Future of EOR & IOR: New companies, infrastructure, projects reshape landscape for CO2 EOR in US

Through oil price swings and ownership realignment, carbon dioxide injection has remained an important method for improving oil recovery in the US, especially in the Permian basin of West Texas and New Mexico.

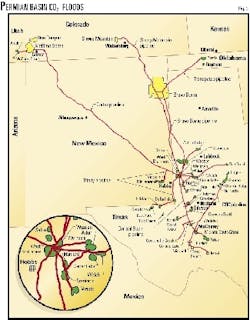

The lower costs for implementing CO2 floods in this area result from the extensive CO2 pipeline infrastructure from CO2 source fields (Fig. 1) and the existing gas processing facilities that extract produced CO2 and recycle it for reinjection.

In the last few years, oil price volatility and ownership changes have slowed growth in new capital expenditures, but 2001 again is starting to see announcements for both CO2 enhanced oil recovery expansions and new projects in the Permian basin and other regions.

CO2 EOR

CO2 EOR projects are long-lived, with many designed for 10-30 years. Expected additional oil recoveries from these projects are in the order of 7-15% of original oil in place. In recent years, computer simulation of CO2 flood performance has improved, and development costs have been reduced, as experience with handling the potentially corrosive mixture of CO2 and water has improved.

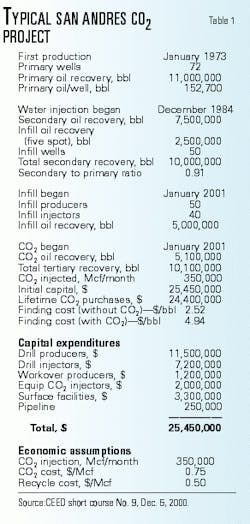

Fig. 2 illustrates a typical Permian basin production facility for handling both CO2 and water injection. The table shows typical costs for a new CO2 project.

Miscible displacement is the most common CO2 EOR technique. In miscible displacement, injected CO2 dissolves in the crude, reducing oil viscosity and increasing oil volume and oil-water relative permeability. The result is that oil moves much easier through the formation and into the producing well.

Because CO2 is relatively expensive, CO2 flood success depends on keeping the CO2 within the flooded area, such as by injecting water on the perimeter of the CO2 flood.

Reservoirs without a natural water drive, without a major gas cap, or without major fractures typically have better recoveries.

CO2 can be injected in a continuous process or in a water-alternating-gas (WAG) process. The injected water provides mobility control and helps prevent early CO2 breakthrough in producing wells. The length of the water and CO2 cycles are often determined on a pattern-to-pattern basis and range from hours to months.

In West Texas, the US government's Crude Oil Windfall Profit Tax Act of 1980 provided much of the initial impetus for developing the CO2 infrastructure. Under that act, the "windfall profit" on conventional crude revenue was taxed at the rate of 70% compared to with 30% for some EOR projects, including CO2 flooding. This incentive ceased with the collapse of oil prices in early 1986.

Fig. 3 shows Permian basin CO2 supply pipelines and fields in the area with active CO2 floods.

Ownership changes

The departure from the Permian basin of Amoco Production Co. (now part of BP PLC) and Shell Western E&P Inc. (SWEPI) significantly changed the ownership of the CO2 infrastructure and producing fields. Both companies had been pioneers in proving CO2 technology. And because of the sizable CO2 reserves in their source fields in Colorado and New Mexico, both companies promoted new floods by providing innovative CO2 purchase contracts with smaller and independent operators.

In 1998, after SWEPI and Amoco combined their Permian basin oil and gas properties to form Altura Energy Ltd., Shell's source field and pipeline interests became part of Shell CO2 Co. Ltd., a venture owned 80% by Shell CO2 Co. and 20% by Kinder Morgan Energy Partners LP.

But these ventures were short-lived.

In 2000, Occidental Permian Ltd. acquired Altura properties and combined them with Oxy USA Inc. properties. These properties, along with Bravo dome CO2 source field, are now operated by Oxy Permian.

Also in 2000, Kinder Morgan CO2 Co. LP became operator and acquired the Shell CO2 Co. assets that included interest in the 500-mile Cortez pipeline and the McElmo Dome CO2 source field, which Kinder Morgan estimates contains more than 10 tcf of CO2. Other Shell assets acquired by Kinder Morgan are Doe Canyon CO2 source field in Colorado and an interest in the Bravo Dome CO2 source field in New Mexico.

Kinder Morgan had previously purchased the 140-mile Central Basin pipeline from Enron Liquids Pipeline Co. This pipeline transports CO2 from Denver City, Tex., near the terminal for the Cortez, Bravo Dome, and Sheep Mountain pipelines, south to near McCamey, Tex.

With its acquisition of the Scurry Area Canyon Reef Operators Committee (SACROC) unit from Devon Energy Corp., Kinder Morgan also acquired an interest in the Canyon Reef Carriers (CRC) CO2 pipeline.

In another pipeline ownership change in 2000, Trinity Pipeline LP, Midland, Tex., acquired CO2 pipelines in West Texas and New Mexico from Air Liquide America Corp. Barry F. Petty, president of Trinity, says Trinity is in talks with three potential CO2 buyers that would increase its pipeline throughput. Currently, its 200 miles of pipeline transport about 80 MMcfd of CO2, and Trinity estimates that the capacity can be increased by 120 MMcfd.

Companies also merged properties. For instance, Pure Resources Inc., Midland, was formed in May 2000 through the combination of Titan Exploration Inc. and the Permian basin business unit of Unocal Corp. The company operates the Reineike and Dollarhide CO2 floods.

CO2 supply

In the US, sources of CO2 include:

- Reservoirs containing very pure CO2, such as McElmo Dome, Sheep Mountain, Jackson dome, Bravo Dome, and Ridgeway Arizona Oil Corp.'s discovery in Arizona and New Mexico.

- Gas processing facilities, such as the LaBarge, Terrell, Puckett, and Mitchell plants.

- The Great Plains coal gasification plant at Beulah, ND.

- An ammonia plant in northern Oklahoma.

Charles E. Fox, Kinder Morgan CO2 vice-president of operations and technology, says that current CO2 supply to the Permian basin is tight, with the Permian basin supply of 1.2 bcfd being 95% utilized. He says Kinder Morgan began drilling the first of two new CO2 producing wells to bring McElmo Dome's capacity to 900 MMcfd from about 840 MMcfd. It needs the wells because of an expected demand increase to 1 bcfd by mid-2002.

From McElmo Dome, Kinder Morgan has a 1.2 bcfd compressor capacity with the Cortez pipeline having a 1.1 bcfd throughput capacity. It also delivers about 50-100 MMcfd of CO2 from McElmo Dome to Utah floods.

Fox says Kinder Morgan is preparing to drill as many as five wells to add 150 MMcfd to McElmo Dome's deliverability capacity by summer 2002, because other suppliers are producing flat out and do not have an easy way for adding production capacity.

Sheep Mountain, the BP-operated property, is in its final decline, now producing under 100 MMcfd. Fox estimates that it will probably reach its economic limit in the next 5 years.

Fox says the Bravo Dome reserve base is large, but CO2 prices are not sufficient to develop the rest of the reserves and increase production above the current 350 MMcfd. The difficulty at Bravo Dome is that wellhead pressures are much less than at McElmo Dome, with plant inlet pressure of about 100 psi compared with 650 psi at McElmo. He says the area around the plant at Bravo Dome has been developed, but new wells farther from the plant would require costly additional pumps.

Petro Source Corp's pipeline from the southern gas plants delivers about 70 MMcfd, although Fox says the throughput varies.

He indicates that some of Kinder Morgan's pipelines are nearing capacity. For instance, it plans to add 4,000 hp of pumps to the CRC pipeline to bring that pipeline's capacity to about 300 MMscfd. The CRC pipeline supplies CO2 to the SACROC, Cogdell, Sharon Ridge, and Reinecke floods.

Fox estimates the CO2 reserves at Bravo Dome are about 8 tcf at $1/MMcf and 2 tcf at $0.60/MMcf. About 2 tcf of CO2 has been produced from it since production started in 1984.

According to Fox, currently CO2 is being sold in the Permian basin at about 3-4% of the oil price. He says that, to help the economics of new projects Kinder Morgan will negotiate a lower CO2 price at the start of a project and increase the price later.

Ridgeway discovered an estimated 21 tcf of CO2 in Arizona and New Mexico near St. Johns, Ariz. Ridgeway says it is still discussing with various operators the possibility of a 500-mile pipeline to California. Currently, it plans to build a CO2 liquefaction plant in the area and to extract helium from the produced gas.

Doe Canyon CO2 reserves are inactive, and Kinder Morgan has no plans to develop them because McElmo Dome has considerable remaining CO2, estimated at 10 tcf. About 3.5 tcf have been produced from the McElmo Dome since production started in 1983.

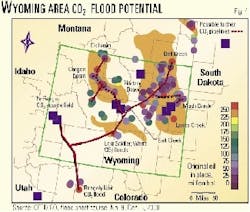

To use more of the CO2 being vented from ExxonMobil Corp.'s LaBarge gas processing plant, PSCO2 LP plans to construct a pipeline from Bairoil, Wyo., to the Salt Creek field (Fig. 4). Bill Townsend, PSCO2 manager, says that plans are to start CO2 deliveries in the first or third quarter of 2002. He says a supply contract with ExxonMobil was signed last December and that PSCO2 is in talks with two producers in Salt Creek field.

New projects

Oxy Permian has been operating the Altura properties for about 1 year. Patrick R. Oenbring, president and general manager of Oxy Permian, says that during this time it has actively infill drilled many of the properties, resulting in a 8,000 bo/d production increase. Its properties produce about 165,000 boe/d.

He indicates that Oxy Permian's 5-year plan includes four or five new CO2 projects, although this may be accelerated. Each project costs on average about $30 million/year. For these projects, Oxy Permian plans to use existing processing plants and infrastructure.

Besides projects in new fields, Oenbring says Oxy Permian also plans 10-12 expansion projects in existing CO2 floods.

The Cogdell Canyon Reef Unit is Oxy Permian's first new CO2 flood. It signed contracts with Kinder Morgan to supply CO2 by the third quarter of 2001 and expects to recover about 10 million bbl of oil that otherwise would have been left behind after waterflooding.

Cogdell is on the eastern portion of the Permian basin north of Snyder, Tex. (Fig. 3).

Tim Bradley, president of Kinder Morgan CO2, says the long-term contracts with Oxy Permian provide for a minimum 10-year supply and transportation agreement for 175 bcf of CO2 through Kinder Morgan's Cortez, Central Basin, and CRC pipelines and for a 20-year processing arrangement, under which Kinder Morgan will process the gas production for a fee and then return the extracted CO2 to Oxy for reinjection. He indicates that this will increase the utilization of available compression capacity at the Kinder Morgan-operated SACROC unit and more fully utilize the processing capacity at the Snyder gas plant.

Kinder Morgan plans to build a CO2 delivery pipeline, install a 1,500 hp CO2 pump, and a produced CO2 and natural gas flowline between the Cogdell unit and its operated SACROC unit.

Another new CO2 flood is planned by Anadarko Corp. for the HT Boyd Unit in Central Slaughter field in Cockran County, Tex. Anadarko says this is its first start-to-finish CO2 project.

As is typical of many San Andres fields in the Permian basin, the HT Boyd area was first developed in the 1940s and underwent secondary waterflood in the late 1950s. Anadarko purchased the property from ARCO Permian in 1992. It says the project encompasses 33 producing and 22 injection wells. No new wells are expected to be drilled.

Anadarko plans to commence its WAG CO2 injection in June 2001 and expects to see production increasing to about 1,500 bo/d in 2003 from the current 330 bo/d. The $10 million project, with CO2 injection of about 22 MMcfd, has a 15-20-year life.

Kinder Morgan will supply Anadarko with CO2 from the Bravo Dome pipeline.

Last June, Kinder Morgan became a producing field operator after purchasing Devon Energy's interest in the SACROC unit. It says that, since becoming operator of the unit, production has increased to 9,100 bo/d from about 8,800 bo/d. During this time, it also implemented Phase 2 of its centerline CO2 project at a cost of $5 million. The project involved drilling 6 wells and recompleting 17 inactive wells.

In February 2001, Kinder Morgan says the centerline area produced 1,100 bo/d, up from less than 100 bo/d in 2000.

Kinder Morgan has also implemented a $25 million Phase 3 for the centerline project. Phase 3 consists of drilling 11 wells, recompleting 25 inactive wells, adding to the gas processing infrastructure, and adding pumps on the CRC pipeline.

NATCO-Cynara, operator of the SACROC membrane facility for extracting CO2 from produced gas, plans to increase the membrane facility capacity to 180 MMcfd from 100 MMcfd.

From Phase 3, Kinder Morgan expects production to increase to more than 3,000 bo/d in 2003 from near zero today. It estimates ultimate oil recovery will be about 8 million bbl, or 13% of OOIP.

Another company interested in starting new CO2 floods is Belco Oil & Gas Corp. Its 2000 annual report says its operated Andrews Unit in Andrew County, Tex., which produces from the Wolfcamp/Penn formation at 8,600 ft, can be enhanced with CO2 or surfactant flooding. The report says Belco's Shafter Lake Sand Andres Unit, also in Andrews County, which produces from the Grayburg-San Andres formations at 4,500 ft, is another CO2 flood candidate.

Outside of West Texas, one project that is no longer believed to be viable is the building of a CO2 pipeline to central Kansas. Initial estimates had indicated a potential for recovering an incremental 150 million bbl of oil from the Lansing-Kansas City formation in central Kansas (OGJ, June 5, 2000, p. 37). Although the Hall-Gurney pilot project in Russell County, Kan., which is partially funded by the US Department of Energy, is still being evaluated, Kinder Morgan's Fox says that the pilot probably will not reach the stage of actual CO2 injection.

He does believe that the Arbuckle formation of Kansas may have potential for enough additional tertiary oil to justify a CO2 pipeline to central Kansas, but for now, the Morrow-formation producing fields near Postle field are more likely candidates for CO2 flooding.