Russia prominent in Wintershall's plans

Wintershall AG, as a midsize international oil and gas player, is thinking big.

Braced by operations income that more than doubled in 2000 to 1.33 billion euros from 625 million euros the year before, the German company has a 5-year program to grow by around 50% through an ambitious campaign of exploration and development.

After selling its portfolio of Canadian and UK assets in 1999, Wintershall drafted plans for E&P activities with a more international scope. Russia, Argentina, Libya, and Romania are among the areas where the outfit, based in Kassel, Germany, will devote exploration and development spending. Those outlays will average 600 million euros/year between now and 2007.

Reinier Zwitserloot, who left ExxonMobil Corp.'s South American operations 6 months ago to head Wintershall's E&P division, acknowledges it will be a big task to show the returns expected.

The keystone of his E&P plans is Russia. Through a longstanding partnership with OAO Gazprom, Wintershall aims to develop ice-locked Prirazlomnoye oil field in the Barents Sea, where reserves are "at least" 500 million bbl, and complete an expansion project at Urengoi-Achimov fields in Western Siberia that would produce 10 billion cu m/year of gas and 2.5 million tonnes/year of condensate.

To Wintershall, the appeal of Prirazlomnoye, in only 30 m of water but in one of the most hostile environments on the globe, goes beyond the standing reserves estimates to the untapped potential of the area around the offshore field.

Technological hurdles

Zwitserloot noted that Gazprom and Australia's BHP Petroleum Ltd. aborted a field development plan for Prirazlomnoye because of the technological hurdles.

"From a technological standpoint it is a very challenging project, but we even think it might be a new production territory where much more activity could take place."

A fixed steel and concrete drilling and production platform that can withstand ice pressures is under construction at a yard near Murmansk.

"While the platform will spend most of the year in very thick ice, the challenge is getting your oil production away from the platform," he said. "For this you need ice-breaking tankers that in size are economic to carry out this operation."

Wintershall and Gazprom have calculated that 60,000-dwt tankers could shuttle oil from Prirazlomnoye to a floating storage unit in open water. From there, larger crude carriers would transport the oil to European and US markets. Discussions are under way with one Canadian and three European shipbuilders to construct such tankers.

The $1 billion Prirazlomnoye development has only "borderline" profitability but would allow Wintershall to get a foot in the door in anticipation of the longer-term development of the Barents Sea, Zwitserloot said.

"If this project were a singled-out opportunity where there were no further prospects, we would never consider doing it. [This project] will push the borders-and there isn't much of an economic cushion. And you have to make almost the full investment before you get a penny back," he stressed.

It bears noting, Zwitserloot added, that the large current reserves estimates were established through 8-10 exploration wells, and there are "seven or eight more leads" around Prirazlomnoye yet to be fleshed out. A total of around 30 wells would optimize production from the field, he believes.

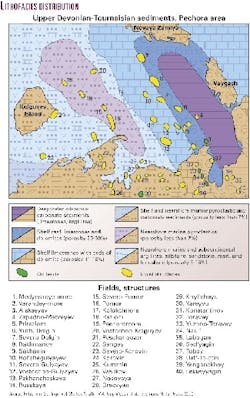

He did not identify the leads around Prirazlomnoye, but a map published in Russian literature last year shows 40 structures and fields in the greater Pechora area (see map).

Though the problem of a finalized Russian-model production sharing agreement continues to prove a thorn in the side of western oil and gas companies looking to advance developments in the federation, Zwitserloot is encouraged that Russian Pres. Vladimir Putin classes Prirazlomnoye as a "beacon project" for future foreign investment.

Wintershall's other key Russian development project with Gazprom could hardly bear less resemblance to Prirazlomnoye: gas; developed infrastructure; no PSA to hammer out. The companies' Urengoi-Achimov field expansion project under way aims to tap reservoirs 2,000 m below production at giant Western Siberia Urengoi gas field, currently making 180 billion cu m/year.

Urengoi's reservoirs, at 1,500 m, have been producing since the 1960s and are only now edging toward the end of their plateau. Wintershall and Gazprom plan to drill to 3,500 m in order to exploit the "geologically more challenging" Achimov formation, a group of Early Cretaceous age reservoirs that overlie the Jurassic Bazhenov formation.

A $50 million pilot project would involve drilling eight wells in a "minor" area within the Achimov formation by 2003. Assuming the pilot is a success, says Zwitserloot, a further $550 million would be spent on 80-90 wells and facilities to produce 10 billion cu m/year by 2006.

"We and our partners (Gazprom) are working on the project very seriously and agree that we have a win-win situation where we can help them economically, and we can bring gas out of Russia for our gas marketing arm [WINGAS, Wintershall's 65:35 joint venture with Gazprom]."

International campaigns

Wintershall struck a deal in Argentina late last year with regional partner Total Austral SA to "equalize" the stakeholding on a number of undeveloped assets by buying 35% of the offshore Tauro-Sirius and Octans-Pegaso concessions in the Austral basin, Tierra del Fuego.

The deal, says Zwitserloot, will enable development of a number of fields rather than solely those in which one company or the other had a large stake. In the case of the Total-operated Tauro-Sirius and Octans-Pegaso concessions, it should mean the exploitation of gas reserves of 21.4 billion cu m.

Before the agreement with Total, Wintershall's portfolio in Argentina was producing some 3.2 million cu m/day of gas for the company. According to Zwitserloot, there are plans to invest around $200 million in the Tierra del Fuego region to develop these "newly-acquired" reserves.

"We already had sizable reserves in the Tierra del Fuego area, but this was a means of getting our production (from Argentina) back up to meet our marketing demands," he noted. The next big step will be development of Total's Carina field on the CMA-1 Block, where Wintershall has a 37.5% interest.

Off Brazil, Wintershall in late April farmed into a 35% stake in Campos basin deepwater Block BM-C-10, operated by Shell, for which the major paid 65.16 million real last year in Brazil's second licensing round.

In Libya, Wintershall is attempting to build on a presence that, through its onshore Sirte basin concessions 96 and 97, stretches almost 40 years. To offset the anticipated drop-off in production from these fields late this decade, Wintershall, according to Zwitserloot, is discussing potential projects with Libyan National Oil Co. and looking forward to future licensing rounds.

And in Qatar, plans to drill two exploration wells on blocks awarded to Wintershall by Qatar Petroleum Co. are moving ahead. On Block 11, Wintershall took over operatorship from BP PLC and increased its stake to 51%. It will spud a well in August based on 2D seismic.

"Qatar is not going to secure my 50% growth (in E&P), but I am shooting on a combination of niches that are nice as far as margins, existing infrastructure, and so on, along with the more major projects like Carina in Argentina," he noted.

In Romania, Wintershall and state-owned gas company Exprogaz SA will begin joint exploration of the Transylvania South Block. Wintershall is acquiring 500 km of 2D seismic in the Saros-Sighisoara region, as part of a $4 million initial phase, before deciding to spud one or two exploration wells at a cost of $4 million.

Looking forward

Over the next 5 years, Wintershall targets E&D spending that will top the 2-billion-euro mark. Zwitserloot said the campaign breaks down into around 400 million euros/year on development and 150 million euros/year on exploration-which he said is substantial for a company Wintershall's size.

"To have 150 million euros to spend on exploration is not small potatoes-nor is having half a million euros to back up your exploration successes with development," he suggested. "If you take 'typical' finding costs and 'typical' development costs, that money will be sufficient to allow me to meet my targets (of 50% growth by 2007)."

For this investment, the company foresees ramping up combined oil and gas production levels incrementally over the next 5 years from 13 million tonnes of oil equivalent this year to 16 million toe in 2003 and 20 million toe by 2007. Wintershall's reserves were slightly more than 120 million toe at the end of 2000-just under 1 billion boe.

The oil-gas split in Wintershall's future production levels, noted Zwitserloot, is difficult to predict. If the Prirazlomnoye project comes to fruition then the crude component will inevitably be much larger, he says, but if the Urengoi-Achimov expansion measures up to its full potential, then gas will likely dominate the mix.

One certainty he takes from his first 6 months at Wintershall is that the company's parent German chemicals giant BASF Gruppe AG is "not risk adverse and is prepared to spend the money" in helping to develop the right projects.

"We aren't big, but we focus clearly on chosen areas. We choose our battles," he says. "And (BASF) recognizes that if you want a return of 15% on investment that can be probably be easily done by sticking to projects in Norway or Canada, but if you want some nicer returns you have to go to some other places in the world to do your business."