OGJ Newsletter

Market Movement

Return of natural gas, oil price link

Has the linkage of natural gas and oil pricing returned for good? The recent price and supply-demand gyrations of the past year provide evidence that it has. And that, in turn, points to the likelihood that oil prices will again be a key determinant of natural gas prices.

As Raymond James & Associates points out, the deregulation of natural gas markets in the mid-1980s spawned a decoupling of the oil and gas price linkage that had previously been the case. Deregulating gas enabled this commodity to develop its own, independent supply-demand and price dynamics.

But rocketing demand for natural gas in the power sector-propelled in large part by air quality concerns-coupled with lagging growth in gas supply has drastically changed the dynamics of natural gas pricing.

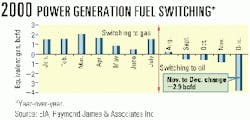

"All of a sudden, with natural gas prices above $4/Mcf in the summer of 2000, the relationship between natural gas prices and residual fuel oil prices became important because of the economic attraction of switching away from gas to residual fuel oil," RJA said (see chart). "Furthermore, once residual fuel oil prices entered the natural gas pricing picture, the supply and demand dynamics of the global crude oil market also become relevant as a determinant of natural gas prices."

New trend emerging

This revived trend manifested itself clearly in late July 2000. Since then, gas prices have generally remained above the equivalent price of residual fuel oil. But last winter's huge spike in gas prices widened the resid-gas price differential, further strengthening the case for fuel-switching.

RJA notes that electric power generators began switching away from gas in earnest beginning in August 2000. Fuel switching, in terms of gas demand, increased to 900 MMcfd by November from 500 MMcfd in September (see chart). By December's extreme cold spell, switching accelerated further, posting an incremental reduction of 2.9 bcfd in gas demand for power generation from the previous month.

But high gas prices did more than spur more fuel switching; it also produced a sharp falloff in industrial demand and a boost in conservation. All three factors combined to produce a steep decline in gas prices in January-February this year. By March, gas prices were again in equilibrium with heating oil prices (on an equivalent heating value basis).

"In our view," noted RJA, "the market's short-term capability to switch a significant percentage [5%] of demand away from natural gas and toward heating oil means the equivalent price of heating oil is likely to become the long-term determinant of natural gas prices.

"The good news is that once the gas-fired power demand kicks into high gear this summer, gas prices will once again likely rebound back to the equivalent price of heating oil."

Natural gas prices continue to be strong

Beyond that, then, the prospect is for continued strength in gas prices because so many forecasts are pointing to the likelihood of continued strength in oil prices and a likely spike in heating oil prices later in the year. Tight gasoline supplies and relative OPEC restraint on production underpins oil price strength in the summer. And with refiners scrambling to make gasoline now, that means they'll be struggling to catch up with heating oil in the fall, so stocks of residual fuel oil are likely to be low heading into the heating season. Of course, another cold-or even normal-spell of winter weather will put further upward pressure on both heating oil and gas prices.

While power generators are not likely to sustain a fuel switch over a long stretch of time, this capability has again become a significant market factor, reestablishing the link between oil and gas prices.

"Assuming no increased environmental limitations on burning residual [or] heating oil, we expect the equivalent price of residual fuel oil [currently about $4/Mcfe-New York Harbor] to put a floor under gas prices, while the equivalent price of heating oil [about $6/Mcfe-New York Harbor] is a probable ceiling."

With that as a given, the expectation grows that there will be near-term softness in natural gas prices, with the bottom likely to come in June, RJA contends: "After gas prices stabilize, back up the truck, because gas prices are likely to rapidly reengage equivalent heating oil prices later this summer."

null

null

null

Industry Trends

TOTAL US DRILLING ACTIVITY DIPPED THE WEEK ENDED MAY 18 AND UTILIZATION OF MOBILE RIGS IN THE GULF OF MEXICO ALSO WAS DOWN, industry sources reported.

There were 1,225 rotary rigs drilling in the US that week, 7 less than the week before but up from the 849 drilling during the same period a year ago, according to Baker Hughes.

This count included 500 rigs working in Texas, 1 less than the previous week. Louisiana and New Mexico reported declines of 8 rigs each to 224 and 67, respectively. But Oklahoma's rig count increased by 1 to 146. Wyoming was up 2 to 53.

Canada had 252 rotary rigs making hole, 24 more than the previous week and up from 182 last year.

ODS-Petrodata Group reported 1 more mobile rig joined the gulf fleet that same week, with a net decline of 1 rig under contract. The gulf's utilization rate dipped to 89.7% with 191 units contracted out of the 213 available.

Activity in European waters was unchanged, with 95 rigs under contract in a fleet of 102, for 93.1% utilization.

Worldwide, the number of mobile offshore rigs under contract was down 2 to 582 out of a total fleet of 650. That put utilization at 89.5%.

OFFSHORE DRILLING CONTRACTOR GLOBAL MARINE REPORTED THE 20TH CONSECUTIVE MONTH-TO-MONTH INCREASE OF ITS WORLDWIDE SUMMARY OF CURRENT OFFSHORE RIG ECONOMICS (SCORE) FOR APRIL.

The company's SCORE increased by 7.2% over March.

"April's SCORE reflects the continuing improvement in key international offshore drilling markets. As these markets begin to go head-to-head to attract equipment away from the Gulf of Mexico, day rates will see continued upward pressure," said Global Marine Chairman, CEO, and Pres.Bob Rose.

SCORE compares the profitability of current mobile offshore drilling rig rates with the profitability of rates at the 1980-81 offshore drilling cycle peak, when speculative rig construction was common. Global Marine's SCORE then averaged 100%, and new contract day rates equaled the sum of daily cash operating costs plus $700/day/$1 million invested. SCORE reflects current rig day rates as a percentage of the estimated rate required to justify building rigs on speculation.

The worldwide SCORE for April is 50.3, up 82.9% from a year ago and down 4.2% from 5 years ago.

Correction

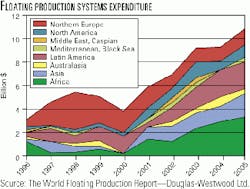

An erroneous version of this chart appeared with a recent Newsletter Industry Trends item reporting on a new study by UK-based analysts Douglas-Westwood Associates Ltd. and data specialists Infield Systems UK projecting worldwide expenditures for floating production systems (OGJ, May 7, 2001, Newsletter, p. 7).

Government Developments

FOSSIL ENERGY, CLIMATE CHANGE, NEW ENERGY SOURCES, AND ENERGY EFFICIENCY WILL BE THE FOCUS OF AN EU-US JOINT RESEARCH PROGRAM.

European Union Research Commis-sioner Philippe Busquin and US Energy Sec. Spencer Abraham earlier this month agreed to the program, which is expected to develop joint standards, share research and development facilities, hold workshops, exchange and network experts, conduct joint technology studies, and coordinate research projects, the EU said.

"The signing of these agreements gives the right political signal and underlines the importance the EU attaches to securing safe and clean energy supplies for future generations," Busquin said. "The global challenges in the field of energy are such that a more systematic collaboration as well as learning from each other is becoming highly desirable, if not indispensable, for the sustainable development of our economies."

Busquin said a good fit exists between the EU's strengths in energy research into thermonuclear fusion and energy efficiency and US expertise in the areas of fossil fuels and CO2 emissions research.

He said the European Commission's "main fields of interest" are fuel cell technology, hydrogen production technologies, solar energy, and biomass.

HOUSE DEMOCRATS LAST WEEK PROPOSED A "WINDFALL PROFIT" TAX ON GASOLINE AND DIESEL.

The bill, the Gas Price Spike Act of 2001, was sponsored by 12 Democrats and one independent and seeks to discourage price gouging.

The bill would impose a tax on "key" oil industry profits that are "above a reasonable rate of return," its sponsors said. How much those profits would be limited was unclear, because a copy of the bill was not available at presstime.

"If oil companies are collecting excessive profits, they should be subject to a stiff tax on those excessive profits. The threat of heavy taxation will send a clear signal to oil companies that price gouging will not pay," sponsors said.

The White House and lawmakers from oil-producing states said such a tax could severely constrict supply and discourage investment at a time when the nation needs more capital poured into an aging energy delivery infrastructure. The proposal most likely will be referred to the House Committee on Energy and Commerce or the Ways and Means Committee, neither of which is likely to advance legislation on the subject.

The House bill would use revenues from the tax to fund a $6,000 tax credit to motorists who buy domestic, ultraefficient cars. It also would direct funds to the "working poor" by earmarking money for regional transit authorities so local officials can discount bus and commuter train fares.

Finally, the bill would give the Justice department authority to order the licensing of reformulated gasoline patents "at a fair and reasonable price" to all manufacturers.

Quick Takes

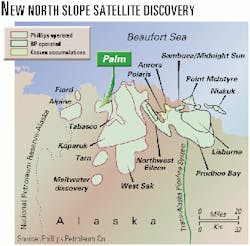

ALASKA NORTH SLOPE OPERATORS BP AND PHILLIPS HAVE EXTENDED KUPARUK OIL FIELD THROUGH A RECENT DISCOVERY.

The Alaskan subsidiaries of the companies said the discovery, which is 3 miles west of Kuparuk River field in the Greater Kuparuk area, is estimated to contain 35 million bbl of reserves.

The Palm 1 exploration well found 30 ft of oil-saturated Kuparuk sand at 5,800 ft. A sidetrack well, Palm 1A, tested at an unstimulated rate of about 2,500 b/d of 26° gravity oil (see map).

Phillips Alaska operates Kuparuk field and holds a 55.29% interest. BP Exploration (Alaska) holds a 39.28% interest, while Unocal, ExxonMobil, and Chevron each hold minor interests.

Production from the satellite field, expected in 2003, will be processed through Kuparuk River field facilities. Phillips expects the discovery will help meet its objective of keeping its Alaska production at 375,000-400,000 boe/d for the next several years.

Kuparuk River-which began production in 1981-is the second-largest oil field in North America after Prudhoe Bay. The Greater Kuparuk area, including four satellite fields, produces 225,000 boe/d.

Elsewhere on the exploration front, Pakistan has amended its petroleum policy to encourage onshore exploration. The move is similar to one made recently to encourage exploration offshore (OGJ, Feb. 12, 2001, p. 42). Petroleum Sec. Abdulah Yousaf said that he is not satisfied with the pace of exploration and is devising a 10-year plan to gradually increase exploration activity to 100 wells/year. The secretary said that the government cut the income tax rate to a uniform rate of 40% from the previous 50-55%. The initial term of exploration licenses has been increased to 5 years, with two renewals of 2 years each, vs. the previous initial 3 years, with 3 extensions of 1 year each. He said the zones also have been redefined to encourage interest. In addition, an open-access regime would be followed for pipeline infrastructure development. For tie-in pipelines constructed by a producer, buyer, or a third party, separate transmission tariffs will be allowed. A 5-year retention of significant gas discoveries will be permitted. And for marginal discoveries, the government has withdrawn the $500,000 production bonus requirement.

Luxembourg's Petreco Sarl, a unit of Melrose Resources, inked a deal with the Bulgarian state-owned energy agency to explore the shallow-water Kaliakra 99 concession in the Black Sea. Kaliakra 99 is southeast of Block 91-III, crossing over parts of the old Blocks II and IV, awarded in the early 1990s to Enterprise Oil and BG. The new 2,601 sq km area, said Melrose, includes "a number of attractive prospects" in waters of 20-500 m, along with the 1986 Samotino More R-1 discovery, which tested at rates as high as 9.5 MMcfd of gas and 204 b/d of condensate. Melrose said its work commitment at Kaliakra 99 for the first 3-year period includes reprocessing and interpreting 300 of the 500 km of seismic acquired from the Bulgarian authorities. The concession may be renewed for two further 2-year periods. F Repsol-YPF confirmed its A1 discovery on the NC-186 exploration block in the Murzuq basin, 800 km south of Tripoli. The A2 well found an oil column in the middle Ordovician sand of the Hawaz. On test, the well flowed unassisted at a rate of 2,670 b/d of 41° gravity oil through a 1-in. choke. The A1 well flowed 2,500 b/d of 41° gravity oil through a 3/4-in. choke (OGJ Online, Nov. 29, 2000). Also, B1, on the same block, previously had yielded1,300 b/d of 40° gravity oil (OGJ Online, Mar. 16, 2001). NC-186 covers 4,300 sq km. Repsol-YPF operates NC-186, NC-187, and NC-190 on behalf of partners National Oil Corp. of Libya, OMV, TotalFinaElf, and Norsk Hydro affiliate Saga Petroleum. Production from the Murzuq basin started in December 1996 from El-Sharara field on the NC-115 block. El-Sharara, operated by a Repsol affiliate, is producing more than 150,000 b/d of 44° gravity oil.

STATOIL'S MORGINAL NORTH SIRI FIELD HAS BECOME THE FIRST DANISH OFFSHORE INSTALLATION TO STOP FLARING GAS, the Norwegian operator reported. An average of 25,000 cu m/day of gas, previously flared in connection with production shutdowns or process trips, will now be used either in power generation, or reinjected.

Statoil said some 300 cu m/day of gas would still be consumed by a small pilot flame on the installation, which is producing 30,000 b/d of oil.

Gas recovery and environmentally friendly technological advances such as injection of produced water are part of Siri's production "philosophy."

The field also has made use of simultaneous water and gas injection into the reservoir, though Statoil noted that injecting produced water has increased wear on the injection pumps, and their design is to be modified.

Oil production began from Siri in March 1999. The field is in 60 m of water on Block 5604/20 on the Ringk bing-Fyn high, 130 nautical miles west of Esbjerg.

Statoil expects Siri to cease production during 2005-07.

CANADIAN NATURAL RESOURCES LTD. SAYS A PROPOSED $7 BILLION (CAN.) OIL SANDS PROJECT IN NORTHERN ALBERTA could produce more than 5.6 billion bbl of bitumen over a 50-year lifespan.

CNRL said the Horizon project-known formerly as Mic Mac-could begin construction in 2004, subject to regulatory approvals. It said production could reach 300,000 b/d of bitumen by 2010. The company said it plans to make a formal application by 2002.

The project would involve infrastructure, surface mining and bitumen processing, in situ operations, and an onsite bitumen upgrader. CNRL plans production of up to 30,000 b/d by 2006.

The product mix would be designed to meet market demand in Canada and the US Midwest. It could include diluted bitumen; light, sweet, and sour crudes; and natural gas liquids.

A MAY 15 FIRE AT HOVENSA'S REFINERY AT ST. CROIX, US VIRGIN ISLANDS, REDUCED ITS GASOLINE PRODUCTION BY 30,000 B/D but has not affected oil processing, Amerada Hess said.

Hovensa is a joint venture of Amerada Hess and PDVSA. Amerada Hess said the extent of damage and the cause of the fire remains under investigation.

The company has estimated it would take 4-6 weeks to repair the fire damage to equipment used in the distillation process of making conventional gasoline.

The refinery's crude capacity is 545,000 b/d, but it has been processing 400,000 b/d, the company said.

Elsewhere in the refining sector, desulfurization technology firm SulphCo formed a JV that will build an 11,000 b/d desulfurization unit at Iplom's 35,000 b/d refinery at Busalla, Italy. The unit, which will use SulphCo's proprietary desulfurization technology-will reduce sulfur content in diesel fuel and fuel oil products by more than 95% to 5-10 ppm. SulphCo and a group of Italian business partners have formed the JV, called Innovative Clean Technologies, to market to refineries and implement the SulphCo technology in Italy. SulphCo owns 75% of the company. ICT will market the technology, provide engineering expertise for installation, and provide maintenance services. Iplom-a refiner and distributor of diesel fuel and fuel oil products in northern Italy-is purchasing the unit and paying for installation costs.

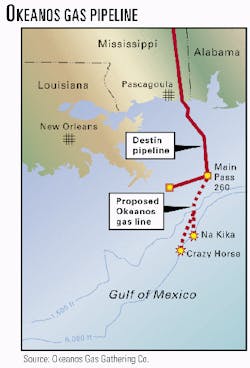

BP AND SHELL GAS TRANSMISSION SAID THEY WOULD BUILD A $150 MILLION GAS PIPELINE TO THE ULTRADEEPWATER GULF OF MEXICO.

The 100-mile Okeanos pipeline will have a capacity of at least 1 bcfd. It will be the deepest gas-gathering system in the gulf, operating in more than 6,000 ft of water, the companies said (see map).

BP will operate Okeanos Gas Gathering Co. with two-thirds ownership. Shell Gas Transmission will own the rest.

Okeanos will connect ultradeepwater de- velopments with Destin Pipeline, which lands in Mississippi and interconnects with five interstate pipelines that serve eastern US markets.

BP's Pascagoula gas processing plant will treat gas from the Okeanos pipeline transported by Destin. Okeanos is the first of the Mardi Gras Transportation System projects that will serve BP developments.

The Okeanos gas pipeline will be built in two phases, beginning in 2002. Shell will manage construction of the first segment-a 74-mile, 24-in. pipeline to gather gas produced from the Shell Exploration & Production-BP Na Kika project. Na Kika is under development by Shell 150 miles southeast of New Orleans.

The project consists of 6 fields tied back to the gulf's deepest permanently moored semisubmersible development and production system, operating in 6,350 ft of water.

Construction of the first segment of the line will be completed in time for the 2003 start-up of Na Kika.

BP will be construction manager for the second phase, a 26-mile segment to connect BP and ExxonMobil's Crazy Horse field to Okeanos near Na Kika. Construction on this segment will be completed in 2005 in time for the Crazy Horse start-up.

In other pipeline news, BP, Royal Dutch/Shell, and ExxonMobil said they are competing for the nod from PetroChina Co. to build a 4,200 km gas pipeline across China. The pipeline would start in Xinjiang and end in Shanghai. Preliminary indications are that the pipeline would have a throughput of 12 billion cu m/year (OGJ Online, Apr. 27, 2001). BP submitted an initial investment proposal on behalf of a consortium that includes itself and Japanese firms Mitsubishi Heavy Industries, Itochu, and Nissho Iwai. BP noted that it was too soon to say how much the pipeline would cost. ExxonMobil, meanwhile, confirmed it had submitted a proposal in conjunction with China Light & Power. No further details were available. And Shell confirmed it had made a proposal on its own, although it hasn't yet created a formal consortium. PetroChina officials have suggested pipeline construction could start in October, with gas deliveries to Shanghai as early as 2003.

THE TANKER NEWS SPOTLIGHT SHINES ON THE USE OF FPSO VESSELS IN THE GULF OF MEXICO.

Conoco formed an alliance with two shipbuilding firms to plan the design and construction of the first shuttle tankers that would qualify to transport oil from a future floating production, storage, and offloading system in the deepest waters of the gulf, officials said.

Conoco established a new wholly owned affiliate, Seahorse Shuttling & Technology, for that purpose. Seahorse subsequently joined with Alabama Shipyard and Samsung Heavy Industries to develop plans for US-built double-hull shuttle tankers that could be ready for service in 2004.

Conoco and Samsung have already completed an extensive conceptual design for a new tanker classification, designated as the Gulf of Mexico Maximum Cargo (Gomax) shuttle tanker. It's a double-hulled, dynamically positioned vessel with a capacity of more than 550,000 bbl of oil that will meet the 40-ft draft restrictions of most US ports along the gulf.

The US Coast Guard requires that tankers operating in US waters be double-hulled. But Conoco was the first oil company to begin building only double-hulled vessels as an environmental safety measure, even before federal requirements were established.