, wholesale and retail gasoline prices spiked in April a respective 30% and 8%. In fact, those price spikes were overdue. Refiners were reacting to the squeeze on margins from crude oil price increases owing to the two OPEC cuts earlier this year by cutting throughput-hence the fall in gasoline inventory levels. Of course, the spike in gasoline prices bolstered margins-by $6/bbl in April vs. March, according to CGES calculations-which encouraged a boost in refinery throughputs, and the higher gasoline prices also attracted more imports of gasoline into the US.

"Assuming capacity utilization remains higher than a year ago, gasoline yields stay around 54%, and gasoline imports average 520,000 b/d means that US gasoline stock cover will get no worse than last year-but no better, either," the analyst said.

If that is the case, then, Atlantic Basin refiners are sure to maximize gasoline production during the summer at the expense of building distillate stocks, says CGES. And that, in turn, will push the upward pressure on oil prices back further into the year, well into the third quarter, when competition for crude between Western and Eastern refiners intensifies-much as it did last year.

Iraqi oil exports

So the elements are already in place for a crude oil price rise in the third quarter. But the market can count on that happening even sooner.

It's a strong likelihood that Iraq will partially halt its oil exports while the Bush administration attempts to modify the existing sanctions regime with an eye to what it calls "smart sanctions."

If a refinery happens to go down at this time-hardly a far-fetched prospect nowadays with refiners running flat out to make product and a lot of big plants overdue for maintenance turnaround-the combination of factors could briefly push crude oil prices well over $30/bbl-perhaps even past $35 and heading toward $40, if it looks as if the Iraqi supplies will be off the market for at least several weeks.

Of course, this would be short-lived, as OPEC would certainly step in to rescind its production cuts and the US would probably raid the Strategic Petroleum Reserve. But if Saddam chooses to keep his oil off the market indefinitely, then $40/bbl would be a realistic prospect for the near term. The 2 million b/d or so of Iraqi oil held off the market pretty much approaches the remaining spare capacity within OPEC-almost all of which is held by Saudi Arabia and the UAE.

CGES contends that OPEC ought to anticipate such price squeezes, because of the delay between a decision to boost output and the increase in crude deliveries (see Watching the World, p. 34). An increase of 1 million b/d beginning in July would stabilize crude prices at OPEC's target level of $25/bbl (OPEC basket), averaged over the quarter. However, the London think tank does not think it likely that OPEC will boost output at the group's June ministerial meeting in Vienna. Put simply, until the price of crude looks like it will stay above the upper end of OPEC's official price band, $28/bbl, OPEC is not likely to raise production.

Even without a disruption of Iraqi exports and another surge in Middle East tensions, CGES expects crude oil prices will rise enough in the third quarter to persuade OPEC to increase production before October.

Either way, it could prove to be a very dicey second half for oil markets.

null

null

Industry Trends

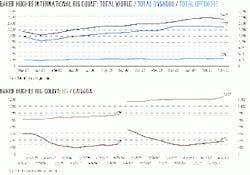

US MINERALS MANAGEMENT SERVICE HAS ALTERED ITS OIL AND GAS PRODUCTION RATE PROJECTIONS FOR 2001-05

MMS now forecasts oil production of 1.526-1.967 million b/d for the Gulf of Mexico region by the end of 2005 and natural gas production of 11.1-16.54 bcfd by the end of the same year (see chart).

The forecast is outlined in a report, Daily Oil and Gas Production Rate Projections From 2001 Through 2005, Gulf of Mexico Outer Continental Shelf.

Deep water, defined as water depths 1,000 ft or greater, shows the greatest potential for development, the report said.

Oil production has been rising steadily in the gulf, from 945,000 b/d in 1995 to 1.426 million b/d in 2000, surpassing shallow-water oil production for the first time.

The forecast said that up to 67% of oil production and 26% of gas production would come from the deepwater gulf.

FINDING AND DEVELOPMENT COSTS AMONG 55 INDEPENDENTS ROSE NEARLY 35% LAST YEAR

Analysts Robert Morris and Michael Schmitz said that independents' finding and development costs were $6.05/boe last year, up from $4.53/boe in 1999 and contributing to a 5-year average of $5.86/boe.

Meanwhile, finding and development costs for the majors declined nearly 30% in 2000, Salomon Smith Barney said. Majors posted finding and development costs of $3.64/boe compared with $5.12/boe in 1999 and a 5-year average of $3.92/boe.

Domestic natural gas reserve replacement for the independents and majors combined totaled 140% in 2000 compared with less than 100% during the previous 5 years.

The majors clearly have shifted their focus to gas, Morris said, pointing to recent acquisitions that include Shell Oil's attempt to buy Barrett Resources and Conoco's announcement that it is buying Gulf Canada Resources.

US SALES OF CATALYSTS WERE ESTIVMATED AT $2.2 BILLION IN 2000 AND THE MARKET IS FORECAST AT $2.6 BILLION BY 2005, Business Communications Co. (BCC) said in an updated study.

The chemical catalysts market was $1 billion in 2000 and is expected to grow by 4.1%/year to reach $1.3 billion by 2005.

BCC lists the market categories as hydrogenation, dehydrogenation, organic syntheses, oxidation, polymerization, and synthesis gas processes.

The petroleum refining catalyst market was $1.1 billion in 2000 and is predicted to grow 3.7%/year to $1.3 billion in 2005.

Growth is spurred by increasing demand for reformulated and other, less-polluting gasolines mandated by the Clean Air Act Amendments of 1990, plus new regulations calling for reductions in sulfur content in gasolines and diesel fuel.

The major segments in this market are the key petroleum refining catalytic processes: alkylation, fluid catalytic cracking, hydrocracking, hydrodesulfurization, isomerization, and catalytic reforming.

Government Developments

US Vice-Pres. Dick Cheney will meet in Washington, DC, June 14 with Alberta Premier Ralph Klein to discuss Alberta's role in the proposed Bush administration continental energy policy (see related story, p. 30).

Klein, political head of Canada's major petroleum producing province, is expected to discuss oil sands development in northern Alberta and the province's expertise in pipelines relative to Canadian Arctic development and mainline connections in Alberta to southern markets.

Klein, a political conservative noted for deficit reduction and tax cuts, will be accompanied by Michael Kergin, Canadian ambassador to the US. Alberta Energy Minister Murray Smith is also expected to join the group for talks with Cheney.

Smith met with US energy officials in Washington last month.

Klein is expected to make the point that Alberta has full ownership of its natural resources under the Canadian constitution and that the province, not the Canadian federal government, has control.

He will also emphasize the importance to any continental energy plan of the oil sands in northern Alberta, already under extensive development and with potential reserves postulated at 300 billion bbl, under current technology.

The gas price disparity between California and the rest of the country has prodded FERC to question why the market has not functioned to equalize prices. It said that higher prices in California should cause more sellers to direct gas to that market, increasing supply, lowering the price, and bringing it in line with the national average. FERC noted that this expected market response has not happened and that the price disparity continues.The US FERC has proposed new reporting requirements for natural gas sellers and transporters serving California markets.

California prices in December 2000 were $11.79-18.80/Mcf, compared with $4-7/Mcf nationwide. In May 2001, prices at the California border were in excess of $9/Mcf compared with $4.50-4.68/Mcf at the New York City gate.

The commission proposed to collect data related to volumes and prices of sales including transportation rates, the daily operational capacity of pipelines to and within the California market, the actual volumes flowing to and within California, and gas sales and transportation requirements of the local distribution companies.

The commission said it wants to know what percentage of gas moving into the California market is priced at the high spot market prices reported at the border.

Comments must be submitted by June 18. Depending on those, the commission will determine whether to proceed with the reporting requirement.

Quick Takes

WOODSIDE ENERGY HAS BROUGHT THE LEGENDRE DEVELOPMENT OFF AUSTRALIA TO FIRST OIL.

The Ocean Legend mobile offshore production unit recently started up the $110 million (Aus.) two-field Legendre development off Australia, operator Woodside Energy reported.

Production from Legendre North and Legendre South fields, 35 km southeast of the Wanaea-Cossack developments on production license WA-20-L, will be ratcheted up to a plateau of 50,000 b/d as three more development wells are completed.

Legendre's field life is forecast at 3-8 years (OGJ Online, Jan. 15, 2001).

In other production action, Kinder Morgan Energy Partners, through its subsidiary Kinder Morgan CO2 Co., has begun a $25 million expansion of its CO2 project in SACROC Unit in Scurry County, Tex. The SACROC (Scurry Area Canyon Reef Operators Committee) project is expected to increase CO2 deliveries by nearly 80% to 125 MMcfd. "This project is the third phase of a redevelopment program," Kinder Morgan CO2 said. "It is expected to increase oil production from SACROC Unit to more than 11,000 b/d over the next few years, compared with current levels of about 9,000 b/d. The project also should increase the ultimate recovery from the field by [about] 8 million bbl," the CO2 will be transported from the McElmo Dome CO2 Unit in southwestern Colorado by the Cortez, Central Basin, and Canyon Reef Carriers CO2 pipelines, all operated by Kinder Morgan CO2. The 50,000-acre SACROC Unit began CO2 injection in the early 1970s upon completion of the Canyon Reef Carriers pipeline. The unit has produced more than 1.2 billion bbl of oil since its discovery in 1948.

ENTERPRISE OIL GULF OF MEXICO RECEIVED THE APPORVAL OF LLANO FIELD COVENTURERS TO TAKE OVER OPERATORSHIP OF THE US GULF OF MEXICO DEVELOPMENT FROM EEX said parent Enterprise Oil.

Subject to MMS clearance, Enterprise will be responsible for all future appraisal and development of the field, on Garden Banks Blocks 385 and 386, including this month's provisional drilling of an appraisal well on Block 385.

Enterprise said the 25,000-ft well would be completed by October. The other coventurers in the Llano blocks are EEX (27.5%), PanCanadian Gulf of Mexico (22%), and ExxonMobil (22.5%).

SPINNAKER EXPLORATION HAS MADE FOUR DISCOVERIES IN THE GULF OF MEXICO.

Three of the finds established new fields, and one is a deeper pool discovery.

South Timbalier Block 274 No. 1 well found pay in three Bul-1 reservoirs at 12,250-12,480 ft TVD. Facility design is under way, and Spinnaker expects first production in first quarter 2002.

Spinnaker owns 100% working interest in the well and block, in 265 ft of water 70 miles south of Bay Marchand, La.

The High Island 202 No. 7 well found productive field pays, including Rob M sands. Spinnaker will complete the well soon and develop it as a caisson tieback 3,000 ft north to the HI 202 platform. The company drilled two wells on West Cameron Block 459 that tested separate structures.

West Cameron 459 No. 1 found 44 ft of pay in the Pleistocene I sand target. The No. 2 well found 89 ft of pay in its two main Pleistocene-age objectives. Platform and facility design is under way; first production from the block, in 134 ft of water 85 miles south of Cameron, La., is expected in early 2002.

Meanwhile, Spinnaker also said it participated in the Murphy Oil-operated Seventeen Hands and Front Runner discoveries. Seventeen Hands is in 5,450 ft of water on Mississippi Canyon Block 299. Murphy is drilling a sidetrack. Front Runner is on Green Canyon 338 and 339 in 3,500 ft of water. The discovery well found 850 ft of pay, and Murphy drilled a sidetrack that confirmed the existence of other field pays downdip. Murphy is sidetracking the well to the Front Runner South prospect.

Elsewhere on the exploration front, Santos, operator of exploration Permit 154 in the Victorian section of the Otway basin in Australia, has made a fifth natural gas discovery in the area. The Naylor 1 wildcat was drilled to 2,157 m TD. It found a potential 84-m gross gas column in Cretaceous Waarre sands at 2,028-2,112 m. Preliminary results indicate at least 30 m of gas pay.

TOPPING PIPELINE NEWS, a consortium of Alaskan natural gas producers has awarded Natural Resource Group (NRG), an environmental consulting firm in Minneapolis, a contract to conduct feasibility studies for a potential natural gas pipeline from Alaska's North Slope to the Lower 48.

BP, ExxonMobil, and Phillips Petroleum are working together to evaluate alternative routes to link the gas supply in Prudhoe Bay field through Canada with the Lower 48 (OGJ Online, Apr. 23, 2001).

In other pipeline happenings, Sonatrach signed a $70 million contract with ABB Lummus Group for the extension of the OH3 oil pipeline linking Hassi Berkine and Haoud El Hamra oil fields in southeastern Algeria. The project involves setting up a crude storage facility and terminal at Hassi Berkine field. The project is slated for completion within 22 months and will allow for an increase in the capacity of the pipeline to 500,000 b/d. F Tennessee Gas Pipeline will hold an open season for its Northeast ConneXion project, which includes an expansion of the pipeline company's market area storage site in Pennsylvania and an expansion of its downstream pipeline capacity from this storage site to New York City, Pennsylvania, and New Jersey. The storage expansion of up to 5 bcf could provide as much as 300 MMcfd of incremental deliverability. The nonbinding open season will conclude May 31.

El Paso Corp. and Marathon Oil have agreed to conduct a feasibility study for a subsea pipeline to transport natural gas from Nova Scotia to the US Northeast. The Sable Offshore Energy Project off Nova Scotia produces 450 MMcfd, which is shipped to markets in the US Northeast and Canada's Atlantic provinces via the Maritimes & Northeast Pipeline. The US location has yet to be determined, but it could be as far away as New York City. The pipeline could be in operation as early as the middle of the decade, said El Paso unit Tennessee Gas Pipeline.

Buckeye Pipe Line signed a letter of intent to purchase TransMontaigne's Norco refined products pipeline system. The purchase includes associated storage, product distribution, and delivery facilities from Chicago to Fort Madison, Iowa, and from Chicago to Toledo, Ohio, as well as an Indianapolis products storage terminal. The transaction is subject to a definitive agreement between the companies, approval of the directors of both companies, and regulatory approval.

ANOTHER OIL SLICK HAS PROMPTED PETROBRAS TO HALT PRODUCTION IT THE CAMPOS BASIN OFF BRAZIL.

Petrobras reported an oil slick estimated at 110 cu m had caused it to shut down production at 12 Campos platforms. It was unclear where the oil came from. It was the second time this month that Petrobras has shut down Campos production because of an oil slick. The slick was 85 km off Rio de Janeiro state.

The platforms will restart production after Petrobras discovers the origin of the slick and cleans it up. Campos is Brazil's most prolific oil province, responsible for 76.5% of Brazil's 1.3 million b/d of crude oil production and 43.9% of the country's natural gas production of 16.1 million cu m/day. Petrobras summoned 11 oil recovery and containment vessels. Three vessels inspecting the platforms' pipelines for leakage also are in the area. State and federal environmental agencies were notified, Petrobras said.

SHELL INTERNATIONAL GAS HAS ORDERED TOW LNG CARRIERS TO HELP SUPPLY GROWING DEMAND FOR LNG.

Mitsubishi Heavy Industries will build one carrier, and South Korea's Daewoo Shipbuilding & Marine Engineering will build the other.

The Daewoo vessel is of the membrane type, and the Mitsubishi vessel is of the Moss spherical tank design. The vessels will be delivered in 2003 and 2004, respectively. The vessels are in addition to the three carriers now on order.

In addition, Shell agreed to the key terms of a deal to purchase up to 3.7 million tonnes of LNG from the North West Shelf project in Australia for future delivery to the Americas. The final sales and purchase agreement is expected to be concluded in the coming months. The LNG purchase runs over 5 years starting in 2004 and will use Shell's new LNG carriers, including the two recently ordered.

TEXACO COMMANDS CENTER STAGE THIS WEEK IN GAS PROCESSING NEWS.

Texaco plans to begin appraisal drilling later this year to evaluate natural gas reserves on three of Angola's most prospective offshore blocks that are expected to drive a proposed LNG joint venture with state oil company Sonangol.

Texaco said that the early estimates of gas volumes to be exploited from deepwater Blocks 15, 17, and 18, along with nonassociated gas concessions on shallow-water Blocks 1, 2, and 3, are 9.5-25 tcf.

Texaco and Sonangol are selecting appraisal well locations to tap nonassociated gas in Block 2 as a backup to associated gas production, he said, while also jointly evaluating bids for drilling rig and services contracts for the project.

Because of safety concerns raised by the onshore storage of LNG and, more centrally, LPG, Texaco said the JV has opted to use a concrete gravity-based storage and offloading system. They said the "dock in the box" system would use a 300 m long structure containing both LNG and LPG tanks located 200-300 m offshore (see schematic).

Meanwhile, Texaco announced a 6-month study for the development of an LNG receiving and regasification terminal in the US Gulf of Mexico. The study will examine and evaluate infrastructure requirements and costs of the proposed terminal, which would be designed to process 1 bcfd initially. The proposed terminal would connect with Texaco's offshore infrastructure, which has excess capacity. Texaco's offshore natural gas infrastructure is connected onshore to several interstate pipeline systems and the Henry Hub, which is operated by a Texaco subsidiary.

The terminal could be operational in 4-5 years and capacity then could be expanded to 2 bcfd. The LNG would be produced from one or more potential projects in the Atlantic Basin in which Texaco holds an equity interest.

In other gas processing news, BG Group agreed to take all available capacity at CMS Energy's LNG import terminal at Lake Charles, La., for 22 years starting Jan. 1, 2002.

The terminal can store and regasify 6.3 bcf of LNG. It can deliver 630 MMcfd of natural gas and has access to 15 interstate gas pipelines. BG will have 80% of the capacity of the terminal until Aug. 31, 2005, and 100% thereafter. The Lake Charles facility, which BG said is the largest in North America, receives gas from Africa, Asia, Australia, Europe, and South America.

The value of the contract was not disclosed, but CMS said it has firmed up present value revenues totaling $450 million from the facility.